Since 2014, China has been the largest ice cream market in the world. By 2024, the revenue will have reached RMB 137.4 billion (USD 19.16 billion). Cities in the eastern and southern parts of China, such as Shanghai and Hangzhou, are leading in ice cream consumption compared to northern China, which consumes less ice cream due to colder weather.

In global comparison, China has generated the most revenue in this market. It achieved a projected revenue of RMB 237.1 billion (USD 33.03 billion) by 2033. Along with the increasing demand, many ice cream-related businesses are emerging. As of 2023, there were 28,800 ice cream-related enterprises based in China.

Download our China F&B White Paper

Chinese ice cream consumers and their habits

From premium to standard: The 5-yuan era

In 2024, the ice cream market saw a shift in consumer preference. The once popular, overpriced ice cream is disappearing, while products priced below RMB 5 have started to dominate the market. Current customers are becoming more rational, less willing to pay for premium ice cream. “Ice cream returns to the 5-yuan era” has become a trending topic on Weibo. It gained 63.8 million views and 16,000 comments as of June 2025. Many netizens are complaining about the prices of ice cream. Netizens recall that they only used to cost RMB 0.5-2 each. However, with the flashy packaging and high prices, fewer people want to purchase them nowadays. Other Chinese citizens also stated that when comparing international brands to cheaper brands, the 5-yuan ice cream offers better value for money.

Healthier options and selective consumption

As Chinese consumers pay more attention to health, many ice cream brands are working hard to eliminate the “unhealthy food” label. Ice creams made of natural ingredients containing less sugar and cholesterol and without dairy ingredients have become trendy. Almost every Chinese domestic brand like Mengniu, Bright Youbei, and Yili Xujinhuan has launched sub-brands in line with this trend.

On RedNote (Also known as Xiaohongshu), many users have shared sugar-free ice cream brands. Even doctors have made videos recommending healthy ice cream options. Many posts are made for consumers who are on a diet yet still want to indulge in a sweet treat in the summer, with a list of affordable grocery store brand ice cream options and the amount of calorie content in each.

In China, ice cream used to be something you enjoy on the spot due to the late development of a reliable cold chain. However, this phenomenon is changing rapidly because of a dramatic rise in online shopping in China. The Chinese ice cream ecommerce market is predicted to reach RMB 16.32 billion (USD 2,272 million) by 2025 and accounts for 28.3% of the frozen food ecommerce market in China.

Major players in the fierce competition

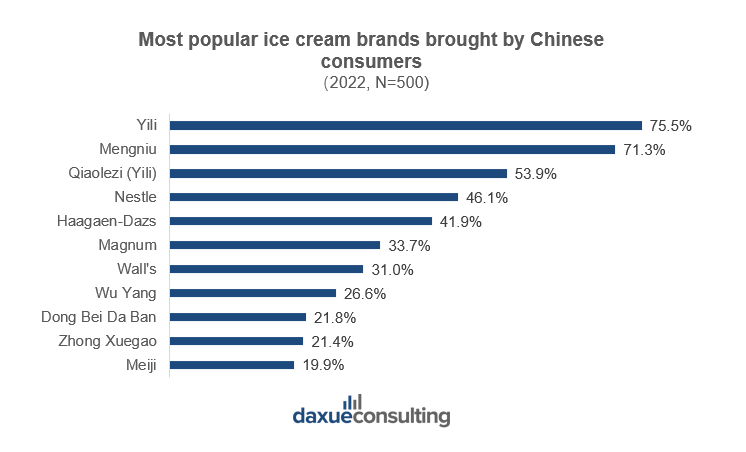

Chinese dairy giants Yili and Mengniu boast a solid leading position in China’s ice cream industry. They each have a market share of 17% and 10% of the ice cream market in China and are mentioned as the top two most purchased ice cream brands in 2024. Qiaolez, a sub-brand belonging to Yili, followed. After the three domestic companies, other spots are taken by foreign brands, with Nestle in fourth and Häagen-Dazs in fifth place.

Although Chinese brands are leading the ice cream sales in the country and are more affordable, foreign brands are more popular in big cities as they are favored for their high-quality branding. Certain city-dwellers are willing to spend more on their products. While Häagen-Dazs ice cream is 5-10 times more expensive than domestic brands, it remains popular in major cities. These consumers are more willing to pay for premium branding and high-quality ingredients. Its strong brand positioning continues to appeal to an upscale segment of the market.

Product localization to cater to Chinese novelty-loving consumers

The importance of aesthetics in the ice cream market in China

In China, ice cream is no longer a snack to consume in hot summer but is becoming something to share with others and to exchange emotions. Many ice cream companies are putting effort into enhancing the design of their ice cream to attract Chinese consumers. Among all the different kinds of ice creams, designs with traditional aesthetics are the most popular ones.

Ice cream inspired by cultural themes has also been trending online and is usually sold at tourist attractions, museums, and amusement parks. For example, in Beijing, many iconic sites like the Palace Museum, the Summer Palace, and Yuanmingyuan have all introduced their own ice cream. These ice creams are designed as a 3D representation of the landmark or site they are sold. As such, they have attracted visitors to buy them and take pictures. Consumers have posted online that for RMB 15, the price isn’t too high, and it’s a unique design that’s very photogenic.

What you need to know about the ice cream market in China

- China has been the largest ice cream market in the world since 2014, with a revenue of RMB 137.4 billion.

- Chinese consumers are less inclined to spend money on premium ice cream. They have gone back to lower-priced ice cream that’s good value for its price. The 5-yuan era has made waves on social media as consumers become more rational.

- Healthier options are trending online as ice cream brands work to eliminate the “unhealthy food” label. People are also sharing ice creams that have low sugar and low calories on platforms like RedNote.

- People have started purchasing ice cream online. The Chinese ice cream e-commerce market is predicted to reach RMB 16.32 billion by 2025.

- The top three ice cream brands in China in 2022 were domestic brands, Yili, Mengniu, and Qiaolez, a sub-brand belonging to Yili. Haagen-Dazs ranked fifth as the most popular foreign brand with the highest price among all other ice cream brands.

- Nowadays in China, ice cream is no longer a snack to consume in summer but is becoming something to share with others and exchange emotions. The design of the ice cream is turning into a key feature for attracting Chinese consumers, especially those drawn from Chinese culture.