China’s birth rate continues to plummet, dropping to a mere 1.15 in 2021 and currently nearing 1.0, despite the 2016 abolishment of the single-child policy. Combined with the booming economy, the trend has a significant impact on child-rearing practices. With fewer children to invest in, parents are now channeling their growing disposable income towards a new focus: their offspring’s holistic development. This shift in priorities has fueled a remarkable boom in the market for children’s activities in China, extending far beyond traditional academic pursuits.

Influencing factors: The blossoming children’s activities in China

The growth of these entertainment and education options reflects the rise of the “children’s economy” in China. The market for children’s arts training alone reached over RMB214.96 billion (USD31.13 billion) in 2019.

One of the factors is due to the increased awareness of children’s holistic development caused by the “Double Reduction” policy. It was aimed at alleviating the academic burden on students in compulsory education. This has drawn sustained attention from various sectors of society. This education crackdown policy mandates a reduction in excessive and advanced off-campus tutoring. The policy prohibits non-academic training institutions from conducting academic training and bans the provision of overseas education courses. Furthermore, off-campus training organizations are not allowed to organize academic training during national holidays, rest days, or winter and summer vacations.

Since the implementation of this policy, there has been a significant decrease in academic tutoring across various regions. At the same time, sports training has surged in popularity, with some popular programs being in high demand and hard to enroll in. Moreover, the inclusion of competitive sports as part of the criteria for Gaokao scores could be a contributing factor to their rising popularity. Additionally, the trend towards smaller family sizes has led parents to allocate more resources to the development of each child.

Outside academics: Parents investment in music and sports as children’s activities in China

Music: Enhancing cognitive and academic excellence

Learning music is widely believed to boost children’s cognitive growth, promote academic success, and nurture creativity and discipline. Mastering a musical instrument is valued as an important extracurricular accomplishment, providing a competitive advantage in China’s school and college entry landscape. Consequently, many parents motivate their kids to pursue music to cultivate these advantageous qualities. According to investment firm data, online tutoring is expected to represent RMB10 billion (USD14.3 billion) of China’s estimated RMB 400 billion music education market in 2022.

China’s Central Conservatory of Music’s website outlined a recommended roadmap for children’s musical education based on different age groups. Children age 1-4 are suggested to be exposed to music. Between 4-6 years, there should be a focus on basic music literacy such as singing lessons. For those 5-12 years old, different instruments are introduced as well as foundational music theory and one-on-one lessons for ages 5-18.

Different musical instruments also suit different age groups. For example, children aged 3-7 can learn to play the piano while flutes would suit children aged 9-12 as the instrument needs a specific posture and breath control. During the second Guangdong Provincial Emerging Music Education Development Conference in May 2023, piano and guzheng were reported as the most popular musical instruments for children.

Swimming: A life skill and a healthy habit

The Chinese government, recognizing the importance of water safety and swimming skills, mandated swimming lessons in some schools. This has led to a boom in both pool construction and children’s participation in swimming lessons. Beyond safety, swimming offers a healthy way to exercise, promoting physical fitness and overall well-being.

In 2021, Yangpu District in Shanghai initiated the “Everyone Learns to Swim” program for nearly 53 elementary schools, targeting fourth-grade students. This program partners with seven community swimming venues to provide two weekly swimming lessons for almost 10,000 students.

Moreover, as reported by CCTV Finance, the swimming and diving training center in Shenzhen Sports Center has become extremely popular after the “Double Reduction” policy. 1,800 students, mostly from primary and secondary schools, enrolled in 2021. Swimming training, in particular, is one of the hottest sports training programs for school-aged children in Shenzhen. Due to limited venue space, new students can only enroll in swimming classes if there are available spots.

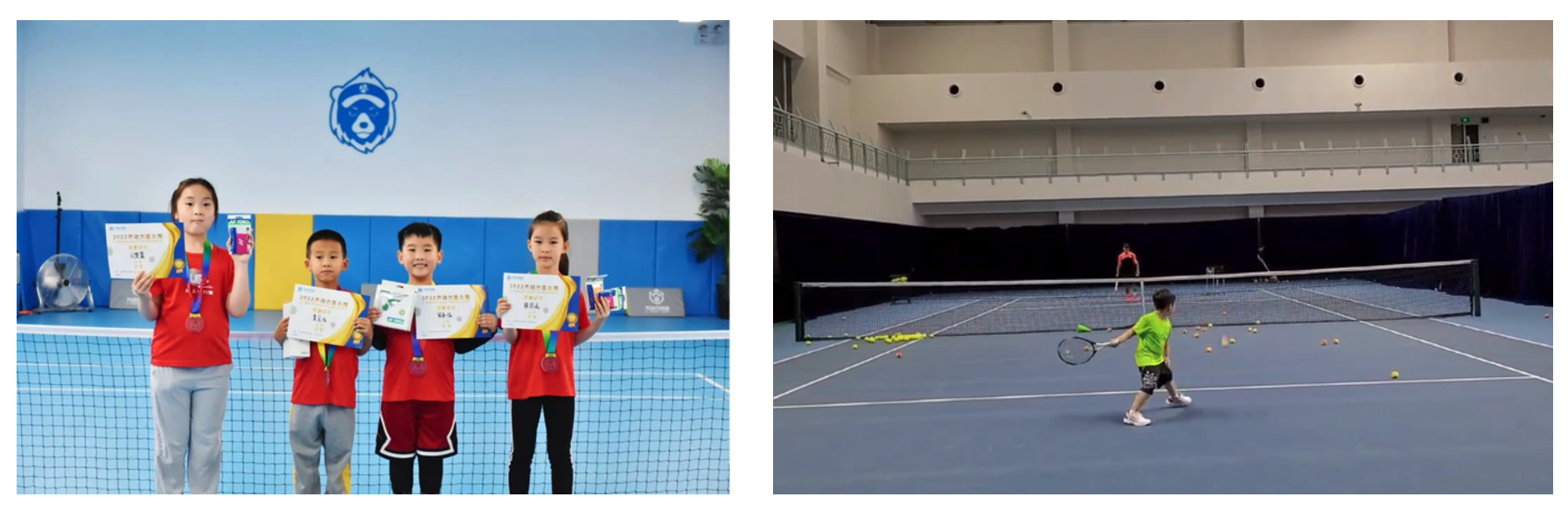

The boom of tennis among youth: Inspiration from Chinese stars

China’s tennis population is second in the world with a significant number of young players ranked in junior categories. This indicates a robust pipeline of talent and a growing interest in the sport among the youth. In Wenzhou, the interest in youth tennis is on the rise. As a result, children make up more than half of the nearly 20,000 tennis players in the city.

This surge in popularity can be attributed to several factors such as the remarkable achievements of Chinese tennis players at major international tournaments, including Grand Slam events, which have garnered significant attention and inspired many young fans. Players like Zhang Zhizhen reaching the ATP 1000 Madrid Masters quarterfinals, Zheng Qinwen’s performance at the US Open, and the historic breakthroughs at Wimbledon have fueled national pride and interest in the sport.

Parents view tennis not only for general fitness but also as offering clear pathways and prospects. Not just for potentially launching professional careers but also for benefiting educational and employment opportunities. Despite the slim chances of making it professionally, having tennis skills is seen as advantageous for admission into schools and for personal development.

Ice skating: From leisure to competitive excellence

Beijing’s Winter Olympics sparked a big jump in kids’ interest in ice sports. Indoor rinks became popular, making ice skating more accessible. Even young kids were having fun learning with special ice walkers. These rinks created a fun community for kids to share experiences. Online deals like group tickets on Douyin further boosted participation.

By the end of 2019, the participation of Beijing’s school students in ice and snow sports nearly doubled from the previous year, reaching around 840,000. The Chinese Figure Skating Association reported a record-high 3,187 applicants for the initial phase of the national figure skating level test for 2021-2022. This marked the highest number of applications for a single event phase since its inception in June 2020. Across the 2020-2021 season, the association conducted two online level tests. It attracted 11,990 participants which highlighted the growing interest in figure skating among the youth.

The influence of the Beijing Winter Olympics extends far beyond ice skating, catalyzing a broader interest in a range of winter sports. An increasing number of Chinese children are enrolling in skiing programs. This phenomenon signals a vibrant and growing market for winter sports and related industries. This newfound enthusiasm among China’s youth is not just a boon for the sports themselves but also presents a significant opportunity for winter sports brands and educational institutions.

Experiential learning: The dual appeal of theme parks and museums as children’s activities in China

China’s theme parks: Children meets fantasy land

Despite a slight decline in visitors (0.33%) in 2022, China’s theme parks’ revenue grew 15.29% to RMB 15.35 billion (USD 2.13 billion) thanks to the opening of 10 new mega parks, including Universal Beijing Resort. As of 2023, China is home to 82 mega theme parks. The industry shows a trend towards branding and themed park chains. Over half of the mega parks belonged to established chains like Fantawild (方特) and Happy Valley (欢乐谷). This focus on branding is seen as a strategy to increase return visits. Shanghai Disney remains the most visited park, while Universal Beijing boasts the highest revenue.

Based on the visitor’s demographic, Shanghai Disneyland attracts all age groups. However, according to a report in 2021, visitors aged 30-50 with children are the second largest group with a proportion exceeding 30%. According to a survey, 85% of parents in China have taken their children to amusement parks in 2023.

Cultivating curiosity: Educational innovations in Chinese museums, aquariums, and education centers

Museums across China are increasingly focusing on creating engaging and interactive exhibits. It was held alongside hosting workshops and events designed to attract and educate younger audiences. For instance, in the summer of 2023, the Chengdu Museum introduced the “Weekend Children’s Museum” event which led to a long queue of families. This initiative aimed at captivating young minds through activities related to the natural world, history, and art.

Similarly, the National Museum of China noted that children and teenagers (ages 1 to 18) comprised 19.24% of its visitors in 2022. They are ranked as the third largest demographic group of museum visitors. Despite challenges posed by the pandemic, the museum continued to offer public educational services, including guided tours, educational programs, and volunteer opportunities. It introduced special programs targeted at the youth. For instance, summer camps centered on Chinese traditional culture, camps for junior guides, and archaeology camps at the Xinglong (兴隆) Site. Additionally, the museum expanded its educational outreach through the Oracle Bone Inscription series and fostered partnerships with schools to form volunteer teams.

Hands-on science: early education centers for kids in China

Aquariums are another venue where children can be sparked by curiosity while learning. The place serves as a living classroom, offering children firsthand knowledge about marine life, ecosystems, and conservation. Many aquariums focus on conservation efforts and teach visitors about the impact of human activity on marine ecosystems. Shanghai Ocean Aquarium (上海海洋水族馆) is one of the most famous aquariums in China. It is known for its long underwater viewing tunnel, which is one of the longest in the world.

In China, there has also been a rise in science education centers aimed at offering hands-on learning experiences for young children. The typical age is between 1 to 7 years. These centers utilize a variety of simulated environments, educational tools, and techniques inspired by neuroscience to facilitate learning. By incorporating games and situational learning methods, these centers allow children the freedom to explore on their own. From an early age, emphasis is placed on fostering children’s emotional well-being, skill development, and personality growth.

Investing in the future through children’s activities in China: Embracing arts, sports, and play

- China’s plummeting birth rate and economic boom have led parents to invest more in their children’s holistic development. This fueled a surge in the children’s economy, especially in children’s extracurricular activities and entertainment.

- The children’s arts training market in China reached over RMB 214.96 billion in 2019. It was driven by increased disposable income, a focus on holistic development, and smaller family sizes.

- The “Double Reduction” policy, aimed at reducing academic pressure, has boosted non-academic activities like sports training. It became so popular that some programs were hard to enroll in.

- Music education is valued for enhancing cognitive growth and academic success. Online tutoring is expected to represent a significant portion of China’s music education market.

- Swimming is promoted for its safety and health benefits, with initiatives like Shanghai’s “Everyone Learns to Swim” program.

- Tennis is gaining traction among youth, inspired by Chinese stars’ international successes. It is seen as beneficial for physical fitness, educational opportunities, and personal development.

- Interest in ice skating surged following the Beijing Winter Olympics, with significant participation in national-level tests and online platforms promoting group ticket sales.

- Despite a slight visitor decline, China’s theme park industry grew in revenue, with new mega parks opening and a focus on branding to increase return visits. Families with children are a significant demographic.

- Museums and aquariums in China are engaging younger audiences with interactive exhibits and educational programs. These were aimed to cultivate curiosity and education outside traditional classrooms.