To know more about Smart Appliance Market in China contact us at dx@daxueconsulting.com

Smart Appliance Market in China

The growth of consumer appliances witnessed a weak performance in 2015, due to the depressing national economy in China. Due to the slowdown in China’s economic growth, the real estate industry continues to stagnate. Lower growth rates for new property purchases has led to sluggish demands for consumer appliances, especially major appliances. However, there has been a shift in what kind of consumer appliances consumers purchased. 2015 saw a plethora of intelligent consumer appliances launched by leading manufacturers, including both major and small appliances.

Such intelligent products can be termed “smart” appliances, as they can be remotely controlled by smartphones. These products can be integrated in order to achieve a smart home strategy, e.g. turning on the air-conditioning using your smartphone before you get home from work so that your home is nice and cool when you get home. In order to achieve this integration, consumer appliance manufacturers began to cooperate with leading internet companies to accelerate their progress of making appliances “smarter”. Manufacturers also partnered with outstanding retailers to promote the marketing and sales of intelligent products both online and offline.

Platforms used for purchasing Smart Appliances

Traditional store-based retailing still constituted the largest share of retailing in 2015, but internet retailing kept grabbing a share, with less than a 40% share in 2015, which is a sharp increase from 33% in 2014. This was caused by manufacturers launching official flagship stores on various internet platforms, in addition to applying online to offline strategies to promote online and offline sales. In order to accelerate internet retailing and capturing online market shares, many manufacturers have developed new products specifically for internet retailing. For instance, iRobot released two kinds of robotic vacuum cleaner particularly for online stores, targeting young consumers who prefer online shopping. Consumers choose internet retailing over traditional stores because purchasing products online are cheaper. Hence, creating value for consumers by reducing costs through economies of scale is easiest through internet retailing. This explains the shift towards internet retailing. An example of this is Danlong, a local brand of electric facial cleaners, which saw booming sales in 2015 by relying on internet retailing.

Market research suggests that 20 – and 30-year-olds are more difficult to reach through direct marketing, compared to older generations. They are more easily reached by advertising through popular TV-shows and by placing products in pop-culture. Hence, with the increasing popularity of TV shows in China, smart consumer appliance manufacturers began to give up traditional TV advertising and tried to engage in marketing by cooperating with TV shows instead. For example, Casarte, a brand of Haier Group, sponsored the TV show “Chef Nic Series 2”, illustrating appliance products effectively throughout the show.

Hence smart appliance manufacturers are shifting towards internet retailing and using non-traditional means of marketing, in order to convey their offerings to consumers clearly and effectively.

To what extent has smart appliances penetrated the Chinese consumer appliance market?

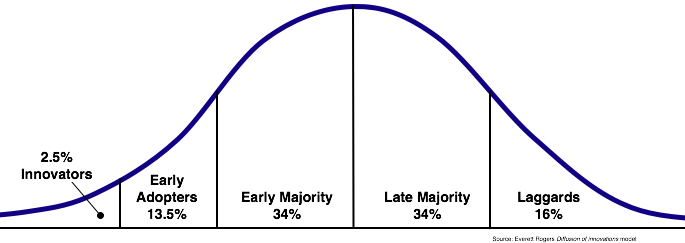

Smart appliances should be regarded as products that require some learning and being an innovative technological product, hence the technology adoption life cycle is relevant with respect to describing the development of the smart appliance market. Although the adoption of smart appliances is increasing in China, it is nonetheless reasonable to consider smart appliances as being purchased by “innovators” and “early adopters”, with respect to the technology adoption life cycle.

Hence most purchasers of smart appliances are willing to pay a premium for innovative products. In order to capture long-term profits, it is important to establish a presence in the early market, and become recognised and accepted by the early market. This is necessary in order to capture market share in the long term, as experience shows that it is often too late to join when a product category has been accepted by the “early majority”, who are characterised as valuing products that have pragmatic benefits.

Due to the necessity of linking smart appliances to the internet, it is necessary to cooperate with internet companies. This trend has already started taking place, as mentioned previously. Moreover, smart appliances are elements in an integrated solution, suggesting that firms that are able to offer integrated bundle packages will be in a strong position to capture market share.

For these reasons, i.e. smart appliances being innovative products part of an integrated solution, and requiring forming partnerships with internet providers to offer this solution, it is important to establish a presence now and obtain market share leadership. In this manner firms can reap the benefits as the market matures and the early and late majority start purchasing smart appliances as well.

In conclusion, smart appliances are transforming the consumer appliance market. It is necessary to use non-traditional marketing channels to market smart appliances effectively, and experience from the high-tech sector suggests that it is necessary to establish a strong presence in the smart appliances market now, as large-scale adaptation has yet to come, but when it comes, a presence must already have been established. Hence the time to enter is now.

Case Study: Home Appliances Industry

A leading television and home appliance company were seeking to revamp its business strategy with e-commerce. The idea was to move beyond a traditional showroom model, and towards a multimedia-selling platform in China. Aiming for a bigger tech presence in China, they contacted Daxue Consulting to advise them on this strategic business transformation. They needed expert assistance to restructure their logistics and change their sales and distribution platform for China’s e-commerce market.

Daxue Consulting helped the client to redesign its business plan to build its online presence and visibility. The final delivery gave the client a clear understanding of the current and realistic cost estimation and recommendations for selecting partners in China.