Alo Yoga, the Los Angeles–based activewear brand known for its blend of fashion and fitness, is set to open its first offline store in China in 2025. To lead this expansion, the brand has hired Aurora Liu, former Vice President at Arc’teryx and brand director at Nike, to head Alo Yoga in China.

Download our report on summer sports in China

Although Alo has no official presence yet, it’s already generating buzz on platforms like Xiaohongshu. The entry has generated both curiosity and criticism among local consumers. While some are drawn to Alo’s trendy image, others are skeptical about its quality and cultural fit. But while Chinese Gen Z love the style, questions remain: Is the market ready? And can Alo deliver beyond the hype?

“Alo Yoga” is available in the Chinese market even before its entry

Despite no stores, Alo Yoga has already gained some awareness among consumers interested in the athleisure market in China. Its image is increasingly visible on social media, particularly Xiaohongshu, where trend-driven users have been sharing content featuring the brand. Moreover, many counterfeits are even accessible through third-party retailers on platforms like Taobao and JD.com. and its

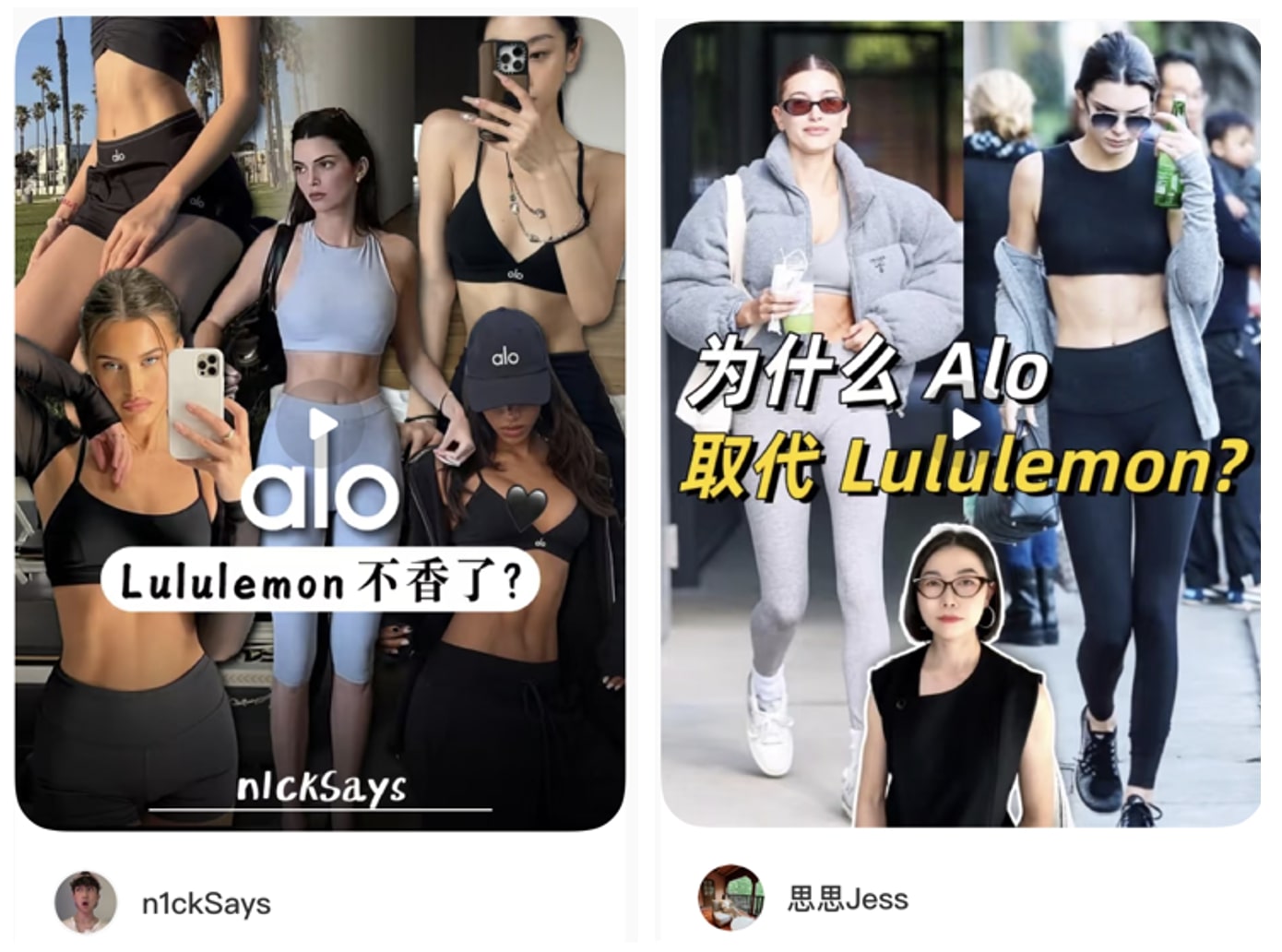

However, compared to market leader Lululemon, Alo Yoga’s reach remains limited. In June 2025, posts under #Alo accumulated approximately 100 million views, significantly trailing behind the 3.7 billion views under #Lululemon. Alo Yoga also lacks official accounts on major Chinese platforms such as Xiaohongshu, Weibo, and Douyin, which restricts its ability to engage directly with local audiences or shape its brand narrative. This fragmented presence highlights both the organic interest in Alo and the untapped potential of a more strategic market entry.

Alo Yoga is not strongly associated with fitness

On Xiaohongshu, Alo Yoga is primarily associated with lifestyle and aesthetic-driven hashtags rather than fitness only. Tags like #TennisCore, #WhiteGirlEssentials, and #SpoiledWifeAesthetics suggest that Alo is perceived as part of a Westernized, aspirational image tied to fashion and femininity. While fitness tags do appear (#FitnessOutfit, #HighFashionSportsBra), they are often blended with street-style or social lifestyle contexts. This underscores the brand’s positioning as “wearable wellness” more than technical sportswear.

A trendy and affordable alternative to Lululemon

Alo Yoga in China has carved out appeal among younger consumers by aligning with fast fashion and online aesthetics. Its association with global influencers like BTS’ Jin as well as Kendall and Kylie Jenner, positions the brand as aspirational and digitally relevant. Compared to Lululemon and other brands like local leader Maia Active, Alo Yoga is often perceived as the most affordable and fashionable option.

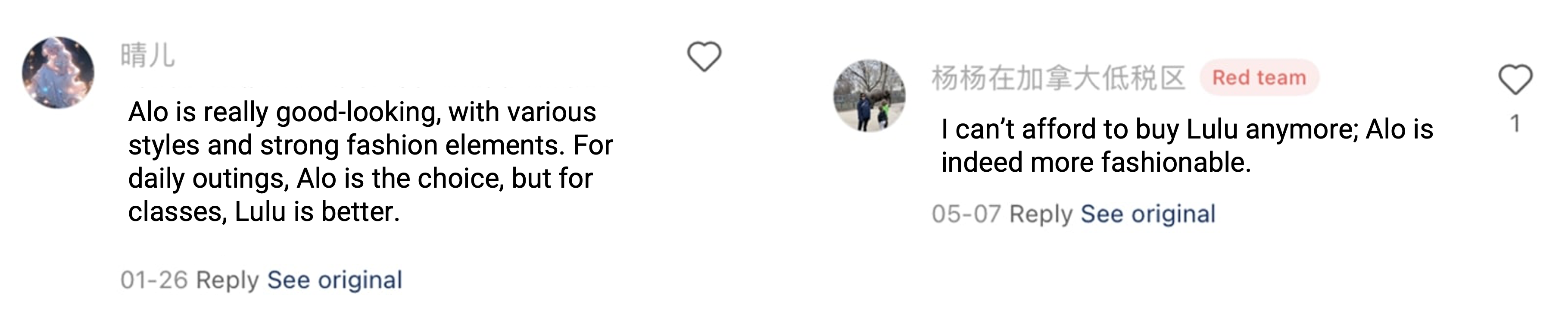

Chinese netizens on Xiaohongshu praise its modern silhouettes and streetwear-inspired looks, often suggesting it’s better suited for daily wear. In many posts, consumers express optimism that Alo Yoga could eventually rival or even surpass Lululemon in popularity.

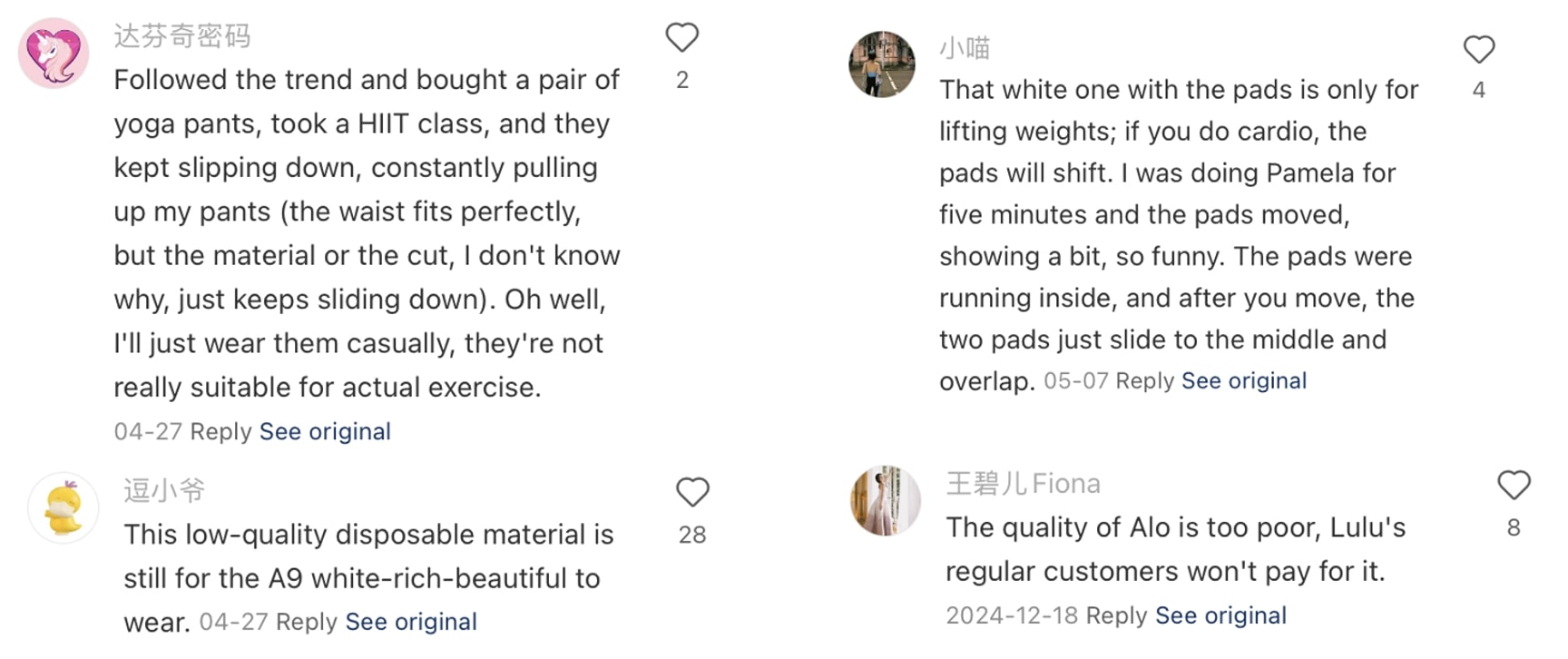

Challenges and criticisms exist even before entry

While Alo is admired for its style, many consumers express disappointment with product performance. Reviews frequently mention that the fabric feels rough or overly warm for China’s climate, and that sizing, based on U.S. standards, is too large or unflattering for Asian body types. The infamous “magic pants” have been called out for poor fit and discomfort during workouts. As one netizen put it, “Alo looks great but isn’t built for movement.” According to a 2025 RedNote survey, only 44% of the 7,295 respondents preferred Alo Yoga, compared to 56% for Lululemon in August 2024.

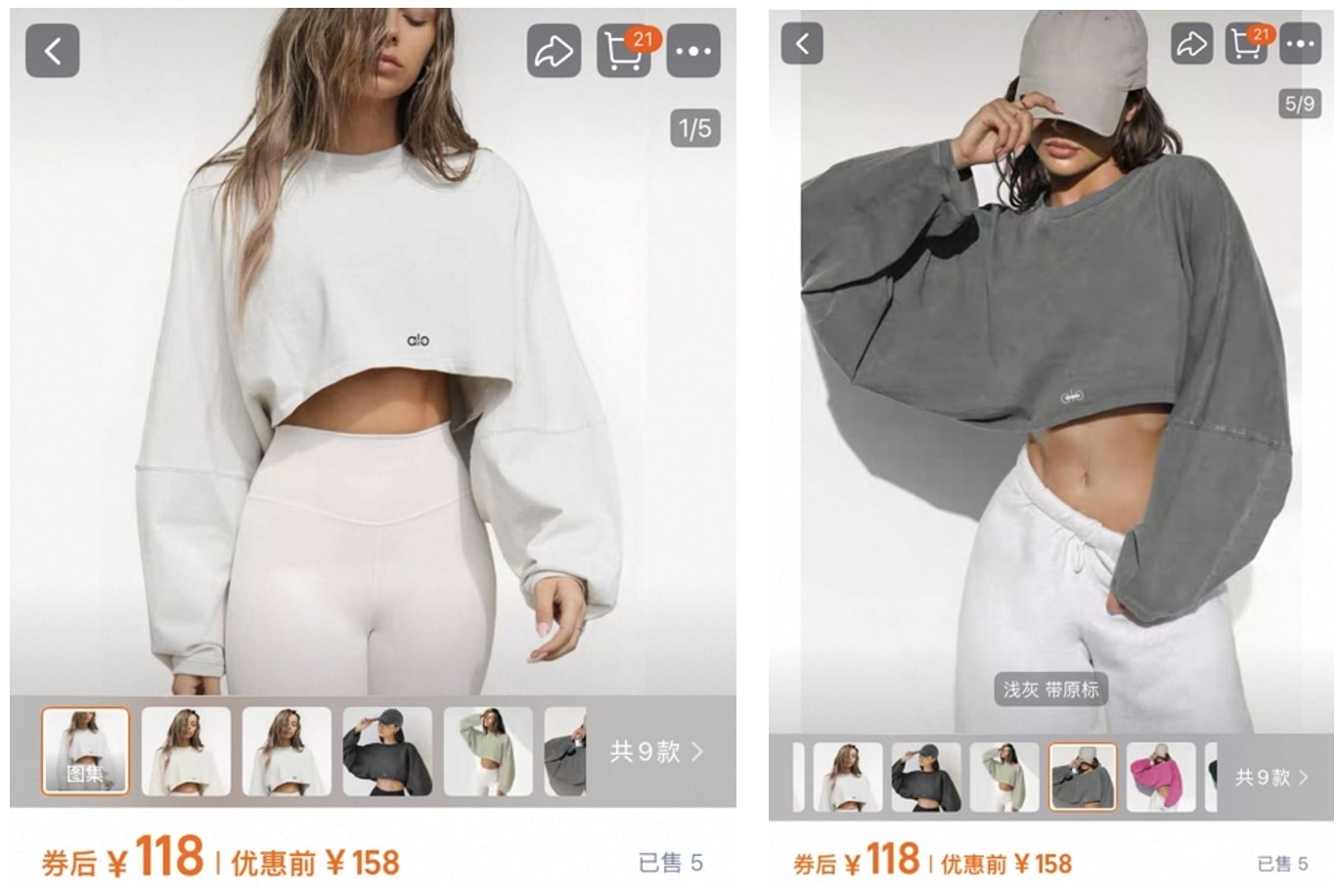

Weak market presence fuels counterfeit proliferation

Alo Yoga’s limited official footprint in the country has created space for a thriving counterfeit market. Imitation products are widely available on major e-commerce platforms in China like Taobao and Pinduoduo, despite efforts by platforms to curb illicit sales.

Easy access to fakes highlights demand for Alo Yoga in Chinese market

On one hand, the visibility of counterfeit goods has inadvertently boosted brand awareness among Chinese consumers. Many discover Alo Yoga through cheaper replicas, which circulate widely across social media and shopping apps.

But the risks outweigh the reach

On the downside, this exposure comes at the cost of brand perception. Widespread access to low-quality knockoffs reinforces the notion that Alo Yoga is a fashion-first, low-performance brand. Worse, the brand ends up competing with its own counterfeits, losing control over pricing, quality, and reputation just as it prepares to enter the market officially.

Alo Yoga raises hopes—can it deliver?

- Alo Yoga is preparing to open its first offline store in China in 2025, with growing visibility but no official local presence yet.

- The brand has attracted attention on Xiaohongshu, where Chinese Gen Z consumers associate it with streetwear aesthetics and aspirational lifestyles rather than technical sportswear.

- While it’s seen as a more fashionable and affordable alternative to Lululemon, Alo Yoga in China faces criticism for poor sizing and product quality.

- Its absence from official Chinese platforms has also led to widespread counterfeiting, which boosts awareness but damages brand credibility.

- To succeed, Alo will need to shift from global hype to a locally grounded strategy that meets Chinese consumers’ expectations.