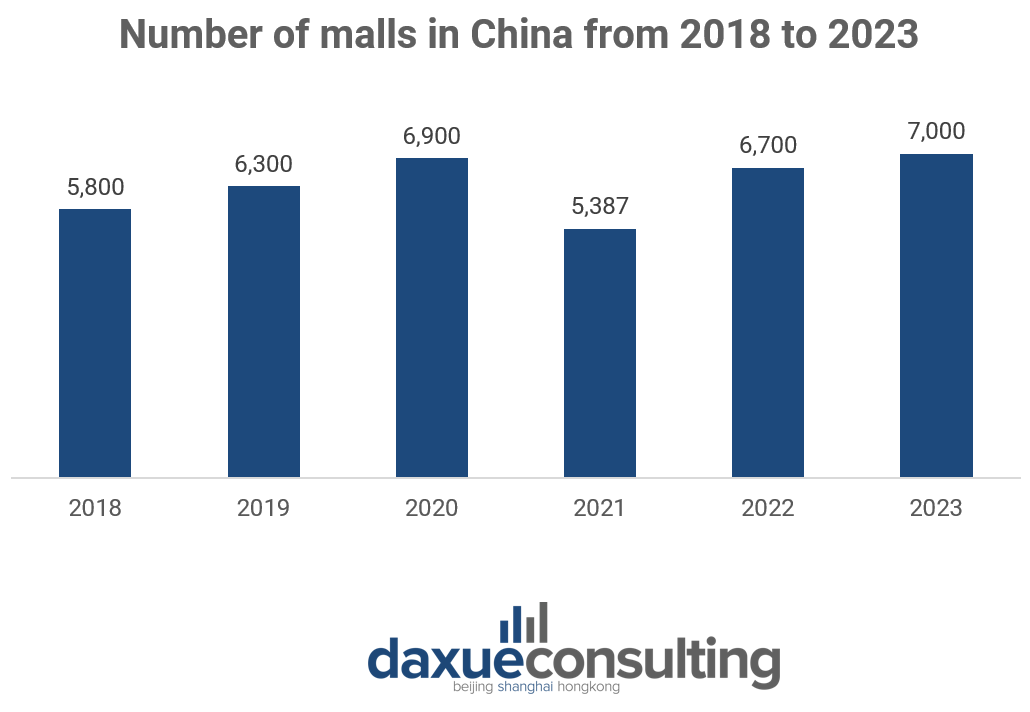

In 2023, China’s retail landscape saw the inauguration of 400 new shopping centers, reflecting a persistent expansion despite previous growth deceleration. Presently, there are about 7,000 shopping malls in China and forecasts suggest a resurgence in the mall market, with an anticipated market size of RMB 1.9 trillion by 2025.

However, challenges persist amidst this growth trajectory. Factors such as an aging population, a slowing economy, and the burgeoning popularity of online shopping are diverting foot traffic away from traditional malls. To counteract this trend and revitalize customer engagement, mall operators are increasingly focusing on differentiation strategies and enhancing value propositions.

Download our report on Gen Z consumers

Against this backdrop, consumer spending emerges as a pivotal driver of economic growth, constituting 82.5% of China’s GDP in 2023, marking a notable 43.1% year-on-year increase. The expected resurgence in consumer activity in 2024, particularly in leisure-related sectors like chain hotels, online travel agencies, and Macau casinos, presents an opportune moment for mall businesses to recalibrate their approaches and attract a broader customer base.

Urban retail powerhouses: a closer look at China’s major shopping hubs

The Department Stores & Shopping Malls industry in China exhibits relatively low market concentration. Notably, Shanghai leads the provinces with 700 shopping centers, securing the top spot nationally, closely trailed by Beijing with 470 malls. In 2021, 52 shopping centers nationwide surpassed RMB 3 billion in sales. Remarkably, Beijing, Shanghai, Guangzhou, and Shenzhen collectively contributed 26 of these centers, precisely 50% of the total. This underscores the significant market presence of these first-tier cities, with their combined sales accounting for half of the national market.

Delving into individual sales performance, Beijing SKP maintains its dominance as the top performer, followed by Nanjing De Ji Plaza and Beijing International Trade Center.

Challenges faced by shopping malls in China

In China, the mall industry faces a multifaceted landscape marked by a blend of challenges and prospects amidst evolving consumer behaviors. Structural hurdles such as oversupply in Tier-1 cities and subpar commercial properties have resulted in a scenario where only a select few operators flourish, leaving many grappling with difficulties. Compounding these issues, the surge in online shopping has exacerbated structural deficiencies, thrusting malls into an intensely competitive arena for customer engagement.

Despite these challenges, malls remain pivotal hubs for luxury brands, attracting affluent and trend-conscious consumers while generating significant foot traffic. Yet, the scarcity of high-end malls in non-Tier-1 cities poses a persistent obstacle for luxury brands seeking expansion opportunities in China.

Mitigating these complexities necessitates a holistic strategy encompassing differentiation, sustainable growth, and digital innovation. Through such an approach, stakeholders can adeptly navigate the intricacies of the Chinese mall landscape, capitalizing on emerging opportunities while proactively addressing prevailing challenges.

4 methods employed to stand out from the crowd

Shopping malls are striving to maintain competitiveness in the face of intense competition by implementing strategies that emphasize effective content marketing and the creation of distinctive shopping experiences. This entails a shift from passive to active management, with a focus on digital-enabled lean operations to better support merchants. Through these initiatives, malls aim to differentiate themselves and enhance their appeal to consumers while simultaneously streamlining internal processes to adapt to evolving market dynamics.

1. Repurposing the space and incorporating entertainment features

Shopping malls in China are undergoing a significant transformation, with a pronounced focus on leisure and lifestyle enhancements. For instance, the newly opened Aeon Mall in Wuhan allocates approximately 21% of its space to recreational facilities, leisure activities, and dining options. Notably, it boasts a sprawling 2,700-square-meter rooftop park and a 300-square-meter indoor kids’ playground, offering customers experiences beyond traditional shopping.

Moreover, contemporary malls are redefining the shopping experience by prioritizing the integration of entertainment and lifestyle elements. One prominent example is K11, which has embraced the concept of “shoppertainment” by curating art exhibitions featuring works by renowned artists such as Damien Hirst, Olafur Eliasson, and Teppei Kaneuji. Additionally, K11 distinguishes itself by incorporating natural elements into its design, including gardens, local flora, green roofs, and urban farming initiatives, culminating in an urban oasis experience for visitors.

Even mundane facilities like restrooms are not overlooked in the quest for innovation. The deluxe restroom at De Ji Plaza, following an RMB 8 million renovation, garnered widespread acclaim upon its opening in September 2022. Described as “more beautiful than a wedding venue,” it quickly became a social media sensation on platforms like WeChat Moments and Xiaohongshu, attracting throngs of visitors eager for photo opportunities and check-ins.

2. Targeting the parent-family demographic

Recognizing the unique challenge of catering to families with parents and children, some malls are prioritizing solutions to keep children entertained while their parents shop.

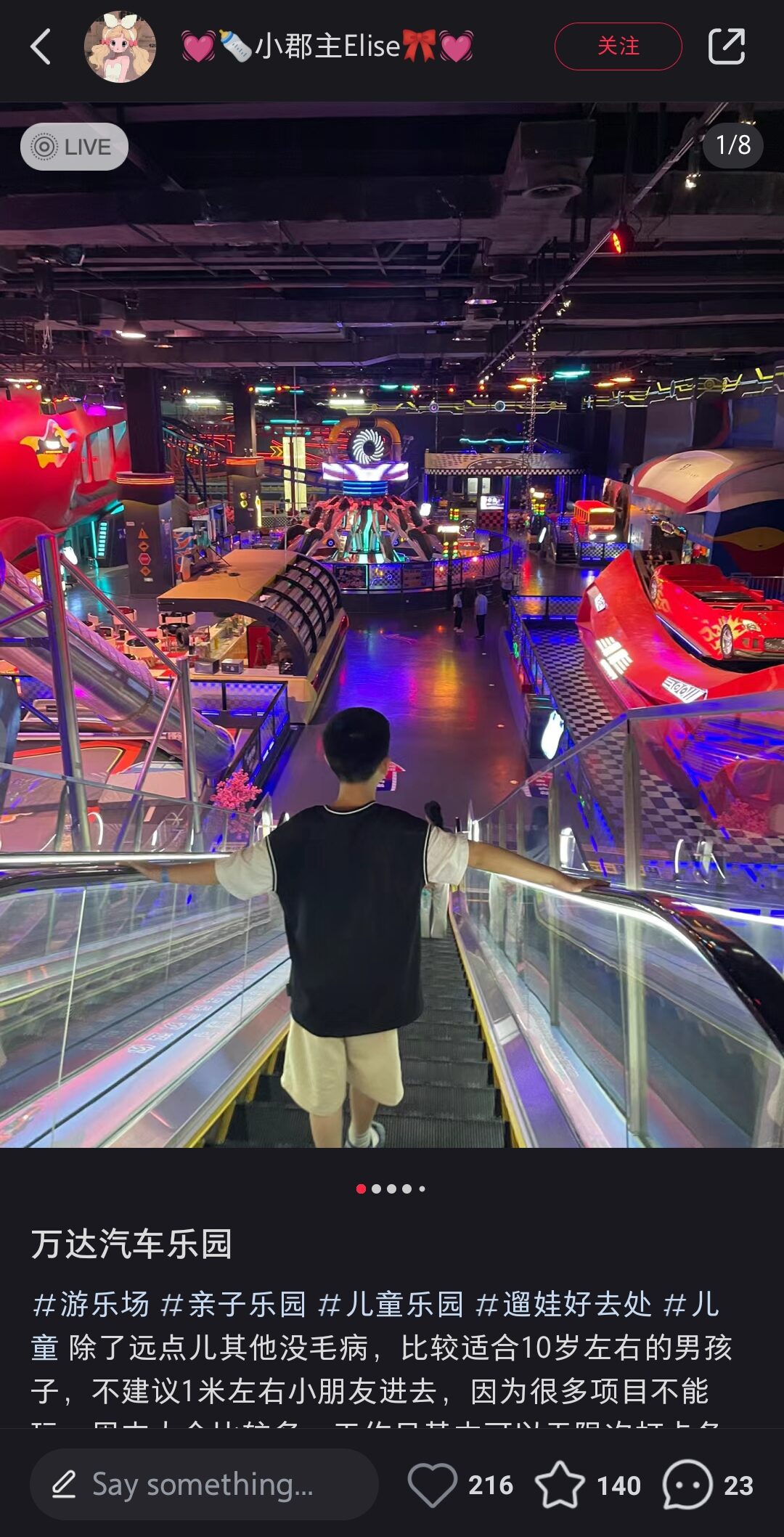

One notable example is the Wanda Group, the largest chain of commercial complexes in China, which is actively spearheading the strategic development of family-friendly spaces. These spaces not only offer high-quality experiences but also cater to personalized needs. This commitment is evident through innovative attractions such as the Wild En Animal Zoo, MELAND Playground, and the Partyday Sports Super Arena. Each of these features is meticulously designed to resonate with the parent-child demographic, providing engaging experiences for families.

This strategic focus positions Wanda Plaza as a comprehensive destination, aligning with its overarching goal of becoming a central hub in every city it operates in.

3. Embracing a multichannel and offline-to-online strategy

In today’s competitive environment, attracting diverse customer segments requires employing varied strategies including leveraging e-commerce platforms, onsite sales, and offline-to-online tactics. Both K11 and Yintai Retail Group adeptly blend physical and digital experiences to enhance customer loyalty.

K11 employs innovative methods to engage mall tenants and retain customers, including the K11 GO WeChat mini program. Additionally, the mall hosts livestreams on platforms like Weibo, showcasing products, offering virtual art tours, and fostering interactive engagements. These efforts, combined with its loyalty program rewarding high-value shoppers, contributed to an impressive 80% year-on-year sales increase at K11 Musea during Christmas 2023.

Meanwhile, the Yintai Retail Group in Hangzhou has embraced an omni-channel approach, transitioning into an ‘internet department store’ through seamless data integration and digital features. This strategic shift has proven highly effective, as evidenced by the attraction of 35 million digital members and a significant surge in online sales, rising from 5% in 2019 to 22% by 2022. These results underscore the success of their multi-channel integration efforts.

4. Offering an experience rather than a transaction

While technological advancements continue to reshape the retail landscape, frontline workers remain indispensable in delivering value-added services and fostering meaningful customer interactions. Thus, maintaining a human-centric approach remains paramount amidst these transformations.

This ethos is evident in Shanghai’s themed malls, which pioneer innovative concepts to enhance customer engagement. For instance, the Japanese amine-themed shopping mall Lalaport, featuring a giant Gundam statue and other ACG-related decorations and stores, prioritizes immersive experiences tailored to consumer preferences.

Moreover, the integration of the metaverse into retail, as demonstrated by Burberry’s social retail store in Shenzhen, signifies a convergence of virtual and physical realms. This trend aligns with the findings of a 2021 Wunderman Thompson Data survey, indicating that 83% of 3,011 respondents across the US, UK, and China anticipate a hybrid shopping experience in the future. Concurrently, the emergence of “smart malls” blurs the boundaries between physical and digital retail spaces, offering customers a unique and seamless shopping journey.

Malls in China at a crossroads

- China’s retail landscape saw a surge in mall openings, reaching 400 in 2023, with an anticipated market size of RMB 1.9 trillion by 2025, indicating persistent expansion despite challenges.

- Malls are employing differentiation strategies, focusing on leisure enhancements, themed experiences, and upscale amenities to counteract challenges and attract customers.

- Family-friendly initiatives like Wanda Group’s themed attractions cater to the parent-family demographic, providing engaging experiences for families.

- The adoption of omni-channel and offline-to-online strategies, exemplified by K11 and Yintai Retail Group, allows malls to reach diverse customer segments and boost sales through digital integration.

- Human-centric approaches remain crucial, with malls integrating frontline workers and immersive experiences to foster meaningful connections amidst technological advancements.