Where lie the challenges facing the market for myopia treatment in China?

As of 2016, the market for myopia treatment in Chinawas already worth $2.7 billion. The market is set to continue growing at 14.8 percent a year, reaching $5.3 billion by 2021, according to a market research institution. Amid the optimism, however, players in the Chinese market for myopia treatment must be prepared to adapt to a dynamic environment of fast-changing consumer characteristics amid immature industry standards.

To first understand this projected growth, it may be noted that a 2014 investigation by the Chinese Ministry of Health (卫生部) and Ministry of Education (教育部) revealed that China had a myopia occurrence rate of 33 percent, which was 1.5 times higher than the world average of 22 percent. In the country, the number of people afflicted by myopia summed up to 400 million and is still growing at an average rate of 8 percent each year, according to a 2016 Hong Kong Trade Development Council (香港贸易发展局) report. Across China’s primary schools, 25 percent of all students have been diagnosed with myopia. Moreover, in junior and senior high schools, the figure rises up to 70 percent and 85 percent, respectively, the report wrote.

In urban China, up to 90 percent of all youth have developed myopia by the time they graduate from high school, according to an LA Times article in 2012. Furthermore, an estimated 10 to 20 percent of these nearsighted youth will develop high myopia –– which is unlikely to be treated and involves high risks of blindness, the article wrote.

At present, there are an estimated 90 companies within the Chinese market for ophthalmic products. The nine leading firms within this market –– Alcon (爱尔康), Allergan (艾尔建), Roche (罗氏), Carl Zeiss Meditec (蔡司), Bausch + Lomb(博士伦), Abbott (雅培), Chengdu Kanghong Pharmaceutical Co. (康弘), Santen (参天) and Topcon (拓普康) –– occupy more than 60 percent of total manufacturer revenues, leaving 31 other companies to compete for much smaller shares, according to a market research institution in 2016.

Nonetheless, the high growth demonstrated by the market for myopia treatment in China presents opportunities for new entrants to establish themselves. Based on our diverse market research and strategy recommendation collaborations with major European and American Meditech and pharmaceutical firms in the Chinese market, Daxue Consulting presents in the following article a brief overview of the market for myopia-related vision care products, surgery devices as well as diagnostic and monitoring devices.

Vision care: The migration to contact lenses

At present, China is the country with the largest potential for vision care products. As of 2015, the overall Chinese market for spectacles was worth $10 billion with a growth of 10 percent. In the same year, the market for contact lens grossed $626 million and had been growing at a rate in excess of 10 percent, Hong Kong Trade Development Council wrote. Furthermore, between 2010 and 2015, Chinese consumers’ spending on contact lens increased at an annual rate of 9.5 percent on average. Globally, the same figure lags behind at 2.5 percent, according to Hong Kong Trade Development Council. Particularly, consumption of disposable one-day contact lens is expected to experience an exceptionally high rate of growth due to the Chinese people’s increasing demand for convenience and hygiene. At the same time, lenses that can alter pupil color or create an appearance of larger eyes have also displayed high potential.

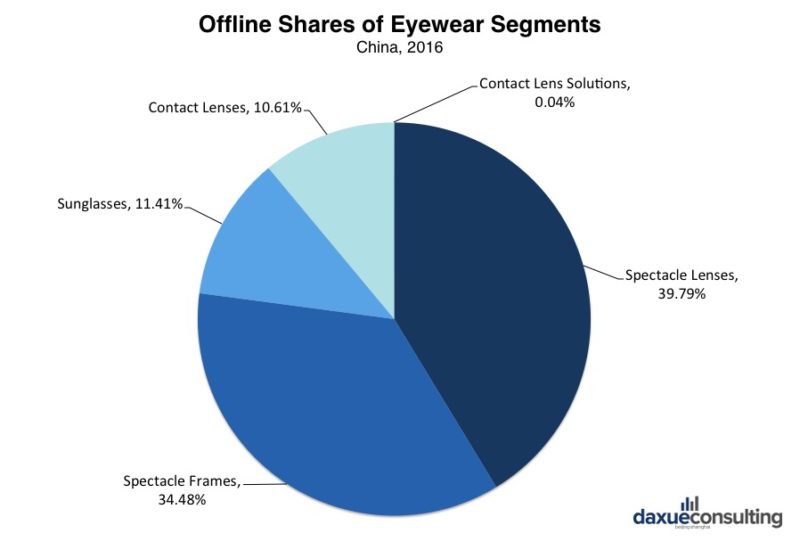

In the current Chinese vision care market, the majority of which occurs offline, however, spectacle lenses continue to lead at a 39.79 percent market share. The runner-up is spectacle frames at 34.48 percent, followed by sunglasses at 11.41 percent and contact lens at 10.61 percent. Contact lens solutions, on the other hand, compose a near-negligible 0.04 percent of the market.

The distribution of offline market shares among five major types of vision care products in China. Source: Daxue Consulting.

[ctt template=”2″ link=”E40WG” via=”yes” ]In the current Chinese vision care market, the majority of which occurs offline, however, spectacle lenses continue to lead at a 39.79 percent market share.[/ctt]A crowd for spectacles

As of 2014, the ten leading brands within the Chinese market for spectacles composed a mere 26 percent of all shares for the product, displaying a scattered distribution of power among players, according to a market research institution. In part, this phenomenon may be explained by consumers’ relative indifference towards brands when it comes to lenses and frames, thus resulting in low entry barriers for the industry, according to a PRWEB report in 2014.

In the market for contact lens, however, the six largest brands compose 88 percent of all shares, Hong Kong Trade Development Council wrote in 2016. Furthermore, imported brands have held major advantages over domestic brands due to their high quality, advanced technology content as well as complete production line. For these reasons, foreign brands have successfully appealed to a fast-growing group of wealthy Chinese consumers.

Playing out the strategies

In China, major contact lens manufacturers include Acuvue (安视优), Ciba Vision (视康) and Bausch+Lomb, according to Hong Kong Trade Development Council in 2016. The spectacles market, on the other hand, is topped by firms including Essilor (依视路), Zeiss, and Ming Yue (明月), China Enterprise News (企业报道) reported in 2015.

- Acuvue: In China, this brand by Johnson & Johnson offers anti-UV rays contact lens as well as colored contact lenses in at least five colors.

- Ciba Vision: Ciba Vision, Novartis AG’s vision care business, offers a range of products including Focus DAILIES contact lens and the AOSEPT PLUS solution for contact lens, which are known for their excellent anti-bacterial properties and suitability to sensitive eyes.

- Bausch+Lomb: Since entering the Chinese market in 1988, the brand has set up five companies in China. In the Chinese market, it offers an array of products from regular contact lens to colored contact lens and other vision care products. The company is the first ISO-certified contact lens supplier in China.

- Essilor: Essilor plays a major role in the Chinese vision care industry, and is en route to further expansion within the mid-range segment by acquiring and entering partnerships with domestic players. Up till 2017, the company has taken a 50 percent stake in the Hong Kong-based corrective lens provider Photosynthesis Group, a 55 percent equity interest in Jiangsu CreaSky Optical (江苏创天光学眼镜), as well as a 50 percent stake in Xiamen Yarui Optical Company (厦门雅瑞光学).

- Zeiss: Zeiss takes pride in its dynamic array of products, claiming that nearly 50 percent of its current products are no older than three years since their introduction to the market. The company has claimed a presence in China since 1957, and went on to establish the China Innovation Center in 2011. According to the company, this center in Shanghai is one of its major R&D sites located beyond Germany, and is strategic to harnessing the potential it sees in the Chinese market.

- Ming Yue: Native to Shanghai, Ming Yue was founded in 1997 and has since targeted China’s mid to high-end market. Ming Yue claims that products are carried at more than 20 thousand locations and consumed by 50 million customers worldwide. As a key part of its strategy, the company has jointly established research and production centers with Korea Optron Corp and Japan’s Mitsui (三井).

Commercial for Acuvue’s Define (美瞳) colored contact lens. Source: Acuvue

A new playing field for children

Within the Chinese market for vision care products, however, new frontiers of contestation among brands are opening up due to the consumers’ changing demographics. According to Professor Fan Lu (吕帆) of Wenzhou Medical University (温州医科大学) in 2016, patients of progressing myopia now tend to be of an increasingly young age compared to those in the past. In China, approximately 67 percent of children aged less than six years old have begun to use electronic products by the age of four, according to Hong Kong Trade Development Council in 2016. As a result, Chinese children are exposed to ophthalmic risks associated with held-held devices starting from a young age, raising parents’ interests in purchasing high-quality glasses for them.

“The overuse of smartphones has dramatically changed people’s behavior,” Lu said. “Children, for example, tend to spend a lot of time reading at a very short distance. The prevalence of myopia among both urban and rural children has gone up as a result.”

Follow us on Twitter to learn more:

What are the untapped potentials for the #Chinese #medical #tourism? Find out here https://t.co/0G5fEK0uf6

— Daxue Consulting (@DaxueConsulting) May 24, 2017

Moving online

At the same time, the retail of vision care products has also begun to see new experimentation with e-commerce. In China, there presently exist four major retail channels for vision care products, including branded chains, medical institutions, eyewear bargain supermarkets and traditional optical shops, Hong Kong Trade Development Council reported in 2016.

Major chains include Daguangming (大光明), Maochang Glasses (茂昌), Baodao Optical (宝岛), Ming Long Optical (明廊) and LensCrafters (亮视点).

In recent years, however, a rising generation of e-shoppers has encouraged the development of online business in the vision care market. Online outlets such as Sigo (视客), Yichao (亿超) and Kede (可得)have gained increasing attention and display promising prospects, Hong Kong Trade Development Council reported in 2016, adding that contact lens may be a major growth point in the online market.

According to research by Daxue Consulting, additionally, e-commerce in its mobile form may play a particularly important role in the vision care market. This increased convenience is key to resolving China’s low ratio of eyewear stores to population. At present, each eyewear store in China must serve 23 thousand people, whereas on average, each eyewear store in developed countries serves about ten thousand, according to a 2016 report by a market research institute.

As a result of this unmet demand, online eyewear outlets have seen considerable growth over the past few years. In 2006, the sales value of vision care products generated online represented a mere 0.3 percent of the market’s total sales value. By 2015, however, the share of online vision care product sales had risen up to 12.9 percent, according to a 2016 report by a market research institution. Additionally, the sales of optical products on the influential Chinese e-commerce platform Taobao (淘宝网) had reached$139 million in June, witnessing a 128 percent growth since January.

Search results on Taobao for the keyword “contact lens” (隐形眼镜) as of August 2017. Source: Taobao

“There may some limitations on vision care sales via e-commerce platforms, however,” said Daxue Consulting Project Manager Christina Ding. “While online vision care shopping may appeal to consumers in their college years or above, younger consumers are dictated by their parents –– who may prefer formal offline optical shops due to the emphasis they place on their youngsters’ health and safety.”

Furthermore, aside from myopia, some consumers may require more comprehensive offline services because they concurrently suffer from other complications such as astigmatism, Ding added.

“I think that vision care e-commerce is still in a very preliminary stage –– while there is in fact a demand for vision care products online, most people continue to buy them offline,” according to Daxue Consulting Project Manager Christina Ding.

[ctt template=”2″ link=”O0dep” via=”yes” ]”While there is in fact a demand for vision care products online, most people continue to buy them offline”[/ctt]

Surgery devices: Harnessing the high tide

Surgical solutions to myopia, on the other hand, have also seen outstanding performance in China. Since its introduction to China in the 1990s, laser vision correction surgery had achieved 1 million procedures a year by 2012, according to the LA Times. A major growth spurt in the service took place after 2005, and the country has since overtaken the USA as the world’s largest market for laser refractive surgery with regards to procedure volume.The Chinese market for laser vision correction has generated $713 million per year since 2012, Kellogg Northwestern School of Management wrote in a report.Furthermore, the market is set to grow up to $2.16 billion by 2023, with a compounded annual growth rate of 11.75 percent, the report projected.

First movers

In response to the opportunity, several leading providers of ophthalmic surgery equipment have already established a presence in China, filling the country’s growing demand for the service.

- Zeiss: In 2011, Zeiss launched its laser vision correction product ReLEx SMILE. Since then, the minimally invasive procedure has become one among the most popular options to myopia patients. According to Zeiss, it has been practiced by over one thousand surgeons and served 750 thousand eyes worldwide.

- Ellex Medical Lasers: In 2007, Ellex entered the Chinese ophthalmic laser market through a division of Guotong Holdings Company Limited (国通控股有限公司), its exclusive distributor in the country. Furthermore, up till 2016, the China FDA has granted approval to an increasingly wide array of Ellex products, indicating higher sales for the company in the 2017 financial year. According to a press release, Ellex sees significant opportunity in the ophthalmic market’s rapid expansion in China, which will be a focus of the company’s strategies.

- STAAR Surgical (达视): STAAR surgical is a leading provider of implantable lenses and ophthalmic surgery delivery systems. The company provided China’s first Visian implantable collamer lens treatment in 2006. As of 2014, Visian ICL procedures composed approximately two percent of China’s more than 875 thousand refractive procedures. The company, however, expected its share in the Chinese market to grow due to its attainment of CFDA permission to market the Visian ICL in 2014.

Commercial for STAAR Surgical’s Visian ICL. The upper line reads “safety, definition, comfort”; the lower linereads“ICL implanted contact lens”. Source: STAAR Surgical.

Turning the tides

There are doubts, however, regarding the surgical vision correction industry’s prospects over the long term. As China enters a stage of population aging, the number of people entering their twenties is set to decrease into the future. This event may have a major impact on the market for refractive surgery. According to InSight Vision Center, most cases of myopia develop during school years but will have stabilized by the patients’ early twenties. Those who undergo refractive surgery around this age tend to experience outstanding outcomes. Thus, the age group plays a significant role as consumers of refractive surgery and will impact the market as it begins to shrink.

Diagnostic and monitoring devices: Sunrise ongoing

Diagnostic and monitoring devices in the ophthalmic market, however, remains largely optimistic into the near future. As of 2015, the Chinese market for ophthalmic medical equipment was sized $2.8 billion, and is projected to continue growing at a rate of 4.7 percent over the next few years, according to a report by the Chinese business news outlet chyxx.com (中国产业信息网). The market, however, is scarcely saturated and harbors considerable space for growth, the report stated. Up till the end of 2014, there were a total of 403 ophthalmic centers in China, with 289 located in cities and another 114 in rural areas. Of all these ophthalmic centers, 32 were opened up between 2013 and 2014.

Foreign firms reign

At present, the Chinese market for ophthalmic devices may be considered an oligopoly dominated by foreign firms such as Topcon, Zeiss and Shin-Nippon(新日本) according to a market research institution in 2017. Within the China, approximately 85 percent of all sophisticated ophthalmic equipment in hospitals were provided by foreign producers, a market research institution reported in 2016.Yet, despite the general lack of high-end domestic ophthalmic technology, there are still, in fact, a number of prominent Chinese firms in the market including New Eyes (新眼光医疗器械), Kanghua(康华瑞明), 66 Vision (六六视觉科技) and Kangjie (康捷医疗), a market research institution reported.

- Topcon: Topcon offers an array of ophthalmic products including diagnostic equipment and software solutions for refractive, retinal, and surgical services. The firm had established a presence in China by 2014, offering mid to high-end products in the country.

- Zeiss: In China, Zeiss provides diagnostic and treatment systems including the CRS-Master and Atlas 9000 systems. CRS-Master appeals to medical practitioners by enabling personalized treatment plans uniquely optimized for patients of different ages. Atlas 9000 is a corneal topography system which uses the patented Cone-of-Focus Alignment System. In the process of alignment, it analyses multiple images to yield highest-quality results.

- Shin-Nippon: A subsidiary of the Japan-based company Rexxam, Shin-Nippon provides an array of ophthalmic products including refractometers, non-contact to no meters, refractors and slit lamps.

Ophthalmologist operating Zeiss equipment. Source: Sohu (搜狐).

Targets in perspective

In order to effectively market products towards suitable clients in China, players in the ophthalmic market must understand the country’s system of hospital classification. Among the three types of Chinese hospitals –– class Irural hospitals, class II secondary city hospitals, and class III primary city hospitals –– class three hospitals have the greatest potential as buyers of high-end foreign ophthalmic technologies, according to a market research institution. These hospitals, located at major population centers in China, have well-developed technical skills and infrastructure, as well as more generous financial capacities.

At present, however ophthalmic practices in China continue to face limitations stemming from low levels of technical expertize and consumption capacity, a market research institution reported in 2017. Despite tier III hospitals’ access to high-quality ophthalmic equipment, the field is nonetheless lacking in standardization of clinical procedures, according to a market research institution in 2016. This phenomenon has often prevented ophthalmic devices from displaying full-service quality, causing discrepancies in treatment and diagnosis. As a result, the establishment of education initiatives by major leading firms that offer sophisticated devices may prove beneficial not just to medical practitioners, but also to foreign players in the Chinese ophthalmic medical equipment market.

In promoting the sales of a product in China, it is advisable for firms to provide technical training to ophthalmologists as a means of introducing their products to these practitioners.As a rule, additionally, it is important to note that key-product qualities sought after by ophthalmic practitioners in China include convenience and durability, according to a market research institution. Therefore, buyers are often more receptive of equipment that is simple in usage and easy to familiarize with.

In constructing marketing strategies for Meditech companies tailored to medical practitioners in China, Daxue Consulting has offered and conducted thorough field research on the market. Aside from comprehensive desk research, we draw analyses based on in-depth interviews and focus groups that extract valuable information from patients and physicians in major Chinese cities. To learn more about key information specific to the market for myopia treatment in China, subscribe to our newsletter or contact our team at dx@daxueconsulting.com.

Contact us to learn more about the Chinese market.