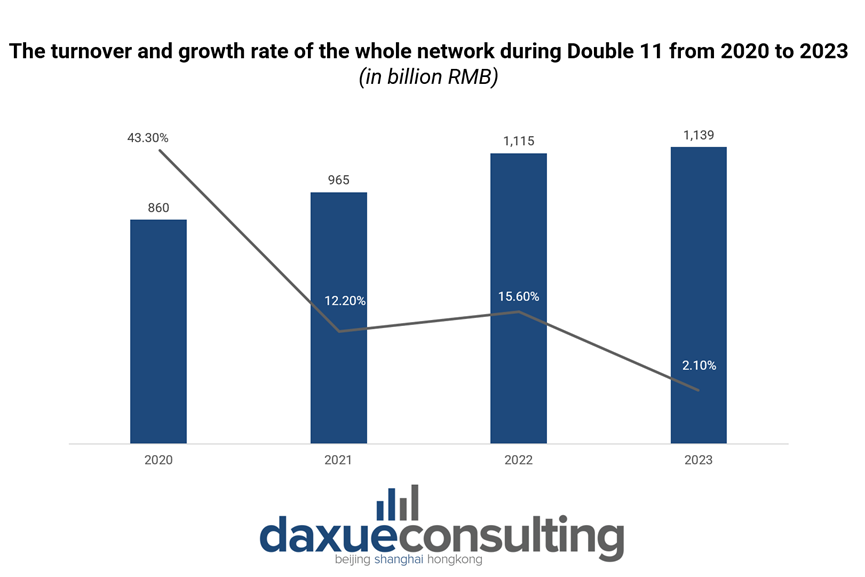

Double 11 in China (双十一), the equivalent to “Black Friday” in the United States, is China’s largest e-commerce shopping festival. It was first organized in 2009 by Chinese technology giant Alibaba Group (阿里巴巴) to celebrate “Single’s Day”. Other e-commerce brands like Pinduoduo (拼多多) and JD.com (京东) have followed suit over the years. Brands made a significant portion of their annual turnover within a few days, while consumers bought products on these platforms at huge discounts. However, the popularity of Double 11 in China dwindled over the years as the promotion period prolonged across the whole month.

Download our report on the She Economy in China

The shift in perception towards Double 11

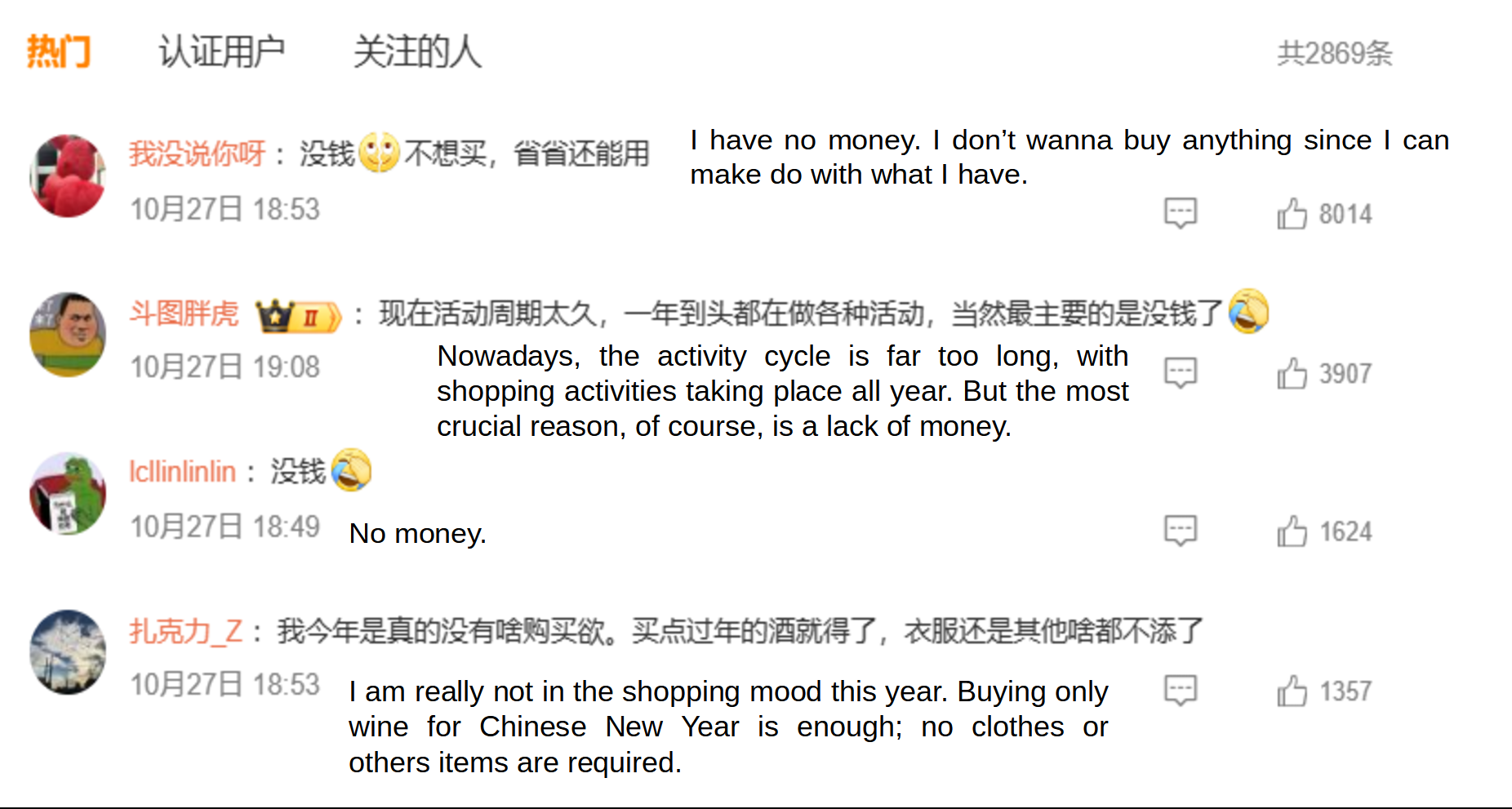

As of November 12th, 2023, the most liked comment in the Weibo hashtag “Is it true that items do not sell well during Double 11?” comments section was ” I have no money. I don’t wanna buy anything since I can make do with what I have”, which was liked by over 8,000 other netizens:

The voices of these netizens mirror the contemporary societal context. Many Chinese people have experienced different levels of income loss as a result of the COVID-19 pandemic. According to the National Bureau of Statistics, the national per capita disposable income was RMB 29,398 in the first three quarters of 2023, up 5.9% in real terms but down from 8.8% at the same time in 2021. At the same time as income growth is sluggish, consumer expectations are not too optimistic. According to China Economic Information Network, China’s consumer confidence index for the third quarter of 2023 was 87.2 (the critical value of the consumer confidence index data series is 100, with greater than 100 indicating adequate confidence and less than 100 indicating inadequate confidence). Judging from this index, Chinese consumers are not very confident in their purchasing and are not willing to splurge on shopping festivals such as Double 11.

On the other hand, netizens are paying more attention to product pricing, and new consumption patterns such as products or services that generate emotional value are emerging during the Double 11 in 2023. Chinese customers are increasingly paying attention to emotional worth and paying for happiness, which has resulted in the expansion of e-sports, cycling, skiing, fashion play, and other categories. Tmall Double 11 this year features over 800 toy tide play firms aiming for double growth. At the same time, the pet industry is thriving. According to Pinduoduo Double 11 data, more than 100 pet brands doubled their business year on year, with pet company Farmina increasing by more than 500%.

Double 11 remains China’s most important shopping festival

Double 11 continues to be crucial despite a slowing growth rate due to the sheer volume of sales generated. It serves as a barometer for the health of China’s consumer economy, reflecting trends in online retail, consumer behavior, and market competitiveness. According to Jingdong data, the cumulative sales of more than 60 brands exceeded RMB 1 billion as of November 11, 2023. Tmall data also show that, as of November 11, a total of 402 brands exceeded 100 million transactions, of which 243 were domestic brands, and 38,000 brands saw a year-on-year increase of more than 100%.

Moreover, driven by longer pre-sale cycles and live streamers, Tmall and Jingdong both surpassed their respective results from last year. According to Deloitte, Tmall’s Double 11 cumulative gross merchandise volume increased by 8.45% to RMB 540.3 billion; cumulative orders placed on JD were RMB 349.1 billion, up 29% year on year. Additionally, the total transaction volume of live-streaming e-commerce platforms such as Douyin and Kuaishou was RMB 215.1 billion, an increase of 146.1% compared with RMB 181.4 billion last year.

In 2023, there’s a noticeable positive trend in consumer behavior during Double 11. Netizens are embracing more rational consumption concepts, as shown in discussions on platforms like Xiaohongshu. The focus has shifted towards mindful shopping and sustainable choices, with users actively sharing insights on product quality, ethical production, and environmental impact. This marks an optimistic departure from the impulsive buying habits observed in previous years. The increased awareness of these aspects indicates a growing consciousness among consumers, emphasizing a desire for products that align with ethical and environmental values. This shift reflects a positive evolution in consumer culture during the Double 11 shopping festival, contributing to a more sustainable and responsible approach to online shopping.

Green consumption supports China’s transition to a low-carbon economy

Furthermore, with the increasing awareness of climate change and environmental concerns, there has been a growing emphasis on green consumption in China. This is to align consumer behavior with sustainable practices and reinforce a responsible approach to economic growth.

Along with this environmental sustainability trend, e-commerce platforms have rolled out eco-friendly initiatives. Logistics company Cainiao (菜鸟), founded jointly by Alibaba Group and other companies, executed a package recycling initiative in over 130,000 of their posts, recycling about 4 million carton parcel boxes from November 1st to 11th 2022.

The “Double 11” green logistics atmosphere will get stronger in 2023. Nearly 50 domestic enterprises have already joined the Cainiao recycling effort, including Bee Flower (蜂花) and Jinmailang Foods (今麦郎); Taobao livestreamers such as Zu Aima and Chao Ran also encouraged consumers to participate in green recycling in the broadcast room. At the same time, Cainiao launched the “Campus Carbon Asset Management Campaign” with nearly 100 universities across the country, including Shanghai Jiao Tong University, Sichuan University, and Tianjin University, so that teachers and students can see the carbon reduction amount of green recycling packages in real-time and encourage students to participate in green recycling at the on-campus Cainiao Station.

Some brands differentiate their offerings from competitors by launching sustainable packaging

During Double 11 in China in 2023, brands are launching sustainable packaging for their products to stand out from their competitors. Sustainable packaging refers to the use of materials and designs that aim to minimize negative environmental impacts throughout the product lifecycle, which focuses on reducing waste generation, promoting recycling, and using eco-friendly materials. For example, WHC (WHC Labs), an Italian healthcare company, has worked closely with Cainiao and has been a direct supplier of Tmall International and Ali Health.

WHC introduced a green express box in 2023, which omitted the dyeing process and retained the material’s primary color. The box is devoid of offset printing and dye, and its entirety is 100% recyclable, resulting in a 30% reduction in material waste compared to the original express box. Other market leaders in China, such as Procter & Gamble and Yunda, have also implemented comparable environmentally friendly packaging strategies. By adopting sustainable packaging during Double 11, these brands can demonstrate their commitment to environmental responsibility and attract more consumers who prioritize sustainability.

The rise of AI adoption: enhancing customer experience through virtual idols on Double 11

To meet the diverse needs of Chinese consumers, including sustainability, many Chinese companies are adopting artificial intelligence (AI). This is not only in line with consumer demand for more eco-friendly alternatives but also an effective method of enhancing customer experience.

According to an Alizila press release, AI-powered merchant tools were utilized over 1.5 billion times throughout the 11.11 preparation and marketing period. During the Double 11, brands are continuously looking for new ways to attract consumers’ attention, particularly the tech-savvy Gen Z, and the use of virtual idols in livestreaming is one method that has gained popularity. Virtual idols offer a more cost-effective alternative to traditional livestreaming setups, enabling sellers to cut expenses while effectively engaging with their audience.

These virtual idols often operate through official social media accounts managed by their teams. This allows them to carefully curate their content and engage with their followers in a controlled manner. Additionally, virtual idols can employ pre-recorded or scripted responses during live-streaming events or interactions with viewers. This helps them maintain control over their messaging and prevent any potential negative comments from derailing the conversation or damaging their reputation. Besides, virtual idols reduce the risk of unexpected occurrences, such as Li Jiaqi’s unattuned remarks or scandals like Viya’s tax evasion, ensuring a smoother and more controlled online presence. Consequently, these virtual personalities have gained popularity and serve as brand ambassadors or influencers during Double 11 in 2023.

Key takeaways of Double 11 in China in 2023:

- Double 11 in China (双十一), is the biggest e-commerce shopping festival. However, it is worth noting that the popularity of Double 11 has been declining year by year.

- The falling importance of Double 11 is due to changing Chinese consumer spending confidence. As a result, Chinese customers have less faith in their purchasing power and are less likely to shop at Double 11.

- Green consumption supports China’s transition to a low-carbon economy. For example, e-commerce platforms and logistics companies including Cainiao (菜鸟) have rolled out eco-friendly initiatives, and some brands, such as WHC, have differentiated their offers from competitors by launching sustainable packaging.

- The increasing adoption of AI is improving the consumer experience on Double 11 through virtual idols. The objective is to attract more Gen-Z consumers and effectively maintain control and mitigate negative comments, avoiding the Li Jiaqi scandal.