Having insurance is a very common practice in China, especially when it comes to individual healthcare insurance. In 2022, around 1.35 billion people were covered by medical insurance, which is roughly 95% of the total Chinese population. This percentage is in rapid expansion. At the end of 2023, the total revenue of the Chinese insurance market reached RMB 29.9 trillion (USD 4.1 trillion), an increase of 10% compared to the year before.

Personal insurance was by far the most purchased by Chinese consumers, around RMB 25.9 trillion (USD 3.6 trillion) out of all the total revenue, followed by insurance against damages, which reached RMB 2.8 trillion (USD 394 billion). There are numerous reasons why an increasing number of individuals are opting for insurance coverage for their belongings and lives. Factors such as easier risk management and uncertainty avoidance contribute to this growing trend.

Differentiation is the key for the main insurance companies

In China’s life insurance industry, the demand for insurance is high across different life stages. By November 2023, the country housed 196 major insurance companies, with 103 serving personal needs and 93 focusing on property concerns. These companies primarily specialize in life insurance, retirement planning, and healthcare coverage.

In 2023, the Ping An Group (中国平安保险集团) was the biggest insurance company in the country, with a revenue of more than RMB 800 billion (USD 111 billion), a general year-on-year 4.1% increase, and an increase of life insurance revenue by 24% compared to 2022. Ping An’s success is partly due to its versatility. The company offers life, health, and financial insurance, catering to both individuals and businesses. This comprehensive approach ensures complete protection against unforeseen events.

China’s life insurance industry is on the rise as younger people grow concerned about their health

In recent years, there have been more and more people interested in health and financial protection, with many extending their priorities and counting on commercial health insurance plans, leading to notable life insurance growth. In 2024, the insurance company “Funde Sino Life”(富德生命人寿), which had more than RMB 4 billion in China as of 2023, published its 2023 annual report, in which the company assured to have provided more than 2.5 million life insurance policies to its customers.

Furthermore, in the same year, the group registered a homogeneous increase for all ages that demanded insurance, interested in better health and financial planning. Millennials and Gen Z were the biggest growth, with a year-on-year increase respectively by 29% and 18% compared to 2022. Two of the most popular reasons for this increment were fear of ageing and protecting their family: sudden hospital expenses and uncertainty avoidance are only a few examples of why younger people are choosing to protect themselves, and getting interested in extending health insurance benefits. There is also rising health insurance premiums interest, with many looking for additional life insurance products and benefits.

Keeping an eye on the future: young consumers are more interested in retirement insurance

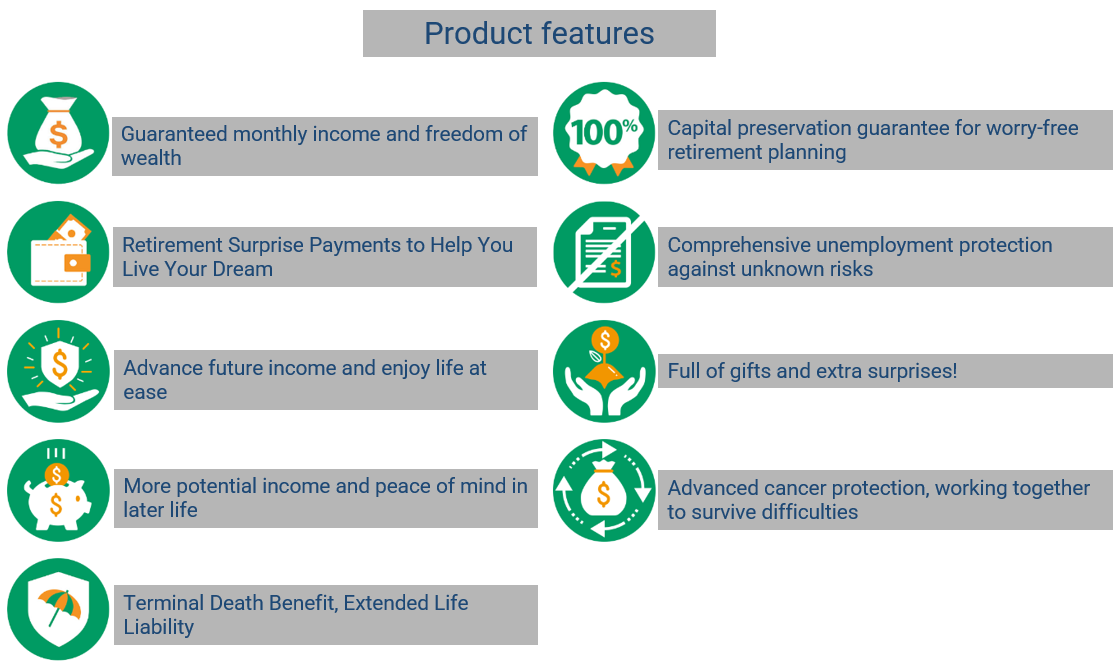

Apart from their health, Chinese consumers started worrying about their wealth. In recent years, the interest in retirement insurance rapidly increased. In 2023, the people who opted for retirement insurance accounted for 545.2 million. In particular, the urban population recorded the biggest growth, increasing by 17 million compared to 2022. These insurances have become particularly convenient for younger people, especially because they have more bonuses and benefits granted and many companies impose age limits for retirement insurance purchases.

In recent years, insurance groups have started creating insurance packages specially designed for young consumers. For example, the Chinese insurance company “China Life” (中国人寿) presented many projects of pension products, such as the formula “乐享人生” (enjoy life). The initiative offered many advantages to consumers under 40 years old who wanted to purchase this type of retirement insurance, such as flexible payments and stricter protection in case of long-term savings. After the first “enjoy life”, the Chinese insurance company released an updated version of this formula in 2023, which included more services, such as a flexible coverage duration and the possibility of multiple insurance by adding illness and injury protection.

The Chinese government is opening up to foreign insurance companies

Overall, the insurance market in China is mainly dominated by domestic companies because, as of 2022, 10 of the biggest groups in terms of revenue were founded in the country. However, foreign insurance companies are slowly becoming known to the country’s consumers, but with some difficulty.

Since the early 2000s, the Chinese government officially allowed foreign health and life insurance players to operate in China. However, only three types of companies were allowed to settle in the country: Joint Ventures (JVs), companies controlled by Chinese groups financed by foreign investors, and fully-owned foreign companies. Starting in 2019, the Chinese government updated the regulations for JVs and foreign-funded insurance companies willing to enter the Chinese market; for example, the stocks of a JV shall not exceed 50% for the foreign group. Furthermore, new government initiatives aimed to enforce other laws concerning the responsibilities and stricter control over these companies.

However, a year later, the limitations on these Sino-foreign agreements were loosened. Since January 2020, the ownership obligation for joint ventures fell, and now insurance groups can hold every percentage of a company’s stocks. Moreover, in November 2023, two foreign-funded companies, named “BMW Insurance Broker Co. Ltd.” and “ERGO FESCO Broker Company Limited”, obtained permits to carry on insurance brokerage activities in China. The event marked a turning point for non-domestic players willing to enter the insurance market, as it was the first time since the 2019 regulations that the government approved two completely foreign-owned companies in China’s insurance industry.

Ups and downs of foreign players in the insurance market in China

Since the Chinese government’s permit concerning JVs, many foreign life insurance brokers have become particularly strong in China, such as “Generali China Life Insurance” (中意人寿保险有限公司) a Sino-Italian insurance company founded in 2002 in Guangzhou. In their 2023 report, it is stated that the group registered a revenue of more than RMB 15.6 billion ( USD 2.1 billion) throughout the year. The company is expanding too, with 15 new branches opened throughout 2022.

Other Sino-European companies, however, are having a rough time getting known in the insurance market in China, and their business isn’t going as expected. As an example, in 2023, the British Joint Venture “Aviva-Cofco Life Insurance” (中英人寿) registered a negative record in revenue, with a decrease of around 96.8% compared to the previous year. The reasons behind this poor performance are partially linked to the high costs of insurance and the fierce competition that the Sino-British company had to face.

The insurance market in China heavily relies on digitalization

Following the ever-increasing number of Chinese digital consumers, insurance services are shifting in the network. As of November 2023, around 53% of all life insurance and 88% of health insurance in China were purchased online. Therefore, many insurance providers such as the Ping An Group have started selling online insurance plans.

Moreover, WeChat became a very popular platform for selling insurance plans. Indeed, the app can provide customers with a simpler user experience for both purchasing and cancelling insurance plans without leaving the app’s ecosystem. For example, in 2017, the Chinese giant Tencent opened its insurance service called “Tencent Wesure” (腾讯微保). Users can navigate through WeChat to have access to the Tencent insurance page and can purchase numerous services thanks to the collaboration with many Chinese insurance companies. Another strength of this service lies in its low costs, which start from a range of RMB 9 per month for a basic plan. As of 2023, the Tencent subsidiary helped more than 44 million customers to purchase an insurance, and 100 million since the app was launched.

The Chinese insurance market opens up to younger consumers

- With a revenue of almost RMB 30 trillion in 2023, the Chinese insurance market is becoming very popular among Chinese consumers of all ages.

- The main insurance companies in China aren’t limited to a single service but can provide numerous plans for life and non-life insurance to their consumers.

- Partially pushed by fear of future unpredictable events, Millennials and Gen Z are becoming progressively more interested in purchasing health insurance.

- Retirement insurance is gaining popularity among the younger generations because they are evermore expressing the need of protecting their economic savings for future investments.

- The Chinese insurance market is dominated by domestic companies, partially due to the strict regulations for foreign insurance groups. The Sino-Italian Joint venture “Generali Life China Insurance” is the biggest of its kind.

- Consumers are starting to purchase their insurance packages online, especially by using WeChat. Indeed, the platform grants faster payments and services for customers, who don’t even have to exit its ecosystem.

Strategic pathway in China’s insurance market with Daxue Consulting

Our consultancy specializes in navigating the complexities of China’s insurance sector, offering market research, consumer insights, and strategic guidance. We focus on understanding the unique dynamics and consumer preferences within this rapidly evolving market, providing tailored strategies to help businesses thrive.

With a data-driven approach, we ensure that our recommendations are robust and aligned with specific business objectives. Our expertise is aimed at enhancing customer engagement, brand visibility, and competitive positioning in the crowded insurance marketplace.

We are committed to empowering businesses to effectively connect with their audience, adapt to the ever-changing market demands, and secure a sustainable path to success in China’s insurance industry. Contact us to learn more about your possibilities in the Chinese market.