Overview of China’s soap market: which opportunities for foreign brands?

In China, where the population has reached 1.4 billion in 2020, 23.68 units of soap are consumed annually per person. The market is subject to a consumption upgrade as the disposable incomes of Chinese rise and consumers look for quality. Other trends include the increasing preference for liquid soaps and increasing diversity of products on the market.

Production volume and market size in China’s soap market

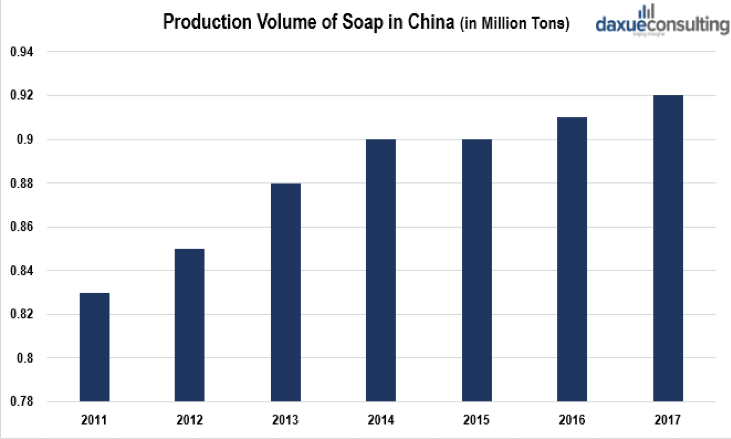

Since 2011, the production volume of soap in China was about 0.83 million tons. Since then, it has been increasing steadily. In 2014 and 2017, it reached 0.91 and 0.92 million tons respectively.

[Data source: qianzhan, ‘Production volume of soap in China (in million tons)’]

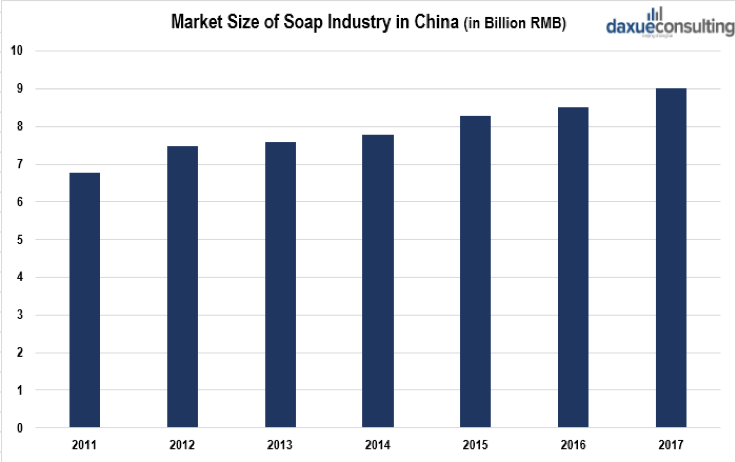

As for the market size of China’s soap industry, in 2011, it was around 6.789 billion RMB. In 2013, it had reached 7.5 billion RMB. In 2015, the figure exceeded 8 billion RMB. By the end of 2017, it increased to 9.23 billion RMB.

[Data source: qianzhan, ‘Market size of soap industry in China (in billion RMB)’]

Import pattern in China’s soap market: fluctuating import volume and stable import partners

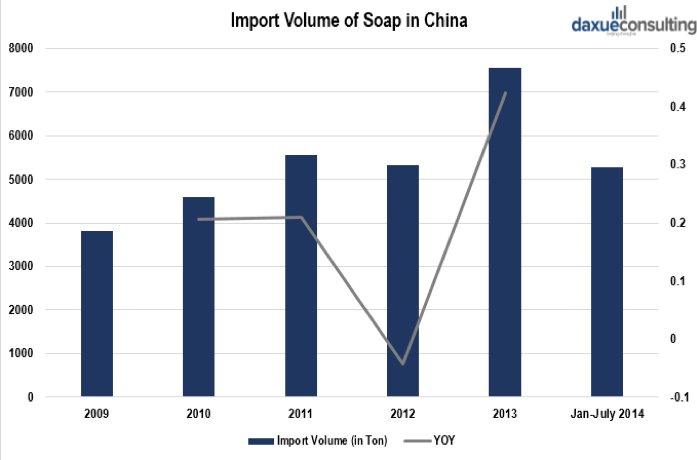

Even though the production volume of soap in China is large, the demand for imported goods has been growing for years. In 2009, 3,800 tons of soaps were imported into China, while in 2014, 7,500 tons of soaps were imported. Meanwhile, according to IBISWorld research, the volume of soap imports into China has still been increasing every year. Imported items occupy only a small share of the market. ‘

[Data source: GACC, ‘Import volume of soap in China’]

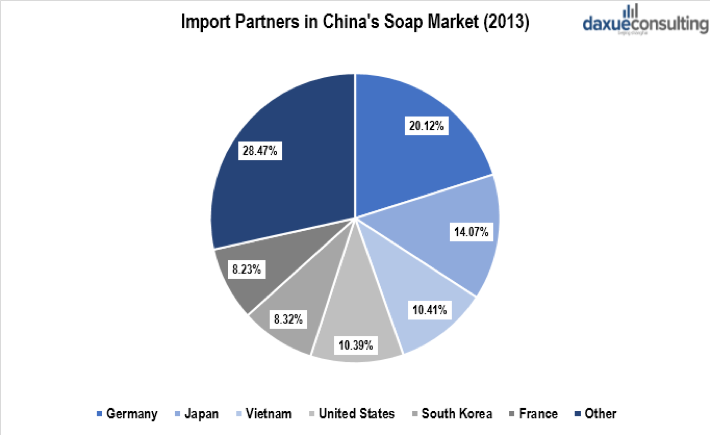

In 2013, Germany was China’s largest import partner with 20.12% of China’s total soap import volume coming from Germany. The second and third positions were Japan and Vietnam with proportions of 14.07% and 10.41% respectively. In 2019, the ranking is slightly different: the top 4 sources of soap imports in 2019 for China are Japan, the United States, Germany and South Korea.

[Data source: GACC, ‘Import partners in China’s soap market (2013)’]

The driving trends in China’s soap market: ingredients matter

Even though the market performance of soap in China is not outstanding, it does not indicate that the market will vanish as there is always a substantial need. With the rising awareness of natural and environmental-friendly products, natural handmade soap come to be popular with white-collar females in China. In the future, it is projected that more and more soap consumers in China will switch to soap made from natural ingredients instead of synthetic. They are turning to soaps made from value-added ingredients such as protein, milk, honey and other nutrients.

This is a general trend towards FMCG’s products that is even stronger in tier-1 cities. Soap consumers in China also demand multi-function soaps. In 2018, facial and disinfectant soaps were the most popular products among Chinese consumers. Even though features such as exquisite packing, high quality and beautiful shape are highly appreciated, other value-added features such as weight loss help, blocking of harmful rays, refreshing agents, moisturizing effect, etc. are criteria for differentiation.

Product categories within China’s soap market

Soap can be either in the form of solid or liquid. For a long time, when it came to personal cleanliness, there was only one choice for consumers: bar soap. Of course, bar soap came in many guises — square bars and rounded bars, scented and unscented, clear and opaque — but its essential look and function went unchanged for many years. Then other cleansers — both soap and non-soap formulas — began to appear.

Bar cleansers were joined by liquid products, which were first used primarily for hand washing. The market eventually became flooded with shower gels, also known as body washes, which quickly became a popular alternative to bar soap in China. Like so many health and beauty products, there are advantages and disadvantages to both bar soap and liquid soap. One of the main complaints about bar soap is that it washes away more than just dirt. Harsh bar soaps can deplete your skin of the moisture it needs to stay healthy. Liquid soaps, on the other hand, often contain moisturizers, but they are also more likely to have fragrances and other additives that can irritate sensitive skins,

According to IBISWorld, the soap market in China includes laundry and bathroom soap in bar, powder and liquid forms. In recent years, manufacturers have increased production of bath scrubs and shower gels. The traditional bar soap is steadily being superseded by an increasing range of liquid soaps and body washes. The market share of soap in China is slowly declining as more convenient and efficient products are being developed.

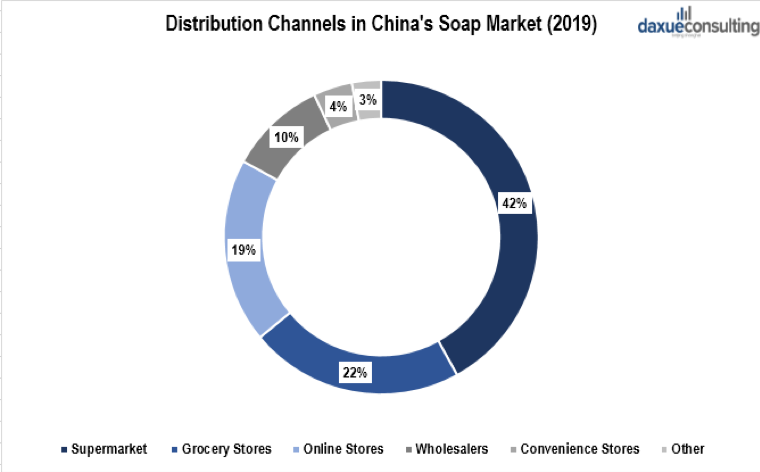

Distribution channels in China’s Soap Market

[Data source: IBISWorld, ‘Distribution channels in China’s soap market (2019)’]

The wholesale and retail sectors in China have been expanding rapidly in the past decade. Thus, a large proportion of soap consumers in China purchase daily products in supermarkets because of the convenience, product quality assurance, and favorable shopping environment. As a result, supermarkets accounted for 42% of the industry’s total revenues in 2019.

Grocery stores

In terms of grocery stores, the demand coming from rural areas is noticeable as over 50% of the Chinese population lives in the countryside. Small-scale supermarkets in towns and grocery stores are the most common venues for soap consumers in China’s rural areas to purchase daily products. With the development of supermarkets in third- and fourth-tier cities, customers prefer to shop in supermarkets rather than grocery stores. Therefore, the soap sales volume of grocery stores is decreasing. Revenues generated by grocery stores accounted for 22% of total industry revenues.

E-commerce

When it comes to e-commerce, revenue from online stores reached 19% in 2019. Online retailers are likely to offer lower prices than brick and mortar stores. Additionally, soap consumers in China prefer shopping online because of the convenience.

Wholesalers

For wholesalers, this represented 10% of industry revenues. Wholesale prices are lower than retail prices but not very convenient for consumers who have to buy large quantities at once.

Convenience stores

Convenience store revenues accounted for 4% of total revenues. Prices of goods in convenience stores are relatively higher and purchases from these venues are occasional.

Department stores

Finally, department stores, franchised stores and direct sales accounted for 3% of total revenue. The popularity of department stores has declined significantly over the past two decades, while online sales have gained popularity throughout China.

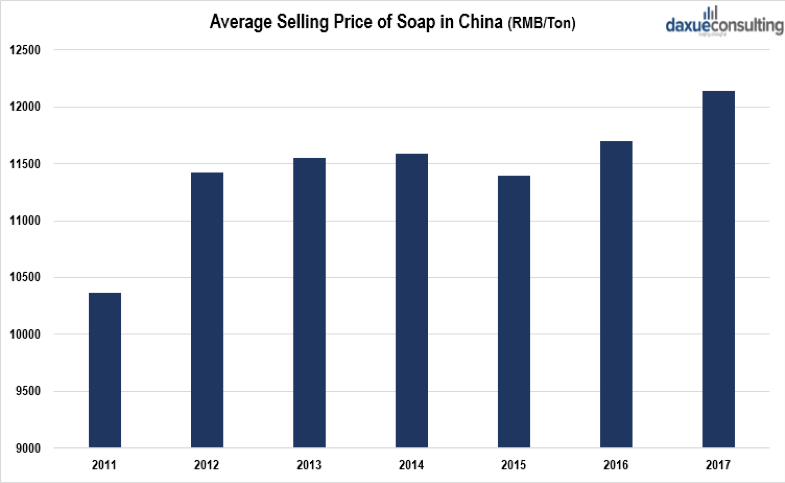

Pricing evolution of soaps in China

[Data source: qianzhan, ‘Average selling price of soap in China’]

In 2012 the price of soap in China was about 11,400 RMB/ton. During the following 4 years, the price maintained at 11,550 RMB/ton. It finally reached 12,144 RMB/ton in 2017.

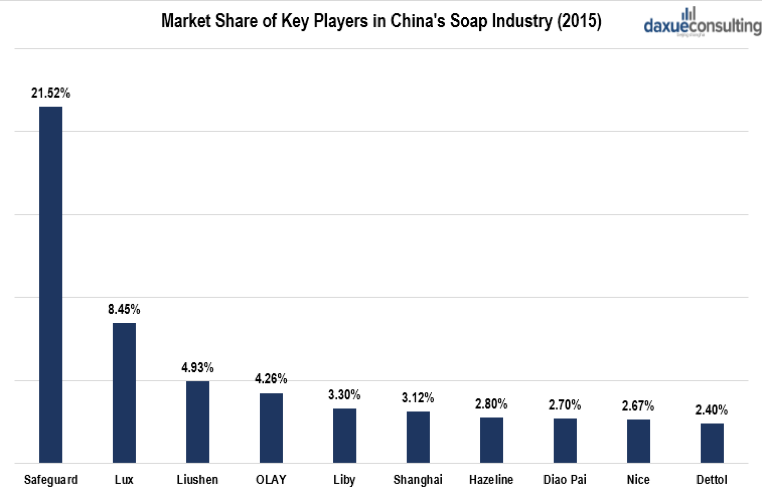

Key players in China’s soap market

[Data source: askci, ‘Market share of key players in China’s soap industry (2015)’]

In 2015, Safeguard, Lux and Liushen were the top 3 brands in China’s soap market and accounted for 56% of the market share. Such a figure indicated that the soap market in China has high level of market concentration.

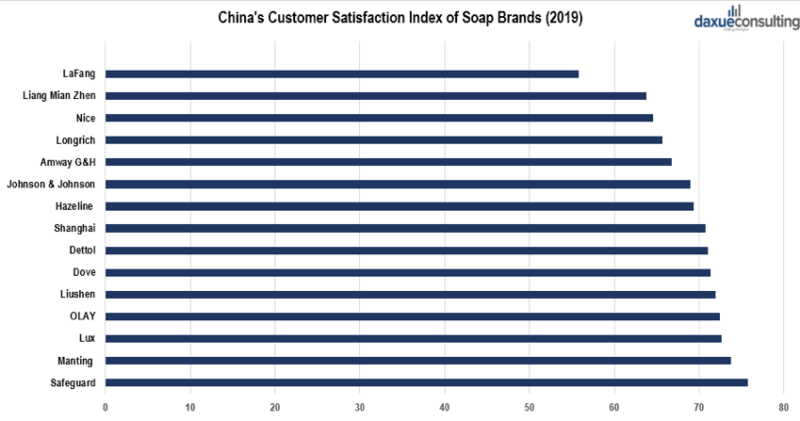

[Data source: Chinabaogao, ‘China’s customer satisfaction index of soap brands (2019)’]

As for China’s customer satisfaction index of soap brands, in 2019, Safeguard ranked first with a C-NPS of 75.7, followed by Manting and Lux, with a C-NPS of 73.7 and 72.7 respectively.

Chinese domestic soap brands: focus on laundry and toilet soap

Liushen

Liushen is a brand of the Shanghai Jahwa Corporation. Founded in 1898, it is one of the most famous domestic cosmetics companies in China and dedicates in the sector of personal care and skin care. According to JD, the Liushen soaps sold via the marketplace are mainly toilet soaps.

[Photo source: Sohu, ‘Logo of Liushen’]

Liby

Liby was founded in Guangzhou in 1994. It operates in the sectors of cleanser essence, laundry detergent, toothpaste, paper products and so on. On JD, Liby sells mainly laundry soaps.

[Photo source: Sohu, ‘Logo of Liby’]

Shanghai Soap Corporation

Shanghai is one of the brands of the Shanghai Soap Corporation. It is the first anti-bacteria soap sold in China. This soap includes a special ingredient that can eliminate bacteria on people skin and clothes. According to JD, most of the Shanghai Yaozao soaps sold via the platform are toilet soaps.

[Photo source: Sohu, ‘Logo of Shanghai’]

Diao Pai

Diao Pai is a Zhejiang company which operates under the Nice Group. With more than 50 years of development, Diao Pai established numerous strategic partnerships with several top 500 enterprises. Diao Pai is specialized in laundry products. All Diao Pai soaps sold on JD are laundry soaps.

[Photo source: Sohu, ‘Logo of Diao Pai’]

In addition to the mentioned ones, other Chinese domestic soap brands can be interesting to look at. For example, the brand Keon, which was founded in Nanfeng, Guizhou province in April, 1996. This company targets people in the countryside as its client base. Currently the company owns 5 branches and 19 different brands. Lonkey is also gaining power in China as it is seen as an historic player: it was founded in 1959 and built up its brand image to create a brand reputation as an established player in the industry.

International soap brands in China: a focus on toilet soaps

Procter & Gamble

Safeguard is an antibacterial soap from the brand Procter & Gamble and is sold in the United States, Mexico and Escudo, Ukraine, Latvia, Canada, Egypt, China and Pakistan and the Philippines. Its 1980s “The Smallest Soap in the House” ad campaign was a milestone for the brand. In this ad, people complained about how their Safeguard bars were getting smaller and smaller due to excessive use. The end of each commercial featured a brand new bar of Safeguard foam soap which, thanks to a stop-motion animation, shrunk just before the voice-over said “The smallest soap in the house”.

[Photo source: Sohu, ‘Logo of Safeguard’]

OLAY is another brand of Procter & Gamble. As one of the most appreciated skin care brands in China, OLAY is known to provide high quality skin care products. On JD, the OLAY soap sold are mainly toilet soaps.

[Photo source: Sohu, ‘Logo of OLAY’]

Unilever

Lux is one of the brands of Unilever. Headquartered in Rotterdam and London, Unilever is one of the leading global consumer product manufacturers in the world. The company has over 400 well-known brands, including Zhonghua, Vaseline, Lux, Dove, Pond’s, Omo, Comfort, Skippy, Walls and Lipton. In 1924, the company launched its debut facial soap in the United States. Until the 2000s, the business has expanded to more than 100 countries. They sell mainly toilet soaps.

[Photo source: Sohu, ‘Logo of Lux’]

Hazeline originated from Sunsilk, is another Unilever’s brand. Sunsilk is the largest hair care brand in the world that brings a lot of innovations in hair care. In 1998, Hazeline entered China. Today, according to JD, the Hazeline soaps sold online are also mainly toilet soaps.

[Photo source: Sohu, ‘Logo of Hazeline’]

Reckitt Benckiser

Dettol is owned by Reckitt Benckiser. Founded in the United Kingdom, the company has established 60 subsidiaries and 100 brands all over the world. Hazeline soaps sold on JD are mainly toilet disinfectant soaps.

[Photo source: Sohu, ‘Logo of Dettol’]

Opportunities in China’s soap market

To summarize, foreign brands take up significant market share and have a positive perception among Chinese consumers. China’s consumption upgrade is certainly visible in the soap market, as they are opting for higher quality products.

Author: Amelia Han

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes