As people in South Korea spend more time at home doing activities beyond just eating and sleeping, there is growing attention to furniture products. South Korea’s furniture market is witnessing growth, with a market worth of USD 3.8 billion in 2023 and projected to experience a CAGR of 4.18% from 2024 to 2029.

Read our Korea’s MZ Generation report

During the COVID-19 pandemic, more people stayed home and invested time and money into their living spaces. This trend has continued even after the pandemic was no longer considered a national emergency in Korea. The demand for furniture extends beyond homes to other spaces like start-ups and office spaces.

Redefining home: From housing to work, self-development, and leisure

The meaning of home in South Korea is expanding beyond just a place to eat, sleep, and relax. It’s becoming a space where one can enjoy culture and activities that were previously done outside, including work, self-development, and leisure.

People are creating their own office spaces at home. Additionally, amid a growing desire for self-development, they’re using their homes as spaces to read books, learn new languages, and engage in home training, among other activities.

People are also spending their free time at home, either alone or with others. For example, before COVID-19, drinking was commonly done in groups outside. However, it has become more accepted for people to drink at home, even alone. People are now enjoying wine and music at home, which was typically an activity done outside in restaurants.

The MZ Generation: the consumer group of the future

The MZ Generation in South Korea is a consumer group receiving significant attention. With Korea’s aging population and low fertility rate, they are expected to play a substantial role in society. This consumer group has shown a strong interest in interior design, attracting attention from brands. According to a recent survey, a substantial 59% of respondents aged 30 to 39 disclosed that they invested in new furniture in 2022, closely followed by 58.5% of individuals aged 20 to 29.

The shift of home representing “my family” to “me”

As single-person households in South Korea are growing, this is redefining what home represents. In the past, a home usually reflected the tastes of one family, including the furniture and objects. However, with more people living alone, choosing not to get married, and experiencing a growing sense of individuality and desire for self-expression, the MZ Generation, in particular, is decorating their homes to express their personal identity. This is driving them to seek for furniture suit their individual tastes and needs.

Prioritizing functionality in furniture: a small space, for big purposes

As single-person households grow, Koreans are demanding small, modular, and multipurpose furniture that allows them to maximize functionality in a small space. For example, they seek partitions to create different areas in their homes for various purposes. Modular shelves are also in demand, as they allow consumers to buy the units they need and arrange them however they want for different purposes.

As people are comfortable with technology, smart furniture equipped with multiple built-in functions is being used as well. In response, top companies like Hyundai’s LIVART Corporation are seizing this opportunity by focusing on the development of smart furniture and appliances. Their “Space Smart sliding vanity” offers a compact design and plenty of storage space, ideal for small living spaces.

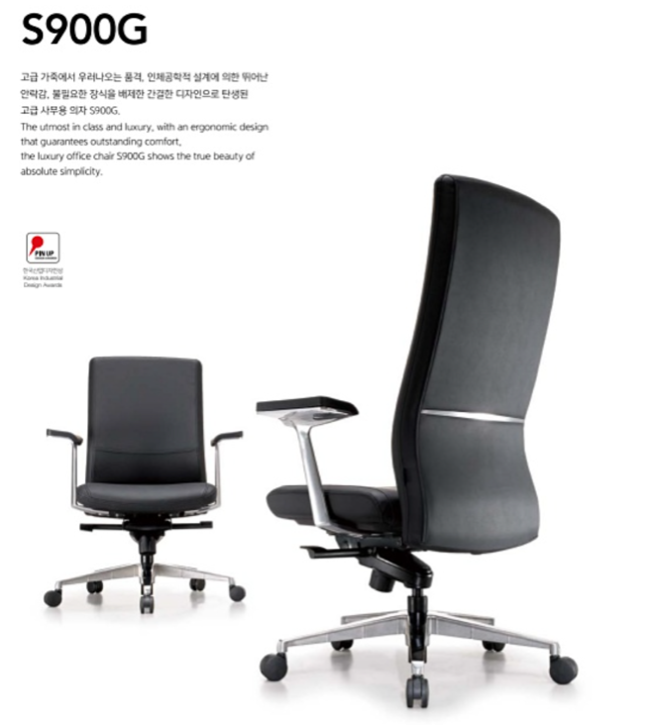

Furniture for offices: Prioritizing comfort and productivity

In addition to the home furniture market, South Korea’s office furniture market has witnessed a substantial increase in demand. This can be attributed to the notable rise in start-ups, home offices, and coworking spaces.

Moreover, there is a greater emphasis on the comfort and flexibility of office furniture. This is influenced by an increasing focus on employee health and well-being and the changing work culture. As companies adopt a more horizontal organizational structure, office spaces are evolving to create a more pleasant and comfortable working environment. In response, brands are focusing more attention on office furniture. Hyundai LIVART plans to prioritize the office furniture sector as it experiences record growth despite economic challenges. In 2022, its office furniture division recorded sales exceeding KRW 100 billion for the first time.

From stores to screens: The rise of online furniture shopping in Korea

With South Korea’s growing e-commerce landscape, increasingly more consumers are favoring online retailers over brick-and-mortar stores. The unparalleled convenience, extensive customer reviews, and lower prices are driving this. Furniture companies like Hanssem, e-commerce platforms like Coupang and Naver Shopping, and vertical platforms like Today’s House, are capitalizing on this trend by offering a wide range of furniture products and services online.

Bucketplace (오늘의 집): An all-in-one lifestyle platform

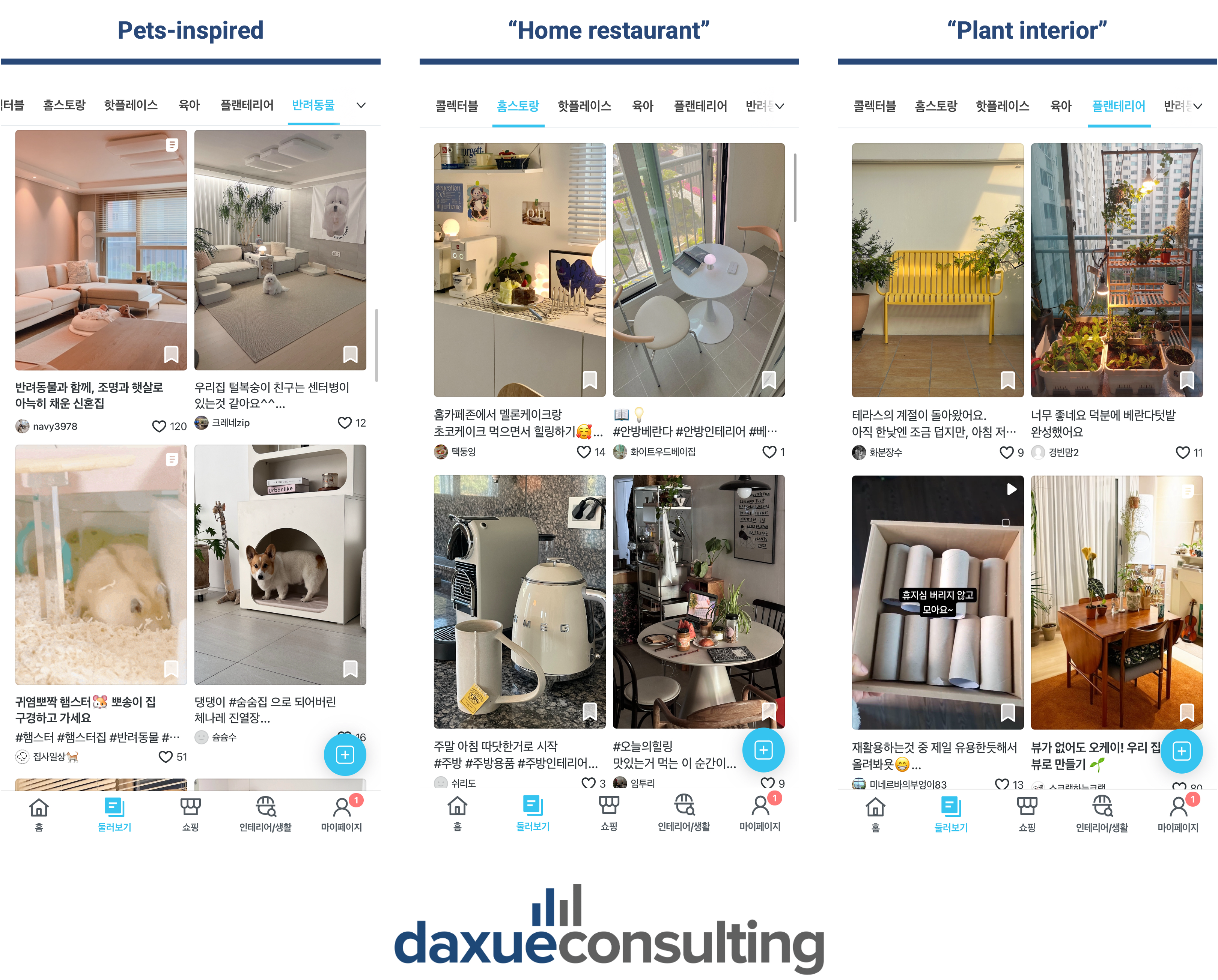

A popular furniture platform in South Korea is Bucketplace (오늘의집). It is a comprehensive furnishing and interior design platform that offers consumers a one-stop furniture shopping experience. Not only does it sell products, but it also provides inspiration for the ideal living space. It also provides moving assistance, house cleaning, and remodeling services.

Today’s House has also risen in popularity by creating a space for content and interaction. Its platform allows users to upload content related to furniture and lifestyle, building a community and driving engagement. In addition to its platform, Today’s House also creates content on YouTube. With nearly 700,000 subscribers, it produces interior design transformation videos featuring real people who seek makeovers for their homes.

South Korea’s furniture market: Changing tastes, preferences, and methods

- The concept of “home” in South Korea is shifting. It’s not only a place to eat, sleep, and rest but a multifunctional space for work, self-development, and leisure activities.

- The MZ Generation is a significant consumer group with a strong interest in interior design.

- Single-person-households are redefining home as a reflection of personal identity rather than family tastes.

- There is growing demand for small, modular, and multipurpose furniture to maximize functionality in small living spaces.

- The office furniture is growing, with a greater focus on those that create a comfortable and flexible work environment to improve employee well-being and productivity.

- People are increasingly turning to online platforms for their entire furniture shopping experience, including finding inspiration, making purchases, and getting post-purchase services.