The sports industry in China has seen great growth in the past few years and is expected to continue growing in the years to come. According to the latest report released by the General Administration of Sport of China, the total scale of the sports industry nationwide reached RMB 3.30 trillion (USD 464.15 billion) in 2022, with an added value of RMB 1.31 trillion (USD 180.87 billion), an increase of 5.9% and 6.9% respectively compared to the previous year.

This robust growth is further evidenced by the surge in outdoor sports participation, which exceeded 400 million people by the end of 2021, driven by the increasing consumer demand for sports and outdoor activities, government support for the Chinese sports industry, and the rising popularity of new activities. Therefore, with a growing number of people engaging in various sports and rising consumption surrounding sports-related activities, there are tremendous opportunities for indoor and outdoor brands and marketers in the Chinese sports market.

How a prolonged pandemic impacted the sports industry in China

As much as COVID-19 posed enormous challenges to the overall well-being of people in China due to various factors, especially with people increasingly working from home, lockdowns, and health complications that come with COVID-19 infections, it has also brought opportunities to China’s sports industry. After a prolonged pandemic, Chinese consumers are increasingly aware of the importance of a healthier, more active lifestyle, a trend pushed forward by policies on a national scale.

Source: Unsplash, a group of people practicing Tai Chi (太极拳) in front of a bank building in Xi’an, Shaanxi province, Photographed by Alexander Schimmeck

According to the “2022 Chinese high net worth individuals (HNWI)” value and lifestyle research report on “desired things” between HNWI and the general public, health is the top priority for both groups, followed by happiness and stable life, signaling the huge demand for health-related products and services among Chinese consumers as well as growing opportunities for the sports industry in the Chinese market.

China’s outdoor sports industry is gaining momentum

In the past few years, China has been promoting the outdoor sports sector through a range of policies to encourage participation, improve infrastructure, and stimulate economic growth. In the Action Plan to Promote the Construction of Outdoor Sports Facilities and Service Enhancement (2023-2025), released by the General Administration of Sport and several other departments in October 2023, it was proposed that by 2025, the total scale of the outdoor sports industry should reach as much as RMB 3 trillion (around USD 414.34 billion). The policies seem to be quite effective so far.

According to data released by Xiaohongshu, the number of outdoor-related posts in 2023 reached 130 million, an increase of 270% compared to the previous year. Additionally, the total views of these posts exceeded 622.5 billion, showing a significant growth of 570% from the previous year.

China’s outdoor sports scene sees increased engagement from post-90s and women

According to the “China Outdoor Sports Industry Development Report” released in October 2023, young people born in the 90s are now the largest demographic participating in outdoor activities in China, comprising 36.1% of total participants, followed by those born in the 80s at 32.5%. These two groups combined account for 68.6% of all outdoor sports participants.

Notably, women have also emerged as the main participants in outdoor activities, making up 59.9% of the total compared to 40.1% of men. This shift strongly indicates a growing interest and engagement among women, challenging the traditional male-dominated outdoor sports scene.

Residents across all city tiers are embracing outdoor lifestyles

In terms of engagement across different city tiers in China, the outdoor lifestyle has increasingly become a trend embraced by residents from all city tiers, according to Xiaohongshu’s report on outdoor lifestyle trends. Compared to metropolitan areas, lower-tier cities tend to have more areas of untouched nature and outdoor space, providing residents with more resources and opportunities to engage in diverse outdoor activities due to convenience and accessibility.

Source: Xiaohongshu, designed by Daxue Consulting, city distribution of outdoor lifestyle participants from January to October 2023

Trending outdoor sports activities

According to Xiaohongshu’s report, hiking, fishing, cycling, camping, surfing, and skiing have emerged to become the most popular outdoor sports activities among Xiaohongshu users, accumulating over 7 million posts as of October 2023. Cycling emerged as the most popular outdoor sports activity, with the topic of “cycling (骑行)” garnering nearly 1.3 billion views and over 1.8 million posts from January to October 2023. Notably, the proportion of cycling populations aged between 19 and 30 exceeded 65%.

Due to the increasing popularity of outdoor sports activities and their status as a lifestyle ideal, both domestic and foreign brands have been benefiting and capitalizing on the trend, such as Patagonia and Free Soul (自由之魂), a local brand specialized in high-end camping products and sports equipment that emerged under the trend on Xiaohongshu.

Source: Xiaohongshu, designed by Daxue Consulting, top outdoor sports activities among Xiaohongshu users from January to October 2023

China is set to promote health and the sports industry through policies and sports events

According to the 14th Five Year Plan for Sports Development, published in 2021 by the General Administration of Sport of China, China is set to push the sports industry forward in hopes of becoming a sports “superpower,” covering various sports-related topics such as exercise and fitness among the general public and youth sports. The plan specifically mentions leveraging sports events like the Beijing 2022 Winter Olympic Games as an opportunity to achieve a “significant leap” in the development of China’s ice and snow industry and winter sports. It aims to promote and popularize winter sports in China, encourage participation in winter sports from 300 million people, and eventually drive a comprehensive upgrade of China’s ice and snow industry.

Source: Xiaohongshu, the number of notes related to winter sports has reached 4 million on Xiaohongshu as of February 2024

China’s ice and snow industry continues to grow after the Winter Olympics

During the Beijing 2022 Winter Olympics, China not only won a total of 15 medals, but it also holds significant economic and cultural value in terms of raising awareness, demand, and participation in winter sports in China. This further promotes the ice and snow industry and enhances sports-related infrastructure.

For instance, the China Tourism Academy reports that the number of winter tourists in China significantly increased, from 170 million in the 2016/2017 season to 254 million in the 2021/2022 season. In Zhangjiakou, a city neighboring Beijing that hosted most of the snow events during the Beijing 2022 Olympics, the city welcomed over 10 million winter sports tourists, generating tourism revenue of RMB 8.61 billion (around USD 1.20 billion) in 2022 alone. Additionally, the number of independent travelers in China’s winter sports tourism increased by 46.37% in late 2023 compared to the same period in 2019, with post-90s and post-80s generations making up 68.95% of travelers.

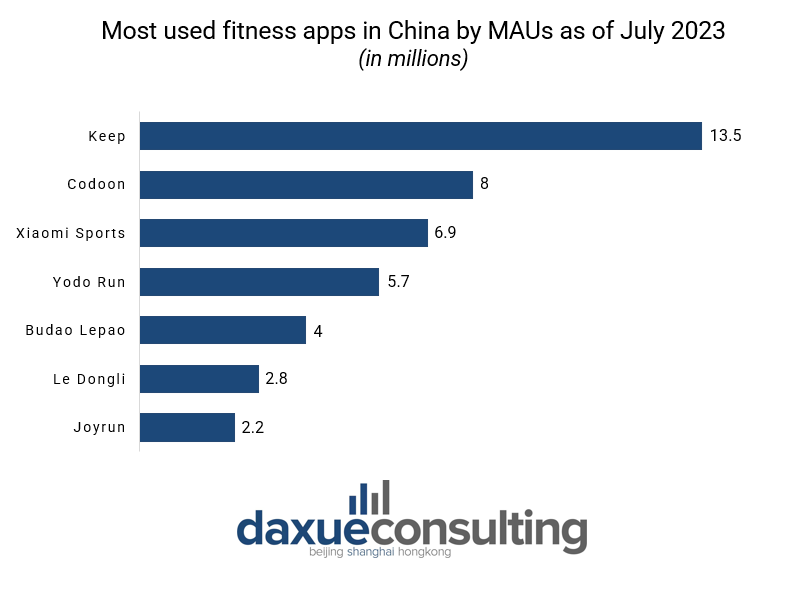

Online fitness continues to increase as traditional gyms struggle to grow

Online fitness and home workouts have become increasingly popular among Chinese people, exemplified by the viral success of fitness influencer Liu Genghong (刘耕宏) during the pandemic. With an estimated annual growth of 8% from 2024 to 2028, China’s online fitness market is seeing robust growth after the COVID-19 pandemic, with online fitness apps like Keep being one of the major players in the industry. In contrast, traditional gyms and fitness studios are struggling, with a decline in the number of gyms from 117,000 in 2023 to 131,000 in 2022, reflecting a 9.9% decrease.

Brand collaboration is increasingly shifting from celebrities to athletes

In recent years, domestic and international brands have been increasingly leaning towards collaborating with athletes and sports teams over celebrities. This shift is due to the positive image athletes typically have, making brands more risk-averse after a series of frequent scandals involving celebrities that have brought losses and tainted the image of the brands. Additionally, in 2020, the General Administration of Sport of China issued a series of documents on athletes’ commercial activities, ensuring their rights to sign with agents and agencies, which further protects athletes’ interests and encourages brand endorsements.

Source: Iminor, designed by Daxue Consulting, the number of athlete brand endorsements in China from 2015 to 2021

Key takeaways from China’s booming sports industry

- The sports industry in China has grown significantly in recent years, and it’s expected to keep growing in the future.

- After a long pandemic, Chinese consumers are becoming more aware of the importance of a healthier, more active lifestyle.

- China’s outdoor sports scene is seeing more engagement from the younger generation and women.

- Outdoor sports have become more popularized, with residents across all city tiers embracing outdoor lifestyles.

- Hiking, fishing, cycling, camping, surfing, and skiing have become the most popular outdoor sports activities.

- The Chinese government is promoting health and the sports industry through policies and events.

- China’s ice and snow industry is continuing to grow after the Winter Olympics.

- Online fitness and home workouts are gaining popularity.

- Brands are increasingly collaborating with athletes and sports teams, rather than celebrities.

We offer expert market insights and consumer understanding in China

The Chinese sports scene is experiencing momentum fueled by the prolonged lockdowns that pushed people to train at home, but also thanks to the Beijing Winter Olympics in 2022, which started a boom in winter sports. Any sports-related brand considering entering or expanding its presence in the Chinese market will face difficulties in knowing what to offer to tech-savvy, very modern, and fast-paced customers.

This is where we enter. At Daxue Consulting, we provide targeted market research, branding, and strategic insights to help you develop your go-to plan for the Chinese market. Winning in China requires to stay ahead of the trends and challenges. Our expert guidance helps companies make informed decisions that align with consumer behaviors, preferences, and market developments. Contact us to discuss your project and see how we can support your strategy optimization and growth.

Download our report on young Chinese consumer trends