Carrefour SA sold 80% of its operations in June 2019 after more than two decades in China, Tesco Plc folded its business into a joint venture in 2013, and Metro AG sold majority stake in METRO China to Wumart (物美) in Oct. 2019. While many foreign firms complain that China is a difficult market, Walmart-operated Sam’s Club has managed to make some major inroads.

Sam’s Club is a world leading membership store, which serves more than 2 million members in mainland China. In 2018, Sam’s Club in China achieved 8% same-store sales growth in China’s market, with almost 80% membership renewal rate. In 2019, Sam’s Club had double-digit sales growth driven by higher sales across all channels.

Sam’s Club China market strategy: Integration of online and brick-and-mortar store locations

“Offline channel (brick-and-mortar stores) is our primary channel, supplemented by online channel.” said Andrew Miles, President Sam’s Club China, “For online channels, self-own channels come first and cooperating with other ecommerce platforms to reach more customers.”

From offline to online

Sam’s Club in China started its journey by launching its first store in Futian district of Shenzhen in 1996. Currently, the brand has 26 brick-and-mortar stores on the Chinese mainland and will have 40 stores opened or under construction by 2022.

In order to meet the need of increasing number of online shoppers, Sam’s Club China began to pay attention to e-commerce development in 2010. In 2010, Sam’s Club China opened its official online store (www.samsclub.cn) to provide direct delivery service in cities where Sam’s Club stores located. In 2014, Sam’s Club launched its own APP to offer more convenient shopping process. Thus, the club’s members can benefit from both the advantages of Sam’s digital platforms and the offline convenience of personal service and experiencing physical products. Thanks to online delivery services and electronic membership card introduced, the revenue of Sam’s Club increased by 8% in 2018.

Strategic cooperation with third-party e-commerce platform

Since both Sam’s Club’s official website and APP only serves its members live around offline stores, the brand is badly in need of expanding its customer base in China. Consequently, Sam’s Club China started the strategic cooperation with JD (one of China’s largest third-party ecommerce platform) in 2016. The cooperation helped Sam’s Club reach a large volume of potential consumers who are originally regular users of JD. In May 2019, the sales of Sam’s Club flagship store on JD global grew by three digits compared with the same period last year.

In addition, Sam’s Club is focusing on creating more online-to-offline experiences by bringing together its strengths in digital and physical retail. For example, Sam’s Club has introduced a new shopping method, which enables customers place orders in it’s JD store by scanning the QR code in offline stores. This way of “offline commodity display + online purchase & delivery” is now quite popular among members.

Currently, Sam’s Club China is continually opening more offline stores, and actively developing new business formats at the same time, such as compact hypermarkets, community stores and cloud depots. The Sam’s Club’s strategy of developing online and offline in coordination works well and enables it to implement omni-channel strategy successfully.

Sam’s Club’s membership system on online and offline channels

Sam’s Club China membership operation based on physical stores

The club, a pioneer in operating a membership model in China, achieved excellent results in recruiting members over the past 23 years, according to Andrew Miles. So far, Sam’s Club in China has about 2.8 million paid members (individual members & business members), made up largely by individual customers.

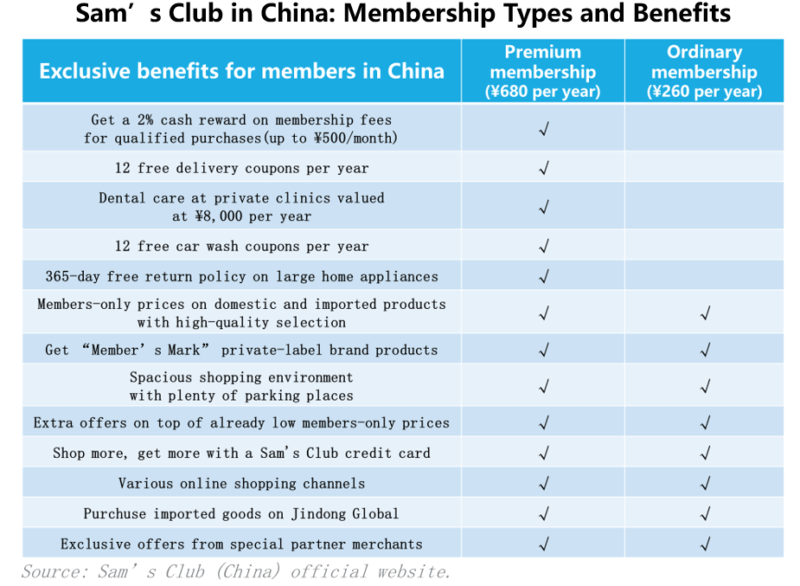

Based on the physical retail properties, members can enjoy two aspects of benefits: price-based benefits and value-added services. Sam’s Club offers two types of membership for retail members in China, one is the 260-yuan ordinary membership and the other is the 680-yuan premium membership. The premium one was introduced in 2018 which targets families that are looking for personalized purchasing experiences. Compared to ordinary members, premium ones enjoy five extra benefits. They are a 2 percent cash reward on membership fees for qualified purchases, 12 free delivery coupons per year, dental care at private clinics valued at 8,000 yuan per year, 12 free car wash coupons per year and 365-day free return policy on large home appliances.

[Source: Sam’s Club China official website, “Membership types and benefits”]

Sam’s Club membership operation on online channels in China: Membership-centered CRM

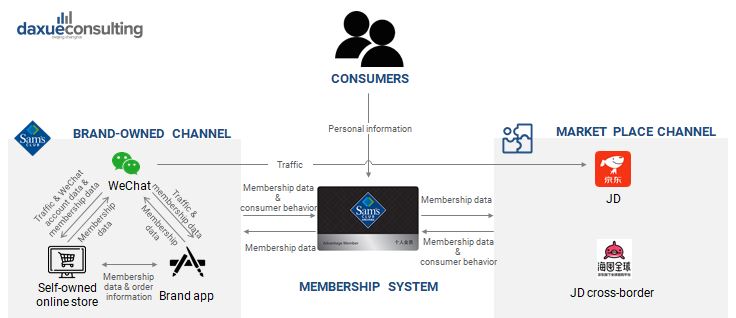

[Source: daxue consulting, “Sam’s Club membership-center CRM”]

Based on the membership–based CRM system which integrates membership data from all channels, Sam’s Club China is able to manage its customers’ information in one place and get a 360-degree view of members for greater insight.

For the external ecommerce channel, Sam’s Club is able to reach more customers on JD and JD cross-border platforms. By binding the JD account and club membership, customers who purchase goods from Sam’s JD flagship store become the club member system. And these customers’ data will be available in Sam’s Club membership system.

Integrating data and driving traffic to brand-owned channels

For brand-own online channel, Sam’s Club in China integrates the membership data from WeChat, Brand official website and Brand APP. At the same time, the Club can drive a large volume of traffic from WeChat to Self-owned online stores and the Brand APP. In this case, the membership system can collect valuable information and data from the integration of self-owned online channels.

The Sam’s Club membership-centered CRM create a powerful loop between multiple channels and its membership system to transform membership data. This CRM system enables Sam’s Club to know every single transaction that happens in the club or online as well as each customer’s expectation by analyzing customers’ data. Thus, Sam’s Club China will know how they can maximize multi-channel’s shopping experiences both to satisfy member needs but ultimately to drive the types of behavior they want. With such membership-centered CRM Sam’s Club can exert full control and retain full ownership over their e-commerce traffic and consumer data.

Sam’s Club’s WeChat-centered digital membership system

Sam’s Club China opened its official WeChat account in August 2017, and made it as the center of the brand’s online membership system.

[Source: daxue consulting, “Sam’s Club’s membership service on WeChat”]

Apart from registering membership in offline stores, the “membership center” in Sam’s Club’s WeChat public account is the only channel for e-card membership registration. Through the member’s center in the mini-program, existing members can activate e-card and manage their membership while non-members can easily register and become the club’s members.

Sam’s Club’s e-commerce strategy in China

Self-owned online channels in China: Brand APP & Brand official website

Brand official website and brand APP are the online sales channels owned by Sam’s Club China. These channels are designed to provide exclusive service for club members. Most of the goods (except fresh food and imported products) can be delivered within one day. In 2017, Sam’s Club China started to offer “1 Hour Delivery”, which includes a large selection of food and drinks items that can be delivered in just one hour.

Self-owned online channels in China: Ensuring high quality services

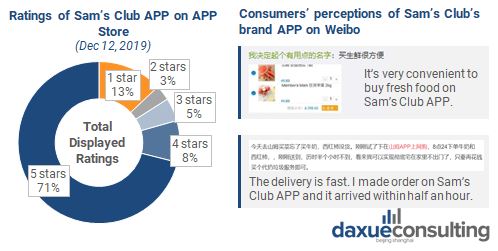

[Source: daxue consulting, “Ratings of Sam’s Club APP & Consumers’ perceptions of Sam’s Club’s brand APP on Weibo”]

Sam’s Club in China is able to create a strong connection with customers on its own channels by serving exclusive members directly. With fully management of the brand APP and official site, Sam’s Club can create a tailored experience to target existing clients and ensure members can get premium service (higher quality after-sale service, one-hour delivery, etc.).

The ratings of Sam’s Club China APP on APP store show the club’s APP enjoys a good reputation among Chinese customers. From consumers’ perceptions on Weibo, we can see that most consumers are satisfied with the service and products provided by Sam’s Club’s brand APP. Thus, by ensuring high quality services provided by the club’s own channels, Sam’s Club successfully increase the customer stickiness.

Partnership with JD.com: Reaching more Chinese customers

Besides own channels, Sam’s Club also cooperates with largest Chinese e-commerce platform-JD. In Oct 2016,Sam’s Club China opened exclusive flagship store on JD.com and 7 months later Sam’s Club launched its Global Flagship Shop on JD Worldwide, the cross-border site of JD.com. In April 2018, Sam’s Club China joined the JD Daojia 京东到家 platform to offer fast delivery of orders in one hour.

[Source: daxue consulting, “Benefits provided by double membership”]

Sam’s Club in China uses a collaboration strategy to convert regular buyers on JD into brand’s own asset. Doubled benefits provided by Sam’s Club JD flagship store persuade more consumers to become the club’s members. In this case, Sam’s Club China is able to attract more members and broaden its consumer base beyond its current city-scope.

Leveraging e-commerce platforms for expanding consumer base

Since e-commerce platforms like JD are interlinked with Chinese consumers’ daily life, the cooperation with JD will expand Sam’s Club’s opportunity in e-commerce by access to JD’s online traffic. By servicing both club’s members and non-members on JD platform, Sam’s Club China is able to reach customers all around the country. However, since JD keeps Sam’s Club’s products in its own warehouse and then delivers to buyers, the quality of service and products cannot be control by the club.

Currently, Sam’s Club China and JD are expanding their cooperation to further integrate their platforms, supply chains and customer resources in China. Hopefully, the further partnership with JD will give the club a huge advantage in reaching China’s rapidly expanding target consumer class and will let the brand leapfrog its expansion.

Sam’s Club’s promotion strategy in China

Selling on brand official site increases brand visibility

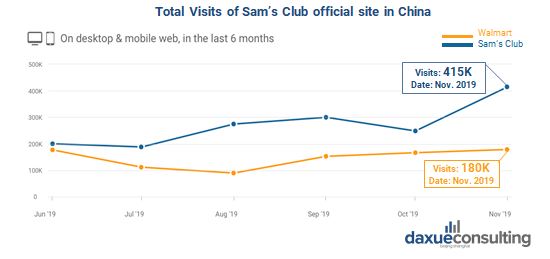

[Data Source: similarweb, “Total Visits of Sam’s Club site in China”]

Here, we compare the visits of Sam’s Club official site in China. The line graph shows that in a 6-month period, Sam’s Club site attracts 2 times more traffic than Walmart’s site, since Sam’s official website in China has online shopping while Walmart’s site does not. Besides, Sam Club’s membership system ensures its website stable traffic volume in a long term.

Besides converting purchase, Sam’s Club China also benefits from a high-traffic site by improving its brand visibility and building the brand image among Chinese customers. Moreover, the official site allows Sam’s Club to create a strong linkage with customers through the membership system, which will retain customers and increase the customers’ loyalty.

Brand APP and WeChat account increase purchase demand

[Source: daxue consulting, “Posts connected to shopping page on Sam’s Club APP”]

Sam’s Club China APP and WeChat account are not only online shopping channels, they also create demand among customers apart from selling to members.

There are regular recipe posts on the “discovery” page of Sam’s APP, the products shown in the post will stimulate purchase desire and readers are likely to tap the link to buy the products directly. As for Sam’s Club WeChat account, most article posts are correlated with various products promotion and marketing campaigns. The attractive images of food or user-friendly products in the posts can always trigger purchase demand.

Sam’s Club China has good reputation among customers without frequent presence on media

[Source: daxue consulting, “Promotion strategy in China on variety show and WeChat”]

Sam’s Club China has relatively less presence on media and it only runs promotion for new store arriving and sales promotion. However, Sam’s brand promotion strategy in China based on high-quality products and service helps it build a power brand image and enjoy a good reputation among customers. For example, Sam’s Club advertises on a popular variety show, which presents Sam’s offline store in real scenario. Also, Sam’s Club did collaborate promotion with influential local media on WeChat to reach their members in different cities. With high volume and engagement, such strategies worked quite well and do attract more customers and drive high traffic to Sam’s online and offline stores.

[Source: daxue consulting, “Consumers perception on WeChat”]

From customers’ perception on social media, we can know that Chinese customers see Sam’s Club as a well-reputed brand. By offering high-quality goods for over twenty years, Sam’s Club has a good reputation among Chinese and becomes the top of mind when people mention bulk buying.

From the case of Sam’s Club, it is not difficult to see that if traditional retailers intend to seize a piece of cake in the fierce market competition in China, they need to develop online and offline in coordination to realize digital transformation. Besides, implementing omni-channel strategy works well with respect to building brand image and improve brand awareness. Last but not least, good brand reputation based on offering high quality service outweighs frequent promotions.

Sam’s Club China’s strategy of driving traffic to their brand owned channels is known as brand independence, and your brand can do it too! Just contact our project team at dx@daxueconsulting.com to get started on your brand independence strategy.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes