In recent years, Chinese consumers have become increasingly inclined to save money and follow trends like consumption downgrade due to the economic slowdown after a prolonged pandemic. On Xiaohongshu, many netizens shared their experience purchasing “poor people combo meals,” among which fast food restaurants and coffee chains such as McDonald’s, KFC, Burger King, and Luckin Coffee were the most talked about. Although #shopping at Sam’s Club has become a label for the middle-class # (逛山姆成为中产标签) in China, the membership-based warehouse club recently went viral on Chinese social media for its “poor people trio.” The combo typically includes 30 eggs priced at RMB 21.90, a 7-piece set of plain bagels priced at RMB 23.90, and a 16-piece Swiss roll priced at RMB 59.80.

Download our China luxury market report

Membership divide: is Sam’s Club truly catering to the Middle Class in China?

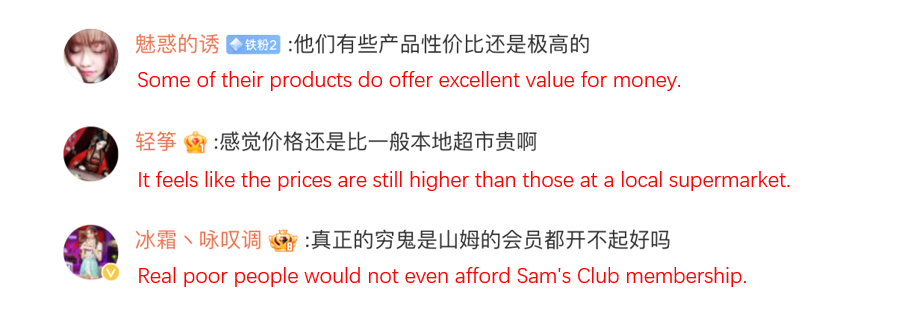

In the last week of February, netizens engaged in a heated discussion in terms of #why the Sam’s Club “poor people combo” drives the middle-class crazy# (为何山姆穷鬼套餐让中产疯狂), garnering over 310 million views on Weibo. According to an ongoing poll on Weibo as of February 28th, 27.8% of the respondents think that Sam’s Club provides excellent value for money for its food and beverages, while 30.6% consider its value for money average. Meanwhile, 22.2% of people find its value for money low and the rest of the respondents have not purchased Sam’s Club products before.

Despite the frenzy surrounding finding budget-friendly options at Sam’s Club, some netizens pointed out that actual poor individuals might not shop there, considering the membership fee alone costs RMB 260, implying its main target audience still consists of middle-class consumers in China.

Sam’s Club ‘poor people combo’ sparks consumer sentiment shift in China

The discussion around the “poor people combo” at Sam’s Club highlights a significant shift in consumer sentiment in China. Businesses need to closely monitor and understand these changing perceptions to adapt their strategies accordingly. The increasingly price-sensitive nature displayed by Chinese consumers, including the middle class, indicates the importance for companies to reassess their pricing strategies. In addition, companies need to focus on delivering or exceeding perceived value to meet evolving consumer expectations. Moreover, the discrepancy between the perceived target audience and the actual consumer base at Sam’s Club emphasizes the importance of aligning brand image with customer expectations. Hence, businesses must effectively communicate their value proposition to avoid any dissonance between brand perception and reality.

Sam’s Club’s ‘poor people combo’: unveiling China’s shifting consumer landscape

- The “poor people combo” trend at Sam’s Club reflects a shift in Chinese consumer sentiment, driven by economic challenges post-pandemic.

- Despite the middle-class label, Sam’s Club’s viral “poor people trio” prompts questions about its true target audience, with netizens discussing value for money and the RMB 260 membership fee.

- Businesses must reassess pricing strategies and align brand image with consumer expectations, as the discussion highlights the need for effective communication in a changing market landscape.

We help brands better understand consumers from Hong Kong and Mainland China

Grasping the nuances of Chinese and Hong Kong consumers’ preferences, behaviors, and expectations is crucial for delivering tailored services and products. The diverse socio-economic landscape across regions, including the distinct characteristics between mainland China and Hong Kong markets, demands thorough and nuanced consumer analysis.

At Daxue Consulting, we specialize in employing advanced research techniques to not only gather consumer insights but also interpret them effectively, ensuring our clients make informed decisions to foster engagement and positive advocacy among their target audience. We offer:

- Extensive consumers research

- Focus groups analysis

- Tribes identification

- In-vivo research

Contact us at dx@daxueconsulting.com to get better results in Hong Kong and China with our help.