The home-sharing market in China is experiencing unprecedented growth. In addition to short term rental apartments, listings on major platforms also include B&B hotels, and vacation home rentals. After the Chinese government issued a directive encouraging new forms of commercial accommodation to meet the consumption needs of the general public in 2015, the industry experienced a 60% growth. Then, the Chinese home-sharing market kept on growing by at least 36% per year as a result of the launch of policies aiming at standardization and quality of shared accommodation services in 2018.

Nevertheless, the annual transaction value of home-sharing market in China dropped from 22.5 billion yuan to 15.8 billion yuan in 2020 due to the outbreak of Covid-19. However, despite travel restrictions, the number of short-term rentals kept on increasing, especially due to government’s efforts to foster rural tourism and homestay economy. In fact, short rental offers were still able to increase from 1.6 million to 3 million.

Meanwhile, in a letter posted on Airbnb Host Community Account on WeChat on May 24th, 2022, Airbnb announced the suspension of their housing reservation service starting from July 30th. Instead, they will refocus on outbound travel services for Chinese customers.

Why Airbnb decided to exit China’s home-sharing market

China’s Zero-Covid policy, cultural differences, and fierce competition have all led to the exit of Airbnb from the Chinese market.

Airbnb has its origin from couch surfing habits in Western countries. Hosts could rent out spare rooms in their homes to travelers who do not want to spend their money on hotels. In contrast, package tours have long been the norm for Chinese travelers. Therefore, sleeping at a stranger’s place is not common for Chinese travelers.

Another challenge for Airbnb in China was the lacking liability framework in the country. In fact, guests might take advantage of the fact that Airbnb only requires them very basic information and feel free to damage the house without any further consequence. As a result, hosts felt the need to raise the prices of their properties to mitigate the potential risk. In fact, although Airbnb has a Host Guarantee policy providing a million-dollar property protection for hosts, they will only compensate hosts when they can prove that guests are directly responsible for the damages.

Lastly, the merger of Ctrip and Qunar allowed them to provide a vertical integration channel. Users can now book plane tickets, rent cars, and reserve a room with just one app. This saves service providers the cost of acquiring new customers. In contrast, Airbnb bears a higher cost to attract new users since they heavily depend on marketing tactics and word-of-mouth.

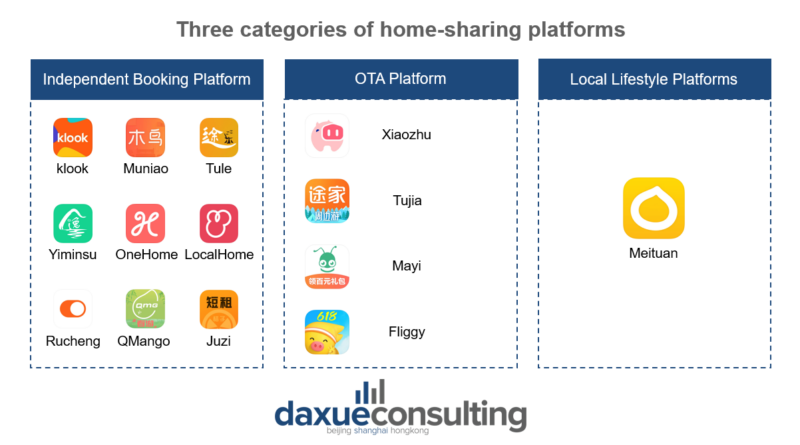

What are the alternatives to Airbnb in China?

- Tujia

- Tujia focuses on the high-end vacation market, both inbound and outbound. They provide all kinds of accommodation solutions, such as serviced apartments, vacation apartments, villas, guest houses and B&Bs. It’s also an optimal choice for business travelers.

- Xiaozhu

- Xiaozhu is an Online Travel Agency-operated (OTA) home-sharing app, allowing tenants and landlords to independently book a room, check-in, and rate their accommodation. Hosts can also rent out their sofas and tents beyond spare rooms. Their listings include typical B&Bs, as well as Beijing hutongs, garden houses, cabins, star houses, etc. Verified university students can enjoy exclusive discounts and are exempt from deposit.

- Mayi

- Mayi, another OTA-operated home-sharing app, offers high-quality apartments in core commercial districts, private accommodation in university areas, garden villas, and cottages. After being acquired by Tujia, Mayi can no long post new house listings.

- Meituan

- Meituan receives most of its traffic from Meituan Dianping and it mostly focuses on the domestic market. Compared to other Chinese home-sharing apps, Meituan has more listings with very distinctive decorations.

- Muniao

- Muniao, an independent booking platform, has plenty of two-bedroom listings available. Considering that most of households in China are only-child families, this app is especially suitable for family outings.

Tujia can better cater to Chinese travelers

Unlike Airbnb, Tujia chose to partner with famous real estate companies in China, and this has turned into its main source of property listings. Moreover, for tourist areas, such as Lijiang and Dali, Tujia also decided to cooperate with some well-established guest houses, thereby gaining a strong market position.

In addition, to enhance user experience, Tujia provides tailored offline services. For this purpose, Tujia collaborates with Sweethome Hotel Management System to implement five-star hotel-style service management for its guests. It consists in aligning its guest management with five-star hotels, thus granting guests the same room service as in luxury hotels.

All the properties are directly managed by Tujia, thus further enhancing the trust of the guests, and they are generally located in well-connected areas. Due to its advantageous locations and affordable prices, Tujia is the favorite choice of many business travelers. Moreover, Tujia platform is plenty of guest houses, which are especially suitable for single-child families since they usually have fully equipped kitchens where guests can cook and share their own meal.

What you didn’t know about home-sharing market in China

- The Chinese government has been introducing new policies to encourage the development of the home-sharing industry.

- Limited listings and the risk of having the house damaged made Airbnb lose competitive advantage in China.

- Tujia, Meituan, Mayi, and Xiaozhu are the top 4 home-sharing platforms in China in terms of available offers.

- Tujia achieved high growth by building ties with real estate companies.