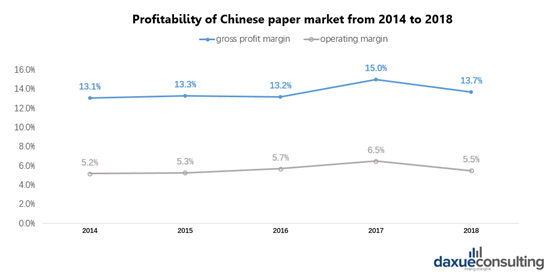

In 2018, 104 million tons of paper was both produced and consumed in China. However, the profitability of the Chinese paper industry is stabling out after an upward trend. The gross profit margin exceeds 13% and operating margin increased from 5.2% in 2013 to 6.5% in 2017. In 2008, the gross profit margin decreased from 15.0% in 2007 to 13.7%, and the operating margin in the paper market in China decreased from 6.5% in 2007 to 5.5%.

China is a leading country in the world’s paper production, consumption and imports for decades. However, Chinese paper market is facing both opportunities and challenges..

[Data Source: China Business Research Institute, “Profitability of Chinese paper market from 2014 to 2018”]

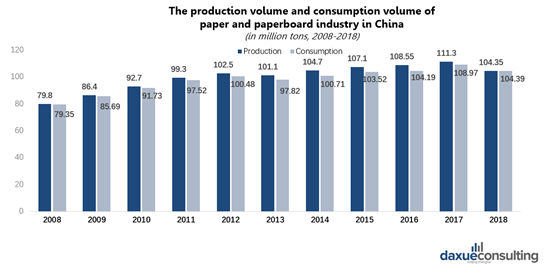

Production, consumption and revenue of paper and paperboard in China experienced a drop in 2018

[Data Source: Chinese paper industry Association, “The production volume and consumption volume of paper and paperboard industry in China”]

Generally, the paper market in China saw an increasing trend from 2008 to 2018. According to the statistics released by the Chinese paper industry Association, the production and consumption of paper and paperboard in China had a stable annual growth rate of 3.08% and 3.16% respectively. In 2018, China’s consumption reached 104.39 million tons and it produced over 104.35 million tons to rank the first in the world. However, compared with that of 2017, the production of paper and paperboard decreased by 6.24% while the consumption experienced a drop of 4.2%.

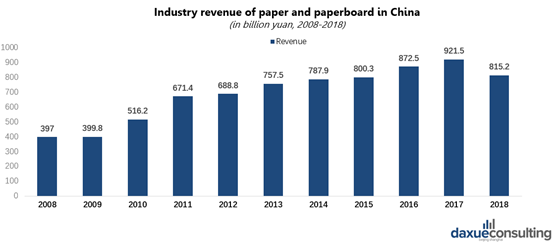

[Data Source: Chinese paper industry Association, “Industry revenue of paper and paperboard in China”]

Similarly, in 2008, the industry revenue of paper and paperboard in China declined for the first time in more than a decade, decreasing from 921.5 billion yuan in 2017 to 815.2 billion yuan.

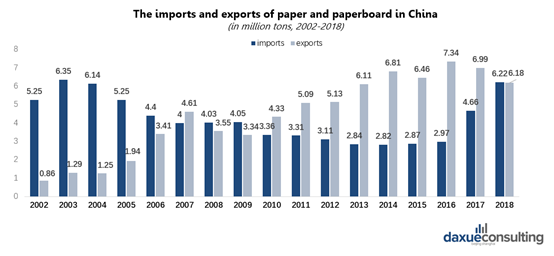

China’s imports and exports of paper, paperboard and papermaking raw materials

The imports and exports of paper and paperboard show opposite trends

[Data Source: China Customs, “The imports and exports of paper and paperboard in China”]

Due to old production technique, China had been importing more paper and paperboard than exporting before 2010. Since 2010, the exports have exceeded imports in Chinese paper and paperboard industry. The imports dropped from 6.37 million tons in 2002 to 2.82 million tons in 2014, and then gradually rose to 6.22 million tons in 2018 while the exports increased from 0.855 million tons in 2002 to 6.81 in 2014, and then fell back to 6.18 million tons in 2018.

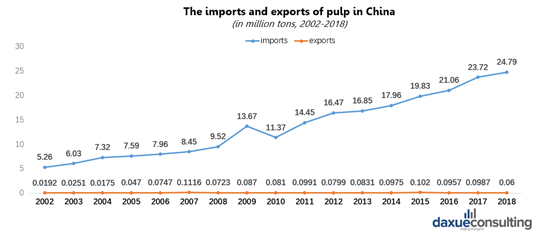

The imports of papermaking raw materials (pulp, waste paper) have increased at a rapid rate and significantly exceeded the exports for decades

[Data Source: China Customs, “The imports and exports of pulp in China”]

The imports of raw materials of papermaking in China, including pulp, waste paper, paper veneer have grown at a fast pace for over thirty years because of the increase in the demand for paper products and lack of high-quality raw materials. China has imported a large amount of raw materials from the international markets and the imports of pulp and waste paper have soared from 5.26, 6.87 million tons in 2002 to 24.79, 17.03 million tons in 2018 respectively. The shortage of papermaking raw materials and the increasing demand in the Chinese paper market can explain such trend of imports and exports of papermaking raw materials.

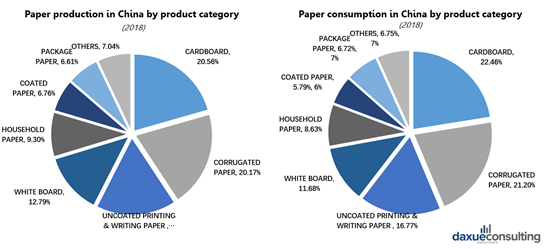

Different kinds of paper and paperboards

The paper and paperboards industry breaks down into the cardboard, corrugated paper, uncoated printing & writing paper, white board, household paper, coated paper, package paper and others.

[Data Source: Chinese paper industry Association, “Paper production/consumption in China by product category”]

The above pie charts compare the production and consumption of different kinds of paper and paperboard in China in 2018. Cardboard, corrugated paper and uncoated printing & writing paper are main kinds of paper and paperboards in terms of both the production and consumption. The white board, coated paper and package paper ranked the fourth, the fifth and the sixth of the production respectively. As for consumption, the proportion of package paper is slightly higher than that of household paper.

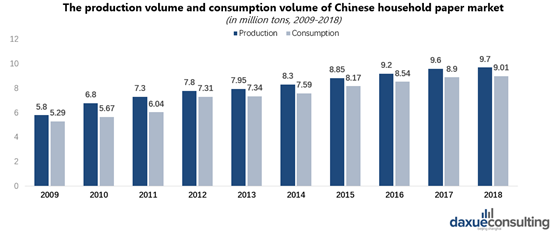

[Data Source: Chinese paper industry Association, “The production volume and consumption volume of Chinese household paper market”]

It is worth noting that the production and consumption of Chinese household paper (which breaks down into the kitchen paper, toilet paper, paper napkin, tissues, women’s sanitary napkins, and baby products) saw a continuous upward trend from 2009 to 2018, raising from 5.8 million tons to 9.7 million tons in production and from 5.3 million tons to 9 million tons in consumption. The average annual growth rate of production was 5.88% while that of consumption was 6.1% in the same period.

The production and consumption of cardboard, corrugated paper and package paper showed similar trends with the paper and paperboard industry in the period from 2009 to 2018: increased steadily from 2009 to 2017 and fell back in 2018, with annual growth rate ranging from 2% to 3%.

A giant paper brand in China: APP

The Singaporean-based company, Asia Pulp & Paper, also known in the paper industry as APP, is one of the largest pulp and paper companies in the world. APP-China has focused on operations in the Yangtze River and Pearl River Delta regions since 1992, and has invested in several large world-leading pulp & paper companies, including Gold East, Ningbo Zhonghua, Ningbo Asia, Gold Huasheng, Gold Hongye, Hainan Jinhai and Guangxi Jingui as well as large scale, modern fast-growing forests.

Following the enterprise philosophy of sustainable development, APP always attaches importance to its special relationships with society and environment. It strives to protect environment and take social responsibility. In order to make APP a first-class enterprise of the world which integrates forestry, pulp and paper production, it invested heavily on artificial forestry development. Until now, its forestry enterprises has made over 4.3 million mu of artificial forestry in China, and the circulating economy model that integrates forestry, pulp and paper production has taken shape now.

Furthermore, over 10 pulp and paper enterprises invested by APP have all passed accreditation of ISO 14001 International Environment Management System, and Ningbo Zhonghua was the first paper-making enterprise that passed accreditation of ISO 14001 International Environment Management System in China. Gold East Paper and Ningbo Zhonghua Paper were awarded “National Environment Friendly Enterprise” in September 2004 and November 2005 respectively, which gradually changes the bad image of pollution maker of paper-making enterprises.

External challenges: The impacts of China’s new regulations on the paper industry

The biggest challenge for Chinese paper industry is the serious shortage of domestic raw materials and China has become highly dependent on international raw materials suppliers. However, due to more and more demands and awareness of environmental protection, in recent years the Chinese government has implemented a series of new regulations on raw materials of papermaking importing, for example, prohibiting importing of unsorted waste paper, lowering the foreign (non-paper) content in the imported waste paper from 1.5% to 0.5% and implanting new import restrictions on recovered paper.

The new policies and regulations have far-reaching impact on China papermaking industry. In China, paper and paperboard producers are currently facing a growing challenge of rising prices across the chain. Although in 2019, China’s containerboard demand recovered to some degree and the recovered paper gap was made up by imports of recycled pulp and containerboard. However, in 2020, with China’s move towards zero RCP (recovered paper) imports, a further potential 40% to 50% reduction in RCP imports will trigger a ‘new’ raw materials supply gap. China’s producers in paper and paperboard industry will continue to be challenged by this new situation.

Internal challenges: Reform in paper industry in China

From the perspective of domestic paper industry, a number of problems accumulated in China’s paper industry during the Golden Decade (2000-2010) have begun to erupt, such as dependence on raw material imports, structural overcapacity, high import dependency of high-end paper products and un-established waste paper recycling and classification system.

In addition, from 2011 to 2015, China has eliminated backward paper capacity of 40 million tons and target for new closure will be another 8 million tons during 2016–2020, which means the industry integration will continue to increasing. It could be tough for small market share companies as well as high polluting and high energy-consuming companies in paper industry.

Potential business opportunity of paper market in China

From demand side, there is still room for development in Chinese paper market

In 2017, the world’s per capita consumption of paper was 54.71 kg per year. Europe and North America are the main force of paper consumption: the figure was 229 kg per year for North America and 178.7 kg for Western Europe. Comparatively, China’s per capita consumption of paper was 75 kilograms. Per capita paper consumption is closely related to the economic development of various regions.

In developed areas, people have relatively higher requirements for the quality of life, which is often reflected in the more exquisite product packaging, the increase in consumption volume of household paper and the continuous emergence of new subdivision paper demand, leading to higher paper consumption.

Since 2000, China’s per capita consumption of paper has increased by 150%. However, the current figure (75 kg per year) is still low considering China’s economic rise. From a global perspective, China’s per capita paper consumption has much room for growth.

Also, as we have mentioned before, the Chinese household paper market has great potential opportunities. If you need more information about this market, please refer to the toilet paper market in China.

Opportunities during industrial transformation

Since available domestic recycled pulp capacities and the weak waste paper recycling capacities cannot sufficiently fill the gap between demand and supply yet, there are opportunities for additional containerboard imports. And due to the more and more strict import restrictions on waste paper, international importers with high-quality waste paper will be more competitive. Also, the import restrictions will provide great opportunities for both international and domestic waste paper recycling market, which aims to improve China’s waste paper utilization and recycling rate.

Facing both internal and external challenges, many paper companies are accelerating the structural adjustment and continue to eliminating less efficient capacities. At the same time, paper companies have been expanding into the industrial chain through the extension of upstream and downstream, in order to achieve the control of raw materials by reducing costs.

Government goals of self-sufficiency

It may be a good timing for companies to invest in new capacity in China if substantially less efficient capacities leave the market.

Overall, the paper market in China is set to enter a new era of great challenges and opportunities while transforming towards achieving the Chinese government’s goals of self-sufficiency and environmental sustainability. Challenges could sometimes be turned into business opportunities if you are sensitive and insightful enough.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes