China’s pet market is growing faster than the pet population itself, indicating a rise in spending per pet. To uncover what’s driving this growth and what sets China’s pet economy apart, Daxue Consulting analyzed 55 million posts between April 2023 and April 2025 across three major platforms—Weibo, Xiaohongshu, and Douyin—and conducted interviews with pet owners. We explored how relationships with pets are evolving, how this shift is shaping consumer behavior, and how brands are responding by targeting pets as valued consumers.

Download our China’s pet economy report here:

Some key findings:

- Most pet owners in China are young people. In 2024, individuals born in the post-90s and post-00s generations made up around 60% of all pet owners. Notably, post-00s are emerging as a major growth driver, with pet ownership in this group increasing by 39.5% year-over-year.

- The perception of pets in China is shifting—from being seen merely as guardians or companions at home to being considered full-fledged family members. This evolution is influencing both how people spend time with their pets and how much they spend on them.

- Dogs are increasingly participating in human-like activities. From April 2024 to April 2025, the most mentioned dog-related activities on social media included birthday celebrations (18.9%), photo shoots (9.3%), and travel (5.5%).

- Even cats, typically viewed as more passive, are now part of more active engagements. The top mentioned activities with cats included training (38.8%), birthday parties (38.6%), and hiking (2.7%).

- While most pet-related spending still focuses on essentials like food, the market is becoming more dynamic. Although foreign brands continue to lead in China’s pet food market, local players like Honest Bite (140% YoY growth of social media mentions), Freshland (93%), and MyFoodie (12%) are quickly gaining ground.

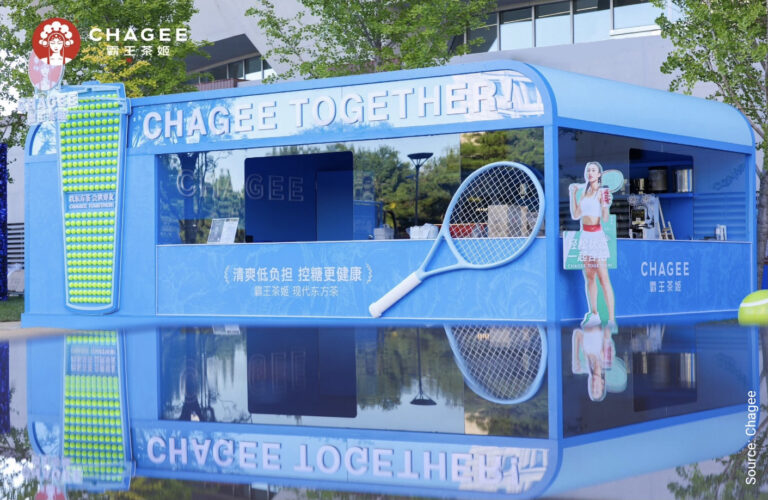

- At the same time, consumption is expanding beyond necessities into lifestyle and experience-based offerings. Industry boundaries are blurring, as more products and services now target both pets and their owners—creating shared experiences and co-consumption opportunities.

- This shift is supported by increasingly pet-friendly environments, especially in China’s top-tier cities. From “pets allowed” to “pet-centered” spaces, more locations are welcoming pets, with varying levels of accommodation.

- Chinese pet owners are also extending their own values—like health and wellness—to their animals. Pet spas, fitness centers, and travel experiences are no longer exclusive to humans.

- In China’s pet economy, exotic pets such as snakes (not just for celebrating the Year of the Snake), hamsters, pigs, and koi fish are also becoming popular among consumers who want to personalize their homes, stand out socially, or stage playful interactions with their unique companions.