The history of China’s insurance industry is remarkably long. In fact, the history of the Chinese property and casualty industry (also known as P&C insurance) can be traced as far back as 3,000 BC when traders first developed rudimentary forms of risk diversification. However, it was not until the 19th century—when foreign traders introduced insurance as we know it today, and the contemporary Chinese insurance market first emerged. More precisely, after the establishment of the People’s Republic of China in 1949 provided the necessary institutional stability for the rapid development of the Chinese insurance market. With the economic reforms of the 1970s, China’s insurance industry further accelerated expansion, whereas following China’s accession to the WTO in 2001, foreign insurers to begin operating in the country. Around the same time, the Chinese Insurance Regulatory Commission (CIRC) also began focusing its efforts on improving the education and training of its employees in actuarial science.

The spectacular growth of the property insurance market in China

China’s insurance market has resisted the drag of a host of challenges to maintain its momentum and remain among the fastest-growing insurance markets in the world. Recently, growth rates have moderated slightly, but they still remain comfortably faster than the GDP growth rate. In addition, strong regulatory support in shaping the development of the Property insurance market in China is paving the way for Chinese insurance firms that are trying to establish themselves internationally. According to the China Insurance Regulatory Commission, in 2012, the country had already reached CNY553 billion or USD87.6 billion total P&C premiums at the average exchange rate during that period. Translated in percentage, China’s insurance industry registered a growth of 15.7% compared with the previous year, with motor and non-motor business expanding at 14.3% and 19.7%, respectively. According to Swiss Re Institute, globally, China’s insurance market is forecasted to quadruple in the next 14 years from US$575 billion in 2018 to about US$2.36 trillion in 2032. With such growth rate, the Property insurance market in China is poised to take over the US counterpart, which is worth about US$1.47 trillion. According to the Swiss Re Group’s chief economist Jerome Haegeli “Asia is the place to be [for insurers],” and “The region and its engine of growth are driving different sectors of the industry”.

Western insurance giants are targeting the Property insurance market in China

As reported in the Financial Times, insurance bosses in the West have come to talk regularly about the vast untapped potential of China’s insurance market. The head of the Asia division of the American insurance firm Prudential says China is poised to become the company’s “fastest-growing market… for many years to come”. Moving on to Europe, the Financial Times also reports that the chief executive of the German insurance giant Allianz hails China as a “strategic market”. In fact, if one takes into account the size of the Chinese population, the country’s economic growth and the relatively low of pro-capita insurance coverage, the excitement around the Chinese insurance industry is understandable. That notwithstanding, the big international groups have struggled to make their presence felt in the Chinese insurance industry. Despite operating in China for decades, their combined market share remains under 5 per cent. According to experts, one explanation for such dismal performances is that the country’s vast armies of insurance agents and tight local regulation are likely to hold back any serious advance by global businesses. Since joining the World Trade Organization in 2001, China has been under pressure to open its financial services industry to the international market. Changes have come slowly and Beijing has been accused of dangling the prospect of greater control in front of some of the world’s largest banks and insurers while simultaneously hampering real reforms.

The strategies of Western insurance companies to penetrate the Chinese insurance industry

According to Financial Times, the Canadian insurance firm Manulife was among the first international financial groups allowed in the country, starting in the mid-1990s when it launched a joint venture with chemicals group Sinochem. So far, the majority of foreign insurers have been granted a 50 per cent ownership, but other significant reforms have largely slow or absent. In what experts consider a breakthrough in the Chinese insurance industry, this year, legislators laid out the roadmap and conditions for allowing foreign securities, asset management, banking and insurance companies to lift their stakes in joint ventures and, in some cases, take full control. As a result, the French group Axa has acquired the remaining 50 per cent of Chinese joint venture Axa-Tianping that it did not control. This move can be regarded as an industry first in the property insurance market in China. However, this will not remain an isolated case, like Allianz, has recently obtained clearance to set up a wholly proprietary branch company in the country. In the words of Oliver Bäte, chief executive of Allianz “The Chinese leadership has held back for a long time and has now decided to open,”.

The emergence of Online insurance companies in China’s insurance market

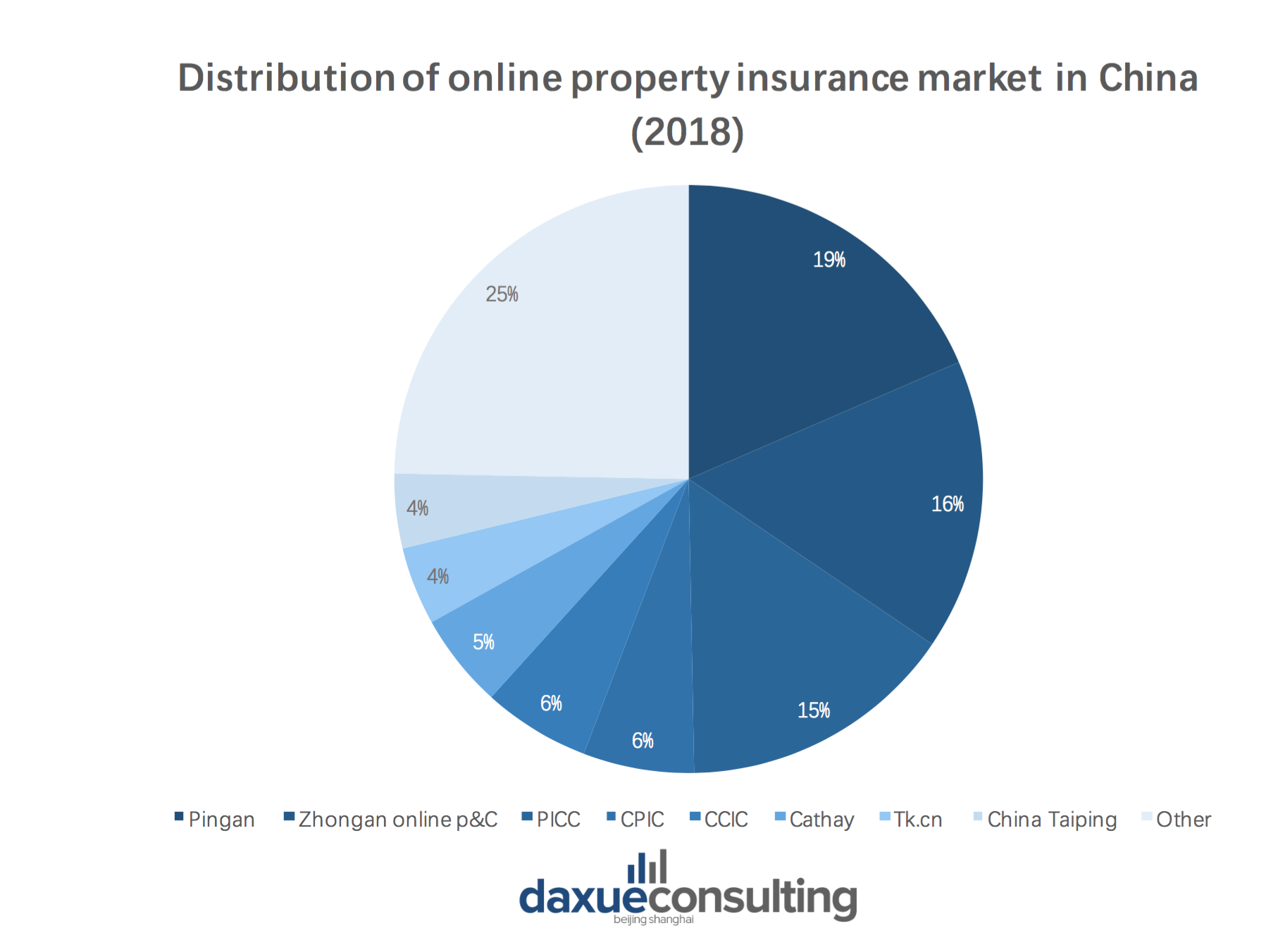

The statistics of the China Insurance Regulatory Commission show that in 2018 the coverage of insurance provided by the insurance industry was 6897.04 trillion yuan, an increase of 66.23% over the previous year. Among them, the insurance coverage of property insurance companies was 5,777.37 trillion yuan, an increase of 90.65% always compared to the previous year. Most interestingly, the estimated growth of premium income to about RMB 300 billion in 2019 highlights the growing importance of the Chinese online insurance market. In fact, the Chinese online insurance market is expected to witness significant expansion during the forecasted period. More precisely, the Insurance Association of China has reported that there has been an increase of about 37.29% year-on-year to 32.64 billion in the first half of 2018. In addition, over 24% of the total income from premiums was registered by online-only insurance companies. In the Property insurance market in China, auto insurance premiums accounted for more than half of the total premiums with a growth of about 15.38%, whereas premiums from non-auto insurance online sales rose to about 79% during the first half of 2018.

The evolving customer behaviour in China’s online Insurance Market

Messaging platforms, Insurtech and online sales channels are disrupting the Chinese insurance landscape. The country’s three major technology companies: Alibaba, Tencent, and Baidu are investing aggressively to expand the scale, reach and accessibility of their digital platforms into financial services. The fact that in the past six years the Chinese insurance market has doubled in size and the relatively low insurance penetration—with 4% the penetration rate in the Chinese insurance market is lower than the American one, where it is 7.3, and the UK, where the figure is 10 per cent—made the country an ideal terrain for the expansion of the online insurance market. ZhongAn, an online insurance company that launched online, micro-policies for different types of insurance ranging from insurance against self-inflicted liver damage for Chinese football fans to reimbursements for flight delays when customers are already at the airport. By 2018, the company had sold approximately six billion policies to more than 460 million people and according to the 2018 annual online insurance policy report, more than 222 million consumers, which accounts for 28% of the country’s total internet users, have purchased insurance policies online. According to another report published by Tencent, more than 75% of respondents to a survey conducted by the company are willing to purchase insurance policies online. More precisely, long-term critical illness insurance, long-term accident insurance and life insurance are the three most insurance policies purchased online. In addition, the report also reports that middle-class families with incomes ranging from USD 1,500 to USD 3,000 per month are among the major consumer groups of online insurance in the country.

Top players in the Property insurance market in China

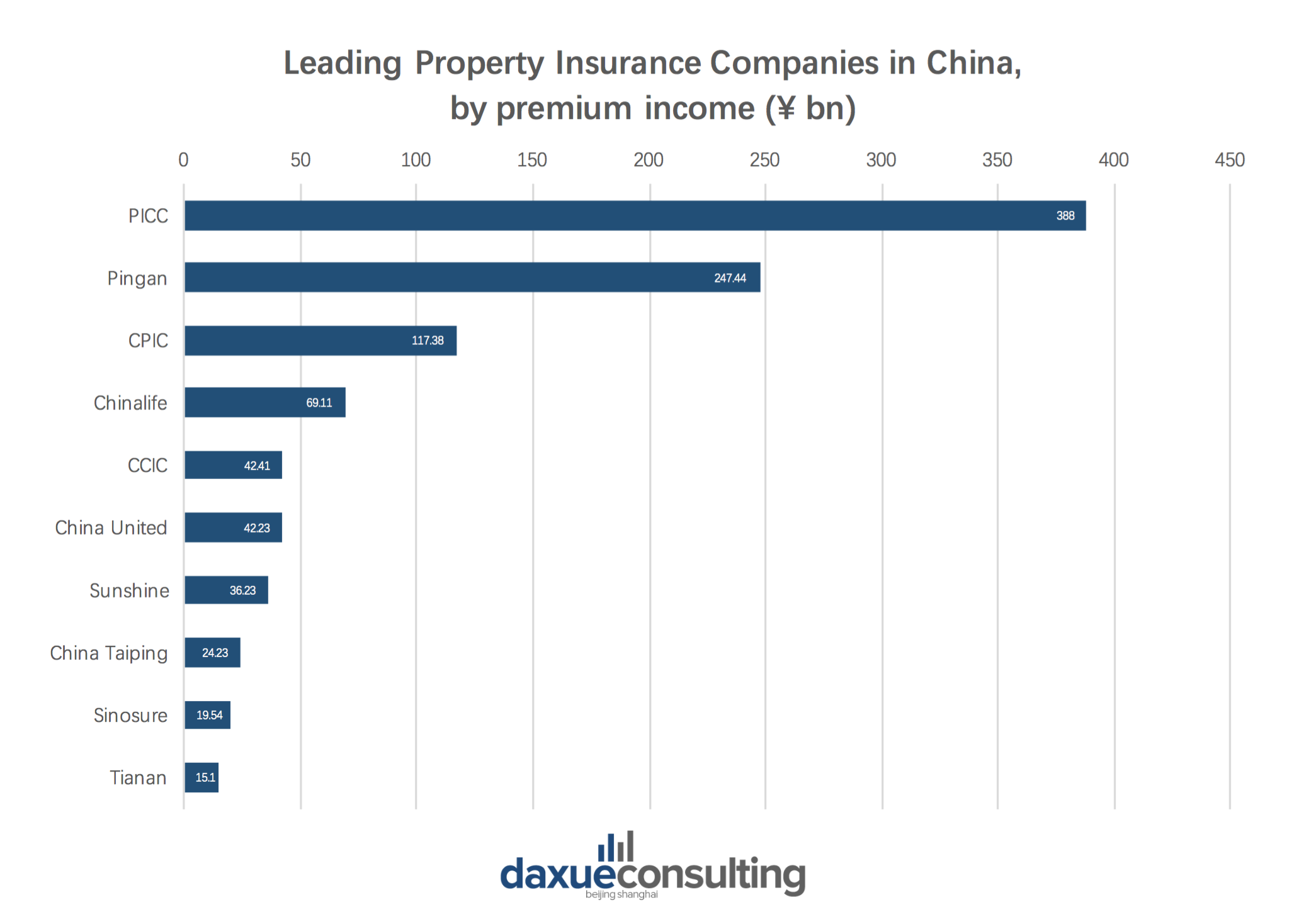

As we pointed out at the beginning of the article, the Chinese insurance market has been growing at a furious pace for more than a decade now. Between 2000 and 2014, the Chinese insurance industry grew about 1,200% in size when measured by written premiums. Meanwhile, as part of an effort to make the industry more competitive, the reduction of government control, greater investments in increasing transparency, and exposing the companies to the demands of the market and shareholders, most of the largest Chinese insurance companies listed shares on the Hong Kong Stock Exchange and other exchanges. As reported by investopedia, in terms of market capitalisation, the biggest insurance companies in China are also ranked among the largest companies in the world. Following is a list of the main insurance companies in China:

China Life Insurance Co., Ltd.

With a market capitalization of roughly $107 billion, China Life Insurance Co., Ltd. (NYSE: LFC) is the biggest insurance company in China and also one of the most important insurance companies in the world. The company traces its roots to the establishment of the People’s Republic of China in 1949. It has developed life insurance as well as P&C insurance businesses, and it now also offers asset management services and other related financial services. China Life maintains a considerable service network across the country, which is made of nearly 750,000 dedicated agents and more than 60,000 service outlets. Thanks to these resources, the customer base of the company reaches a combined 200 million individual and group customers. China Life is listed on the Shanghai Stock Exchange, the Hong Kong Stock Exchange and the New York Stock Exchange.

Ping An of China

Ping An of China was founded in 1988 and held its initial public offering (IPO) in 2004. Contrary to many other top-ranked companies in the Chinese insurance industry, Ping An began its operations as a property and casualty insurance company. the company has since expanded into the banking, life insurance, wealth management businesses and online financial services with the declared goal of becoming a comprehensive financial services provider in the Chinese insurance market. Ping An has a market capitalization of about $90 billion. It employs more than 225,000 full-time employees and partners with more than 625,000 sales agents across the country. Currently, the company can count on more than 89 million customers across its business network. Ping An is listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange.

China Pacific Insurance

China Pacific Insurance Group traces its roots to 1991. It is an integrated insurance provider offering life insurance P&C insurance and reinsurance products, as well as asset management and investment services. China pacific counts on more than 300,000 agents across its business network and assists about 80 million customers across China. The company has a market capitalization of more than $33 billion and was listed on the Shanghai Stock Exchange in 2007 and the Hong Kong Stock Exchange in 2009.

People’s Insurance Company of China Group

People’s Insurance Company of China Group was founded in 1949. Today, its many offices assist more than 300 million customers in life insurance, property and casualty insurance, health insurance, and real estate. Its most important subsidiary is PICC Property and Casualty Company, which offers a wide variety of non-life insurance products, including home insurance, auto insurance, commercial property and agricultural policies. People’s Insurance Company of China Group is listed on the Hong Kong Stock Exchange. It has a market capitalization of about $21 billion.

New China Life Insurance

New China Life Insurance Company was established in 1996 and has quickly emerged as one of the top five companies in the Chinese insurance industry. While its primary business remains life insurance, the company also has growing business interests in the investment industry and the health care industry. At present, the company counts more than 175,000 agents and 1,600 business locations to assist its 26 million customers across the country. The company was listed on both the Hong Kong Stock Exchange and the Shanghai Stock Exchange in 2011. It has a market capitalization of more than $17 billion.

Learn from 100 successful entrepreneurs in China