China and Brazil have long been looking towards one another, and their relationship took off when they signed a strategic partnership in 1993. Their connection was later underlined when they were named part of the “BRIC” by Goldman Sachs economist Jim O’Neill. However, the trade relationship between China and Brazil began to gain momentum in the early 2000s: China’s increasing demand for commodities, coupled with Brazil’s status as a major exporter of agricultural and mineral products, played a crucial role in fostering trade ties.

Download our report on Chinese Gen Z consumers

The countries also extended their relationship into the political realm. Representing four major emerging economies, Brazil, Russia, India and China created a joint organization in 2006 to collaborate and discuss common interests. Since then, Brazil and China have signed multiple agreements and created closer ties.

With its Belt and Road Initiative, China has become a major investor and trade partner for Brazil. In the past years, China and Brazil’s trade has been on the rise. Since 2009, Chinese products have consistently accounted for the largest share of imports to Brazil, representing 22% of all its imports in 2022. Conversely, Brazil has become a notable exporter to China, contributing 4.4% of China’s total imports, which constitutes 26% of all of Brazil’s exports. It has to be noted that the foreign investments are not just one-sided: Brazil has invested in 277 projects in China, with a contract investment of USD 247 million.

China and Brazil’s trade is pushed forward by diplomatic efforts

Since President Lula’s entering office, the two countries have been growing even closer. In 2023, the Brazilian leader visited China, and rounds of talks were held to find possibilities of increasing mutual trade. As a result, 15 bilateral agreements worth approximately USD 10 billion were signed between the two states.The joint statement pointed out that the two countries aim to deepen cooperation in fields, including poverty reduction, social development, technological innovation, environmental protection, climate change, the low-carbon economy, and the digital economy. The agreements span across sectors such as technology and energy, with the goal of bolstering trade and investment ties between the two nations.

One of the main achievements of the talk was the deal that will enable the two countries to conduct their massive trade and financial transactions directly. Instead of using the dollar as an intermediary, the two sides will be able to exchange yuan for reais and vice versa, which will reduce costs and further promote bilateral trade and investments.

Overall, the deals open up the Chinese market even more to Brazilian products, with the country welcoming key Brazilian exports such as soybean, concentrated soy protein, corn, peanuts, and citrus pulp. An important change on China’s side was allowing Brazil’s Ministry of Agriculture to conduct sanitary inspections, which hugely facilitates the process.

Agricultural products are the core of Chinese imports from Brazil

Brazil is known for its important role in soybean exports, which are crucial for the Chinese economy. This has made the product pivotal in the countries’ trade relationship, with exports from Brazil making up 62% of all soybean imports in China in 2021. Overall, agricultural produce is crucial for China in the countries’ bilateral trade. Soybean products, meat, forest products, sugar and alcohol, fiber and textiles are the main agricultural products exported to China, with a total export of USD 49 billion, accounting for 83.2% of the total agricultural exports.

In addition to five main categories of agricultural exports, Brazil also sells cocoa, coffee, grains, juice, animal feed, oil, tea and other products to China. Among these, coffee and juice take up larger shares. Coffee exports were USD 86.2 million, while juice exports amounted to USD 95.1 million. This comes at a time when coffee is enjoying growing popularity in China: in recent years, coffee sales have skyrocketed in the country. The countries are also working on raising fruit exports from Brazil to China, especially lemons, melons, grapes. All this promises further opportunities for Brazilian trade.

Brazilian companies are indeed optimistic about the opening opportunities. Suzano, a pulp manufacturer based in Brazil, entered the Chinese market in the 1980s and now has grown to become one of the world’s largest in this field. The firm sees China not just as a booming market, but as a high quality market. It also offers many possibilities for innovation, and Suzano hopes to make use of them by setting R&D centers in China’s innovation hubs. The firm also focuses on promoting sustainability, which aligns with main market trends.

Natural resources strengthen the trade between Brazil and China

As a major global economy, China places a high priority on securing access to essential natural resources. This brings the two countries’ interests closer, because Brazil is a major exporter of iron ore and energy resources. Iron ore is the largest category of Brazil’s exports to China, making up 33% of total exports by value, slightly more than the total exports of agricultural products. The third most-exported category is crude petroleum, amounting to 16%, after agricultural products.

Vale, the main mining giant, has been working with China for decades and has been part of the bilateral talks held in the spring of 2023. The company is expecting further growth of its sales, and is also working on sustainability and improving the quality of products to better fit the demand. Petrobas, Brazil’s state-owned oil company, has also engaged in partnerships and export agreements with China, has set to extend partnership with China in the energy sector and collaboration in research in oil exploration and production.

Can smaller Brazilian companies trade with China?

Smaller companies are seeing opportunities open up in the market too, with Chinese consumers showing growing interest towards Latin American products. Chinese e-commerce giants have promoted this by creating more opportunities for sales of Brazilian products.

To coincide with the Brazilian leader’s visit to China, JD.com announced its launch of a Brazilian e-commerce week. The week-long promotion showcased more than 80 featured products such as wines, liquors, maté tea, coffee beans, and Acai berry powder. They were offered at promotional prices to attract consumers throughout the themed sales week, with sales growth rising by 5 times compared with the previous week.

Moreover, Alibaba has been looking into promoting Brazilian products in the Chinese market. The company is planning to train Brazilian merchants to effectively enter China, teaching them techniques in digital marketing and video production to showcase products considering the specifics of the Chinese market. This would allow more local Brazilian producers to export directly to China.

Chinese social media users’ awareness of Brazilian brands

At the moment, Chinese consumers are not yet widely aware of Brazilian brands. Social listening shows that Weibo posts demonstrate much more interest towards the topic of football rather than imported products. However, acai, coffee and tea are occasionally mentioned by users. JD.com’s Brazilian week also sold other Latin American countries’ products, too, due to a broader demand than usual. Still, it can be seen that strong efforts are made to increase trade with both small and larger companies from Brazil.

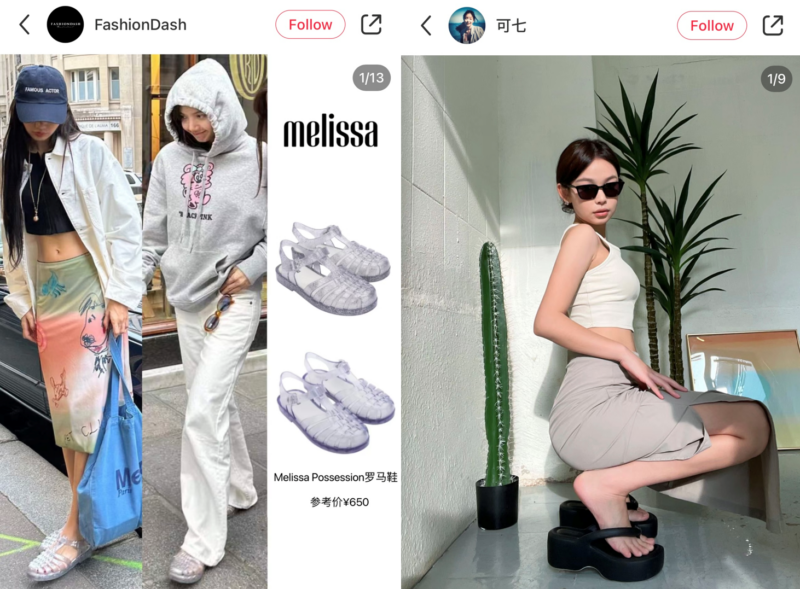

Apart from food and beverage products, Brazil is known for its summer shoe industry. Indeed, Brazilian shoe wear is attracting Chinese consumers’ interest. The classic, Havaianas, have been expanding in Asia for years, but still enjoy interest from Chinese users online. Currently, the brand’s Weibo account is not very active, while on Xiaohongshu, users are showcasing their stylish outfits paired with the brand’s flip flops.

A newer player, Melissa, has successfully tapped into a diverse segment of the shoe market. This Brazilian brand specializes in rubber footwear and has gained attention by offering playful and distinctive styles that align with current market trends. Melissa has taken an active approach in promoting its products on Weibo and is gaining significant consumer engagement across various Chinese social media platforms. On Xiaohongshu, numerous users are showcasing Melissa’s distinctive footwear by incorporating them into their everyday outfits. It’s worth noting that while some consumer reviews express discomfort with Melissa’s products, the brand’s versatile and unique designs continue to attract a growing consumer base.

The main trends in China and Brazil’s trade

- Brazil and China are actively developing their political and economic relationship, with a number of bilateral agreements having been signed in 2023.

- The main categories of imported products are agricultural produce and natural resources, which China needs for its growing economy.

- Big Brazilian companies are seeing a lot of possibilities in the Chinese market.

- Although small companies have yet to uncover the market, bilateral efforts are made to allow more local Brazilian producers to trade with China.