In 2009, Chinese multinational technology company Alibaba launched Double 11, or Single’s Day. Originally an “anti-Valentine’s Day” day for singles and a strategic sales event to boost online shopping, it grew into a massive shopping festival for everyone. It revolutionized e-commerce with innovative promotion formats, such as live-streaming, AR/VR shopping, and the integration of AI. By 2020, it expanded beyond a 24-hour sales window to meet consumer demands for longer shopping periods and better services. However, in recent years, it have witnessed declining enthusiasm, reflecting the shifts in consumer behavior and economic pressures. The 2024 Double 11 marks a new approach to consumer engagement and brand strategies, including the cancellation of Alibaba’s iconic gala and the expansion of the event into a month-long period.

Download our 2024 China Summer Sports Market report

2024 Double 11 recap: key events and trends

Since 2022, major platforms like Alibaba and JD.com have decided not to disclose their GMV. However, according to Syntun, the total sales in this year’s festival reached RMB 1.44 trillion, marking a 26.6% increase from 2023.

Although this sets a new record, it doesn’t necessarily mean that 2024 was significantly more successful than previous years. This is particularly because it doesn’t take into account the high returns and refunds that occurred this year.

Returns and refunds aren’t new, but their high amounts are

Returns and refunds happened in previous years. Many consumers engaged in “bundled purchase returns” (凑单退货), where they would buy unwanted items to qualify for discounts, only to return or refund them later. For instance, “spend 300, get 50 off” deals were prevalent, and consumers would buy several items totaling RMB 300 to get the RMB 50 off. Notably, these discounts could still be valid even after returns were made. In addition to the discounts, consumers request returns and refunds reasons unrelated to discounted prices. They may have purchased products on impulse, the products did not match how they were promoted during live broadcasts, or they intentionally bought multiple items to select the one that best suits them—a practice commonly seen with clothing.

However, what makes this year unique is the high return. While there’s no exact return rate disclosed by e-commerce platform and brands, numerous sources suggest that the returns were particularly high this year. The main reason is that the promotional threshold was higher than previous years, which incentivized people to buy high-end products to quality for discounts. The festival was even lasted several days longer than in previous years, giving consumers more time to engage in these practices.

Ralph Lauren – the biggest victim of high returns?

While the exact size of returns and refunds is unknown, there are brands who were victims of this tactic. Ralph Lauren, for example, reportedly experienced a sales surge with a GMV exceeding RMB 1.6 billion. However, some reports say that this didn’t last long – it in fact suffered a 95% return rate.

While there is no evidence to support this, consumer conversations on social media show that it is not uncommon for brands to use Ralph Lauren for the bundling discount. Some netizens even mentioned that even if Ralph Lauren performed well and didn’t experience such return rate, it did increase the brand’s visibility. Many say they have started to follow Ralph Lauren and placed orders after the festival. The reason why Ralph Lauren is a bundle favorite is due to its wide price range, selling towels priced at RMB 190 to high-end apparels worth several thousand.

It is not the first time, however, that Ralph Lauren experiences this. In fact, happened in Double 11 in 2023 too. For example, one of its sweaters priced at RMB 1,250 had over 20,000 cart additions but only 52 post-purchase reviews, indicating a potential high refund rate.

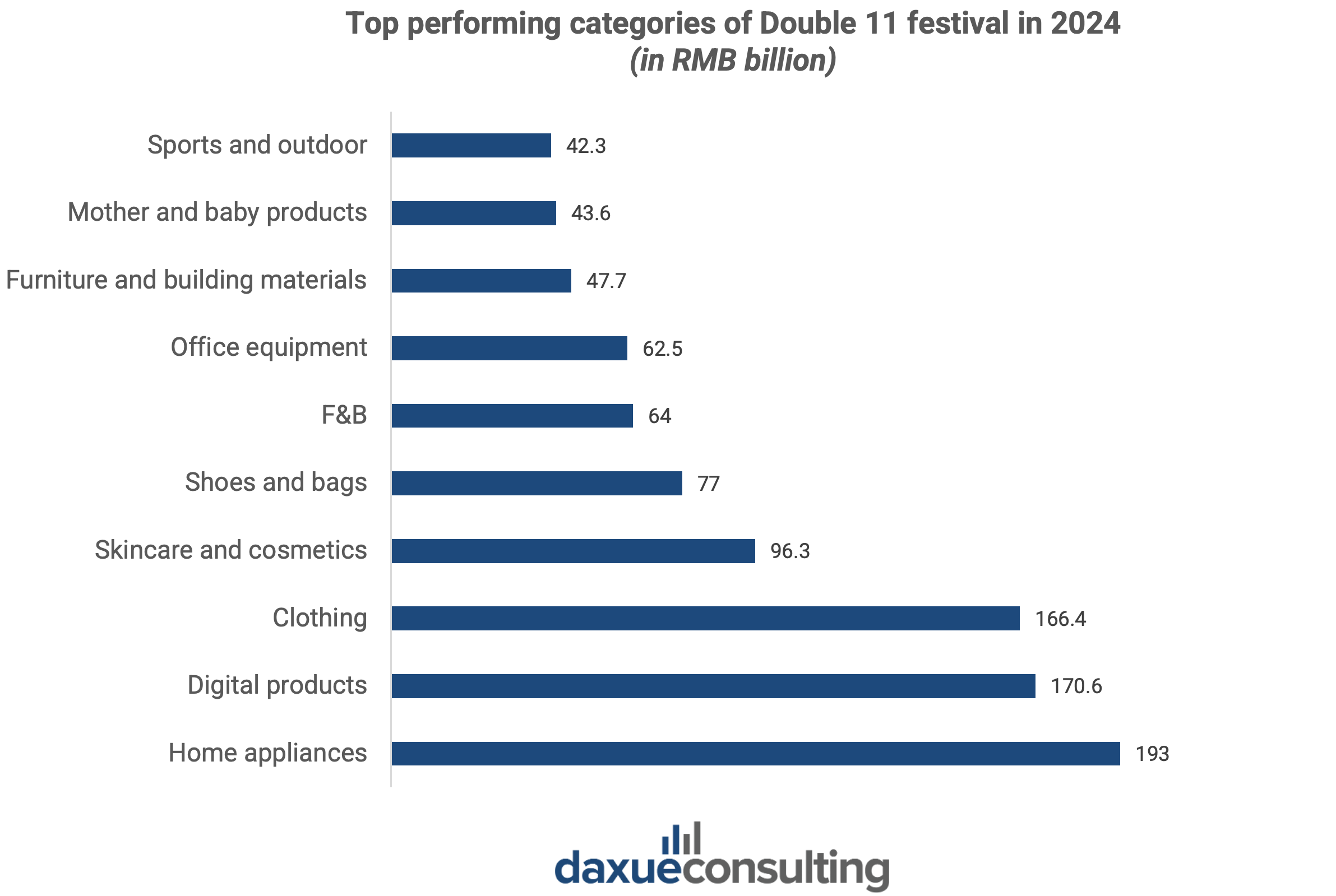

Top performing categories in Double 11 in 2024

According to Syntun, top performing product categories include home appliances, digital products, and clothing. On Tmall, 589 brands surpassed RMB 100 million in gross merchandise volume (GMV), up from 402 the previous year. Additionally, 45 brands, including Apple, Haier, and Xiaomi, exceeded RMB 1 billion in sales. The strong performance of home appliances and digital products was driven in part by the Chinese government’s support for green consumption. Policies such as the trade-in subsidy incentivized purchases of energy-efficient appliances, boosting sales and promoting sustainable consumerism.

Clothing is also another top-performing category, according to data from Syntun. However, women’s clothing has allegedly been hit the hardest. Some women’s clothing stores on social media platforms reported astonishing return rates. One store claimed that among 2,000 garments sold, 1,500 were returned. Consumers said they did because they got the wrong size or the item did not match what they ordered or expected. This could indicate that brands need to better communicate what their products are truly like, especially during live videos, where live streamers may overexaggerate and encourage impulse purchasing. In other cases, such as with Ralph Lauren, people returned them as they were used to meet the high promotional thresholds.

Double 11 in 2024 lasted longer than it did in previous years

A major distinction in this year’s Double 11 festival was its expansion, making it the longest edition to date. Alibaba group and JD.com kicked off their sales on October 14th, roughly 10 days earlier than in 2023, to leverage the government’s trade-in policy. This earlier launch provided platforms with additional time to showcase products, offer personalized services, and manage peak sales periods. Major discounts and substantial vouchers helped drive consumer interest, signaling a shift toward longer, value-driven shopping experiences. These adjustments enhanced logistics and after-sales services, addressing consumers’ growing demand for quality and overall value, such as better service, convenience, and long-term product satisfaction. The event expansion into a month-long period highlights the growing preference for a longer, more flexible shopping experience.

AI integration drives efficiency and engagement in 2024 Double 11

The Double 11 festival this year showcased advancements not only in sales extension but also in technology integration. Alibaba embedded AI throughout Taobao and Tmall, revolutionizing the shopping experience with personalized recommendations, smart customer support, and streamlined logistics. For example, Taobao’s “Ask Taobao” (淘宝问问) service automated product Q&A using AI, cutting customer service response times by 50% and boosting satisfaction. JD.com’s smart recommendation systems helped merchants achieve a 30% increase in sales, showcasing how AI can be utilized for enhancing both operational efficiency and customer engagement.

These developments underscore how AI-driven technology is reshaping the e-commerce landscape, making operations more efficient and fostering deeper consumer connections. The 2024 Double 11 festival highlighted that as AI applications expand, they will continue to play a pivotal role in enhancing platform services and merchant success.

Alibaba’s decision to cancel the gala and its impact

The cancellation of the 2024 Double 11 gala represented a strategic pivot for Alibaba, focusing more on direct consumer and merchant support rather than extravagant entertainment. Originally introduced in 2016, the gala became an integral part of the Double 11 driving consumer engagement and attention. The gala featured celebrity performances and live promotions to build excitement and drew massive viewership. However, as consumer enthusiasm waned over time and competition within the e-commerce industry intensified, the gala’s influence diminished. The public’s growing preference for practical shopping experiences over entertainment, combined with increasing costs and diminishing returns on investment, led Alibaba to prioritize spending on initiatives with greater impact.

This year, resources shifted to direct consumer and merchant support. For instance, Alibaba offered RMB 30 billion in consumer vouchers and RMB 3 billion in merchant subsidies, with over RMB 10 billion allocated to traffic investment. These measures enhanced affordability and participation, fostering a shopping environment centered on value and quality.

For consumers, the absence of the gala meant a shift from the urgency of one-night events to more flexible, monthlong promotions, allowing them to better plan purchases without pressure. Brands responded by emphasizing loyalty programs, strategic deals such as bundle offers, and extended live-streaming to capture interest, showcasing a move toward sustainable, long-term engagement over spectacle.

Broader implications of changes to 2024 Double 11 festival

The cancellation of Alibaba’s 2024 Double 11 gala and the extension of the event to a month-long festival highlight a notable shift in e-commerce strategy, emphasizing sustainable growth and deeper consumer relationships. This move reflects broader trends seen in the market in recent years, where consumer behavior leaned towards balancing quality and price instead of simply seeking low prices.

According to the “Double 11 Quality Consumption Report” released by Tmall, the sales of high-ticket items increased by 50% year-on-year, while the sales of low-priced items declined by 10%. Brands like SK-II and WHOO capitalized on this shift through quality assurance and interactive content such as live streaming, which fostered strong consumer engagement and loyalty.

Platforms also strengthened their membership programs by offering exclusive perks and personalized services to foster loyalty. Tmall’s 88VIP program, for instance, drove repeat purchases through special benefits. Furthermore, e-commerce livestreams have also evolved from being dominated by top influencers to featuring mid-tier hosts, who saw a 60% increase in viewers and a 40% boost in sales, according to Douyin. This diversification meets the demand for more personalized, relatable content. Collectively, these trends signify a move towards holistic, value-driven shopping, aligning with consumers’ desire for richer, more responsible consumption experiences.

Key takeaways about Double 11 in 2024 in China:

- E-commerce platforms like Alibaba have decided not to disclose their GMV since 2022. However, according to Syntun, 2024 saw record sales. The GMV reached a record-high RMB 1.44 trillion. However, this doesn’t accurately reflect the success of the festival.

- Sales this year were particularly driven by the high promotional tactics rather than genuine demand. There is no exact return rate. However, numerous sources suggest that the promotional thresholds were high, and consumers used expensive items to reach them.

- Double 11 in 2024 has also been the longest so far. It is no longer a one-day online shopping extravaganza but a monthlong festival. This gives consumers more time to make purchasing decisions and even decide which products to keep and return.

- Home appliances and digital products lead growth, driven by government incentives and extended shopping periods.

- E-commerce platforms focused on creating a sustainable, curated shopping experience for more meaningful brand-consumer relationships. For instance, they integrated AI into the Double 11 festival. This enhanced personalized recommendations, automated customer service, and optimized sales strategies, thereby driving efficiency and consumer engagement.

- Alibaba also canceled its iconic gala, marking a significant shift from flashy promotional events to a more consumer-centric approach that focuses on value and long-term engagement.

Download the full report on China’s summer sports market by daxue consulting here: https://daxueconsulting.com/china-summer-sports-market-report/