Liability insurance belongs to the non-life insurance market in China or the property and casualty insurance market in China. It protects the insured party against claims resulting from injuries or damages to other people or property. The policies cover both legal costs and other compensations if the insured party was found legally liable. Any entity, a business or an individual, can acquire liability insurance to protect their themselves, company and assets.

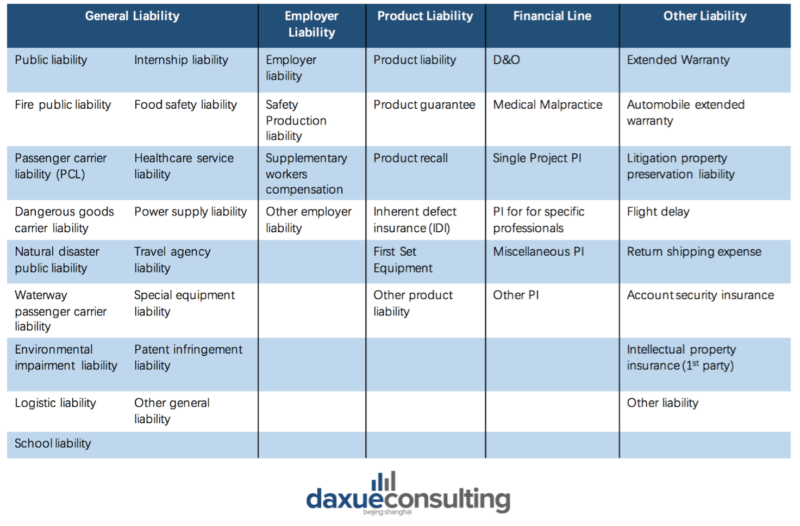

There are many different types of liability insurance, these are the five main types and what is unique about them in China’s market.:

General Liability Insurance in China

General liability insurance in China is one of the most important insurance categories for an individual or a business as it helps cover the cost of claims against third party bodily injury or property damage. It currently offers a broadest range of liability insurance products in China and is China’s most developed liability insurance category.

Employer Liability Insurance in China

Employer liability insurance in China helps to cover employers’ financial loss resulting from job-related injury or illness of their employees. Although employer liability insurance provides extensive protection, many Chinese companies do not purchase such insurance as sound business safety regulations have not yet been developed nor imposed in China.

Product Liability Insurance in China

Product liability Insurance in China is usually purchased by manufacturing businesses. It protects against claims arising from injury, damage or death caused by their products. Huge demand and development potential lies ahead for product liability insurance in China to promote safe production and to maintain public safety.

Financial Line in China

Financial Line in China stands for the liability insurances that cover financial loss and costs against crimes in the finance industry. It includes many different types of finance related insurance: directors and officer liability insurance, financial institutions Insurance, cyber insurance etc. However, financial line in China is yet to be developed as more individual recognize its protection extends beyond financial institutions.

Other Liability Insurance in China

Other liability insurance in China includes a vast varieties of liability insurance: flight-delay insurance, online shopping return freight insurance etc. Increasing number of liability insurance products have been added to this category as different sectors such as E-commerce, logistic, chemical industry etc., continue to develop and expend in China.

The liability insurance market in China: A developing sector

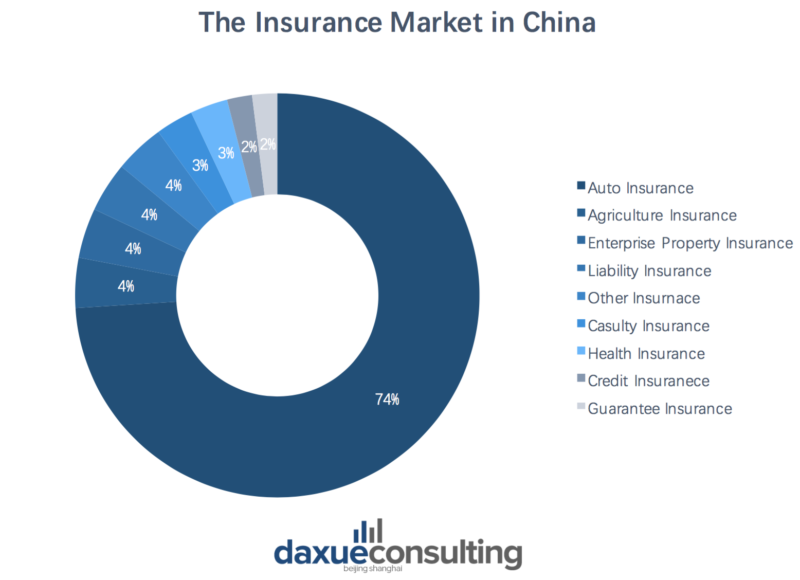

How does liability insurance compare to China’s greater insurance market

The Chinese liability insurance market is currently fairly small, merely accounts for 4% of the total market share of the insurance market in China. Comparing to the stagnating auto insurance market in China with a dominant 74% market share, liability insurance still has a huge growth potential in the foreseeable future.

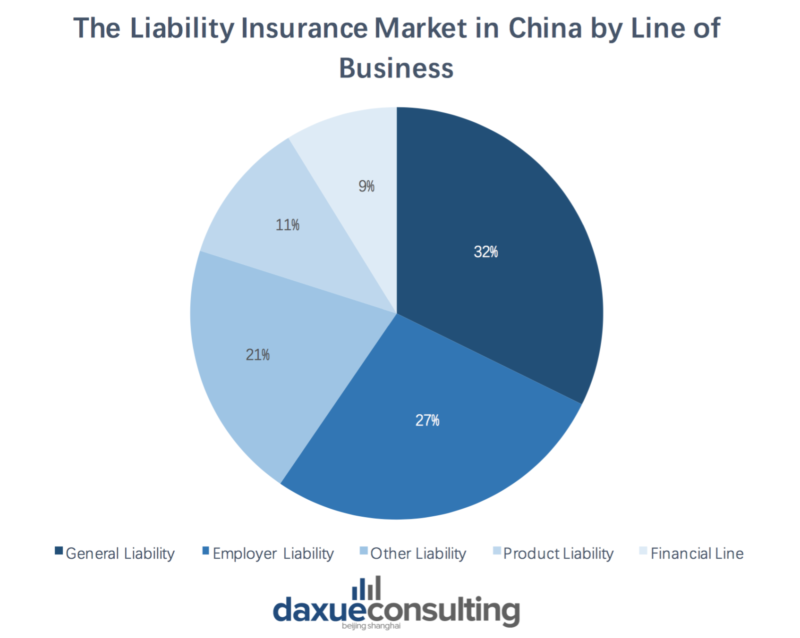

The dominant insurance type within the liability insurance market in China is general liability, followed by employer liability and product liability. Passenger carrier liability, despite had been the biggest general liability product for the past few years, experienced a reduction in size in 2018. For financial lines, Medical malpractice dominates the category accounting for 65% of the premium, while First Set equipment and IDI together make up for about 56% of product liability premiums.

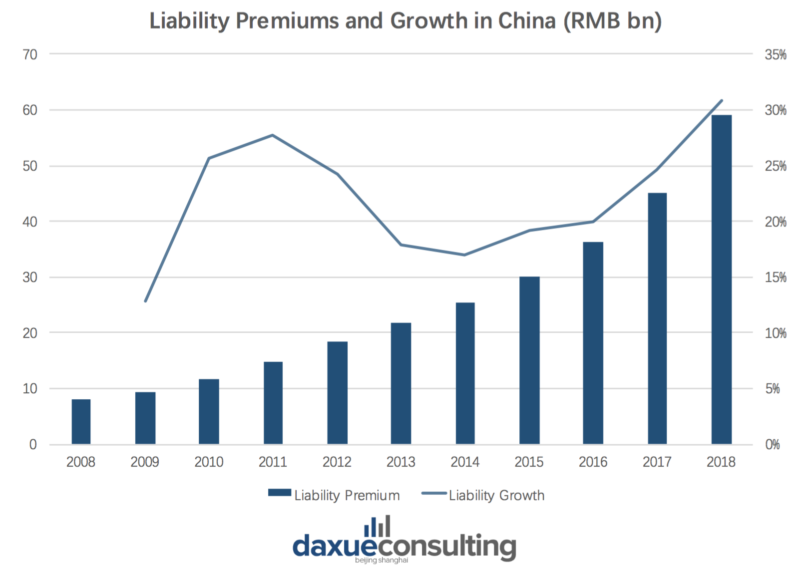

Liability Premiums in China

The Chinese market liability premium totaled up to RMB 59.1 billion in 2018, which represents a growth of 30.9% from 2017 (2017 Liability premium is RMB 45.13 billion). The average growth rate of the liability insurance market in China has been around 18.4% per annum between 2010 and 2018, and is expected to further accelerate from 2019 onwards. Its huge development potential should cast no doubt when compared to the overall property and casualty insurance market in China that only had a 14% growth per annum for the same period and a stable future outlook.

Consumers of liability insurance in China?

Consumers can range from individuals to businesses depending on the type of liability insurance. However, due to the fact that liability insurance in China is still at the awareness stage, specific consumer information is yet to be determined.

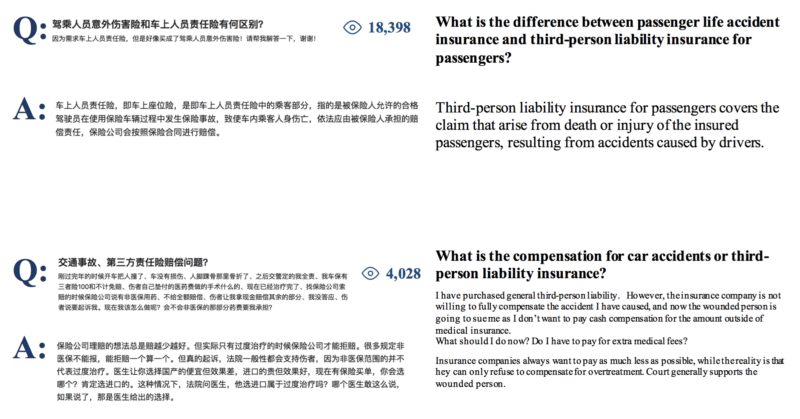

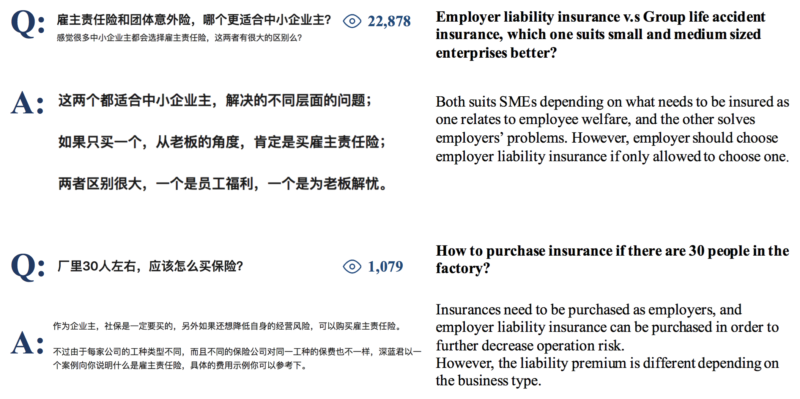

The discussion for liability insurance on Zhihu centers most on general third-person liability and employer liability. The questions asked by consumers are generally quite basic, which may indicate that they still are learning about the different types of liability insurance in China, and are seeking for more valid reasons to purchase these insurances over or along with other traditional types of insurances. Question based on general third-person liability are mostly asked by individuals, whereas questions on employer liability are asked more frequently by employers representing a business perspective.

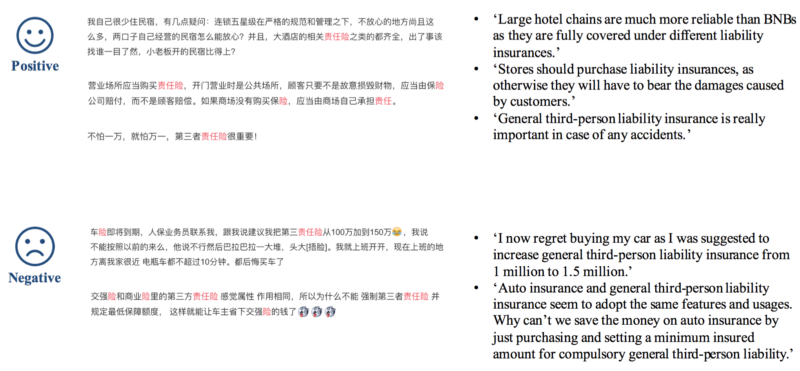

Optimistic Weibo consumers seem to show extensive knowledge on liability insurance, as they recognize its importance and agree on the protection it offers to an individual or to a business. Comparatively, negative opinions mostly arise from lack of understanding of the insurance type or due to a high insurance fee. Overall, consumers are looking to gain more information regarding liability insurance as many struggled to understand how premiums are calculated, what is its difference to traditional types of insurance and what exact benefit it will bring.

Insurance companies in China have attempted to bridge the knowledge gap by offering multiple sales channels where consumers can gain detailed information according to their needs. Consumers are encouraged, at their own convenience, to contact sales person via online chats, phone chats or over the counter in order to obtain more information regarding liability insurance.

Degree of competition within the liability insurance market in China

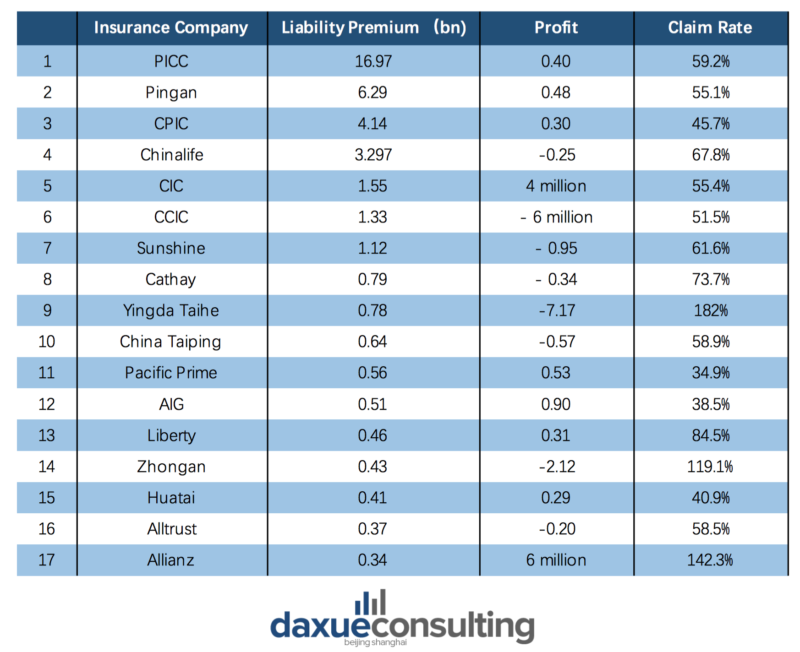

A total of 4,961 liability insurance products was provided by 82 insurance companies in China at the end of 2018. The top four players in the Chinese liability insurance market are PICC(中国人保财险), Pingan(平安保险), CPIC(太平洋保险) and Chinalife (国寿财险). They together shared 71.05% of the total liability market premium in 2018.

Although CPIC offered a broadest range of liability insurance products in China, PICC still occupied the most market share attributing to its larger company size and higher profit. Zurich(苏黎世保险) was the only foreign company that got ranked for the abundance of liability products it offered. However, most of the products are subjected and limited to certain big cities and it did not enter as one of the top 20 liability premium companies.

[Source: Non auto-insurance product observed Number of liability insurance products offered by insurance companies in China]

Despite that local companies control most of the Chinese liability insurance market, foreign companies such as AIG(美亚), Liberty(利保保险) and Allianz(安联保险) performed well in the past year. They have achieved positive profit return and liability premium revenue that ranked them amongst the top 20 in the Chinese market.

[Source: Non auto-insurance product observed Chinese market liability premium]

The degree of competition is quite intensive in the Chinese liability insurance market as switching cost is low, most Chinese market liability premium and market shares are controlled by the big four insurance companies.

However, there are still opportunities for new entrants or existing competitors to gain market share as liability insurance, currently only accounts for around 4.28% of the non-life insurance market in China. This figure is much less comparing to foreign countries with mature insurance markets where liability normally occupies around 30% – 40% of the total property and casualty insurance market.

Local insurance companies recognise the importance of online sales channels

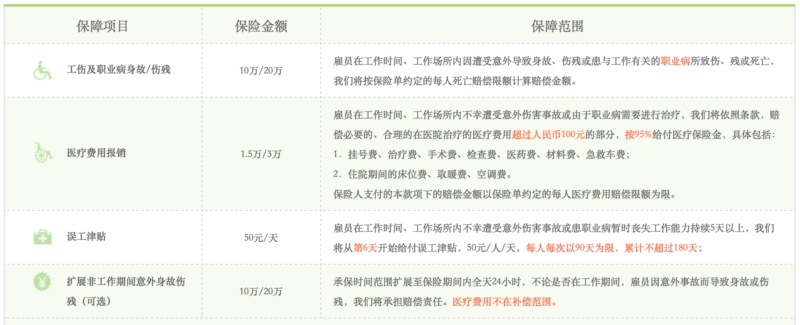

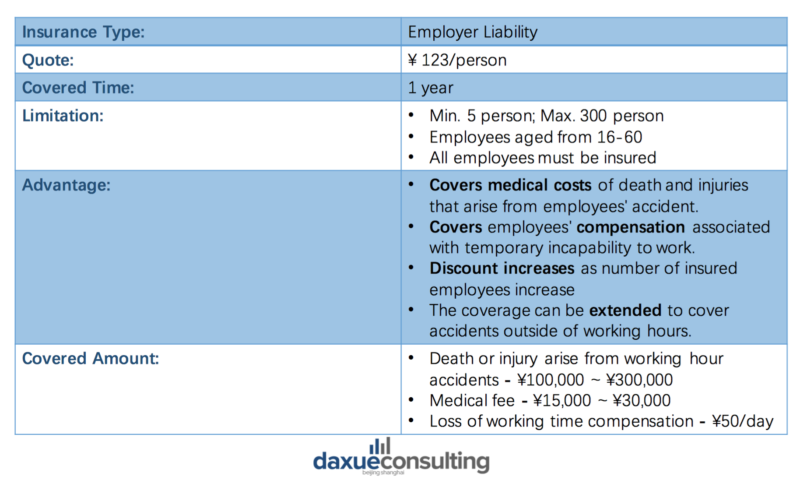

Local companies like Pingan utilizes multiple channels to reach their potential customers and especially focuses on the online channel. Their developed webpage for liability insurance products provides ease of purchase, and serves to bridge the knowledge gap between their customers. Employer liability provided by Pingan has a specific landing page with clear and basic information including quotation, coverage amount, insurance condition and other product characteristics. It encourages its customers to complete the whole insurance process online through a simple three step purchasing process. Moreover, Pingan has also made it easy for customers to contact sales person online or offline whenever they have any further questions regarding the insurance.

[Source: Pingan Employer liability insurance by Pingan]

[Source: Pingan Coverage details of employer liability insurance by Pingan]

[Source: Pingan Summary of employer liability insurance by Pingan]

Foreign insurance companies in China rely on offline sales channels

Zurich, the company that provides most liability products out of all foreign insurance companies in China, did not adopt any online sales channel. Consumers are encouraged to directly contact the insurance company if they want learn more about the liability insurance they wish to purchase.

[Source: Zurich.com.cn Zurich’s liability insurance products]

What to expect as a new entrant in the liability insurance market in China?

Overseas insurance company that wishes to enter the Chinese liability insurance market has to understand the strength, weakness, opportunity and threat embedded within. The liability insurance market in China is currently in between the introduction and growth stage, in which a positive future outlook and chances to take market share may be foreseen.

Strength: Utilizing experience from overseas market

Most overseas insurance company already have extensive products and services established in their home country. This means they can utilize their experience gained in the foreign market on the Chinese market. A great advantage for the foreign company is that the overseas liability market is much more mature which most readily have more experience handling liability insurances.

Weakness: Understand Chinese consumer behaviour and their needs

Local Chinese insurance companies can more readily access Chinese consumer information than foreign companies, which means companies that are planning to enter the Chinese liability market will need to gather more information in order to understand in depth Chinese consumer behaviors. The local insurance companies currently emphasize online channels to sale their liability products, while foreign companies who are already in the market have not yet placed enough weight on their online services. This may create chances for foreign companies entering the market if they can utilize the online channels effectively to communicate with their potential customers.

Opportunities:

Government support for liability insurance in China

The Chinese government is encouraging the use of liability insurance as a risk management tool to manage social disputes. Policies and regulations have been imposed by the government on various industries, which may accelerate the growth of liability insurance market in China in the near future. Safety production liability, environmental impairment liability and medical malpractice will be imposed to resolve social disputes.

Liability product innovation will expend the Chinese liability market

Product innovation is set to bring further growth to the liability market in China. Mature foreign market liability products such as cyber insurance and intellectual property insurance are slowly entering the Chinese market.

The impact of technology advancement on liability products in China

E-commerce is especially important in China as consumers are increasingly making online purchases. It is pushing for many new liability products such as shipping expense insurance and delivery service liability, which have been designed to manage potential risks embedded in online purchases.

Moreover, AI technologies have been continuously updated to provide more efficient risk analysis, pricing and automatic claim handling.

Overall, foreign companies entering the Chinese liability market should focus on the market trend and decide what exact liability products to be provided, in order to successfully grab the opportunities to gain more Chinese market liability premium. Huge potential lies ahead for liability insurance in China as Chinese economy continues to expend, legal regulations become more robust and E-commerce channels continue to develop.

Author: Chenyi Lyu

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes