The yoga market in China is riding the wave of the nation’s increasing health awareness. The annual revenue of the yoga market in China reached around 25.4 billion yuan in 2017 and was projected to reach 46.8 billion yuan in 2020. Sales of yoga-related products, such as yoga apparel, mats, and other equipment, as well as yoga courses drive the market growth.

The per-customer spending on yoga products and services is low

Though most gyms and fitness clubs in China offer yoga courses and services, the per-customer spending on offline yoga classes is limited. Some large and medium-sized fitness clubs offer free yoga classes to attract more store traffic to convert to memberships, which they then up-sell personal training classes.

In 2018, the total amount of spending of offline yoga courses (68.9%) was higher than that of online courses (31.1%). However, after the global COVID-19 pandemic which pushed China’s fitness industry further online, Chinese yogis have become more inclined to take digital classes. Moreover, given the nature of yoga, many customers prefer to undertake yoga exercises at home following the guidance of fitness APPs like KEEP. What’s more, many large companies are starting to provide employees with in-house free yoga classes as employee benefit. These factors open the yoga market to a wider range of consumers.

However, the per-customer spending of yoga-related products is also limited since these products are not fast-moving consumer goods, so the repurchase rate is low. As more small businesses enter the market, the competition gets fiercer.

Customer segmentations of the Chinese yoga market

In general, Chinese women are more likely to undertake light exercises such as walking or yoga than men. Yoga studios are concentrated in tier-1 and tier-2 cities, with Beijing, Shanghai, and Chengdu leading the number of yoga studios in China. Accordingly, 65.8% of Chinese yoga practitioners are in tier-1 and tier-2 cities.

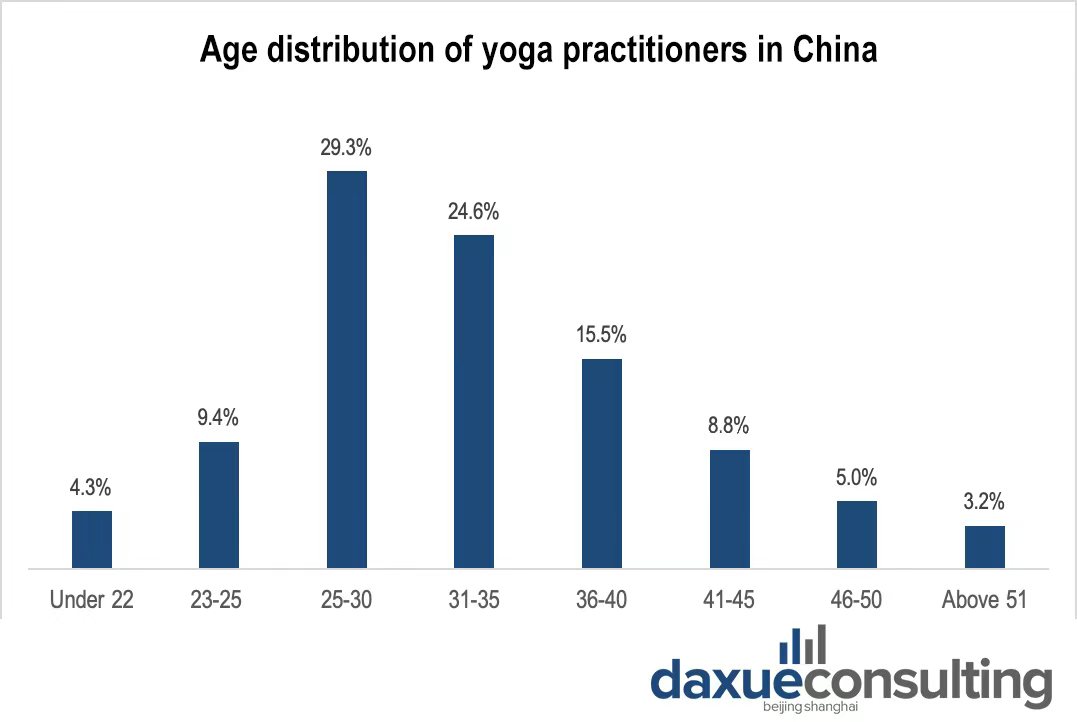

Data Source: Chinabaogao.com. Chinese yoga practitioners are relatively concentrated among young people aged 25-40, accounting for 69.4%.

According to insights from a Lululemon sales assistant in China, in traditional yoga studios, which offer free or affordable courses for the mass market, the majority of consumers are women in their 30s and 40s. “They are yoga lovers and attend yoga classes for self-help as well as social needs, and tend to hang out in groups and treat yoga as a social activity.” Hence, she finds word-of-mouth marketing to be effective among this group of consumers.

Cost-effectiveness and social networking are the key decision-making factors for mid-market yoga consumers. But this is not the case in the premium market.

The premium yoga market in China

In premium yoga/pilates studios, which offer specialty yoga courses, the consumer base shows a wider gender range. From our discussion with the Lululemon sales assistant, we learned men and women in their 30-40s with high disposable income are the core premium yoga clients. It’s worth pointing out that only in more premium yoga studios that male consumers are present and they are mostly medium to high income.

Image Source: Dazhong Dianping Mobile App., A premium speciality yoga studio in Shanghai founded by KnowYourself, a lifestyle online education tech company. KY started by creating self-help content online and expanded to sell lifestyle products and services. It is a stark example of online-to-offline model in the yoga market.

The The facilities, environment, and trainers in high-class yoga studios are better, and the offerings are more diverse as well.

Some studios will offer trainers with certified yoga coach training courses. High-end consumers tend to buy one-on-one classes and are also consumers of expensive yoga clothes and yoga mats.

Premium experience and expertise of trainers are the major decision-making factors.

How to reach general vs. premium yoga consumers

The Thus, business operation knowledge and marketing skills are crucial, whereas, the latter group forms the core clients group and demands membership management and a high level of yoga expertise from yoga studios.

Young millennials under 25 are relatively active in attending yoga classes. The majority of them prefer to engage in more intensive bodybuilding courses to lose weight or build muscles and take yoga classes as a stretching practice or for correcting poor postures incurred by sedentary professional life.

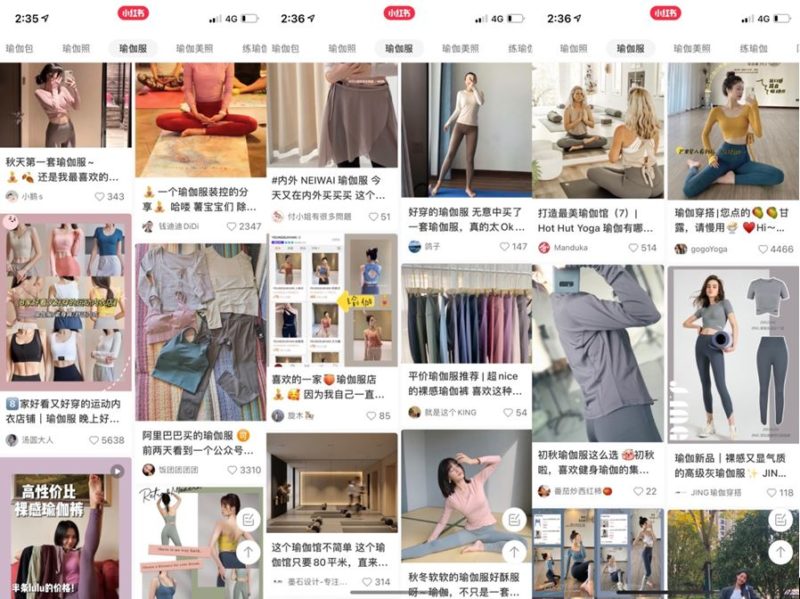

Image Source: Red (aka. Xiaohongshu小红书), Younger millennial women are the target consumers of yoga apparel, but not necessary the target consumers of yoga classes.

On a similar note, young millennial women are the targeted consumer segment of the athleisure market in China, which is comprised mostly of yoga-appropriate clothing. This age group are more likely to share photos of yoga outfits or activities on social media; hence aesthetic appeal is important to yoga apparel brands looking to tap into the athleisure market.

Postpartum recovery yoga courses are popular among young millennial moms. However, P there are increasingly more pilates classes in the market.

How Yoga brands in China compete

Lululemon in China: Premium and gender inclusive

The yoga clothes and equipment market in China are developing, with the market concentration rate still low. Lululemon, the Canadian athletic apparel brand, is leading the premium yoga wear market. As the value delivery chain of yoga market in China centers on yoga courses, Lululemon in China is expanding its operation to offering yoga courses in local communities in collaboration with various brand ambassadors and KOLs.

It’s not only beneficial for expanding the consumer market, but also for managing existing consumer relationship. What’s more, unlike other brands that specifically target women, Lululemon aims to include more male consumers.

Lululemon has set itself up for a premium image in China. With a classic minimalist appearance, along with offline stores located in ritzy areas such as Shanghai’s Xintiandi.

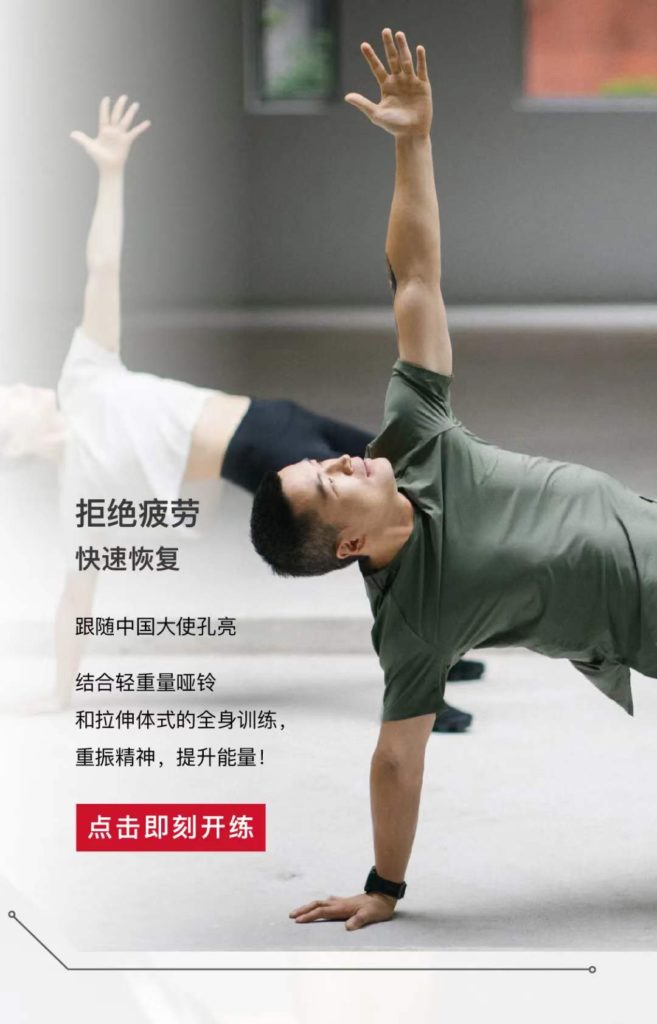

Image Source: Lululemon’s WeChat official account. Lululemon promotes O2O community-based yoga classes as a way to improve customer stickiness and yoga popularization.

Domestic Chinese yoga brands like Neiwai target the mainstream market

Meanwhile, domestic brands are offering cheaper alternatives to Lululemon. For instance, the rising Chinese Neiwai, the Chinese sportswear brand, , and many small e-commerce start-ups offer affordable yoga clothes and equipment.

Since yoga clothes and equipment have little product differentiation, consumers either choose affordable prices with a reasonable quality or trustworthy brands that have the power to charge customers premium.

Image Source: Neiwai’s Tmall store, Unlike Lululemon, Neiwai focuses specifically on female yoga lovers by collaborating with female KOLs in yoga and ballet fields.

Consumers buy premium brands such as Lululemon not just for satisfying functional needs, but more importantly, meeting their symbolic and experiential needs. Premium brands imply personal identity and signal what their tribe is.

Besidespremium brands provide their customers with experiential values not only through customized products and services but also O2O community activities.

Prospects of the yoga market in China

In a fast-paced society with a culture for low-indulgence, yoga is still enjoyed by a minority of the population that has raised economic growth. Among the minority population of yogis, there are customer segments with distinctive needs. Hence, it requires different sets of knowledge and skills from businesses in the China’s yoga market to tackle the target segments. As the market gets more competitive, it remains clear that future battleground will demand comprehensive solutions rather than cheap prices.

Learn something new? Stay updated on the Chinese market by following our WeChat, scan the QR code below, or subscribe to our newsletter

See our report on the underwear market in China

Listen to over 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast