Despite not being a coffee-producing country, South Korea stands out as a significant consumer of coffee. In 2018, the per capita annual coffee consumption reached 363 cups. With an annual average growth of 2.8%, this figure rose to 405 cups by 2023. This surge in coffee consumption has prompted a notable increase in the number of cafés. From 44,305 coffee shops in 2017, the count skyrocketed to over 91,000 in 2022, marking a remarkable growth rate exceeding 200%.

Read our Korea’s MZ Generation report

Reflecting the robust coffee culture, the revenue of the Korean coffee market is projected to reach USD 2.2 billion in 2024. This growth is anticipated to persist, with an expected annual growth rate of 3.71% from 2024 to 2028, highlighting the sustained demand and economic significance of the coffee industry in the country.

Instant coffee is still dominating coffee market in South Korea, but its influence is gradually declining

Among the coffee drank at home, instant coffee, especially coffee mix, is the most popular. According to a survey by Korea Agrofood Data eXchange, 54% of 19,120 respondents consumes instant coffee in their homes, showing the popularity of instant coffee. This is particular relevant to older generations, who prioritize convenience and a rapid energy boost over the nuanced taste of coffee.

However, due to concerns about health and increasing demand for higher quality coffee, consumption of instant coffee has been decreasing since 2014. More Korean consumers are willing to spend extra on coffee for a better experience rather than settling for the sugary taste of instant coffee mix. Consequently, more customers are opting for coffee machines when drinking coffee at home.

Why is Americano South Korean consumers’ favorite type of coffee?

Based on a 2020 analysis conducted by Starbucks involving 5 million members nationwide, it was revealed that Americano was the favorite choice among South Korean consumers. First popularized by Starbucks in the late 1990s, Americano has become the most preferred coffee choice in South Korea over the past decades.

Americano stands out as a popular coffee choice in South Korea, driven by several factors. The increasing demand for a healthy lifestyle has led to a preference for sugar-free and low-calorie coffee like Americano. Additionally, its affordability enhances its popularity, often being the cheapest drink in cafés. Given that the primary reason for drinking coffee is for an energy boost, South Korean consumers tend to choose coffee that cost less money.

Moreover, Korea is known for its love for iced Americano. In fact, the expression “eoljukah” (얼죽아) became a term that gained popularity on social media platforms. The phrase is an abbreviation of the phrase “얼어 죽어도 아이스 아메리카노,” meaning “Even if I freeze to death, it’s Americano!” This reflects Korea’s “ppalli-ppalli (빨리빨리)” culture, a word describing the country’s fast-paced lifestyle. Iced Americano, being quick to prepare and consume, allows customers to obtain caffeine in a short amount of time.

Premium franchise cafe is the most preferred type of coffee shop in South Korea

Among different types of cafés, including private cafes, bakery cafés, and dessert cafés, premium franchise cafés like Starbucks and Twosome Place are the most popular types in South Korea. They are highly accessible, and they offer a more better drinking experience compared to the smaller or medium sized cafés like Mega Coffee. Many go there as they serve as excellent choices for casual meeting spaces. In fact, they’ve even become go-to sports for the “cagongjok (카공족)”, people who spend hours studying or working in cafés without necessarily consuming more drinks or desserts.

Many consumers often go to the premium franchise cafés to redeem gift cards received from KakaoTalk, Korea’s top messaging platform. Gifting, a common practice in Korea for building and maintaining relationships, is notably facilitated through the coffee gift cards. Franchise cafes’ coffee gift cards is one of the most popular gifts consumers give through KakaoTalk Gift, effectively drawing consumers to the stores.

Increasing demand for cheap franchise coffee shops

In the competitive coffee industry, newly emerging franchise coffee brands like Mega Coffee and Compose Coffee use cost-effectiveness as their main strategy. With the escalating cost of living, cheap franchise cafes have become popular, particularly among the MZ Generation and young working-class consumers. In 2023, Mega Coffee surpassed Twosome Place in number of stores and came in second for the most stores among coffee chains in South Korea.

Contrary to the traditional perception that associates cheap coffees with low quality, these brands have successfully refined the narrative. Cheap coffees are no longer considered as low quality beverage. By focusing on their take-out services over their interior designs, these brands were able to provide decent quality coffees at cheaper prices.

Moreover, Mega Coffee and Compose Coffee chose brand models that are popular among younger consumers, who are their main consumers. For instance, Mega Coffee chose Korean star soccer player Son Heung Min (손흥민) as the brand’s model, while Compose Coffee opted for famous K-pop group BTS member (뷔). Collaborating with these prominent figures not only appeals to the younger generation but also forms a crucial part of the franchises’ efforts to connect with their international audience.

Starbuck’s success in South Korea

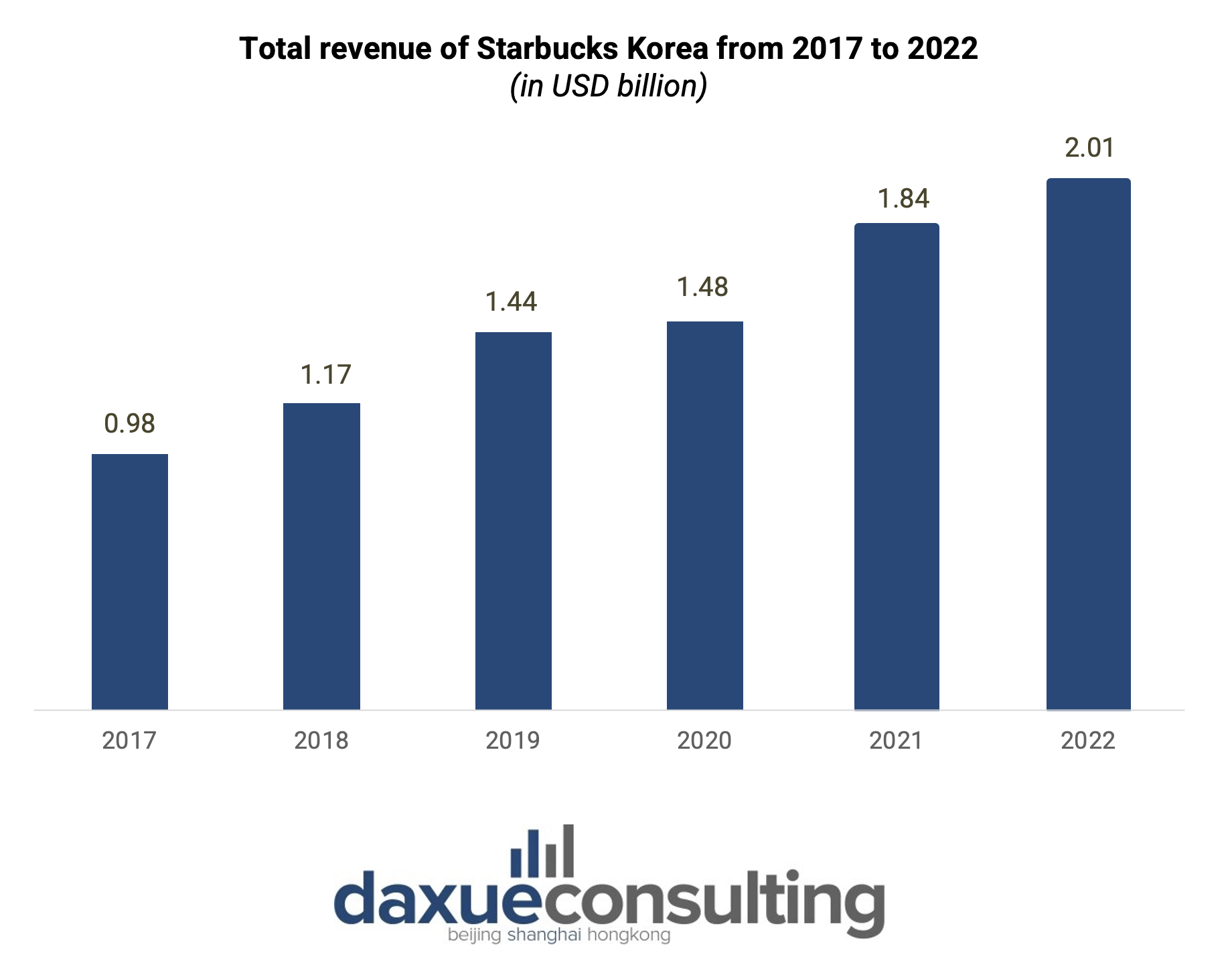

According to South Korean public opinion polling agency Realmeter, Starbucks Korea is the most preferred café brand in South Korea. With 1,750 stores all over the country, Korea is Starbucks’ 4th largest market after exceeding Starbucks Japan in 2022, just behind the United States, China, and Canada. With the brand’s strategy of selling culture and securing customer loyalty, Starbucks continues to dominate the coffee market in South Korea.

Starbucks in South Korea: Beyond coffee, creating a premium brand image

The combination of high prices and well-designed stores has positioned Starbucks as a premium brand in the country.

Starbucks Korea was first launched in 1999 near Ewha Womans University. Back then, the price for a short Starbucks Americano was USD 1.93, which was equivalent to the average cost of lunch in South Korea at that time. Fast forward to today, a drink and dessert at Starbucks might as well be equivalent to one’s lunch budget.

Moreover, the allure of Starbucks in South Korea goes beyond just the coffee. The brand attracts consumers with its friendly service, creatively crafted drinks, and aesthetically pleasing spaces. These elements contribute to the perception that customers aren’t merely buying a cup of coffee. Instead, they are investing in the culture and ambiance that Starbucks uniquely offer, reinforcing the premium positioning of the brand.

Starbucks’ localization strategy in the Korean coffee market

Starbucks’ localization strategy was successful due to its joint venture with the South Korean department store franchise Shinsegae Group. The Korean chaebol not only owns department stores but also supermarket brand E-mart. This allows Starbucks to produce beverages that meet South Korean consumers’ tastes. In addition, Starbucks has developed many of its drinks based on Korean local specialties. Jeju-exclusive beverages are among the menus that Starbucks Korea sells exclusively in Jeju and few selected areas.

Furthermore, reflecting on South Korea’s “ppalli-ppalli (빨리빨리)” culture, Starbucks Korea released “Siren Order” in 2014. This system enables consumers to order drink from nearby Starbucks store through applications, saving consumers’ time and removing the waiting process.

Starbucks’ limited edition merchandise stimulate consumption

Starbucks is also known for its diverse and compelling merchandise. It even holds e-frequency events twice a year, requiring consumers to buy certain amount of drinks to get its limited edition merchandise, fostering consumer loyalty with such rewarding system. Starbucks also releases merchandise that specifically targeted South Korean consumers. Merchandise commemorating the National Liberation Day of Korea and co-branded merchandise with K-pop idol group Blackpink gained popularity among local consumers.

Key takeaways on the Korean coffee market

- With an increasing number of cafes and an increasing demand for coffee, the revenue of South Korea’s coffee market is expected to experience an annual growth rate of 3.71% from 2024 to 2028.

- Instant coffee is still the most preferred coffee in South Korea. However, its influence is gradually declining due to consumers’ growing interest in health and demand for higher-quality coffee.

- The high accessibility, comfortable spaces for gatherings, work, and study make premium franchise cafes the most popular type of coffee shop in South Korea.

- With its premium image, localization strategies, and limited-edition merchandises, Starbucks is still the number one coffee brand in South Korea.

- Cheaper franchise cafes are also gaining popularity, specifically targeting younger consumers.