In July 2016, POP MART in China introduced blind boxes, signifying its evolution from a conventional toy distributor to a pop toy intellectual property operator. Not long after in 2020, it was listed on the Hong Kong Stock Exchange, paving the way for international expansion. Its revenue from Mainland China in the first half of 2024 reached RMB 3.2 billion, while that from Hong Kong, Macao, Taiwan, and international markets totaled RMB 1.35 billion, representing a revenue distribution of 70.3% and 29.7%, respectively. In comparison, the corresponding figures for 2023 were 86.6% and 13.4%. This indicates that while Mainland China market remains the primary market for POP MART, its global presence is growing.

Download our 2024 China Summer Sports Market report

Innovative products that are not limited to blind boxes

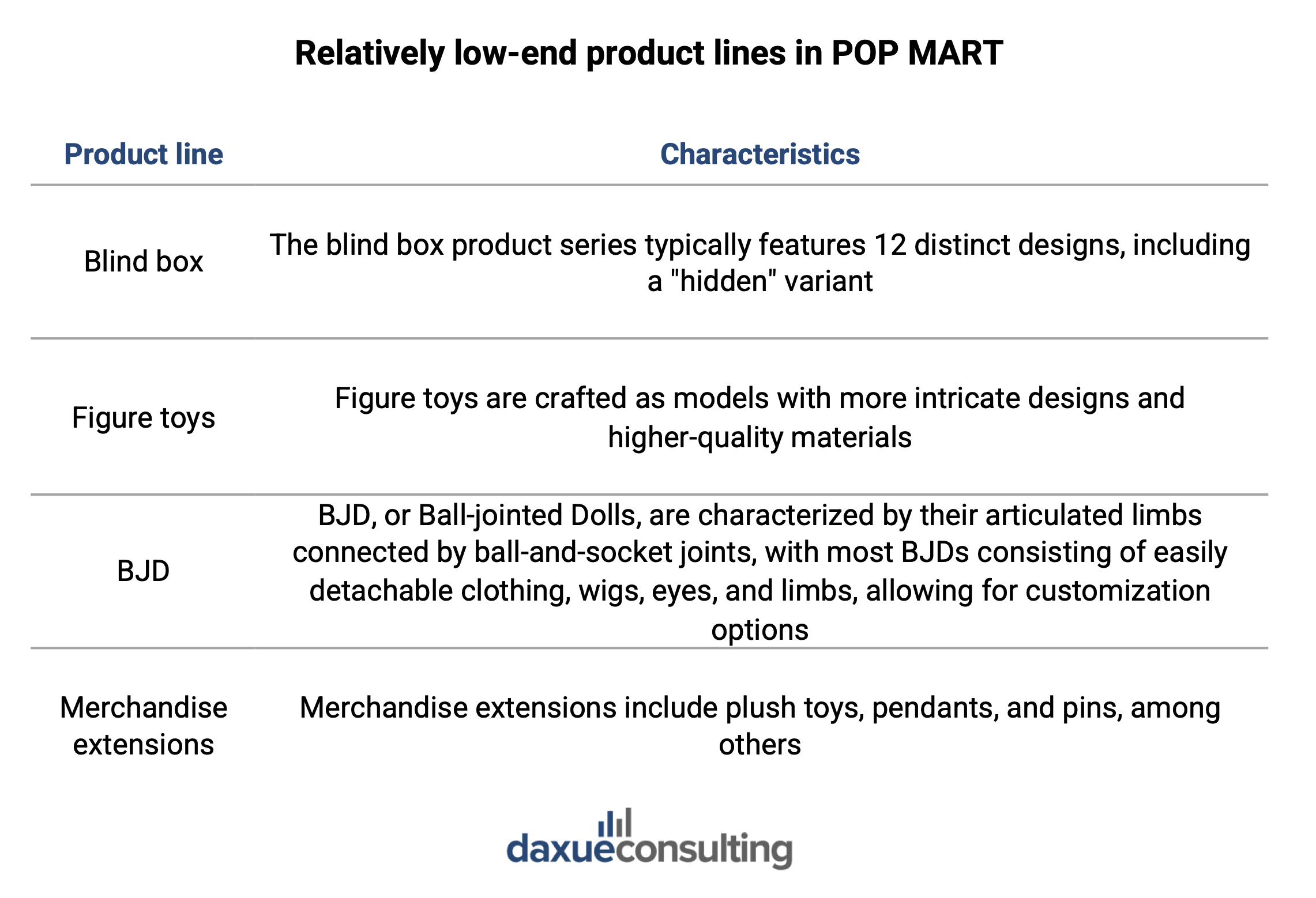

The company’s offerings can be categorized into two distinct product lines: relatively low-end and high-end. When it comes to products, POP MART’s revenue surge was mainly fueled by innovation in product categories and co-branding strategy with top brands.

The low-end product line primarily features blind box dolls, figures, Ball-jointed Dolls (BJD), and various derivatives.

POP MART in China pioneered blind boxes and has established a strong reputation in this niche. However, the company is gradually moving away from its reliance on them. In POP MART’s 2024 semi-annual results meeting, the leadership team said that the current sales of blind boxes and figures have been reduced to 60%. In contrast, “new plush toys, blocks and other categories have shown very good sales results”. Additionally, the company plans to launch accessory shops to sell necklaces, rings, bracelets, among others, as merchandise extensions.

Source: Founder Securities, designed by Daxue Consulting, major categories of relatively low-end product lines in POP MART

The high-end product line, known as the “MEGA collection”, is strategically positioned as “the premier collector’s item for the youth”. It is further segmented into “MEGA100%”, “MEGA400%”, and “MEGA1000%”, reflecting a tiered pricing strategy from low to high. POP MART embraces both traditional Chinese culture and western trend culture to give consumers a refreshing feeling. For example, the Grand series launched the first ceramic material pop toy.

Moreover, the company also carried out cooperation with CLOT, Lamborghini, and other top brands in different industries. These initiatives have attracted the attention and resonance of consumers from different circles and achieved great success. The collection achieved remarkable revenues of RMB 681.5 million in 2023, representing 10.8% of the company’s total revenue.

Despite falling behind foreign brands, POP MART focuses on IP development

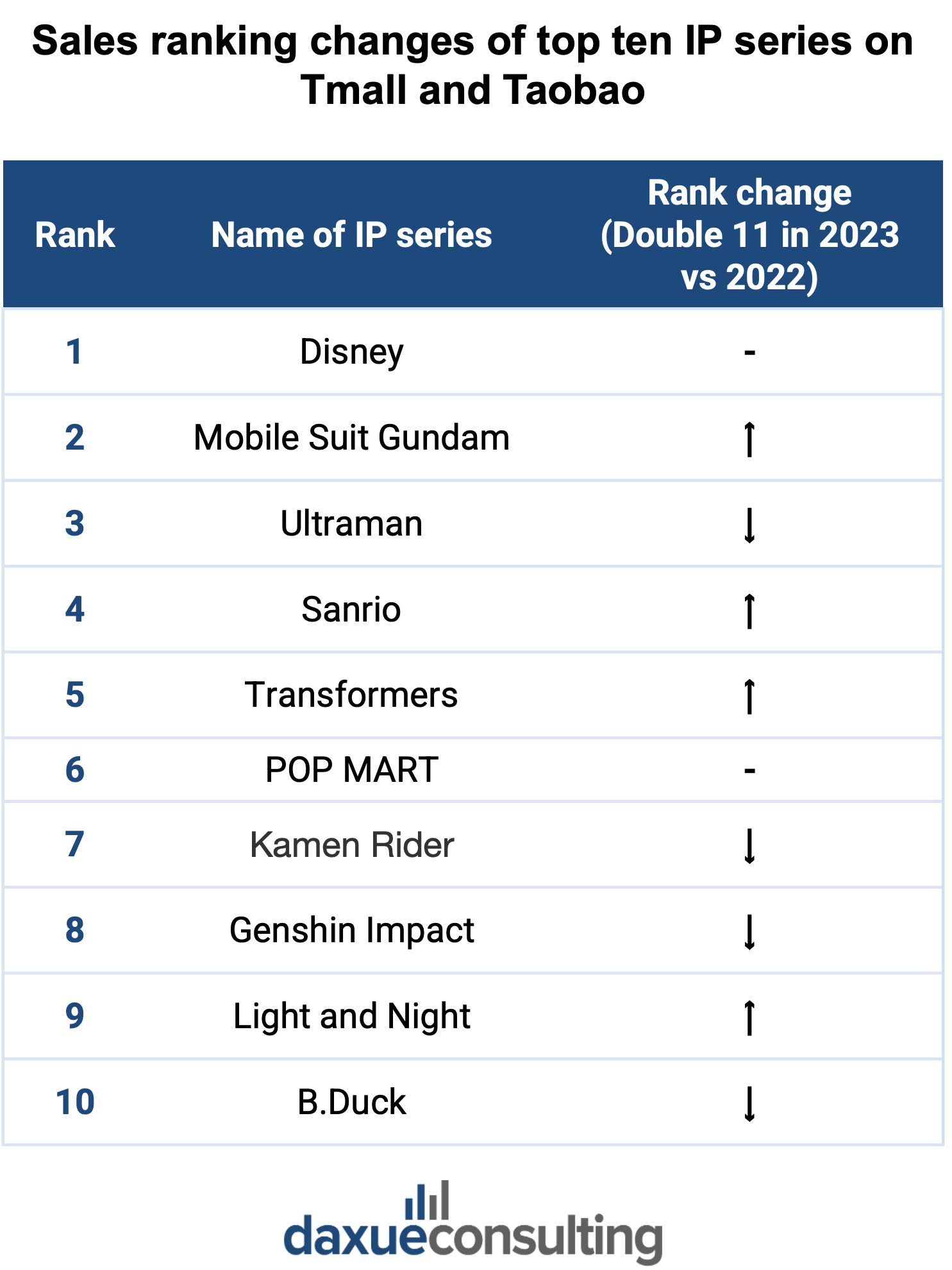

In the domestic pop toys market, international IPs are still far ahead of domestic IPs. In Double 11 in 2022 and 2023, the top IP series by sales were American or Japanese.

Besides the production of the pop toys like many other competitors, POP MART in China engages in all stages in the supply chain. It is especially involved in IP creation and operation, which is considered to be its greatest competitive advantage.

POP MART established a long-term co-operation with artists, so that they can take ownership of the original IP. So far, the number of its own IP is up to 40. There is a wide disparity in revenue generated by different IPs, with ten IPs generating more than RMB 100 million in revenue. The combined revenue from Molly and Skullpanda accounted for 42% of the total operational income generated by its own intellectual property. The brand also leverages co-branding in China with brands from various industries.

Labubu: POP Mart’s latest IP that conquered the world

Labubu is an elf character under “The Monsters” toy series, designed by Hong Kong-Belgian artist Kasing Lung. It debuted in 2019, but did not achieve commercial success in the early days. The “ugly-cute” (丑萌) character gained traction in late 2022, but its fame was bound in China. Its popularity skyrocketed in April 2024, when a K-Pop band, Blackpink’s member, Lisa, posted photos on Instagram with Labubu dolls. Other global celebrities such as Dua Lipa, Rihanna and Kim Kardashian were also seen dotting the toy, which made the IP viral worldwide.

Viral celebrity endorsement and social media hype had fueled a global frenzy over the IP. The success of Labubu shows that POP MART is working towards becoming an IP-centric toy manufacturer and trend setter. This drove a lucrative resale market for Labubu, where human-sized rare editions are sold for over USD 150,000. However, counterfeiting threatens Labubu’s value. As such, POP MART has created anti-piracy measures such as holographic seals and AI monitoring alongside trademarks and copyrights to protect the value of its IPs.

POP MART expands: More focus on the experiences around the products

In 2024, the company reorganized its business into four segments: IP incubation and operations, trendy toys and retail, theme parks and experiences, and digital entertainment. This showed the company’s shift to a conglomerate operation. Based on its own IP character, POP MART in China launched its first self-developed handheld game “Dream Home” to attract players of different ages. Moreover, the company also opened the first theme park in pop toy industry in China to provide consumers with an immersive experience. They also invest in the cultural entertainment sector like the animation film “Green Snake”. The diverse range of business activities has facilitated the creation of a robust revenue framework, resulting in an operating profit of RMB 1.23 billion in 2023. This is a remarkable 111% increase compared to the same period last year.

POP MART’s primary consumers and revenue by channel breakdown

Although the company may be perceived as catering for children, its primary target audience is young women, typically students or white-collar workers. Known as the Generation Z, they are aged between 16 and 28 years old.

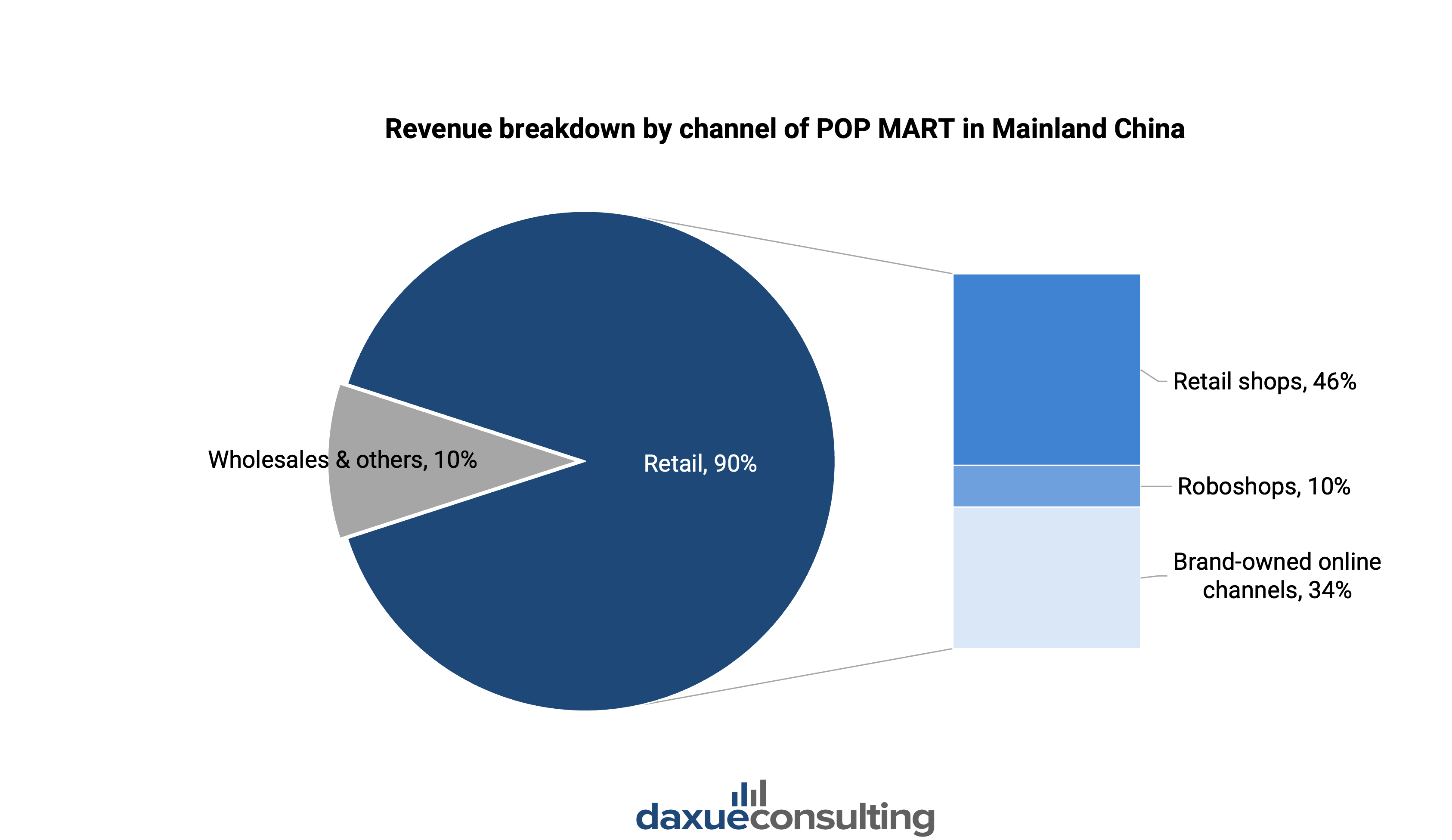

Compared to indirect channels, brand-owned channels offer greater control and enable real-time access to market trends and consumer feedback. They contribute to 90% of the total revenue of POP MART in China. The brand’s offline channels have seen significant growth as people value more immersive shopping experiences. In the first half year of 2024, retail shops accounted for 46% of the total revenues generated by offline channels. Roboshops, specializing in blind box products, contributed to 10% of the revenues. These shops are strategically located in shopping malls, office buildings, airports, and subways. Even though this channel is the most convenient, it generates the least amount of sales revenue. This is because there is very little interaction: consumers just pay and get the item.

Online channels, including Bubble Boxer’s WeChat Mini Program, Tmall flagship shop, and Douyin, were the main contributors to the revenue mix in the first half of 2024. They accounted for the rest revenue of brand-owned channels.

Controversies surrounding blind box marketing in China

Despite being popular among consumers, POP MART’s collaboration with KFC in 2022 sparked controversy. Some customers hired “eating agents” and paid exorbitant prices to obtain the figurines. Chinese authorities criticized this, describing it as an extreme form of hunger marketing that encouraged impulsive buying and food waste.

Moreover, the quality of blind box toys has become a serious concern in China. In a Blind Box Consumption Survey report released by the Sichuan Consumer Rights and Interests Commission in 2022, more than three-quarters of the 1,425 respondents reported quality problems in the products. Also, four out of five respondents claimed experiencing obstacles when trying to return or exchange them.

China’s state media, People’s Daily, insisted on stricter controls over the sales of blind-boxes and trading cards to schoolchildren under eight years old. The editorial, which was released on 20th June 2025, demanded measures such as age verification upon payment for these toys and explicit parental approval during online transactions. This is to prevent children from cultivating the habit of gambling and spending excessively on toys such as mystery boxes or cards.

Young people’s new obsession: POP MART

- As a pioneer in the Chinese pop toys market, POP MART has never settled for the status quo. For its lower-end product line, it maintains a high frequency of product innovation, expanding categories based on blind box concepts. In its higher-end product line, POP MART skillfully blends Eastern and Western cultures, allowing young consumers to appreciate the beauty of art.

- We often perceive companies in the cultural entertainment industry as easily imitable and surpassable. However, POP MART stands as an exception. By developing collectible figures, designing games, constructing theme parks, and launching a series of marketing initiatives, it has established an IP empire with significant competitive barriers.

- POP MART’s success serves as a reminder to other pop toy companies that offline channels still matter. Generation Z, as the primary consumer group, values the purchasing experience, particularly when it comes to retail stores owned by pop toy brands.

Learn about 10 mistakes Chinese brands make when going overseas