Retirement in China has been a heated topic for quite some years. It’s no secret that China has younger retirees compared to the global average. An official retirement age set so low poses a financial burden on the state in terms of pension provisions. On the other hand, a transition into a delayed retirement requires infrastructure and policy preparations to ensure the psychological and financial well-being of the generations to come.

Delayed retirement in China is to be expected in the coming years

Current official scheme of retirement in China

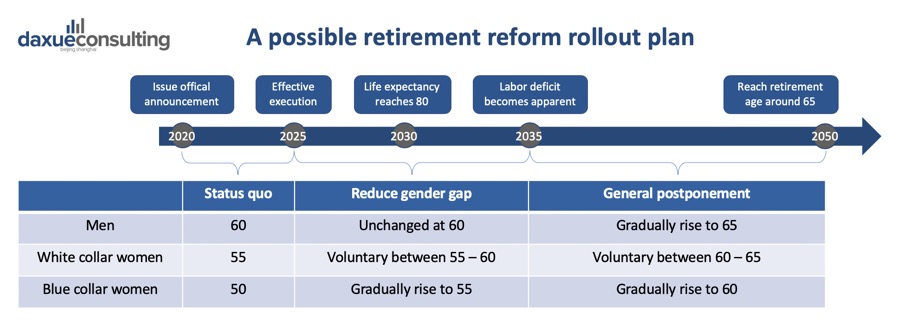

Currently, all men retire at age 60, while blue-collar women at 50 and white-collar women at 55. Workers in health-harming professions such as underground, high-altitude, labor-intensive jobs enjoy a 5-year reduction. So do men and women who can prove their illness or disability.

This has been the case since the founding years of People’s Republic of China in the 1950s, regardless of the fact that the life expectancy rose from 57 to 77 years old in the past 60 years. Globally, as societies age, most developed countries set the retirement age around 65, and treat men and women equally. This gap reveals a delicate yet imperative task for China to make retirement reforms before it can no longer afford to.

Considerations for reforming retirement in China

The modification of official retirement scheme requires comprehensive understanding of the 5 following issues, according to Gongcheng Zheng, professor at Renmin University of China.

- Life expectancy: an extension of life expectancy naturally entails to an extension of working years.

- Labor market: if the labor supply surpasses the demand, then keeping the elderly in the workforce would hamper the career progression of the young; inversely, if there is not enough labor supply, the elderly has to be withheld.

- Education: the more educated the worker is, the more human capital goes to waste if the worker is let go too early.

- Societal aging: as the population ages, the average age of the general workforce also has to rise, respecting intergenerational equality and sustainability. Otherwise, the Chinese elderly might overburden the working adults.

- Gender equality: if the female workforce quit the labor market sooner than the male counterparts, then the nation essentially deprives women of their rights and voices in the active participation of the society.

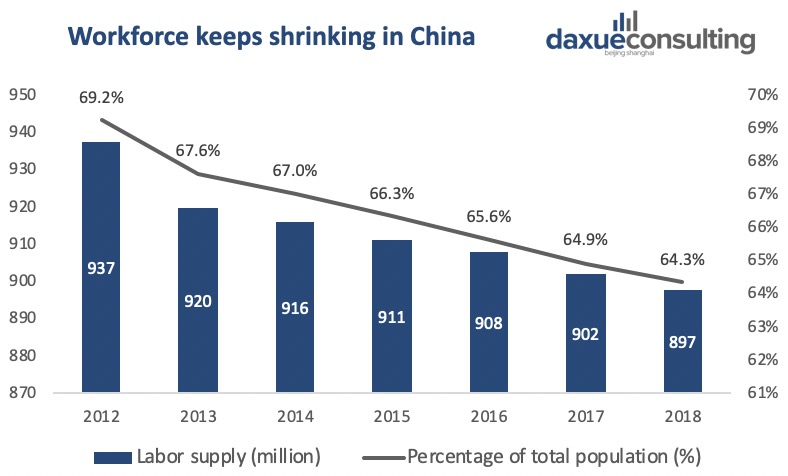

Currently in China, all five of these issues check out. According to National Bureau of Statistics, life expectancy and the level of education keep rising over the years. Urgently, the labor supply shrinks at a rate of millions every year and is expected to continue. Jian Su, the director of China Center of Economic Research pointed out to Tencent news that the 410 million second-wave baby boomers born from 1962 to 1978 will exit the labor market, further reducing the domestic labor supply for another 20 years. What’s more, the aging trend is irreversible, and feminist groups have louder and louder voice. No matter much how people debate over the years, the delayed retirement is coming in China, recently confirmed by Ministry of Human Resources and Social Security (MOHRSS for short).

Data source: National Bureau of Statistics, the China’s workforce keeps shrinking

A possible reform rollout plan

There has not yet been an official announcement of reform rollout plan, but the clock is ticking. According to the Outline of the 13th Five-year Plan of the Ministry of Human Resources and Social Security (MOHRSS), a reform of retirement in China needs to see the day by 2020.

Source: daxue consulting analysis, possible retirement reform rollout plan

Considering the delicacy and severity of such task, the then-Minister of MOHRSS Weimin Yin emphasized the importance of baby steps and flexibility. After the announcement, the society will be given another 5 years to adjust to the new reality. In addition, individuals should have some discretion over the exact exit age in a set range, depending on their profession, location and health condition. Furthermore, provincial differences should be taken into account, as the 5 issues discussed above don’t score the same across regions.

Life after retirement marks a new search for meaning

The psychology of retirement

It is widely acknowledged that retirement is a process, not a simple action. Before the set retirement date, the retiree-to-be would already start daydreaming about their retired life. Then comes the honeymoon phase where they rediscover the joy of freedom and novelty. However, soon they would taste frustration as the rhythm slows down and lack of meaning seeps in. In this stage, many would feel lost, upset or even depressed for the loss of goals or feedback loops. After self-readjustment and assistance from the family and society at large, most of them would recover and find a new direction in fit with their retired life. Finally, and ideally, they will again be at peace and ease with their new expectations and limitations, effective in their objectives and content with their self-value.

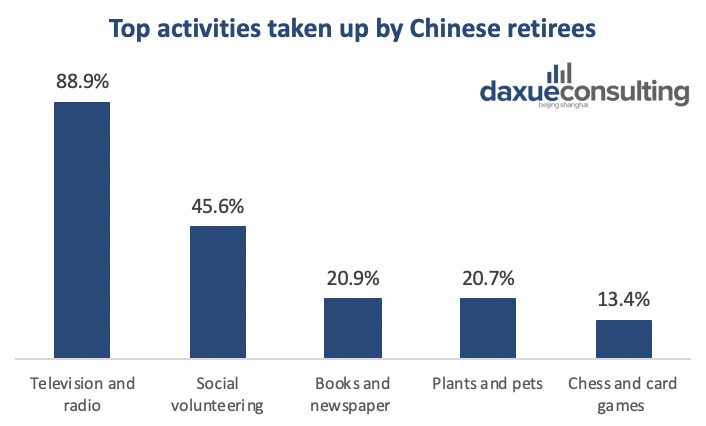

According to the 4th National survey on China’s elderly in 2015, watching TV and volunteering are among the top choices of activities for retirees. Traveling for Chinese seniors, on the other hand, is getting popular too.

Data source: Ministry of Civil Affairs, Top activities for Chinese retirees

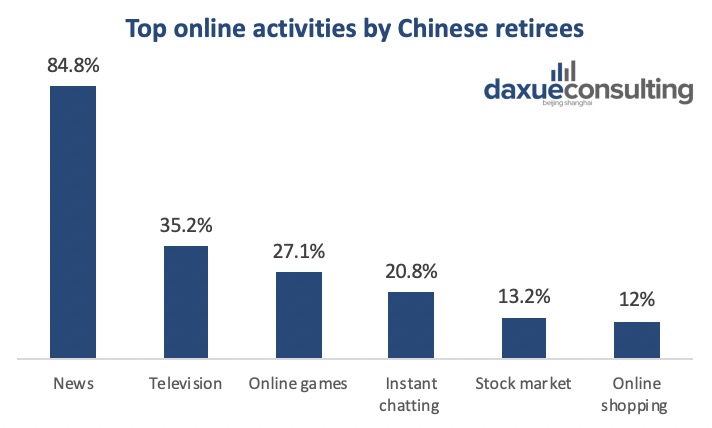

According to the Report on the Living Conditions of China’s elderly initiated by China Research Center on Aging, the newly retired seniors in China represents a new driver for internet growth. As mobile consumption spreads to the older generation, more and more of the retired people turn to internet for recreation.

Data source: China Research Center on Aging, Top online activities by Chinese retirees

Reinsertion to society is a rising demand to revitalize the newly retired

According to the Report on the Living Conditions of China’s elderly, a total of 17% of male and 10% of female retirees still exercise a profession. Out of the working retirees, 86% of them are in the agriculture industry, 7% in construction industry and very few in social or service sectors. It’s safe to say that a staggering majority of Chinese working retirees live and work in rural areas.

In cities however, many retirees find it hard to be reemployed, due to high legal risks posed on the employer and a reduced number of suitable opportunities. As a consequence, only 7% of the urban retirees are back to working life, compared to 40% in rural areas. Most retirees who successfully re-enter the urban society are those with transferable expertise, such as accounting or medicine. Compared to Japan and Korea whose government issue policies to support retiree reinsertion, China is lacking.

Fortunately, the private sector is actively finding solutions, such as an online labor market dedicated to the retirees. With endorsement from China National Committee on Aging, the precious human capital resided in healthy retirees will hopefully be re-empowered after their retirement in China.

Increased income is also a main motivation to improve life after retirement in China

It is great news that the financial situation of the elderly in China improved drastically over the years. According to the 4th National survey on China’s elderly in 2015, the urban retirees annual income per capital reached 23,930 RMB in 2014, while that of rural retirees was 7,621 RMB. It implied a 5.9% and 9.1% of CAGR from the year 2000 for the urban and rural retirees respectively. Furthermore, the income gap between the urban and rural areas got reduced. While the guaranteed income dropped from 90% to 80% of total income for the urban retirees from 2000 to 2014, that of the rural retirees increased from 14% to 36%.

Younger retirees could use more income

A deeper look at the source of income shows that labor income cannot be neglected for the younger retirees. In fact, income from work outweighs pension, family provisions or minimum guaranteed income until the age of 68, based on a paper published by Peng Du, professor of gerontology in Renmen University of China. After 68, family provisions take the lead, while pensions fluctuate around 20% of the total income.

This explains why, the younger bracket of the retirees (aged 60-69) actively looks for opportunities to put their energy and expertise to use. As loving parents, they generally don’t want to be a financial burden to their middle-aged children. Working after the official retirement age gives them more income to lead an easier life in the future.

In summary, the in the future, Chinese will retire later but better. And once they retire, many would search for new forms of meaning and income. Even though there is still a lot to develop in the silver economy in China, the rising life expectancy presents new challenges and opportunities for the elderly industry in China as well as for the retirees themselves.

Author: Della Wang