ANTA(安踏), a prominent player in the Chinese sportswear market, has secured a notable position second only to Nike with revenue reaching RMB 29.6 billion in 2023. The sale is mainly from sports apparel and footwear segment. The company recorded a substantial revenue of RMB 11.1 billion from sports apparel sales, marking a notable increase from the previous year’s RMB 9.2 billion. The sports footwear segment contributed around RMB 7.2 billion to its annual revenue.

The surge in outdoor sports in China has been a crucial factor in bolstering the brand’s success. According to the National Sports Health Trend Report, the heightened public health awareness, driven by improved living standards, has led individuals to prioritize physical well-being. Outdoor sports, evolving from a form of relaxation to a means of enhancing self-worth and image, have gained popularity, particularly among the younger generations. This trend provides both social interaction and fitness opportunities, aligning with its market strategy.

Download our report on the She Economy in China

Balancing affordability, cultural relevance, and innovative marketing

Initially facing perception challenges in the middle-class market, the Chinese sportswear company strategically addressed this by acquiring competitors. Wu Ge from the Beijing Institute of Fashion Technology notes that residents in Tier 1 and 2 cities often viewed the brand as inexpensive, impacting their willingness to purchase. However, there has been a shift in consumers’ perceptions.

Is ANTA another Li-Ning?

Like Li-Ning, the Jinjiang-based sportswear brand has recently gone through a rebranding and repositioning process capitalizing on the spread of Guochao, the consumer preference for Chinese culture, traditions, and design. As reported by Bloomberg, the trend is quickly gaining traction among young Chinese consumers, especially the 270 million-strong Gen-Z cohort. These young consumers are redefining the traditional stigmas associated with Chinese goods; the ‘Made in China’ label is now seen as a badge of honor among Chinese consumers.

Local brands like Li-Ning and ANTA customize their marketing strategies to align with the preferences of the Chinese market. For example, surfing on the new trend among Gen Z for tea and a lifestyle promoting a slower pace, the sportswear brand took a creative approach. In Guangzhou, they transformed a designer-shoe store into a tearoom, bringing the traditional tea ceremony to the forefront. This initiative has successfully created a buzz on social media, with the main hashtag of the campaign, “Millennial slow-paced youth” (千禧慢系青年), garnering around thousands of views on Xiaohongshu.

Moreover, the Jinjiang-based brand extended its engagement with Gen Z by launching the “ANTA Gen-Z Radio”(安踏千禧 RADIO), a radio program that provides a healing recipe for listeners seeking moments of peace amidst the slower-paced life experiences.

“Single-focus multi-brand omni-channel” strategy

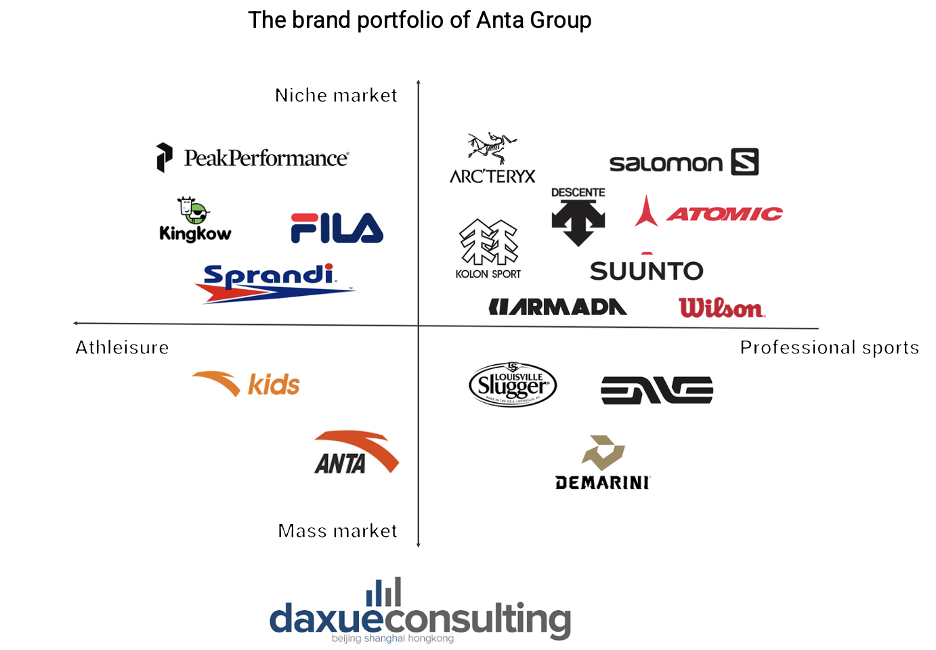

ANTA has strategically expanded its portfolio through mergers and acquisitions, creating a domestic brand umbrella that encompasses various international brands. This approach allows consumers to enjoy a diverse range of international brands under the brand’s umbrella.

One significant aspect of the company’s strategy is the “Single-focus multi-brand omni-channel” approach, aiming to cover all consumer segments. In the first half of 2022, the revenue surpassed that of Nike China and Adidas China, reaching RMB 259.65 billion in the first half of 2023, the performance soared to a new high, on the verge of breaking the RMB 300 billion mark. This remarkable achievement is attributed to its acquisition strategy, evident in its purchase of FILA in 2009. FILA, previously facing consecutive losses, became a major success under ANTA’s ownership. By 2020, FILA’s revenue exceeded that of ANTA’s own brand, solidifying its position as the flagship of ANTA’s fashion sports lineup.

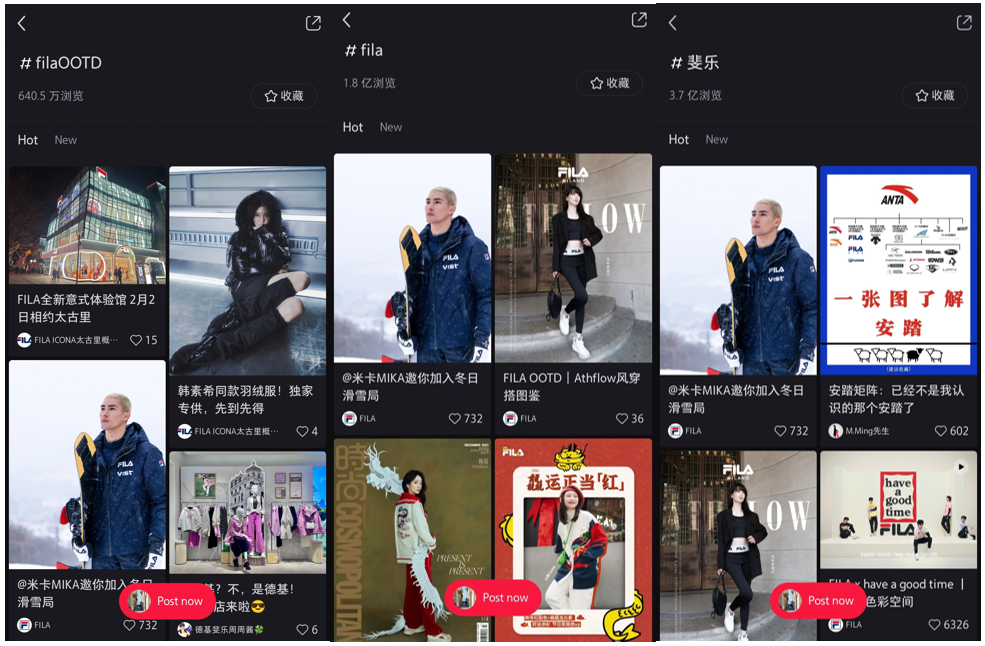

FILA adheres to three top strategies: top-tier products, top-tier brand, and top-tier channels, maintaining a leading position in consumer perception of fashion attributes, with the brand income increasing by 13.5% to RMB 122.3 billion. The brand has expanded into elite sports such as golf, tennis, skiing, and outdoor activities, with a steady increase in the proportion of professional sports and footwear products. Major e-commerce platforms showed significant growth, and retail store efficiency continues to lead the industry.

Broadening its customer base by including more brands in the niche markets

The Chinese sportswear company strategically positions itself by expanding its customer base through the acquisition of additional brands in niche markets. These premium brands, including Wilson and Salomon, aim to compete in the higher-end market, focusing on professional sports. Meanwhile, the Jinjiang-based company retains its focus on the mass market. SPRANDI, acquired in 2010, prioritizes comfort, style, and functionality, catering to consumers seeking quality and comfort. Descente, a Japanese skiing brand, joined the brand in 2016, known for its high-quality and professional sports gear in skiing, running, and fitness. In 2018, ANTA acquired Arc’teryx, a Canadian outdoor brand founded in 1989. Renowned for its excellent design, innovation, and high-quality outdoor products, Arc’teryx has become a respected choice among outdoor enthusiasts. These acquisitions showcase the Chinese athleisure brand’s commitment to providing a diverse range of high-quality and specialized sportswear options for a wide consumer base.

ANTA is gaining its online presence through its DTC model

As of the end of 2023, the company has a total of 9,633 ANTA and ANTA Kids stores worldwide, with approximately 3,817 operated through the DTC (Direct-to-Consumer) model. The DTC business, including both online and offline channels, accounts for 70% of the total. To unlock future growth, the company envisions a DTC model transformation, prioritizing e-commerce development, digitalization, structural reforms for offline channels, and improvements in operational and inventory management.

During the 2023 Double 11 festival on Tmall, Nike continues to hold the top position, with FILA and ANTA, both under the ANTA Group, closely following in second and third places, respectively. Descente is also within the top 20 list.

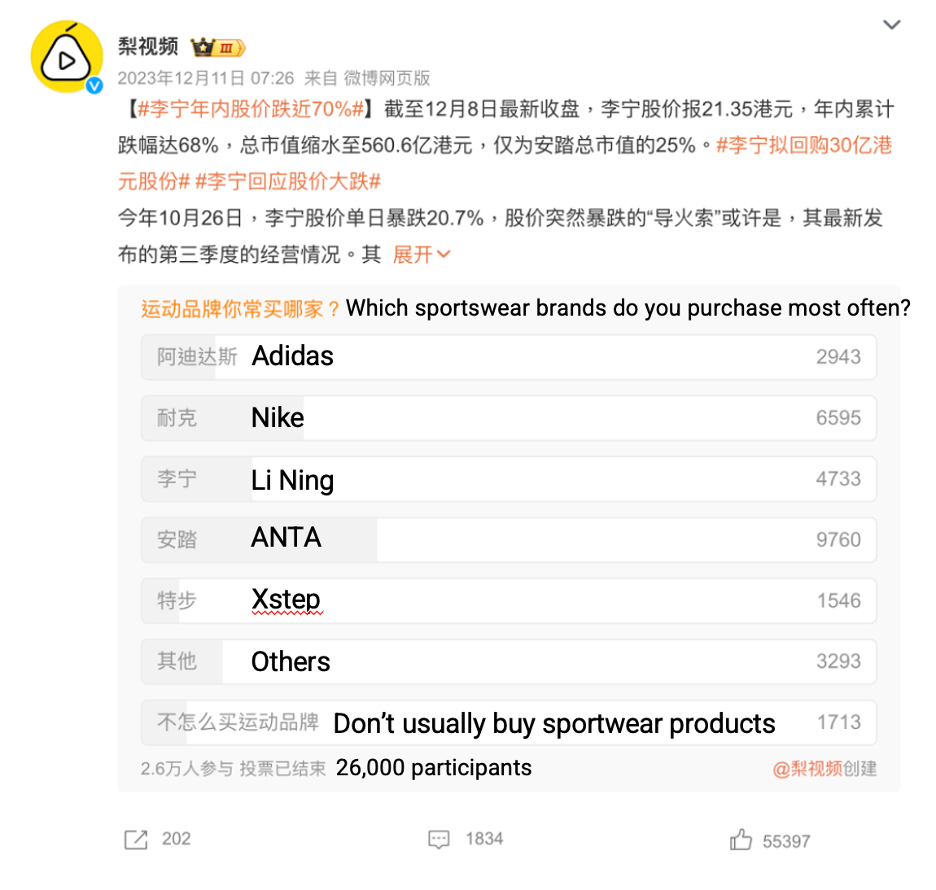

In the popularity ranking based on the cumulative number of transactions, Li-Ning and ANTA, two major Chinese brands, claim the top two spots, with Nike following in third place. On the member transaction amount ranking, which reflects user stickiness, Nike, FILA, and Adidas take the top three spots, highlighting the continued influence of traditional international brands. According to an online survey on Weibo, the brand continues to hold the top position as the most frequently purchased brand among Chinese consumers.

Blending offline and online features

ANTA has effectively integrated both online and offline components into its retail strategy, incorporating features such as the Metaverse, VR, and cutting-edge designs within its flagship stores.

In its innovative approach, the Chinese sportswear brand embraced the Metaverse and Virtual Reality (VR), shaping the “ANTA Ice and Snow Metaverse” digital space. This futuristic integration allowed users to engage with the 2022 Winter Olympics in a unique and immersive way. Users are incentivized through the reward of NFTs for Winter Olympics-related knowledge, highlighting the company’s forward-thinking digital strategy.

In May 2023, Leaping Creative has played a pivotal role in introducing the “Future Arena” concept for ANTA T-AGE’s flagship store and brand design. This concept aligns seamlessly with its commitment to providing high-quality, tech-driven sportswear tailored for teenagers. Situated in Chengdu and Changsha IFS, these flagship stores cater to the diverse interests of the new generation, bridging the gap between the online and offline space. The “Future Arena” narrative envisions the use of technology to capture and visualize sports moments, offering a dynamic and engaging retail experience for customers.

ANTA’s ESG strategy seen in its R&D investment and greener materials

Committed to environmental responsibility since 2015, the company joined the UN Global Compact in 2021, aiming for carbon neutrality by 2040. In 2022, it partnered for sustainable projects, promoting energy-saving and eco-friendly materials like space leather and recycled nylon, notably REPREVE (with a 44% energy saving and 50% less carbon dioxide emission compared to regular nylon). This aligns with market preferences, particularly in Europe and America, allowing the company to enter the international market with a compelling narrative, appealing to the sustainability-conscious younger generation.

US expansion through celebrity endorsements

In 2021, the Jinjiang-based athleisure brand adopted a 10-year-long strategy, “Single-Focus, Multi-Brand, Globalization”. The retail channels, R&D network, supply chain, and production bases are spread worldwide, with 75,000 sales outlets in North America, Europe, and the Asia-Pacific region. In particular, the company strategically expanded its presence in the US through celebrity endorsements, notably securing NBA stars like Klay Thompson in 2015 and Kyrie Irving in 2023. Irving’s recent RMB 905.7 million, five-year deal not only boost the brand’s popularity but also grant him authority in player recruitment. Despite this success, concerns arise as the CECC (Congressional-Executive Commission on China) calls for NBA action against ANTA, Li-Ning, and Peak due to alleged ties to forced labor, adding complexity to its US strategy.

Simultaneously, the Chinese sportwear brand is preparing for a significant global move on March 6, 2024, signaling its entry into the competitive US sportswear market. CEO Xu Yang emphasizes the company’s determination for widespread market penetration, with promotional events planned in key cities like New York and Los Angeles. Its subsidiary, Amer Sports, acquired five years ago, is progressing towards an IPO on the New York Stock Exchange, estimated to raise up to RMB 7.1 billion. Despite challenges, this move solidifies the group’s commitment to international expansion and establishes it as a global contender in the sportswear industry, aligning with Chairman Ding Shizhong’s dual-drive strategy for ANTA and Amer Sports.

ANTA’s rise, repositioning, and global ambitions in sportswear

- ANTA has become a major player in the Chinese sportswear market, securing the second position after Nike with a revenue of RMB 29.6 billion in 2023, largely driven by strong sales in sports apparel and footwear segments.

- The brand’s emphasis on outdoor sports resonates well with younger generations, providing both social interaction and fitness opportunities.

- Its strong emphasis on the DTC model, with 70% of its business coming from online and offline channels, positions it for future growth, particularly with a focus on e-commerce development and digitalization.

- The Jinjiang-based brand has repositioned itself by incorporating brands in other niche markets, overcoming the perception of being inexpensive, especially in Tier 1 and 2 cities, and aligning its offerings with the evolving preferences of Chinese consumers.

- Despite concerns raised by the CECC regarding alleged ties to forced labor, ANTA remains committed to its global expansion, particularly into the competitive US sportswear market.