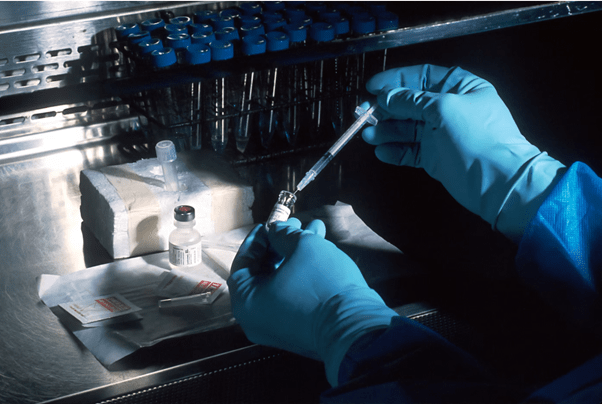

A biopharmaceutical, also known as a biological medical product, refers to any medical drug manufactured in, extracted from, or semi synthesized from biological sources and produced using biotechnology. The biopharmaceutical market is one of the most innovation-intensive industries in the world, investing a great share of capital into research and development compared to any other industry.

While its healthcare market in general continues to grow rapidly, China’s biopharmaceutical market is still relatively small compared to global players. Beijing has recognized the need to grow the industry in its ‘Made in China 2025’ plan. Today’s Chinese biopharma firms offer a significant opportunity for multinational and foreign companies. By closely examining how China’s biopharmaceutical market is developing, multinational companies (MNCs) can strategize how to optimize the country’s growth and innovation for their own business success.

China needs biopharmaceuticals more than ever

Faced with a quickly ageing demographic, China has become the world’s second largest biopharma market, with growing demand for treatment against cancers, diabetes and cardiovascular diseases. Moreover, some cancers such as gastric and oesophageal, and diseases such as hepatitis B are more common in China than in the West, and thus has not received the same level of attention from foreign MNCs.

More funding is available for biopharmaceutical R&D in China

There is an increasing amount of available private capital via PE and VC firms to invest in R&D in China. The National Natural Science Foundation of China and government grants fuel PE firms, and China is currently only second to the US for highest funding globally. Pharmaceutical companies listed in the mainland and Hong Kong exchanges show higher valuations than those on US exchanges, which attract more public investments for R&D. For example, top pharmaceutical products distributor, Sinopharm Group Co Ltd, raised $1.13 billion for its Hong Kong IPO in 2009, and has also recently come into the global limelight for its Covid-19 CoronaVac vaccine. This means the Chinese biopharma firms can obtain capital easily and cheaply.

Innovation boom for China’s biopharmaceutical market

Ten years ago, virtually all Chinese drug development was centred around generics – cheap copies of branded drugs. However, China has seen a push in innovation for Chinese drug development and now the industry is focused on numerous new products and technologies. There are three waves of Chinese innovation.

The first innovation wave triggered around the start of the 21st century, when much attention from innovative Chinese biopharma firms was on quickly catching up with me-too and me-better drugs. As this innovation wave continues, the focus is moving more toward me-better products. The competition among fast followers in China has resulted in a reduced time in Chinese drug development between global first-in-class and fast followers. Three main factors have allowed China to reduce this time gap. Firstly, Chinese biopharma firms are developing compounds earlier in the timeline. Secondly, Chinese drug development has become a swifter process through streamlined approval timelines. Thirdly, Chinese biopharma firms can conduct trials quicker due to more sophisticated trial recruiting and execution systems.

Combo therapies and novel antibodies

The second innovation wave occurred around the beginning of 2016, which saw a growing number of activities in original indication expansion, combo therapies, and novel antibodies. For example, three original indication expansions have been discovered in oncology, and most particularly, in areas with high unmet needs: nasopharyngeal carcinoma, advanced hepatocellular carcinoma, and advanced oesophageal squamous cell carcinoma. In addition, local pharma focuses more on combos with mature mechanisms of action which have more than one targeted therapy and usually chemo. China has exerted increasing efforts on the forefront for novel antibodies too; among the 13 bispecific antibody combinations China is presently researching, 10 have succeeded reaching the advanced stage and some even on par with worldwide standards.

The third innovation wave is still at a very early stage. It involves entirely new mechanisms of action and innovative technologies. Activities of the third wave focus on cell therapies and gene editing, which has benefited from the support of regulators. For example, academic professors and hospital principal investigators have been collaborating on clinical trials with gene-editing technology CRISPR (clustered regularly interspaced short palindromic repeats).

Challenges foreign firms face when operating in China’s biopharmaceutical market

While it is true that China is striving to transform itself into a global powerhouse in biopharmaceuticals, its policy measures are inherently ‘innovation mercantilist’, including weak IP protection, biased drug approvals, severe price controls, and import restrictions. Such measures threaten a slowdown in the innovation of global life science, with negative consequences for cures and medicines. The Chinese government unfairly supports and favours indigenous drugs and biopharma firms at the detriment of more innovative foreign firms.

Another entry strategy for MNCs in China’s biopharmaceutical market

China represents a great opportunity for MNCs since it is the second largest biopharma market with an ageing demographic holding specific medicinal and therapeutic needs. However, given the favouritism from Beijing on Chinese biopharma firms, it would be wise for an MNC to consider an indirect approach to market entry. This could be in the form of partnering with local R&D via joint ventures and alliances. Other options include establishing incubators for local firms to develop and test, or perhaps even to leverage products from local firms into the global spotlight.