In recent years, international fast fashion giants have encountered substantial challenges in remaining competitive in China’s dynamic fashion industry. These challenges stem from various factors, including the growing emphasis on sustainability and mounting competition from both domestic and international brands. On top of these factors, brands such as H&M, Zara, and Gap have faced scrutiny from the China’s consumer market due to controversies surrounding sourcing cotton from the Xinjiang region of China, leading to further drops in sales and store closures. H&M alone has reduced its number of physical stores in China from 479 in 2020 to 445 in 2021, and further decreased to 360 in 2022.

In juxtaposition to the obstacles international fast fashion brands face in China, there has been a surge in the appeal of Scandinavian niche brands among Chinese consumers. For example, Swedish fashion brand Acne Studios has established a notable presence in the Chinese market since the opening of its first flagship store in 2018 in Beijing Taikoo Li Sanlitun (三里屯太古里). As of October 2023, Acne Studios has opened 17 stores in the Greater China area in 9 different cities.

With their minimalist design aesthetics, commitment to quality and sustainability, and a unique cultural heritage, Scandinavian niche brands present a unique allure that sets them apart from mainstream fast fashion brands. Their brand value and positioning align well with the evolving tastes of Chinese consumers, particularly the expanding base of eco-conscious and discerning shoppers. Therefore, for brands and marketers targeting the fashion industry in China, it is important to understand the increasing appeal of Scandinavian niche brands to tailor products and brand messaging in the way that resonates with the evolving preferences of Chinese consumers to better navigate the market.

Scandinavian design aesthetics 1.0: Less is more

Originating from Nordic countries like Denmark, Sweden, Norway, Finland, and Iceland, Scandinavian fashion style is defined by its modern, minimalist, and practical design approach. With concepts like minimalism and gender neutrality on the rise in China, consumers are increasingly favoring brands that embody these values, a trend accelerated by the COVID-19 pandemic as people spend more time indoors, focusing on functionality and natural materials.

Some of these brands have already established presence on Xiaohongshu (小红书) as well as other Chinese social media such as Weibo and Douyin For instance, on Xiaohongshu, fashionistas can easily find a variety of posts related to Scandinavian niche fashion brands, ranging from try-on hauls to streetwear to collections of brand recommendations. Such posts can be brand collaborative or non-collaborative made by celebrities, influencers, as well as everyday users. Keywords commonly associated with this theme include minimalism, gender neutrality, simplicity, and utilitarianism, among others. Taking the Swedish fashion brand Toteme as an example, the stories of its founders, Elin Kling and Karl Lindman, can be found among the most popular posts related to Toteme. These narratives help humanize the brand and create emotional connections with consumers, subtly influencing their purchasing decisions.

Scandinavian design aesthetics 2.0: The perfect balance between simplicity and boldness

Simplicity and minimalism are fundamental to Scandinavian design aesthetics. Incorporating such design principles have enabled Scandinavian fashion brands to create clean and timeless products that appeal to a broader audience and achieve the global brand recognitions they have today. However, there have also been Scandinavian fashion brands that somewhat defies this stereotype, incorporating vibrant elements into the traditional monochrome color palettes, exemplified by brands like the Danish fashion brand Ganni and the Finnish design house Marimekko who have attained popularity on the global stage as well as China in recent years.

Marimekko: A decade of growth and collaborations in China

Renowned for its pioneering design with bold prints and colorful patterns, Finnish fashion brand Marimekko has become a lifestyle ideal, representing an optimistic and joyful way of living in the post-war era since it was founded in 1951 by Viljo and Armi Ratia. Its complicity is birthed from its simplistic design philosophy characterized by the intricate repetition of its iconic patterns such as Unikko (罂粟花/poppy blossom), Kivet (石头/stone), and Lokki (海鸥/seagull). With its daring design and comfortable, loose-fitting garments tailored for women, Marimekko has come to be “a uniform for intellectuals” as well as an emblem of feminist art.

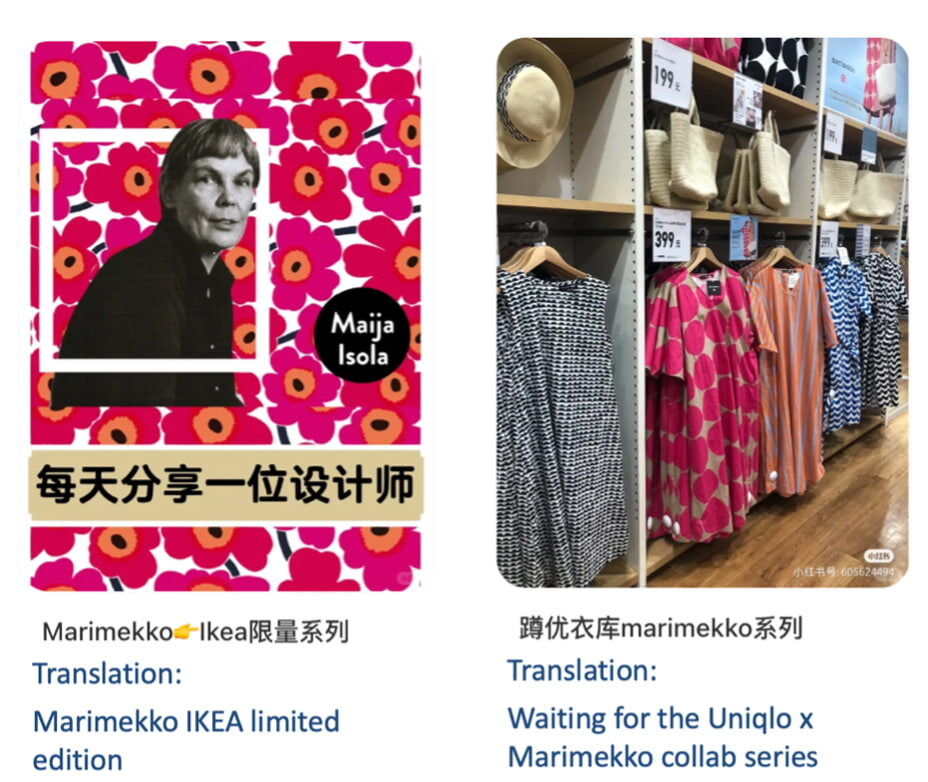

Ten years since Marimekko first set foot in the Chinese market, Marimekko has established a strong presence in China and looks to expand further. In 2023, Marimekko has launched a new strategy period with a strong emphasis on scaling and growth, particularly in international markets with a main focus for expansion in the Asian sector. In Q1 alone, Marimekko launched two stores in Beijing and expanded its e-commerce presence on China’s ecommerce platform JD.com. Marimekko’s marketing efforts have been marked by a series of successful brand collaborations with well-established entities in the Chinese market, including Uniqlo, Adidas, IKEA, and even China’s homegrown coffee shop chain, Seesaw. On Xiaohongshu, Marimekko’s co-branding campaigns are one of the most talked about content related to the brand.

Ganni: A fresh face of affordable luxury fashion in China

Although having already established a global prominence outside of China, Ganni did not officially enter China’s fashion industry until the opening of its first two physical stores in Shenzhen and Shanghai. Standing in the sweet spot between fast fashion and luxury brands, Ganni is known for being an “affordable luxury brand”. With a more adventurous and innovative approach, Ganni’s aesthetic incorporates playful elements such as Peter Pan collars, bubble sleeves, animal prints into elements of Scandinavian minimalism, creating a unique appeal to a global audience as well as Chinese fashionistas who seek for chic and contemporary style. On Chinese social media, keywords related to Ganni usually include girly vibes (少女感), affordable luxury (轻奢), and sweet style (甜美风).

Although there have been concerns over Ganni and similar Scandinavian brands’ competitive edges in China due to their late entry into the Chinese fashion industry, Ganni is set to expand its online influence on Chinese social media as well as sales channels. “Our first step was to build brand presence on local platforms like Xiaohongshu, Weibo and Tmall,” Ganni’s chief executive officer Andraea Baldo said.

The rise of Scandinavian niche fashion brands in China

- Scandinavian niche brands, exemplified by Acne Studios, have gained popularity among Chinese consumers due to their minimalist design, quality, sustainability, and unique cultural heritage.

- Scandinavian niche fashion brands can roughly fall into two different categories: Scandi 1.0 and Scandi 2.0.

- Scandi 1.0 brands emphasize a minimalist look and quality of material, creating an effortless sophisticated look.

- Scandi 2.0 brands incorporate a touch of boldness into their simplistic design notion, usually cater to younger audience who embraces fashion that allows for self-expression.

- Some Scandinavian niche brands have established a presence on Chinese social media platforms like Xiaohongshu, Weibo, and Douyin.

- More physical stores are also set to open as more Scandinavian niche brands set to expand opportunities in China and the broader Asia-Pacific area in general.