Li Ning is a Chinese sportswear company founded in 1990 by the Chinese “prince of gymnastics” Li Ning (李宁). In recent years, the brand has seen its sales skyrocket and its patriotic designs gain popularity, especially among new generations. The enhanced Chinese nationalism combined with the surge of the sports market following the COVID-19 pandemic are important drivers behind the growing success of Li Ning in China.

The company’s ups and downs

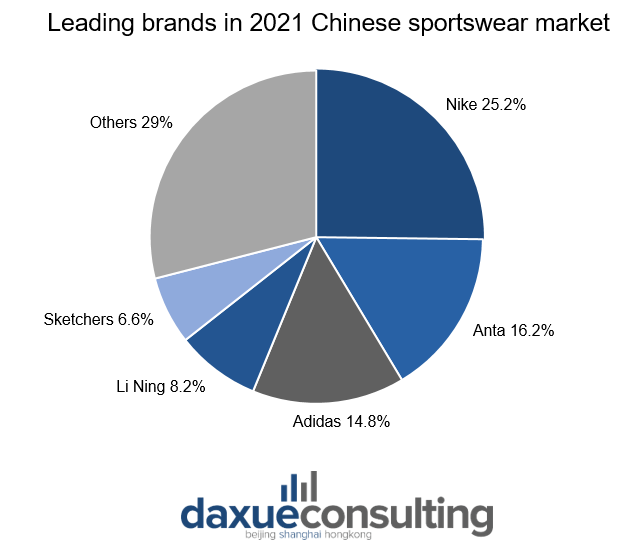

During its 30-year-old history in the market, Li Ning has earned a notable success. As of 2021 the Chinese sportswear company owned 8.2% of the market share, ranking fourth behind the international giants Nike (25.2%) and Adidas (14.8%), and the local brand Anta (16.2%).

Despite its popularity today, the story of Li Ning in the Chinese market is full of ups and downs. In the two decades from 1990 to 2010, the brand set off in the market with the vision of becoming the first national sportswear brand in China. With this purpose, it worked on improving the brand recognition, by taking advantage of the founder’s popularity as Olympic medallist and by promoting different sponsorships. In 1996, the brand sponsored the Chinese delegation in the Atlanta Olympics and in 2001 it was selected as the ‘Strategic Partner of the China Olympic Committee’.

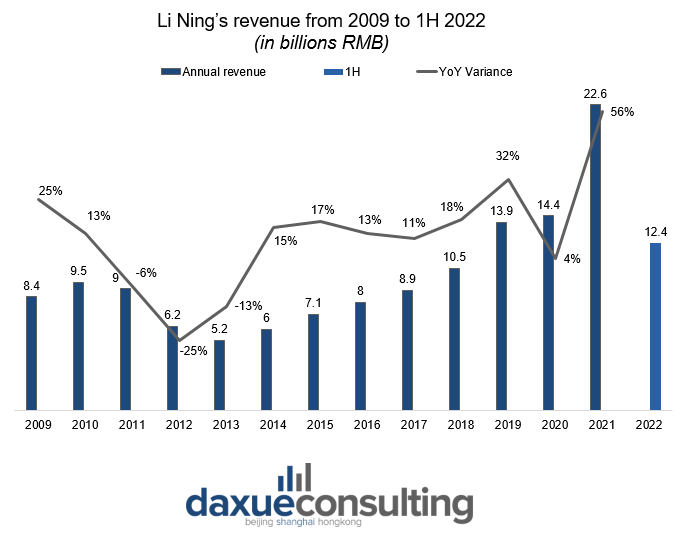

The 2000s marked a rapid growth for the company. the sportswear brand opened an average of 721 stores a year and started specialising in key sectors: running, tennis, soccer, basketball, and general fitness. At this time, its products represented a cheaper option to other élite and more expensive brands like Nike and they were mainly bought by conscious spenders.

Li Ning’s rebranding attempt

In 2010, the company attempted to reposition its products, by changing its logo and slogan from “Anything is possible” to “Make the Change”. Its objective was to be perceived by Chinese consumers as Nike’s and Adidas’ equal competitors, therefore they raised the products’ prices by 10-20%.

The sudden change did not bring the outcome they had hoped. For three years in a row from 2011 to 2013, Li Ning did not fail to register losses, with a drastic Year over Year (YoY) variance of -25% in 2012.

The company revalued its positioning in the market and launched a new management programme, as well as new sponsorships with important athletes like the basketball player Dwyane Wane in October 2012. From around 2015 on, the Chinese athleisure brand also improved its presence in e-commerce platforms, by collaborating with Alibaba and setting up its own Data Middle Office, thus improving the coordination between online and offline businesses.

Li Ning’s sudden surge in popularity

In 2018, Li Ning was the first Chinese sportswear brand to participate in the New York Fashion Week, showing its new “中国李宁” (China Li Ning) collection. According to Baidu index search frequency data, the search volume for “Li Ning” peaked in around February 2018. From this year onward, pulling the threads of nationalistic sentiments, the brand gained increasingly more popularity.

Another factor of success is the recent controversy involving the Xinjiang cotton in March 2021. When Nike, Adidas, H&M and other foreign companies announced they would cut on their supply of cotton originating from the Xinjiang region, Chinese consumers were indignant and started boycotting them. On the other hand, the sportswear brand promptly branded its products with the words “Xinjiang cotton is used in our products”. Furthermore, along with other local brands like Anta, Li Ning seized that opportunity to reposition on the market and change their pricing strategy: as a result, their prices skyrocketed in a short span of time. However, local newspapers condemned the brands’ choices as exploitation of patriotic sentiments and the companies had to withdraw their expensive products from the market.

The strengths of Li Ning in China

Li Ning’s marketing strategy can be easily summarised with the formula: “single brand, multi-categories, diversified channels”.

The Chinese brand identified five core sportswear categories as their main targets, which are basketball, fitness, running, badminton and casual sport and they operate through both online and offline channels. According to the company’s financial data for the first half of the year 2022, the offline retail channel is still the most profitable compared to the online one, with an overall 71.5% share of the revenue (47.5% franchising and 22.5% direct store sales).

The new popularity of Guochao

The Guochao (国潮) is a trend in China that consists of including traditional elements of the Chinese culture into modern fashion designs.

The nationalistic element has always been source of inspiration for Li Ning, which was founded with the exact reason of becoming China’s first national sportswear brand. However, it was not before the “中国李宁” collection and the incorporation of the Guochao trend in the company’s designs that the Chinese athleisure brand could break free from the label of “old-fashioned national product” and become something new and appealing to young people.

The main consumers of such products are indeed between 18 and 25 years old and have a stronger sense of national identity compared to older generations.

Surely, this collection mainly targets Chinese consumers and overlooks the international community, which represents only 1.5% of the company’s revenues. The Beijing-based brand has always wanted to become a successful brand inland as well as overseas, but the recent marketing strategies it has put into action seem to neglect its foreign consumers.

Li Ning’s co-branding strategy

Co-branding is a very popular marketing strategy in China that helps brands increase exposure among other brands’ consumers. Over the years, the CHinese sportswear company has collaborated with other brands, celebrities and variety shows to promote its products.

For instance, in 2019, the sportswear brand cooperated with the media department of People’s Daily (人民日报)– one of the oldest Chinese newspaper publishers – and launched new co-branded T-shirts, hats, and shoulder bags. Chinese young consumers queued outside the media department of People’s Daily just to purchase Li Ning’s new products.

A more recent example is its new collaboration with Tencent’s League of Legends Professional League (LPL). The Chinese sport brand will be in charge of designing the team’s new uniforms. This cooperation not only strengthens the position of the brand in the Chinese market of e-sports, but also represents a victory over the US competitor Nike, who had been designing the players’ outfits for 4 years before them.

What makes Li Ning in China vulnerable?

Although Li Ning in the Chinese market has registered growing revenues for years now, the brand’s marketing strategy has a few flaws.

Hunger marketing strategy enrages consumers

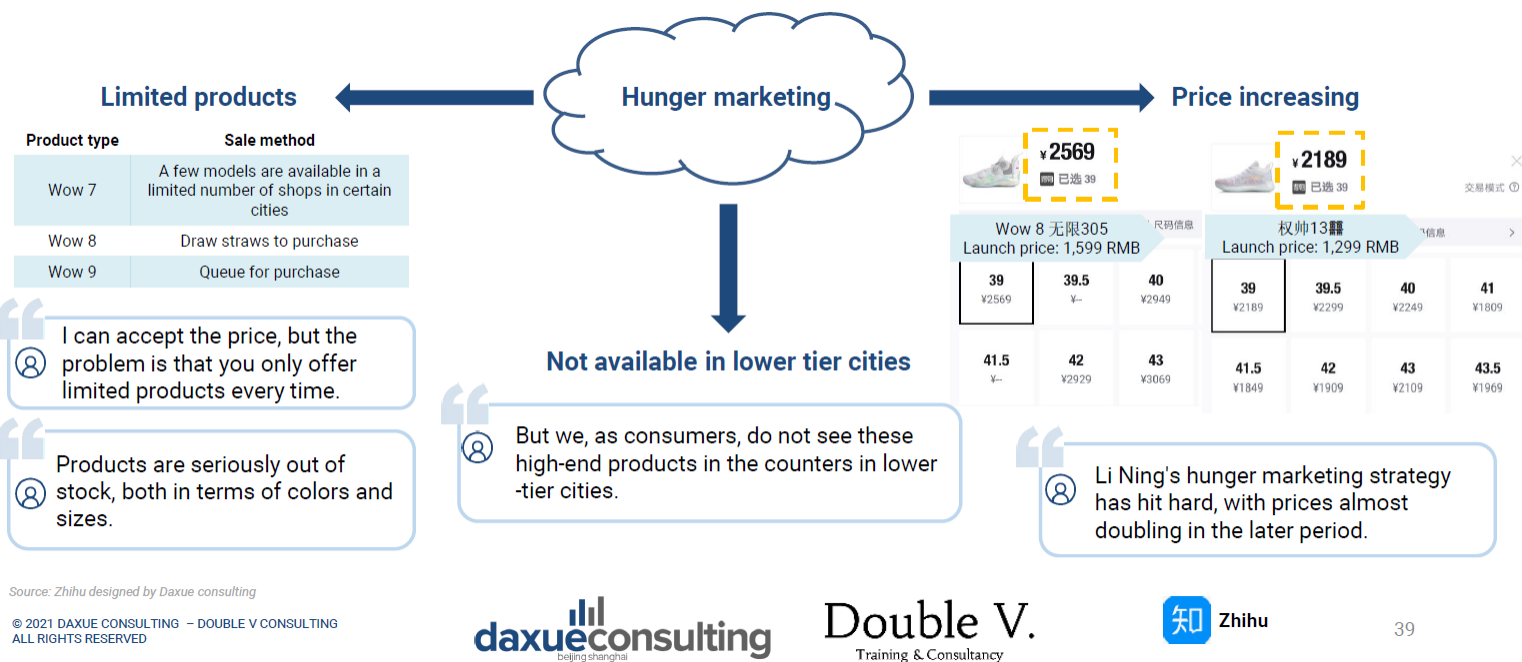

The hunger marketing is a specific strategy that takes advantage of consumers’ emotions and psychology. This is what the Chinese sportswear brand is somehow doing with its new Guochao collections. By appealing to nationalistic sentiments, the brand has won over the hearts of young consumers and has put an expensive price over their patriotism. Due to the limited product offers, prices are deliberately higher, even higher than internationally renowned brands such as Nike and Adidas.

However, its products tend to be lower quality than some of its international competitors’ as the brand lacks core technology. Chinese consumers are mainly attracted by the designs, but as much as the Guochao trend has revealed itself to be a winning card, Li Ning should not rely on it too much. It would be advisable to start innovating the brand’s products even outside the fashion field, especially if their aim is to become an international sportswear brand.

Their brand positioning is confusing

The Chinese company aspires at becoming a high-end fashionable sportswear brand. With this objective in mind, it has repeatedly attempted to change its positioning in the market. The short-sighted transitioning in 2010, though, is proof that becoming the Chinese new Adidas is not an easy task and requires time.

The company is not doing a great job with the re-branding. The transitioning is not smooth but abrupt and this is making the brand’s position in the market confusing. Li Ning was founded to be a sportswear brand. However, the company gives more importance to fashion design than to the development of products for sport activities. Its fashion series is also more popular than its sport collections, creating confusion among consumers about its market positioning.

Even the price positioning is not clear. Generally speaking, it is an affordable brand, but it also releases expensive products, whose only difference to the rest of the collections is the limited availability.

Li Ning recent controversy

In September 2022, Li Ning launched its new Winter collection at its fashion show at an airport in the Hubei province. The brand would have never expected, though, that the designs they had carefully planned to match the “flying” theme of their new “Dream Walk” collection would remind the Chinese netizens of Japanese soldiers’ uniforms during WWII. Apparently, the ear protection design of the helmets took inspiration from Chinese traditional military helmets, as stated in a post by the general manager of Li Ning’s e-commerce business on Weibo. Nonetheless, Chinese consumers were furious about the new outfits and its sales plummeted in October 2022.

If a brand whose main strength is patriotism is accused of being anti-patriotic, the consequences might be drastic. All the more reason why the Chinese company should not gamble everything on 中国李宁 but should vary with its offer.

Key points to understand Li Ning in China

- It was founded in 1990 as a sportswear brand. In its 30 years in the Chinese market, it went through multiple ups and downs. In 2012, it registered a YoY variance in revenue of -25%. Now, the brand is extremely popular in China.

- Since its participation in New York Fashion Week in 2018, the brand has registered a surge in popularity. This is due to the incorporation of the Guochao trend in its designs and the launch of the new collection 中国李宁.

- Li Ning has also successfully collaborated with other brands, among which the People’s Daily newspaper and more recently the LPL.

- However, the brand’s position in the market is ambiguous and it relies too much on its nationalistic designs, being vulnerable to potential scandals – like the most recent one in October 2022 – and failing to effectively expand into the international market.

Author: Chiara M. Barbera

See our report on Li-Ning’s China market strategy

Listen to 100 China entrepreneur stories on China Paradigms, the China business podcast

Listen to China Paradigm on Apple Podcast