China’s Gen Alpha, born between 2010 and 2025, represents approximately 230 million people, or 16.3% of the country’s population as of 2023. According to the United Nations, it is projected to represent over 19% of the population by 2050. This segment is often overlooked even though the size of the children’s consumer market represented about 8% to 12% of China’s overall consumption market in 2023, ranging from RMB 3.9 trillion to 5.9 trillion, according to the China Children’s Industry Center. As young parents increasingly prioritize quality experiences and holistic development, brands that tap into Gen Alpha’s interests—from beauty products to edutainment and outdoor sports—are finding new opportunities for growth.

Download the winter sports market report:

China’s all-inclusive ecosystem creating the first true digital native generation

The government promoting mindful digital consumption

While Chinese children enjoy watching short videos and playing popular games like Honor of Kings and Genshin Impact, their online entertainment time is regulated by the government. Since 2021, minors are allowed to play video games for only three hours a week, limited to one hour per day between 8 p.m. and 9 p.m. on Fridays, Saturdays, and Sundays. While the government doesn’t directly enforce these rules on children, it does require game companies to implement time limits. In fact, leading companies like Tencent and NetEase are enforcing these rules by implementing identity verification systems, including real-name registration and facial recognition. If a child tries to play beyond the allowed time, the system will automatically log them out. While many minors bypass these rules by using the account of an older friend, sibling, or even their parents’ account, the regulations are still expected to shape the gaming industry for years to come. For example, game studios may need to design experiences that can be completed or enjoyed in sessions of less than an hour.

Authorities are also pressuring tech companies to develop “minor modes” that restrict available features. For instance, Douyin (the Chinese version of TikTok), limits users under 14 years old to just 40 minutes of use per day. This highlights how both parents and the government encourage more mindful digital consumption, which raises the importance of brands creating short, high-impact content.

Rapid advancement of e-learning in China

Beyond entertainment, the digitalization of education in China is advancing at an unprecedented pace, far outstripping that of Western countries. E-learning platforms like Xueersi, Yuanfudao, and Zuoyebang dominate the market for study assistance and online tutoring. Many schools now rely on apps such as DingTalk. This all-in-one app, similar to Teams, supervises homework and conducts online classes and includes extensive tracking features. However, the app’s intrusiveness has drawn strong criticism from students. It earned a low rating of 2.4 out of 5 on the Apple Store in 2025. Meanwhile, classrooms equipped with tablets and AI-driven tools have become increasingly common. Before new restrictions were introduced in 2021, online schooling had significantly boosted students’ screen time. Some institutions had even gone further. They used connected devices to assess students’ concentration levels and employed facial recognition technology to monitor engagement during lessons.

New generation of child influencers

The prevalence of smartphones over computers in China created a generational preference for vertical and short-form content, as can be found on Douyin, Kuaishou and Xiaohongshu.

In recent years, China has seen a significant rise in child influencers on both platforms. Famous ones include Bo Ge Wei Wu, two brothers dubbed “drama kings” by netizens. Xiao Sutang is a five-year-old girl doing lifestyle videos and Liu Gege is a ten-year-old who went viral with a “Jellyfish” hairstyle. Accounts like @小橙子先生 (little orange man) showing funny and cute videos of a 3 years old reached over 22 million followers on Douyin.

Even though this trend sparked debates about child privacy and exploitation, many brands are eager to collaborate with these influencers, to target children and millennials, Gen Alpha’s parents. These partnerships can take the form of unboxing, sponsored content and live streaming in China, which are extremely popular.

Video channels specialized in toys also emerged and gained popularity in recent years. Those channels post regularly entertaining videos sponsored by toys brands to promote their products. A famous player is Xiaoling toys (@小伶玩具), a channel producing three videos a week on average that even reached over 1.45 million subscribers on Haokanshipin in 2025, a Chinese equivalent of YouTube.

Gen Alpha opening opportunities in new industries

Introduction to beauty products at an earlier age

Compared with the rest of the world, the children cosmetic market emerged relatively late in China and is currently undergoing rapid growth. Chinese parents are more willing to pay for safe ingredients and high-quality products. In response, brands like Pigeon and Mustela market baby cleansers and moisturizers explicitly for toddlers and receive great popularity.

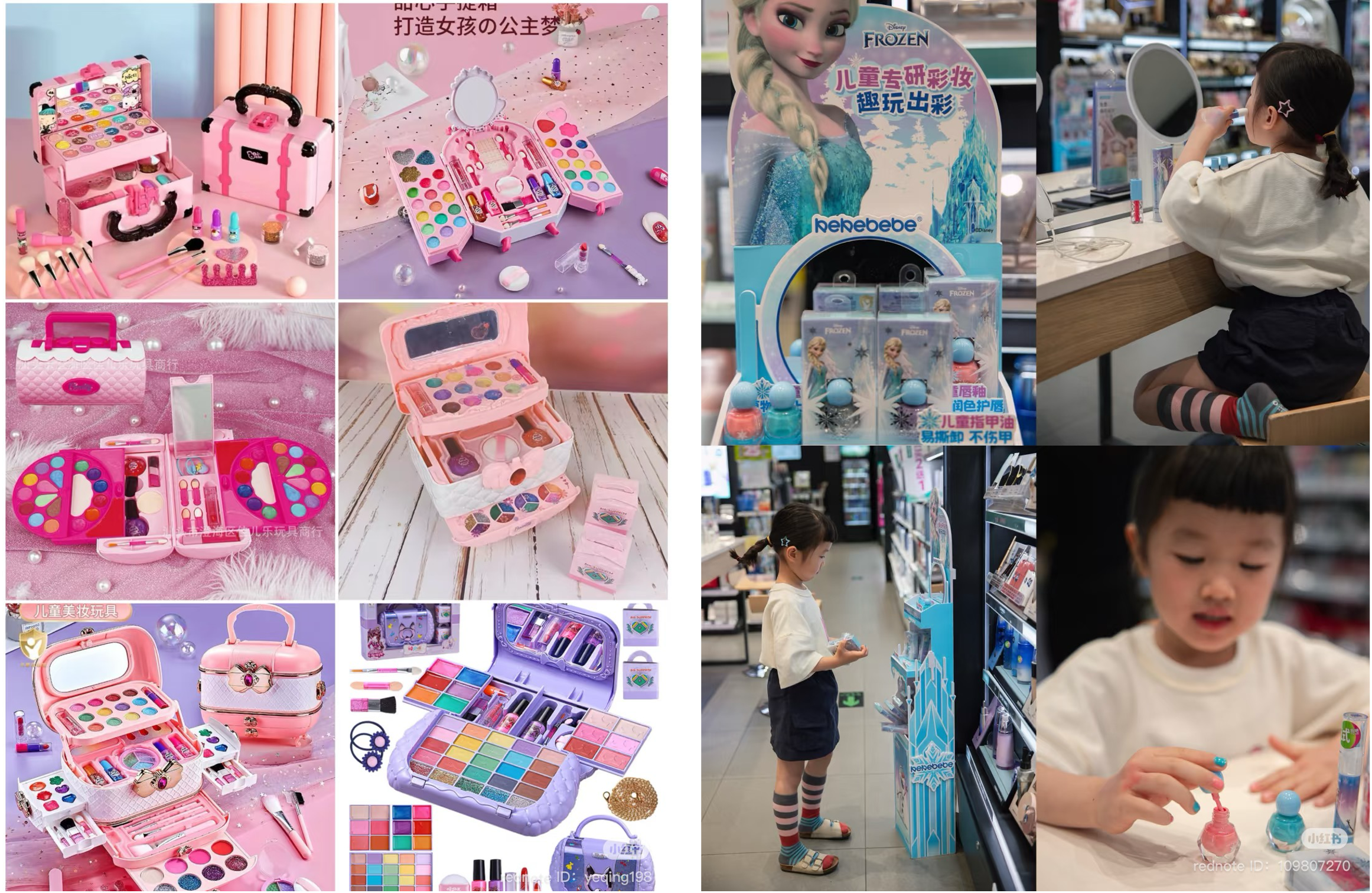

At the same time, the growing presence of children on social media has exposed them to broader content from a younger age, especially regarding beauty. Following this trend, many beauty brands have created products targeting little girls, with often many colors and a variety of small tools. Disney soon became the biggest player, proposing movie-themed kits. According to data from Kaola, in May 2020, Disney sales were up by more than 100% year-on-year.

Chinese Gen Alpha is exposed to more sports than previous generations

The Chinese Generation Alpha is being introduced to a wider variety of sports than previous generations. This is thanks to the rise of school programs, virtual reality playgrounds and increased institutional support. Winter sports serve as a clear example of this trend. Even in areas without natural snow, schools are utilizing tools like roller skates and field hockey to develop foundational winter sports skills. Government initiatives are also playing a key role, with national youth teams being cultivated at prominent venues such as Beijing’s National Aquatics Center.

In response to the 2021 “double reduction” policy in China, which aims to ease academic pressure, many parents are enrolling their children in winter ski courses, especially in tier-one cities like Beijing and Shanghai. Camps such as the Beijing Winter Sports Training Camp and Hebei’s Thaiwoo Camp further nurture young talent by combining skill-building with international coaching expertise, signaling a robust future for winter sports among China’s youngest generation. Meanwhile, the spread of indoor facilities in southern provinces is making these sports more accessible. This early exposure could lead to potential growth of China’s winter sport market in the upcoming years as future generations become more aware of those sports.

Growing popularity of future-self workshops

The future-self workshop is a growing sector and a popular activity for children in China. It started with policemen and firefighters organizing career discovery afternoons, where children got to discover one career. On Xiaohongshu, many users share posts of children participating in fire fighter, doctor and little banker experiences.

In recent years, brands started using it to their advantage by organizing their own. International companies such as McDonalds and Starbucks as well as domestic ones propose one day workshops where children often earn a certificate at the end. They can learn to make coffees, prepare orders and play games.

Parents often document these activities on Xiaohongshu, turning them into aspirational parenting moments. Brands leverage this by designing photo-friendly setups, such as mini-Starbucks aprons, McDonald’s “graduation” certificates, ensuring viral sharing.

How China’s Gen Alpha is shaping new consumer landscapes

- China’s Gen Alpha, born from 2010, already holds major economic power. They drive a children’s consumer market size ranging from RMB 3.9 to 5.9 trillion in 2023.

- Gen Alpha in China grew up as a true digital native generation, with 97.3% internet penetration among minors by 2023. However, government-imposed limits create more structured and mindful digital consumption, requiring brands to deliver impactful content in limited time windows.

- Children’s preference for vertical, short-form video content on Douyin and similar platforms is accelerating the rise of child influencers and reshaping brand marketing.

- Young parents are focusing on their children’s holistic well-being and are more open to new experiences compared to previous generations. This creates new opportunities in industries once underdeveloped or aimed primarily at adults, including beauty and skincare, winter sports, and food and beverage.