Brief history of auto insurance in China

People Insurance Company of China (PICC) provided the first local car insurance in China in the year 1950, which ended foreign monopoly in the industry. Most consumers in China were not aware of auto insurance at inception. In 1980, auto insurance in China was gradually promoted along with the rapid growth of public transportation and private cars. Starting in 1988, auto insurance started to dominate the non-life insurance market in China. In 2006, the Chinese government imposed mandatory regulations on drivers to purchase liability car insurance. These regulations may have further boosted the auto insurance market in China. As of 2019, new regulations were implemented to include more foreign insurance companies in order to increase competitiveness.

Overview of the auto insurance market in China

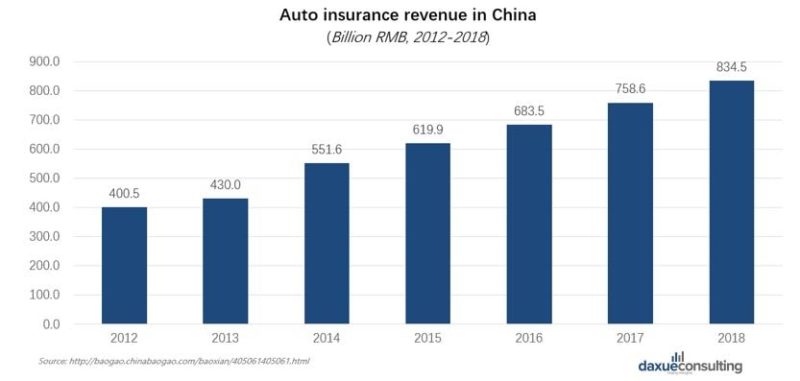

Auto insurance belongs to the non-life insurance market in China. The car insurance market in China has a total revenue of 834.5 billion RMB and a 10% year-on-year growth. In addition, auto insurance dominates the non-life insurance market with over 70 percent of the total premium.

Types of auto insurance in China

Compulsory liability insurance in China, for traffic accidents (交强险)

Compulsory liability insurance in China is used to cover third-party injuries and/or deaths in car accidents. It is compulsory for both private or commercial use. Premium is regulated and stipulated by a simple rating table, according to vehicle types and a few other variables. As of May 1st 2012, foreign-invested insurance companies are permitted to write compulsory liability insurance for car accidents in China, subject to the prior approval of China Insurance Regulatory Commission.

Commercial motor insurance in China (商业险)

Commercial motor insurance in China offers a wider financial protection. This includes claims other than traffic collisions, such as theft, keying, weather or natural disasters, and damage caused by colliding with stationary objects.

There are two segments of commercial motor insurance in China: basic risks and additional risks. Car owners have to purchase insurance for basic risks first, which will then provide them with access to additional risk insurance.

Basic risks include:

- Vehicle damage insurance covers all the damage to the car regardless of reason.

- Theft insurance covers the vehicle and anything happens in an event of burglary or theft.

- Quota-free insurance pays 100% compensation regardless of who is hold responsible for the accident.

- Passengers insurance covers all passengers and is purchased according to the number of car seats.

Additional risks include:

- Free compensation special insurance is when insurance company is responsible for compensation in the liability limit according to the deductible amount, based on the rate specified in the corresponding basic insurance clause.

- Risk of spontaneous combustion refers to the compensation for the loss of the combustion vehicle caused by the failure of the vehicle’s electrical, wiring, fuel supply system and the cause of the cargo itself.

Gap insurance in China (差额保险)

Gap insurance in China, often flogged by pushy car salesmen, covers the difference between the amount you paid for your car and the amount an insurance company would give you if it was totally damaged or stolen. As gap insurance in China is not a main form of car insurance in China, which traditional insurance companies do not offer. Nonetheless, many auto finance institutions provides gap insurance. Consumers who purchased car gap insurance are entitled to receive the exact same amount equal to the purchase price when vehicles are damaged or stolen. The “gap” between the amount insurer pays and the amount consumers originally paid will be covered. Those who did not purchase gap insurance will receive compensation payments. However, the amount will likely to be much less than the purchase price of the vehicle, as insurance companies are only responsible to pay the depreciated car value.

Collateral protection insurance in China (CPI)

When people buy vehicles through bank loans, bank will ask consumers to use their cars as collateral and purchase collateral protection insurance (CPI) in China. If consumers can not pay their debts and that the car values can not cover the principal and interest of the loans, then the insurance companies will pay for the amount short. Collateral protection insurance in China readily transfers part of risks from banks to the Chinese insurance companies. Thus, banks often relax the credit status evaluation of consumers. However, Chinese insurance companies often re-values consumer credit status to determine the correct CPI rate (insurance rate). This process is very strict since they have to bare more risks.

CONTACT US NOW TO ANSWER YOUR CHINA BUSINESS QUESTIONS

Geographical distribution of car drivers in China

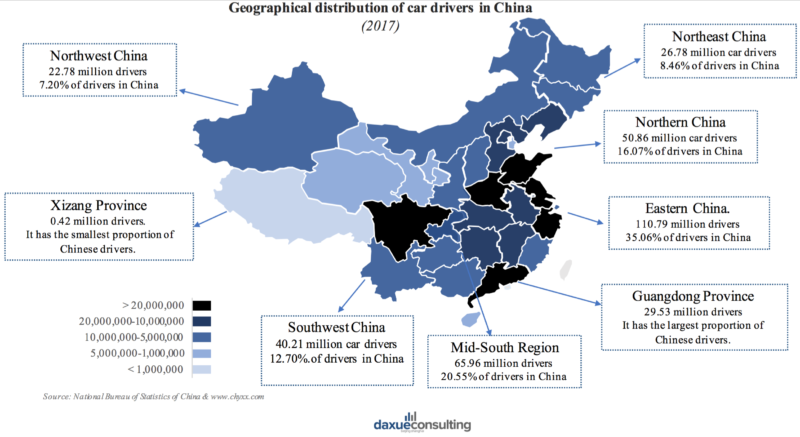

More market potential for auto insurance lies in developed regions, as there are more drives. For example, Eastern and Northern part of China each accounts for a large percent of total car drivers in China.

Road safety in China and how it affects the auto insurance market

The main causes of traffic accidents in China such as violating the traffic rules, over-speeding, drunk driving, driving without a license and recklessly driving in reverse make auto insurance in China increasingly important to cut the losses of car owners.

Developed regions usually have more traffic accidents since they are densely populated. Thus, car owners from developed regions have a higher demand for auto insurance. However, auto insurance demand for areas like Guizhou province are also high as these areas are more prone to accidents with mountainous roads.

Consumers of auto insurance in China

Key consumers of auto insurance in China

Men are the main consumers in China’s auto insurance market. They cover 75.8% of the total auto insurance consumers leaving their women counterpart with only 24.2%. However, more Chinese women are becoming drivers and car owners, which means they will start to buy more commercial insurances for their cars. 31-40 year old individuals are currently the main consumers of auto insurance in China. However, as the number of 25-30 years old consumers is consistently growing, increasing number of young people purchasing cars and related insurance will be expected.

Consumer demand for car insurance in China

There are several factors that influence consumer demand. Fuel costs and repair costs incurred in the use of car affect auto insurance purchases. Excessive fuel costs would reduce the automobile usage to a certain extent, while repair costs will be considered along with the purchase of car insurance in China to control the costs that may incur in the future. Consumers who purchase auto insurance usually adopt stronger safety conscious and insurance-related expertise. Higher educated individuals will have more purchasing awareness and demands for auto insurance. In addition, the degree of transportation industry development reflects the proportion of demand for public transportation to private cars. Thus, in areas with underdeveloped public transport, people are more likely to drive private cars, which would lead to a higher demand for car insurance in that area. The income level also seems to be one of the influencing factors that contributes to the booming car insurance market in China. Individuals or families with stronger purchasing power are more willing to purchase cars that may increase the potential consumption of auto insurance in China.

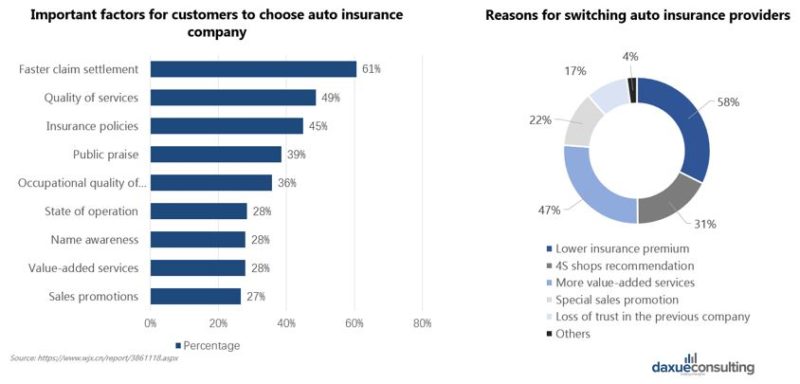

Purchasing reasons for auto insurance in China

Faster claim settlement and service quality are the most important factors for customers when considering for which auto insurance companies to choose from. They usually prefer to choose insurance companies with lower premium and more services provided and may easily switch from one company to another if they feel unsatisfied or feel that they are not spending money for value.

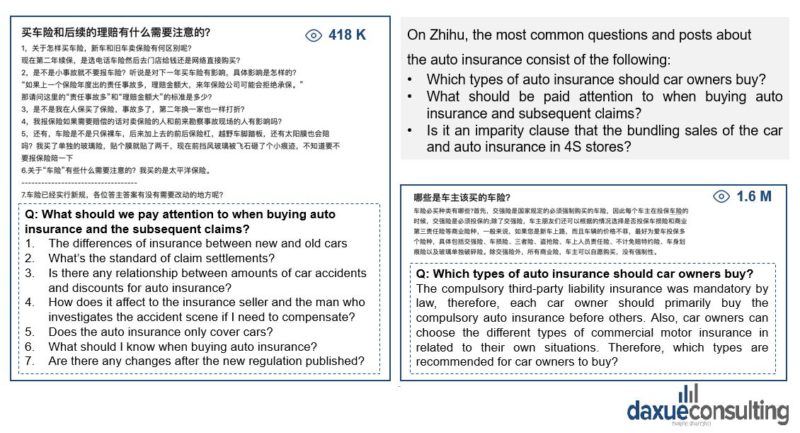

Consumer perception and discussion on car insurance in China

Zhihu is especially relevant to reach higher, well-educated social classes. The most common discussions on auto insurance centers on clarification of the types car insurances needed to be purchased and the considerations needed to be taken at purchase.

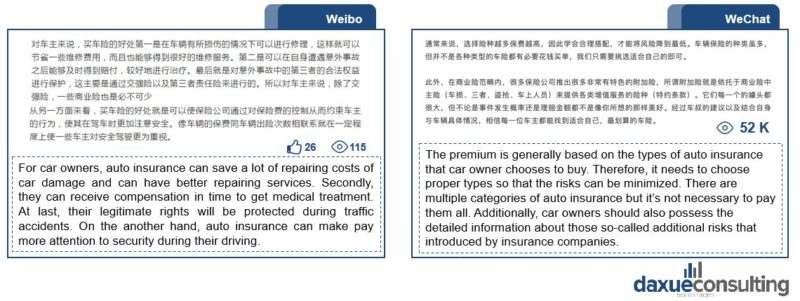

Positive consumer perceptions of auto insurance in China suggests that it can cut consumer losses in traffic accidents and protect car owners’ legitimate rights. Different sales channels both online and offline are also praised by consumers as they have made the selection and purchasing process of car insurances much more convenient.

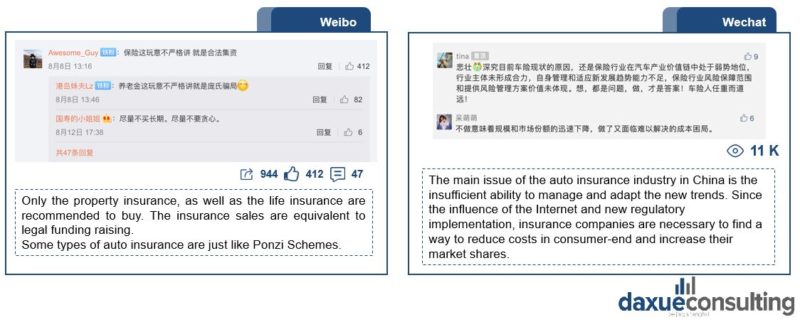

Negative perceptions of customers mostly arise from the extra costs that results from conflict of interests between auto insurance sales in 4S stores and from the insurance companies. Many consumers are disappointed by the false advertising of some insurance companies, and feel that their risk protection have been exploited for profit purposes.

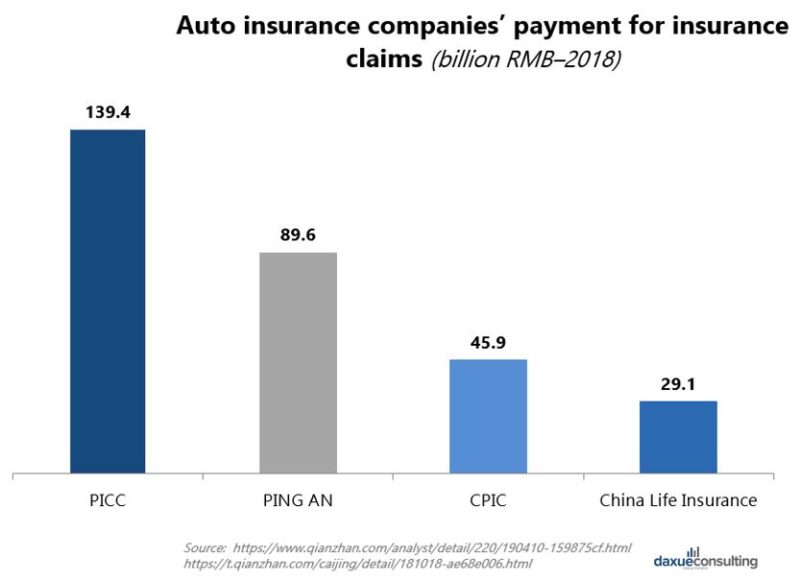

Competitors in the auto insurance market in China

Auto insurance market in China is dominated by large domestic brands, due to scarce insurance licenses and fierce competition, small and medium-sized companies are difficult to grow through a traditional business model.

In large auto insurance companies, car insurance claims usually occupies 70% of their total payments. Third-party distributors (such as 4S stores, agencies, etc.) are very important distribution channels for the Chinese auto insurance companies. For example, in 2018, 90% of CPIC’s auto insurance sales revenue came from third-party distributors.

Leading Players in the auto insurance market in China

PICC is one of the largest insurance companies in China and is the leading player in the car insurance market in China. The company is devoted to fast auto insurance claims and excellent after-sales services. PICC provides 9 types of auto insurance for different purposes, one example is coverage for scratched and broken car windows. Currently, owners of private vehicles with no more than 9 seats can directly purchase PICC’s auto insurance on its website and pay by Alipay or WeChat. PICC also provides several kinds of after-sales services to consumers which include 24-hours damage assessment service and free rescue service in mainland China. Consumers can request road rescue services for free within 100 km of any mainland China cities. In an emergency, consumers can also request helicopter rescue and insurance claims through mobile phones. Private car consumers can directly use PICC’s mobile app or its WeChat public account for claims, and the claims can be settled within one hour if accidents are of unilateral liability and the losses incurred are below 10,000 RMB.

PING AN is one of the Fortune 500 enterprises and is also a leading brand in the auto insurance market in China. PING AN has around 40 million car insurance consumers with high customer satisfaction achieved for many years. Consumers only need 3 steps to purchase a car insurance on Ping An’s product page. The 3 simple steps listed in order are information filling, quotation and payment procedure (mobile or bank cards). They will then receive a contract and a certificate in 2 days through the mail. Consumers can apply for fast claim through Ping An’s mobile app and receive the payments in 3 days if accidents are of clear or unilateral liability with no injuries incurred. Road rescue services can be requested for free by consumers who have cars with less than 12 seats. However, the rescue place must be within 100 km from any city.

Case study-Autohome.com (家家金融)

Autohome Inc. was founded in 2006. It is the leading online destination for car drivers in China. The mission of Autohome is to engage, educate and inform auto consumers in China with everything they need to know about buying, using and selling cars. Now, the platform also provides auto insurance as an online distributor. Consumers can customize car insurance with 20%-30% discount on the website. By downloading the App, consumers can buy insurance, receive free counseling and apply annual vehicle inspection. Car insurance consumers can get premium paid directly on the website in a short time. The platform also offers emergency rescue and designated driving services.

Case study-CheChe.com (车车车险)

CheChe.com was launched in 2015. It is an online insurance transaction platform that offers vehicle insurance products from different companies. Consumers are allowed to purchase auto insurance with the company through WeChat, Cheche’s APP and their official website. A convenient and fast purchase process is adopted. The platform provides auto insurance from more than 15 different companies and consumers can easily compare different types of insurance and their associated prices directly from the website. Customized services are offered to give consumers suggestions on auto insurance based on the situation of cars, which encourages to pick and select between different insurances.

Drivers of the car insurance market in China

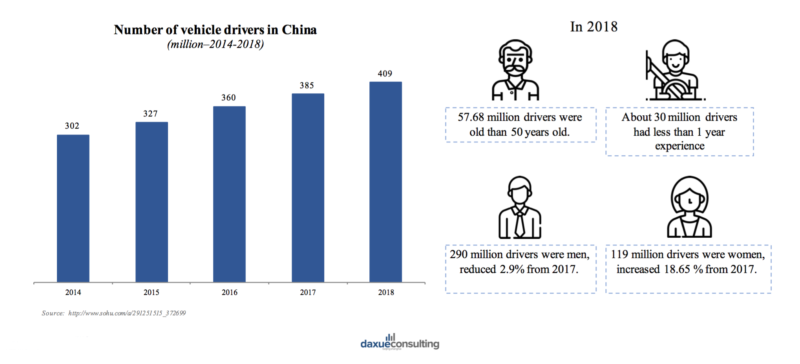

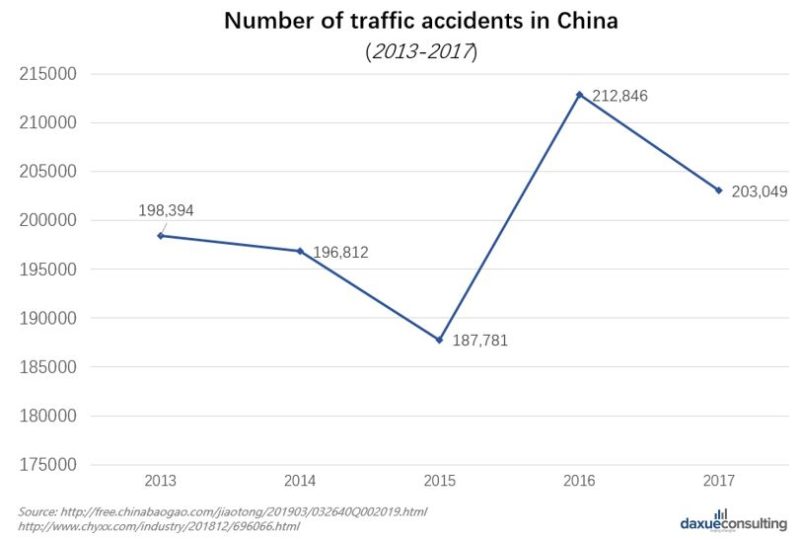

The fast development the auto insurance is driven by several factors. Firstly, the huge vehicle market in China served as the basis for the rapid market growth. Despite that vehicle sales in China declined in 2018, China remained as the largest car market in the world and that the number of drivers in China has been rising steadily for the past several years. The sales revenue for the vehicle market have further boosted the development of the auto insurance industry. Secondly, frequent traffic accidents and the increasing road safety awareness pushed for the expansion of the auto insurance market in China. Although the total number of traffic accidents involving casualties slightly decreased in 2017, 63,772 deaths and a large number of physical injuries were inevitably caused. Due to the road accidents caused by many elderly or inexperienced drivers, and the enhanced public road safety awareness contributed by multi-agency education and publicity, the demands of auto insurance in China have greatly increased among car owners.

Policy support from the Chinese government also plays an important role. The Chinese government has been continuously releasing new policies during the past few years to regulate the auto insurance industry and supporting the development of new business model in this field. Moreover, with the increasing internet users in China, online insurance platforms are becoming popular and important distribution channels. Utilizing online platforms could potentially be a win-win situation for both the insurance companies and their customers. As reduced costs and improved sales efficiency can be achieved for the former, while a one-stop service with simplified purchasing process can be provided for the latter.

Opportunities for car insurance market in China

New car insurance business models

Traditional business model burdens the development of car insurance market in China. Many companies have already started using a new business model. Internet plays a very important role in the new business models of auto insurance industry comparing to traditional brick-and-mortar 4S stores. Insurance companies can effectively reduce costs by gradually replacing offline distributors with online platforms. With regard to the core values required by users, auto insurance companies can build precise consumers profiles through big data, carry out precision marketing and improve claim settlement services. Although traditional business model that are activated through sales agents in most China’ s insurance companies can secure high margins by increasing the price of insurance, high cost and investment to maintain market share will be required. Many insurance companies are pushed to set up branches at different cities and initiate price wars against one another. The new business model is centered around online sales and promotions rather than offline. This strategy effectively decreases costs and improves services quality. Self-operated and third-party platforms will be the main sales channels of new business model.

Innovation in auto insurance business models

Usage-based insurance (UBI) is also known as pay as you drive (PAYD), pay how you drive (PHYD) and mile-based auto insurance. The costs of this insurance are dependent upon the type of vehicle used, measured against time, distance, behavior and place. It requires installation of UBI devices or UBI mobile app in vehicles to collect the data of driving behaviors, time, distance, etc. The data will be sent to a UBI system/platform, and will be stored for later use. Lastly, auto insurance companies can make precision marketing strategy (including price) to target specific groups using this innovation.

Obstacles of China’s auto insurance market

Some auto insurance companies do not have high quality service as they have focused their efforts on reducing cost rather than improving after-sales services. Thus, many consumers are disappointed at the attitude of staffs. Moreover, due to the fact that auto insurance market in China is still at an early developing stage, frequent insurance scams have occurred during the past several years with not enough legal protection. Therefore, how to effectively prevent and curb insurance fraud has become an urgent problem to be solved in the auto insurance industry.

Furthermore, insurance companies assess the degree of damage of vehicles to decide the amount of compensation to be provided. However, many assessment results are much lower than consumers’ expectations. Not to mention that the claim procedures are often complicated and customers do not receive payment in time.

In order to attract more clients, many auto insurance companies lowered their prices to increase the rate of compensation. However, many some small and medium companies could not receive enough revenue to cover their expenditures from such a strategy.

Overall, auto insurance market in China is developing rapidly and there is a lot of opportunity to be seized within this market growth. Meanwhile, the demand for quality service is increasing, challenging companies to compete with innovative business models and superior customer service.

Let China Paradigm have a positive impact on your business!

Listen to China Paradigm on iTunes