The story of air travel in China began on February 21, 1972, when a Boeing 707 landed at the Beijing Airport.

This particular 707 was the U.S. Airforce One at the time, and it was also the first Boeing commercial jetliner to ever land in China. As U.S. President Richard Nixon walked off the air stairs, he ushered in not only a new era of American-Chinese relationships but also modern jet engine air travel.

Partly due to the admiration for such a large capable jetliner and partly due to diplomatic gestures, the Civil Aviation Administration of China (CAAC) ordered 10 new Boeing 707s for $125 Million later that year and took the first delivery in 1973. These planes, like their predecessors, would not be serving civilian travelers as air travel at the time was limited exclusively to government officials (above certain ranks) due to the scarcity of the planes.

These 10 Boeing 707s proved to be a key step forward for the Chinese airline industry. Prior to their arrival, China relied on Soviet-built commercial airliners and most of the planes were propeller planes. For example, Boeing 707 allowed China to expand its international routes from 4 in 1972 (all in Asia) to 8 in 1976 (including Beijing-Paris). Boeing 707 marked the beginning of a new era of commercial jets lead by Boeing and Airbus.

1980s: When China’s air travel was a sign of prestige and reserved for privileged travelers

Chinese commercial aviation landscape in the 1980s

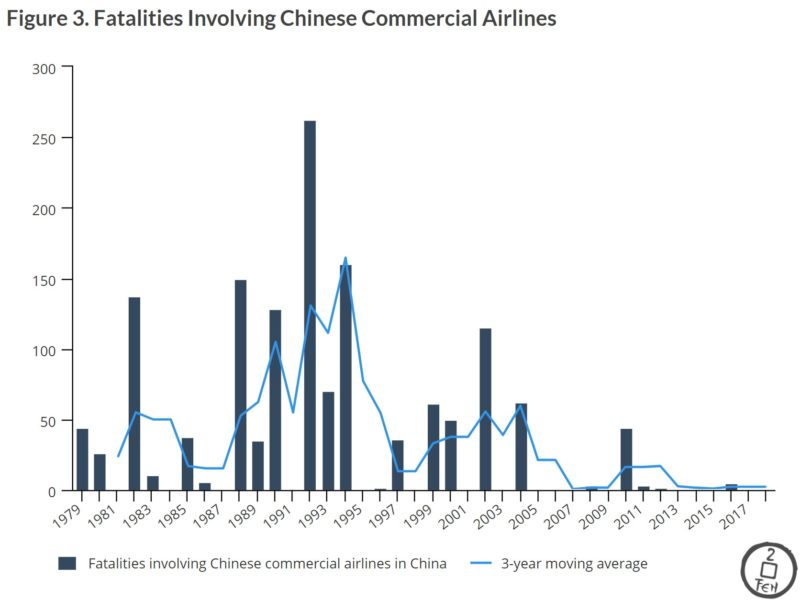

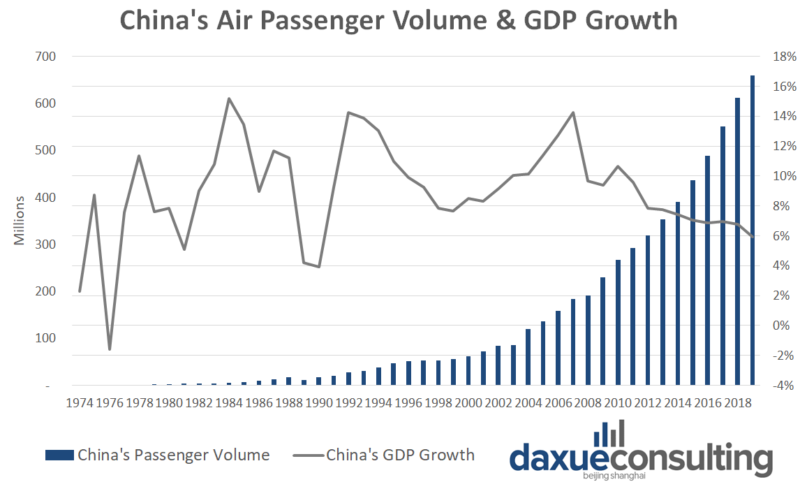

China’s commercial airline industry was still in its infancy stage by 1980 — the country only moved 3.4 million passengers that year, having 35th in the world (by 2020s it got #1 in the world). Most of the flyer were either government officials or people working on government initiatives. Infrastructures, fleet size, and operating capabilities also had low quality.

The political background during this time was about liberalization of the market and decentralization of power, which paved the way for increasing the presence of foreign companies and encouraging international cooperation. The Civil Aviation Administration of China (CAAC) became less involved in the day-to-day operations of airlines and shifted towards being the regulator of the Chinese aviation industry. Eventually in 1988, the operating division of CAAC was split into 6 airlines, among which were the big three: Air China, China Southern Airlines, and China Eastern Airlines.

How Boeing helped develop China’s aviation industry

Boeing continued to capitalize on its early access to the Chinese aviation market. In 1980, China took delivery of its first wide-bodied plane—Boeing 747SP. The 747 allowed China to open itself up by offering new flight routes to the U.S. After the 747, China saw its first 737 in 1983, first 767 in 1985, and first 757 in 1987.

But Boeing did not stop at just being an aircraft exporter. Commercial aviation is a complex industry that includes more than just planes. Maintenance, parts, skilled labour, and infrastructure significantly impact the operations and performance of the planes. At the time, China didn’t have training pilots, running airlines and couldn’t manage air traffic control, or operate safe and profitable airlines. Therefore it was in both Boeing’s and China’s interest to develop China’s aviation capabilities. As a result, Boeing sought deeper cooperation and became a strategic partner of the Chinese aviation industry.

First, Boeing started integrating Chinese state-owned company Xi’an Aircraft Industrial Corporation into its supply chain in China as early as 1980 and allowed Xi’an Aircraft Industrial Corporation manufacture certain parts such as the cabin doors and empennage. Second, Boeing started training technical crews (as part of the deal to sell planes) as early as 1973. Later in 1987, Boeing assisted in building the parts centre of the Beijing International Airport.

McDonnell Douglas’s China market entry

Another commercial jet manufacturer McDonnell Douglas also entered the Chinese market with its MD-82, a rival of the Boeing 737. Similarly, McDonnell Douglas also deepened its partnership with China by having Chinese state-owned company Shanghai Aeronautical Industry Group assemble 19 out of the 27 MD-82 ordered. MD planes gained quite some popularity in China due to their shape and quiet cabin so much that they got the nickname “The Handsome of The Sky” by Chinese airlines. However, McDonnell Douglass eventually left China in 2008 due to the lack of product-market fit.

Airbus entered the Chinese market

Perhaps the most significant entrant in the 80s was Airbus, which back then was not nearly as big as it is today in terms of market share in China and around the world. The eastern division of CAAC, which later became China Eastern Airline, took the first A310 in 1985. A310 was a direct competitor of Boeing 767. Of course, no plane purchase deal was signed without committing the manufacturer to the development of the Chinese aviation industry through projects such as subcontracting. Interestingly though, the subcontractor of Airbus was also Xi’an Aircraft Industrial Corporation and the parts outsourced were also cabin doors.

Foreign airlines operating in China in the 80s

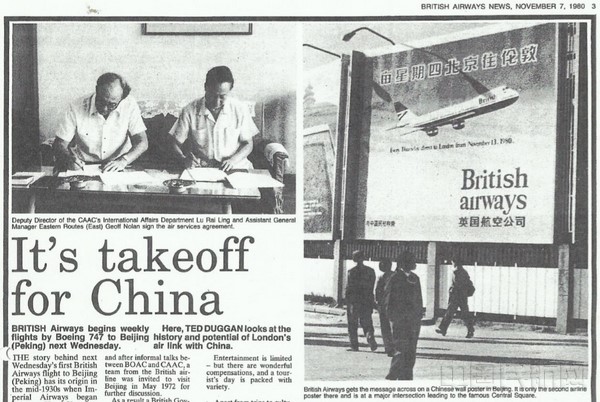

As western plane manufacturers entered China, so did western airlines. British Airways was among the first airlines to offer service to Beijing in 1980, with weekly services to London. German airline Lufthansa also began offering service to Beijing in 1980.

China’s aviation infrastructure development in the 80s

The development of China’s commercial airlines was hindered by the lack of infrastructure. For example, there were 110 airports in China by 1990, and only 7 could land Boeing 747. To put that in perspective, the U.S. had 730 certificated airports (serving passenger-carrying operations air carriers) in 1980. Building airports was no simple business of just paving runways and constructing buildings. An airport is its own ecosystem with ground crews, operating procedures, management, supply chain, road connections to nearby cities, etc. Moreover the CAAC controlled both the airports and the airlines, including almost all aspects from route establishment to plane purchases, thus slowing the speed of development. The recognition of infrastructure problems in 1985 lead to the subsequent reforms of CAAC.

What was it like being an average air traveler in China back in the 80s?

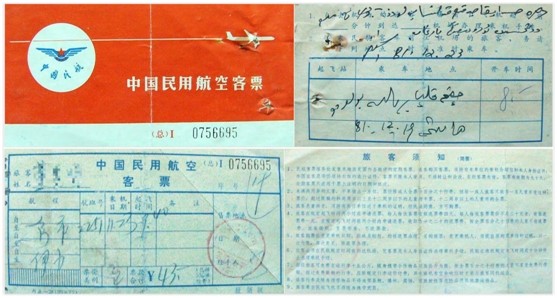

First, you needed to be way-above-average rich to even consider air traveling. An average air ticket in the 80s would start at around 50 yuan while the salary of an average worker was only 30-40 yuan/month, with very few workers making close to 100 yuan.

The demand of tickets outstripped the supply

Let’s say you managed to save enough cash. The next thing you needed was a “reference letter” or a “jieshaoxin” from your employer or “danwei”. The employer must certify that you were a legitimate person traveling for a legitimate purpose. How easy was it to get a reference letter? We couldn’t find out, but what we knew was that the process would take about one to two weeks.

With cash and reference letter in your hand, you would then head to the very few ticket agencies in your city (sorry there was no internet back then). You timed yourself to be the first one at the ticket office at 8am, but you would be surprised to find out that there were people who had been lining up there starting from the night before. Yes, even with the high price and restrictions, it was still hard getting a ticket because the demand outstripped the supply by margins.

On the other hand, air travel in the 80s had many perquisites that don’t exist today. Food and drinks were on a completely different level comparing to today, with international flights offering the “Maotai” wine and Peking duck. At first this was for travellers of all classes, and slowly it became limited to first class travelers. There were also many free giveaways such as key chains, fans, airplane models, and notepads. The reason was that there were no ticket discounts at the time, so the only way to build customer loyalty was through service and giveaways.

What were Chinese flight attendants like in the 80s

Of course, no discussion of Chinese airlines would be complete without mentioning the flight attendants. Just like their western counterparts, flight attendants seemed to be a glamourous job in China especially in the early days of air travel. You had to meet stringent criteria in appearance, knowledge, and language skills (mostly English).

1990s: Transition to Common Travelers

Political and historical background of Chinese aviation market in the 90s

By 1990, China’s air passenger volume was 13million flyers/year, 4 times the volume in 1980. Total air passenger volume of China would continue to experience exponential growth this decade. Previous reforms of the CAAC continued to take effect and infrastructures continued to grow. The number of airports would grow from 110 in 1990 to 139 by the end of this decade.

The deregulation in market entry and route establishment also boosted China’s pace of internationalizing its aviation market. By 1990, there were 44 international routes to 24 countries. The number of routes would triple by the end of this decade as a result of several catalysts. First, China’s airports were registered in the system of the International Civil Aviation Organization (ICAO) in 1996. Also China’s big three airlines also signed code-sharing agreements with international airlines (United Airlines, Japan Airlines). International air travel began to grow in absolute numbers as with total air travel, but its proportion would remain relatively small and stable at 8% throughout this decade. But the international aviation network set in the 90s provided a solid foundation for international travel to grow in the subsequent decades.

The end of the Cold War meant that the world has entered a new stage of rapid globalization led by the US. Both American and European companies would benefit from this trend and deepen their ties with the Chinese aviation market.

No longer a privilege: Chinese travelers could finally ride the plane (if they had the cash)

Perhaps the most noteworthy change for air travel in China in the 90s was the abolition of the requirement of “reference letters” to purchase tickets. Starting in 1993, any Chinese citizen with a valid ID could purchase air tickets instead of planning one or two weeks in advance. Ticket management systems were beginning to use computers and it was possible to order your itinerary via the phone. There were still some hand written elements though. Affordability was still a bit of an issue. Ticket prices ranged from several hundred yuan to several thousand yuan, while the average monthly salary was a few hundred yuan.

Also there were no discounted airfares as fare prices were heavily regulated, i.e. airlines could not freely give discounts. But that did not seem to hinder the growth of air travel in China too much as there was so much buildup of unfilled demands from the 1980s. At this point, air travel was no longer a privilege but still held some prestige, albeit less than it did in the 80s, perhaps due to the removal of all-you-can-drink “maotai” baijiu.

The removal of “reference letters”, decreased regulations, and the growth of infrastructures all contributed to the boom in air travel volume during this time.

Boeing dominated China’s aircraft market in the 90s but was held back by the politics

China took 20 years to grow its fleet of Boeing planes from 0 to 100 in 1992, and but only another 2 years to grow from 100 to 200. By 1997, Boeing’s market share in China was 70% in terms of the number of commercial airplanes operating in China’s commercial jet fleets. In terms of new models, Boeing 777 entered China and started serving in China Southern Airline in 1995.

The degree of cooperation and involvement between Boeing and China was beyond just planes and continued to grow in many aspects. Technology wise, Boeing invested $11 Million in a Joint Venture Engineering Company (TAECO) in Xiamen in 1997. Regulations wise, Boeing and the Federal Aviation Administration (FAA) worked with Chinese regulators in creating new aviation laws, designing new airports, improving safety, and other initiatives aimed at increasing the overall capabilities of China’s aviation legal framework. Supply chain wise, the number of subcontractors in China continued to grow and China produced an increasing number of parts. Education wise, Boeing provided flight simulators to China’s aviation college to help train new pilots.

Boeing had a vested interest in developing China’s commercial aviation market as the economic recession in the early 90s forced Boeing to cut its production and staff in the U.S. China also was increasingly reliant on Boeing planes with its share of Boeing’s commercial planes revenue growing, amounting to $1.2 Billion in 1993 or 6% of Boeing’s global commercial planes revenue. Over the next 2 decades, China’s market would eventually account for 20% of Boeing’s global revenue.

China – US relations in the aviation industry

The U.S. political environment was not particularly supportive since the start of the Clinton Administration in 1993. President Bill Clinton repeatedly threatened to revoke China’s status as the “Most Favoured Nation”, but none of the threats became the reality due to the administration stuck to its motto during the presidential campaign— “It’s the economy, Stupid”. Overall, the China-US relationship was not as friendly as it was in the 80s and this made Boeing lose orders to Airbus in the mid to late 90s.

As for McDonnell Douglass, it merged with Boeing in 1997 but its planes would remain in operations until the 2000s. This merger proved to have profound implications for Boeing. Some argued that Boeing’s culture shifted from an engineering company to a cost-reduction company. This shift would influence all of Boeing’s subsequent product designs.

Airbus’s strategy to catch up through deep dive and localization

14 years after Boeing established its office in China (though the office only had one person), Airbus finally established its first China office in Beijing in 1994. Airbus’s performance prior to this point had been lukewarm, with only 95 planes in China by 1995, compared to Boeing’s 200 planes in 1994. One key reason was not understanding the Chinese market, which at the time was dominated by Boeing 737s. In the first half of the 90s, Airbus delivered A300 and A340 in addition to the existing A310, neither of which were suitable for the market. For example, A340 was known for its inefficiency.

Things started to take off for Airbus in the mid-90s due to various reasons.

From a product strategy perspective, Airbus’s localization to the Chinese market and diversified offering proved to be effective. In 1995, Airbus offered its A320 to combat Boeing 737. A320 was more competitive than Boeing 737 in several ways. From a consumer perspective, the A320 was a slightly roomier plane, which suited the taste of Chinese travelers. From an airline operator perspective, A320 featured the latest “Fly-By-Wire” technology at the time, which simplified pilot training and licensing. At the time, Chinese airlines were experiencing growth and one key bottleneck was the pilots, so Airbus’s offering was on point.

Moreover, Airbus segmented the Chinese market more finely and began offering something for every niche when Boeing had a relatively standardized 737. For example, one of the observations was that the southwestern region of China was characterized by mountain ranges and high altitudes. As a result, Airbus offered the smaller but more nimble A319 whose performance impressed the Chinese customers.

From a political perspective, the diplomatic climate also favored the growth of Airbus as Sino-European relations warmed. As high ranking officials from Europe and China visited each other more often starting from 1996, they also brought more plane orders. This created a stark contrast with the U.S. who at the time tightened its visa restrictions for China. On the supply chain side, Airbus also continued to help China build its aviation capabilities through the establishment of an engineering centre in Beijing.

2000s: Growth Propelled by the Internet

Political and historical background of Chinese aviation market in the 2000s

You can’t talk about the 2000s without mentioning the word “internet”. The Chinese aviation industry was no exception to the disruptions caused by the internet. Flight tickets would become electronic by the end of this decade, and Boeing launched its Chinese website in 2001.

Internationalism was another theme. China’s increased participation in the international communities continued to open up its aviation market. Another theme was China’s participation in the World Trade Organization (WTO), which significantly boosted exports, removed the barriers for foreign companies to enter China, and increased the incentives for international air travel. For the Chinese aviation industry, this meant more international flyers and more foreign airlines began to operate in China. In 2000, China had 133 international routes to 33 countries. The number of international air passengers would continue to more than double at the end of this decade, but the proportion of international travel would remain relatively stable.

Infrastructure wise, China reached 143 airports in 2004 and its Beijing International Airport was revamped due to the Olympics.

Finally, with Airbus achieving a 50% market share globally by 2000, the battle between Boeing and Airbus became fierce.

Internet’s revolution in air tickets and flight searching

In March 2000, China Southern Airlines published its first e-ticket and thus pioneered the new era of flight booking. This proved to be revolutionary in many ways.

For travelers, they no longer had to travel to ticket sales agencies to acquire actual tickets and they also no longer needed to worry about losing their tickets. For airlines, they no longer needed to maintain ticket selling offices in the cities and thus saved a lot of fixed costs. E-tickets and itineraries facilitated online booking, which also in turn allowed travelers to book anytime and anywhere with significantly reduced effort and time. Trickling down the chain, the rise of online booking stimulated the growth of the e-payments industry. Of course, the transition was not 100% smooth. At first people felt weird about arriving at the check-in counter with just their IDs and some even insisted on issuing paper tickets. Others raised the question of how to issue receipts for tax purposes.

The supply chain of ticket selling was seriously disrupted, with many small to medium ticket sales agencies closing doors as the businesses moved increasingly to websites. But none of those forces could stop this revolution so much that by 2006, Air China stopped selling paper-based tickets.

Boeing and Airbus battled fiercely for the Chinese aviation market

As the majority of the existing airplane models have already entered China and new planes were still under development in the 2000s, we did not see any new commercial jet models enter China except for the delivery of China’s first A330 to China Southern Airline in 2005. A330 was a wide-bodied aircraft for medium to long range flights and it was a direct competitor of Boeing 777. Although A330 had a slightly smaller capacity than Boeing 777, it boasted a slightly better range and the price was about 10% lower (list price. The true delivery prices are not disclosed). Overall A330 and Boeing 777 were very similar, but A330 proved to be a very successful model in the Asia Pacific region with more than 40% of its global deliveries destined to this region.

The introduction of A320 was a reflection of the fierce battle Boeing and Airbus. Globally, Boeing and Airbus filed cases against each other in front of the WTO accusing each other of receiving subsidies. Locally, China became a key battleground as the China aviation market accounted for an increasingly larger share of their revenues. This reliance became even greater after the Great Recession in 2008 when China became the only market that continued to heavily invest in aviation.

By the end of this decade, Boeing had delivered 800 aircrafts to China while Airbus had delivered more than 630, or 43% of the Chinese aviation market. There were many theories behind why Boeing was losing market share to Airbus starting in the 2000s, including subsidies, ethics scandals, and complacency. But if we just look at the Chinese market we could see signs of this trend in the 90s when Airbus took their game in China seriously while Boeing faced several pullbacks.

Compromises as China began building its own commercial jets (again)

In 2006, China had announced its plans to build its own commercial jet and the government established the Commercial Aircraft Corporation of China (COMAC) in 2008. In fact, China had always wanted to build its own commercial jet since the beginning and this was not China’s first attempt. Such news was well received by the Chinese public but was certainly not pleasant to both Boeing and Airbus. At this time, Boeing and Airbus had enjoyed a textbook duopoly in the global commercial jet market and any new entrant would certainly no be welcomed.

Building a commercial jet was no simple business and was a reflection of a nation’s overall industrial capabilities as a system. The technology barriers for key components such as engines were high. For example, the major jet engine suppliers Prat & Whitney, General Electric, and Rolls Royce were all American or European. Such technology was national level secrets and as a result not shared. Even if you had all the parts sourced from Boeing or Airbus suppliers, putting them together and making sure that everything worked as intended was still challenging. China had already made such an attempt back in the 80s when it repurposed some of the parts (including the engine) of a Boeing 707 to create a prototype of its own planes. The project ended in failure due to the lack of capabilities to create an effective body using aluminum.

Boeing and Airbus sharing know-hows

Recognizing the technical challenges, the government of China leveraged the reliance of Boeing and Airbus on China and pressured them to either transfer their know-how or risk losing the Chinese market. Boeing and Airbus entered a temporary truce as a result of this shared challenge. After a few rounds of arduous negotiations (like the previous negotiations), Boeing and Airbus decided to share limited know-hows (i.e. cabin interiors). Therefore, Boeing and Airbus’s increasing presence of their supply chains in China was more of a result of a compromise with the Chinese government. Airbus built its first A320 assembly plant in Tianjin in 2008 while Boeing entered a JV with COMAC to build a 737 completion and delivery centre for 2018.

2010s: Digitalization & Growth of International Traveling

The political and economic background of China’s aviation market in 2010

China’s air passenger volume continued to grow exponentially, partly driven by the addition of new airports. There were 183 airports by 2012. This passenger volume growth lead to the subsequent development of a new international airport in Beijing, which at the time of writing is the largest airport in the world. International travel would start to get even more popular both in absolute and relative terms. In 2010 there were over 300 international routes to 54 countries, and 23 million out of the total 292 billion (8%) China’s air passengers were traveling internationally.

By the end of this decade, there would be over 700 international routes to close to 60 countries and over 10% of China’s 650 million air passengers would be international. This was partially spurred by the liberation of international travel to Association of SouthEast Asian Nations (ASEAN) countries as the liberation allowed Chinese and foreign airlines to penetrate to more cities.

Chinese tourists were getting increasingly interested in vacationing abroad in the 2010s due to the growing income, more favorable exchange rates, and increasingly relaxed visa requirements to certain countries. Their top 10 destinations concentrated around Asia such as Japan and Thailand. The only non-Asian destination in the top 10 was the U.S. By this decade, air travel had lost most of its prestige, unless you were traveling first class.

Boeing and Airbus introduced the new generation of aircrafts

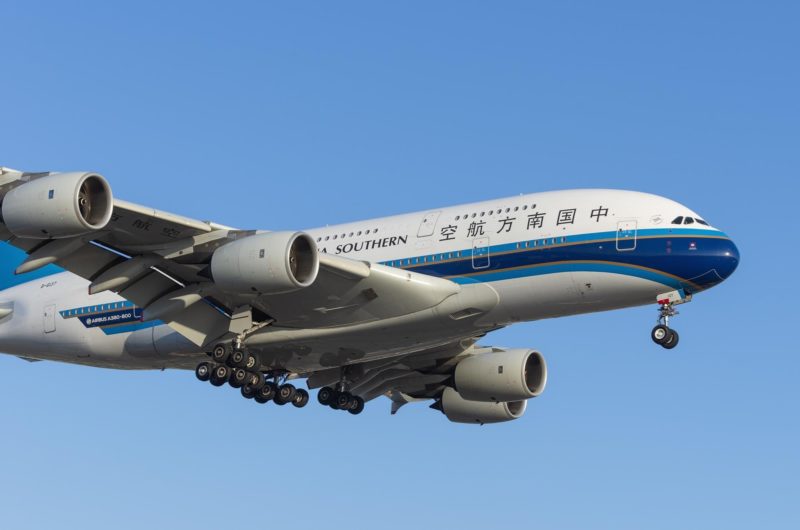

Both Airbus and Boeing brought their new generation of planes, A380 and 787, to China along with their different visions for the future of air travel.

A380 was and is the world’s largest jumbo jet, and its business case was built around the vision that the future of air travel would be “hub-and-spoke”. This meant travelers would go to their nearest big city (the hub), take the A380 to fly to the hub closest to their destination, and finish the travel with another flight.

Boeing’s 787 was a medium sized aircraft for long haul flights and its business case was built around the vision that the future of air travel would be point-to-point. Boeing’s product strategy was built around bringing passengers directly from point A to point B in an efficient and comfortable manner.

How did the Chinese market receive them?

In 2013, Boeing delivered China’s first Boeing 787 Dreamliner to China Southern Airlines for both domestic flights and international long haul flights. So far, there were more Boeing 787 delivered compared to its competitor A350. But starting in 2021 A350 will be delivered from Airbus’s delivery center in Tianjin, China, therefore A350 could still catch up.

As for the world’s largest commercial jetliner A380, it was delivered to China much earlier in 2011 to the hands of China Southern Airlines. A380’s sales did not take off in China partly because A380 was a niche product to begin with. But as Chinese companies increasingly participated in the supply chain of A380, sales could improve in the future for political reasons.

But in the end, both companies continued to enjoy success in China and continued to be reliant on China. In 2017, Boeing delivered its 2000th aircraft to China and 20% of Boeing’s global commercial airplanes revenues came from China, amounting to $11.9 Billion. On the other hand for Airbus, there were over 1700 Airbus aircrafts in service in China by 2018 and deliveries to China accounted for ¼ of Airbus’s global deliveries.

The mobile apps revolution in air travel

“Digital” was the buzzword of the 2010s, powered by the rise of smartphones and apps. Booking a flight ticket from the internet was already fast, but apps allowed people to book from anywhere (even while traveling) on any device with internet connection. Thus came the era of flight booking apps in China. In 2013, already 15% of air ticket bookings on Ctrip, a leading travel-booking website in China, came from mobile apps. The flight boarding experience had become more automated and self-serving.

Foreign airlines also increasingly paid attention to Chine consumer behaviours around mobile apps, especially apps such as WeChat. Airlines such Air France, KLM, and Finnair ran official accounts or mini programs on WeChat to interact with their passengers and even sell tickets.

Chinese consumers’ new requirement: Wi-Fi Connectivity

Another key feature that revolutionized air travel was in-flight Wi-Fi and it first appeared in China in 2013 on an Airbus A330 operated by Air China. Prior to the arrival of in-flight Wi-Fi, any time spent on the plane seemed not productive, due to the lack of connectivity. Passengers could sleep or entertain themselves using the built-in in-flight entertainment system. With in-flight Wi-Fi, passengers had more options to browse the content they want or work. But on the flip side, business travelers needed to stay connected at all times, which may or may not be a desirable outcome depending on your perspective. Chinese consumers were overall enthusiastic about this feature though, with 85% willing to pay for such service. This figure jumped to 90% for Gen X and Gen Y travelers.

Post COVID19 era

Like the rest of the world’s aviation industry, China’s aviation market experienced steep passenger volume drops since 2020 due to a combination of pandemic, economic, and political factors. However, the Chinese aviation market still seems as the powerhouse that will drive the growth of both airlines and airplane manufacturers for the next decades, with a forecasted demand of over 8,000 aircrafts through 2038. As we have seen in the past few sections, the journey of China’s aviation market had never been challenge-free. Political tension, pandemics (SARS), and economic deterioration were present throughout the last 40 years yet every time the Chinese aviation market came out intact and all the players in the market were able to capture their long term benefits. Therefore, we remain optimistic about the future of the Chinese aviation market.

Author: Cedric Zhang