Founded in 1999 in London, Jellycat entered the Chinese market in 2013. However, it was not until recently that the brand gained significant popularity, especially among young female professionals in their 20s to early 40s. In 2024, Jellycat’s sales on major Chinese e-commerce platforms reached approximately RMB 830 million (USD 128 million), an a significant 106.4% year-over-year growth. During the 2024 Double 11 festival, which took place from October 31st to November 11th, Jellycat’s official Tmall store exceeded RMB 100 million in sales, outselling popular plush toy brands such as Disney. This reflects not just a temporary sales spike from special event, but sustained demand driven by young consumers. Jellycat in China has attracted people through its emotional. By turning everyday items — such as toilet papers, Christmas trees, and potatoes — into plush characters, many having unique backstories and personalities, they are more like emotional companions than just collectibles.

Download our guide to Chinese gifting habits

Jellycat reaches consumers from bookstores to the gray market

Jellycat’s distribution strategy in China relies exclusively on third-party retailers rather than self-operated stores. For example, it’s not uncommon to find Jellycat plush displays in popular chain bookstores or in stylish café corners, where they attract young shoppers. This distribution approach has proven remarkably effective, creating a sense of exclusivity while simultaneously ensuring broad market penetration across diverse retail touchpoints.

The brand’s decision to work through authorized dealers has created an ecosystem where retailers actively compete to secure the latest Jellycat releases and popular items. One Shanghai bookstore owner noted that keeping Jellycat in stock is a challenge — to the point that her store must restock one to two weeks to meet demand.

The gray market (China’s Daigou industry) and resellers play a significant role in Jellycat in China largely due to supply shortages and limited editions selling out quickly through official channels. On the secondhand market (for instance, the Xianyu app), popular Jellycat models are sold at double the original price or even more. This thriving gray market indicates that the demand for Jellycat in China is very high. Many buyers are willing to pay a premium to get popular items immediately.

Emotional companions for a new generation

For many young Chinese consumers, Jellycat plush toys serve as “emotional companions” rather than mere collectibles. Consumers in their late teens to 30s treat these stuffed animals as sources of comfort, stress relief, and even companionship in daily life. It is now common to see students toting a small Jellycat to class or workers displaying one on their desk as a morale booster.

Some affectionately refer to their plush as “情绪搭子” (an “emotional partner/buddy”), highlighting the toys’ role in providing psychological comfort. This trend of adults openly engaging with toys reflects a broader cultural shift: people are moving away from the notion that toys are “only for children” and acknowledging that people of all ages can find joy and solace in these products. The hashtag “#大人也爱玩玩具” (“#AdultsAlsoLoveToys”) has garnered over 150 million views on RedNote (known as Xiaohongshu in China) as of June 2025, indicating how widespread and accepted the “kidult” phenomenon has become.

Comfort in a high-pressure society

Crucially, emotional and psychological factors drive these consumers’ attachment to Jellycat. Modern life in China’s cities can be lonely and high-pressure, with fast-paced jobs, academic stress, and many young people living far from family. In this context, Jellycat plushies offer unconditional comfort and stress relief for many young people. There are frequent posts on Xiaohongshu with pictures of users hugging a Jellycat at the end of a hard day or talking to it as a non-judgmental friend. “Whenever I couldn’t control my emotions, I would hold my Jellycat in my hands and feel her warmth” said one user.

The brand’s image in China is deeply tied to ideas of “治愈” (healing) and companionship. The COVID-19 pandemic particularly accelerated this trend, as lockdowns and social isolation created increased demand for comfort objects that could provide emotional support during difficult periods. According to a McKinsey’s & Company survey on China’s consumer trends in 2024, 64% of Chinese consumers prioritize emotional fulfillment, often choosing to buy products or engage in activities that make them feel good. This percentage is even higher among younger demographics.

Jellycat café led adults to revisit their childhood

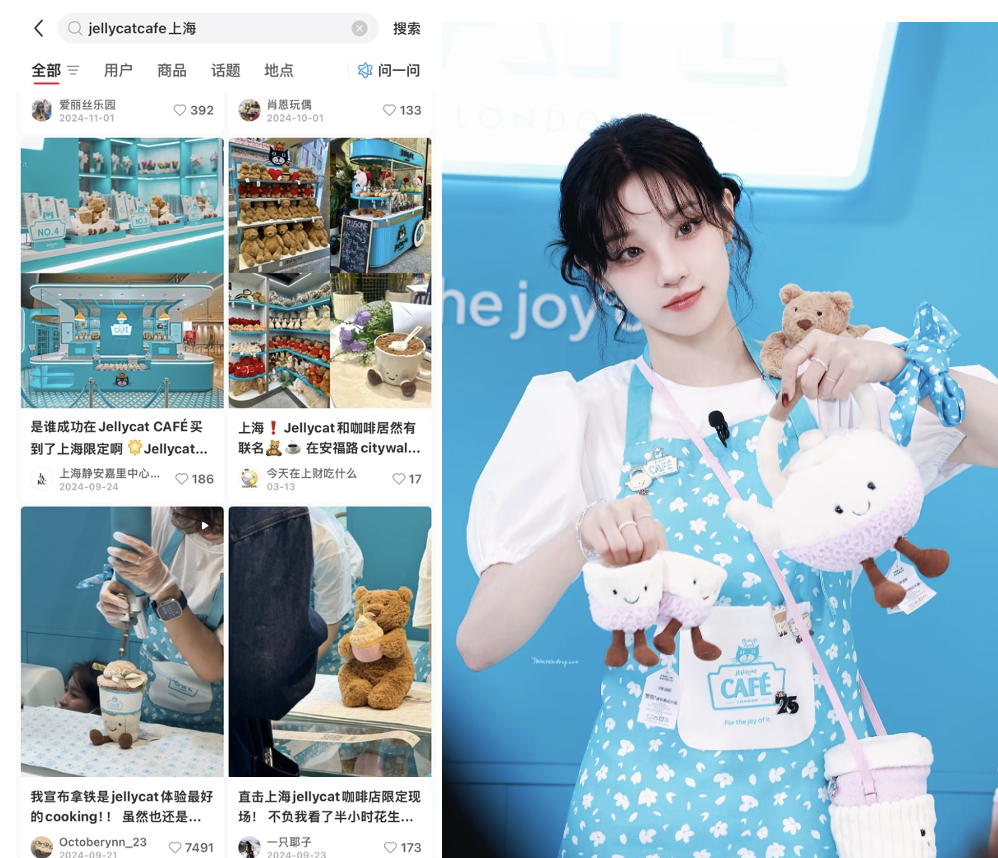

In late 2024, Jellycat opened a themed pop-up café in Shanghai’s Jing’an Kerry Centre, the first immersive Jellycat store experience in Asia. The café was designed as a pastel dreamland bakery, complete with staff dressed as baristas and bakers, Jellycat toys “baking” behind glass displays, and a faux menu of plush toys disguised as pastries.

Customers didn’t just shop; they participated in a playful ritual of ordering their toy as if it were food, watching staff perform skits like adding pretend frosting to a plush cupcake or frying a plush “egg” on a toy stove. The pop-up drew massive crowds, with people queued up for hours to get inside. Half of the top 10 most-liked Xiaohongshu posts about Jellycat in that period were related to the Shanghai pop-up’s fun skits.

Moreover, it also went viral on social media. Many visitors shared videos of the experience, delighted by the notion of “revisiting childhood” in such an interactive way. The event also got a boost from celebrity involvement: Song Yuqi, a Chinese K-pop star from (G)I-DLE, made an appearance as a “guest barista” at the Jellycat café, attracting even more attention.

A snapshot of Jellycat’s popularity in China

- In China’s collectible toys market, Jellycat is particularly popular among young professional women, who use the toys as emotional companions and carry them in their daily lives—at home, at work, and elsewhere. In 2024, Jellycat’s sales in China reached RMB 830 million across major e-commerce platforms, doubling from the previous year.

- The brand uses bookstores and cafés instead of self-operated stores, driving scarcity and exclusivity. High demand has led to resale prices often doubling on platforms like Xianyu.

- Young adults view Jellycat as emotional companions, not just toys. The trend reflects a broader cultural shift where comfort and cuteness are openly embraced by grown-ups.

- Many buyers use Jellycat for stress relief and emotional support during tough times. Posts on Xiaohongshu often show users hugging their plush toys or speaking to them as friends.