In recent years, the growth of the sports and fitness market in China has been exponential. The fitness population reached approximately 374 million people at the end of 2022, with an increase of 9.6% since 2016, and generating a revenue of more than RMB 941 billion (USD 132.4 billion) in the same year. The latest booming of outdoor sports was accelerated by the pandemic, which pushed more people to embrace a healthier lifestyle and seek adventure. Because it is a so vibrant and dynamic market, the Chinese fitness population has seen the growth of many trends concerning a healthy life and personal achievements.

Download our report on Gen Z consumers

Stress relief and socializing are the main reasons to take up exercising

The new wave of the “fitness craze” has particularly reached Gen Z and Millennials. There are numerous reasons behind the surge in outdoor activities, with growing health awareness and the need for stress relief likely serving as the primary drivers motivating young Chinese consumers to adopt outdoor sports. Moreover, there’s a palpable thirst for adventure among this demographic, propelling them to explore the outdoors as a pathway to personal fulfillment and discovery.

From Tai Chi to winter sports: Chinese fitness enthusiasts are interested in a wide variety of activities

In recent times, there has been a notable shift in fitness trends, particularly among the younger demographic, away from traditional perceptions of slow fitness as solely an activity for the elderly. More and more young people are gravitating towards a slower, more holistic approach to fitness, which emphasizes both physical and mental well-being.

This form of training focuses on activities that are not necessarily tied to specific fitness goals; instead, they involve slow movements combined with breathing exercises. This approach is believed to aid in stress relief and boost the immune system. The 2023 National Fitness Trends Report published by the fitness app KEEP highlighted the growing popularity of traditional Chinese exercises like Tai Chi and Baduanjin.

According to the report, the number of individuals regularly practicing meditation, Tai Chi, and Baduanjin saw a significant increase of 7.9% compared to 2022 and a staggering 46.1% compared to 2021. Participants reported feeling more energized and experiencing notable improvements in concentration and memory after engaging in these slow exercises. Furthermore, these activities have gained traction on Chinese social media platforms, with hashtags related to Tai Chi amassing over 110 million views on Weibo and exceeding 6.4 billion views on Douyin.

The 2022 Beijing Winter Olympics still had a powerful impact on the Chinese fitness market

The echo of the 2022 Beijing Winter Olympics still resonates strongly among Chinese consumers, and the winter sports market has never stopped blooming since then. During the 2023/2024 winter season, the number of ice and snow leisure tourists is projected to exceed 400 million people, with an estimated revenue of RMB 550 billion (USD 77 billion).

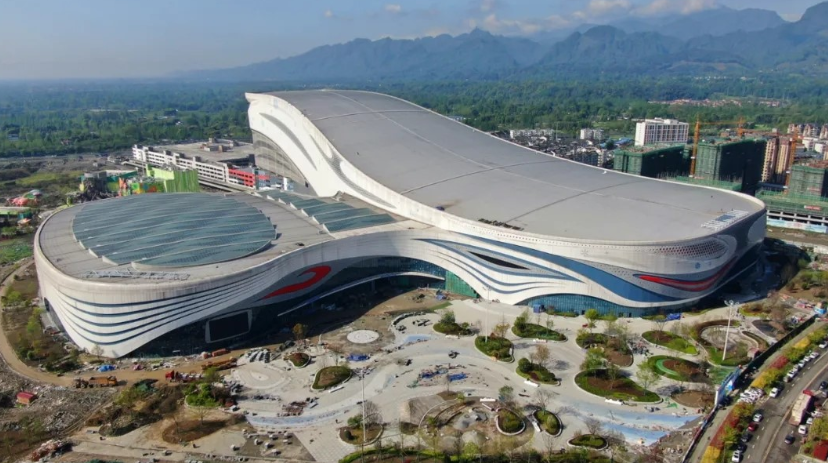

Considering that skiing has only recently become popular, the number of skiers is very high. During the winter season 2022/ 2023, there were approximately 20 million skiers in China, combining both indoor and outdoor. The government fostered the rise of winter sports and invested more than RMB 2.8 trillion (USD 400 billion) in snow tourism infrastructures from 2016 to 2022. The number of ski resorts has increased too. As of 2023, there were around 700 ski structures across China and more than 50 indoor ski resorts. One of the most impressive buildings of this kind is the “Chengdu Sunac Cultural Tourism City Water and Snow World”, a massive 367,600 square meters ski resort that opened in 2020 in Chengdu.

Cycling and running stand out as the most popular outdoor activities

Chinese fitness consumers aren’t only attracted to seasonal activities such as skiing, but they are also keen on practicing year-round sports such as cycling and running. In 2023, around 17% of the fitness enthusiasts approached these types of outdoor activities. In particular, cycling is becoming a very popular sport among consumers. In 2023, the bicycle market in China reached a revenue of more than RMB 210 billion (USD 29.5 billion), with a year-on-year increase of 3%; and there was a year-on-year increase of 40% in cycling merchandise transactions from January to August 2023. Moreover, cycling enthusiasts train for about 1.9 days per week, showing a great commitment to the sport they are practicing.

In the last few years, running has also become extremely popular among outdoor fitness enthusiasts. From January to August 2023, approximately 35 million people took up running as an everyday training. This activity is very popular among male sporters aged 18 to 25, who consider this activity as a means to strengthen their bodies. Meanwhile, female sports individuals who take up running see it as a faster way to lose weight.

Consumers are shifting to a more personalized fitness experience

Even though more and more people do sports in China, gyms and fitness studios are lately sailing through troubled waters. As of December 2023, there were approximately 69.8 million gym members, reflecting a 2.4% decrease compared to previous figures. There has also been a slight decline in the number of gyms over the years: in 2023, the count stood at around 117,000, down from over 131,000 in 2022. This trend can be attributed to a restructuring within the sector, where only the most competitive players can thrive. Changing consumer habits also contribute to this decline, with more individuals opting for outdoor activities and preferring shorter subscription plans. Furthermore, there has been a shift towards a diversification of fitness activities, with a growing interest in training courses as opposed to traditional bodybuilding and cardio exercises. Additionally, the rising costs of membership fees, which can reach up to RMB 6,000 (USD 833) for an annual plan, further impact the sector’s dynamics.

To face such challenges, many gyms and fitness studios have begun adopting a user-oriented experience, utilizing the “pay as you go” formula. This approach offers consumers maximum flexibility in terms of when and where to train. In recent years, there has been a notable shift towards personal training sessions, particularly among women. Many fitness enthusiasts, as reported on the popular lifestyle app Xiaohongshu, are opting for fitness studios due to their professional environment. These studios often feature highly qualified personal trainers who can provide individualized attention to each customer. With the focus primarily on the individual rather than a group, these sessions allow for more specific and tailored training.

Since the outbreak of COVID-19, more and more consumers have taken into consideration digital fitness

The online fitness market in China experienced a rapid and quite stable expansion after 2020. Indeed, China’s penetration rate reached 41.3% in 2022, compared to 58.1% in the United States. The market is also projected to reach an annual growth of more than 8% between 2024 and 2028, potentially reaching a revenue of around RMB 275 billion (USD 38.2 billion). Fitness apps are doing particularly well in the Chinese fitness market, reaching a combined revenue of almost RMB 800 million (USD 111.1 million) as of 2023, and they are expected to exceed RMB one billion by the end of 2024.

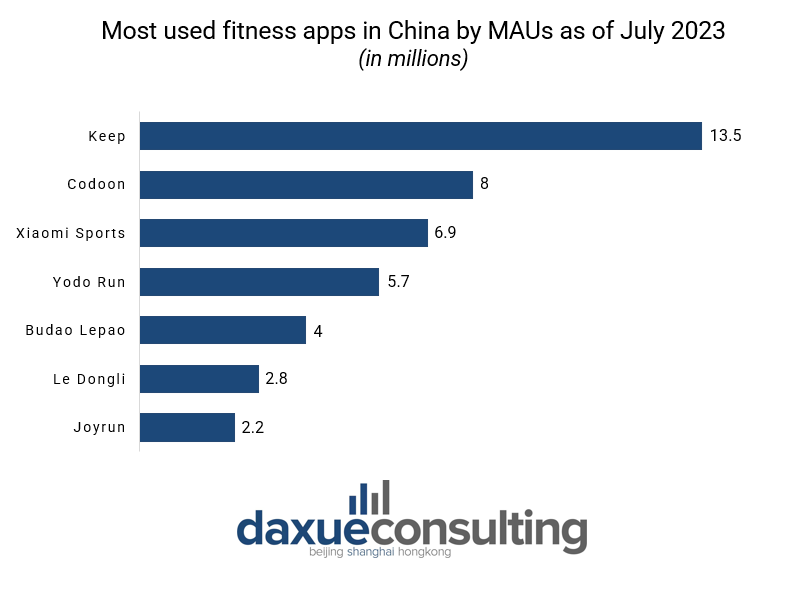

As far as the number of monthly active users (MAUs) is concerned, the Chinese fitness app “Keep” is crushing the competitors. As of July 2023, the Beijing-founded app had more than 13.5 million MAUs, almost doubling the MAUs of “Codoon”, the second most-utilized fitness app.

One of the main reasons why so many individuals have taken up digital fitness is mainly linked to the outbreak of COVID-19 when people searched for new ways to exercise without going out, leading them to fitness influencers and apps. After the pandemic ended, many users still pursued practicing online fitness exercises, partially due to their flexibility and convenience, as they can be practiced wherever and at lower costs than going to a physical gym. As a result, many fitness influencers have emerged offering online tutorials and product advertisements. As an example, Zoey Zhou, also known as “周六野Zoey”, (Saturday wild Zoey), boasting more than 4.3 million followers on Weibo, offers online tutorials and in-person fitness tutoring on Tmall. In addition, Zhou even launched her brand, called “She is a spark” (她是火花), commercializing yoga mats, yoga balls, and resistance bands.

Where there’s a will there’s a way: the fitness “fever” opens up a world of possibilities

- In recent years, the fitness market in China has experienced exponential growth, partially linked to the 2020 Covid pandemic.

- The “fitness wave” has hit particularly Gen Z and Millennials, who engage in healthy activities for stress relief and for having social interactions with other people.

- Chinese consumers are searching for new ways of relaxing while staying healthy. Hence, slow exercises based on respiration such as Tai Chi and Baduanjin are gaining popularity even among younger individuals.

- Many activities in the Chinese fitness market are linked to winter sports, especially after the 2022 Winter Olympics in Beijing. After the event, many indoor and outdoor ski resorts have been opened across China and the skiers’ number has increased significantly.

- Cycling and running are two of the most preferred ways of doing sports activities in the open air.

- Despite the hype for physical exercise, gym and fitness studio memberships in China are declining due to changing consumer preferences favoring outdoor activities and shorter subscription plans.

- Gyms and studios are responding by offering flexible “pay as you go” options and personalized training sessions.

- The COVID-19 outbreak drove a surge in digital fitness adoption in China, with leading apps like “Keep” experiencing significant growth in monthly active users.