Due to the traditional notion that oral hygiene is a minor issue and the lack of oral care knowledge in China, oral problems and diseases are quite common among Chinese people. According to the Fourth National Oral Health Epidemiological Survey in 2017, the prevalence of oral caries among 5-year-old children in China was around 71.9%, an increase of 5.8% as compared to ten years ago due to the increased consumption of food and drinks that are high in sugar.

Despite the prevalence of oral problems in China, people are increasingly becoming aware of oral health, especially among younger generations like Gen-Z. According to the Oral Health Epidemiological Survey, 60.1% of the respondents have a fair knowledge of oral care. Moreover, the growing importance of oral health care was written into the healthy China 2030 blueprint, which underlined the accelerating development of the oral care-related industries to achieve the goal of enhancing the overall oral hygiene of Chinese people, such as reducing cavity rates down to 25% among 12-year-olds.

The increasing awareness of oral care issues among Chinese people is stimulating the growth of the oral care industry in China in recent years. Therefore, it is important to have a deeper understanding of the status quo of China’s oral care market to better cater to the oral needs of Chinese consumers to grasp the opportunities in the growing market of oral health care in China.

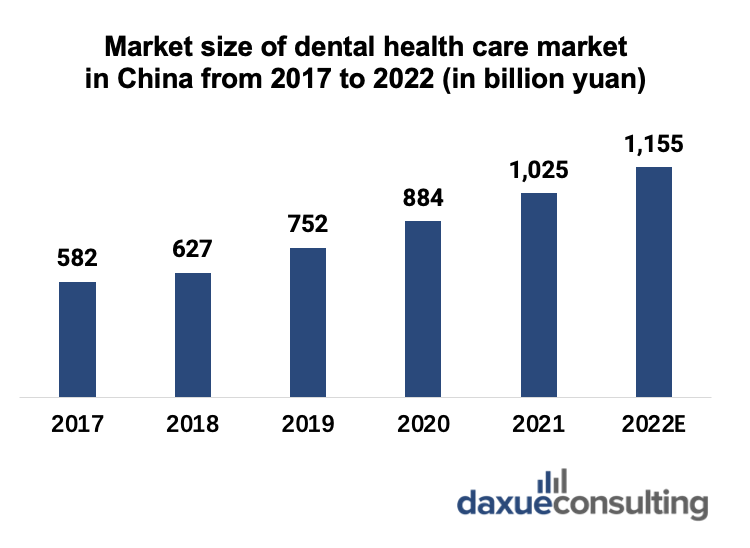

The oral health care market in China is growing rapidly

The oral health care market in China is showing steady growth since 2017. As the saturation rate of oral health products increases, the market size of the oral health care market in China is forecasted to reach 1.2 trillion RMB in 2022, which will be doubled from the number in 2017.

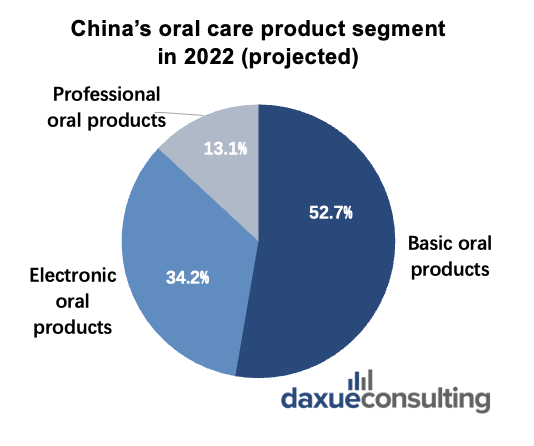

Overall, China’s oral care products can be divided into three segments. Most oral care products in the Chinese market now fall into the basic category, which includes basic oral care products for both children and adults, such as traditional toothbrushes and toothpaste. However, Chinese consumers are increasingly looking for advanced oral care. Therefore, although basic oral care products still take up 67% of the total sales of oral care products in 2020, it is forecasted to decrease to 52.7% of the market share in 2022 as the sales of other product categories keep increasing.

Secondary to basic oral care products are electronic oral products, such as electronic toothbrushes and electronic water flosses. This segment shows strong growth and therefore is projected to increase from 22.6% in 2020 to 34.2% in 2022.

Last but not the least, professional oral care products, including mouthwash, tooth strips, and mouth spray, are also seeing growth, whose market share is also projected to increase in 2022.

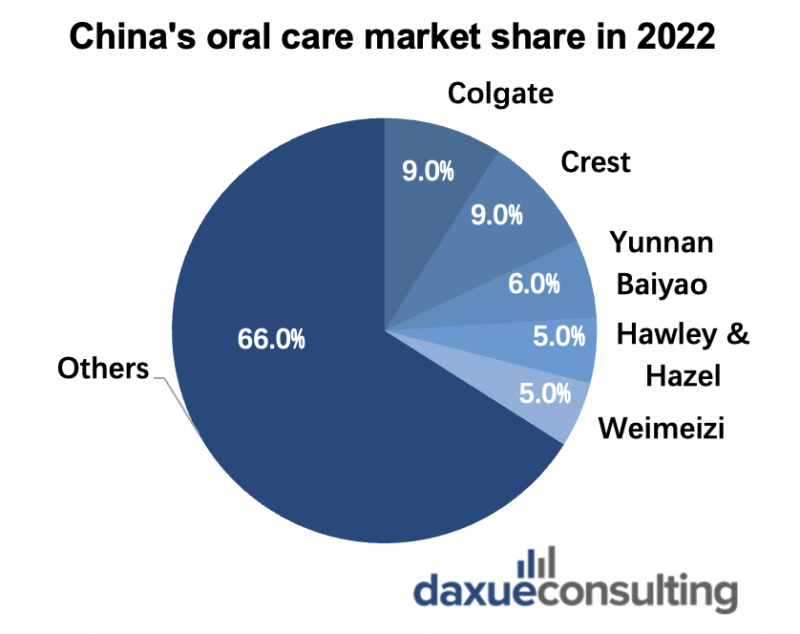

China’s oral care market is fragmented

As mentioned above, basic oral care products, mainly toothpaste and toothbrushes, are an essential part of Chinese people’s daily oral care routine, taking up more than half of the oral care market share. When it comes to toothpaste, there are usually a variety of options in the supermarket for Chinese consumers to select. According to Sensingasia, Chinese people from high-tier cities like Beijing and Shanghai are very specific preferences about their toothpaste. Therefore, China’s oral care market is highly competitive and fragmented in the sense that there are multiple key players in the game.

New players are stirring up the competition

The shift of consumer interests from basic to advanced oral care products pushes traditional players to explore more possibilities in the oral care field. Traditional brands like Yunnan Baiyao and Hawley & Hazel are providing consumers with a variety of oral care options from mouthwash to dental floss other than their signature toothpaste product lines. On Yunnan Baiyao’s Taobao store, consumers can easily find professional products like probiotics mouthwash for advanced oral hygiene.

Apart from traditional players like Colgate, Crest, and Yunnan Baiyao, new brands are entering the market in recent years, which further accelerated the competition in the oral care industry in China. These new entrants in the oral care market in China are usually committed to one product category.

Usmile, founded in 2015, is focused on electronic toothbrushes. By July 2022, Usmile has over 1.4 million subscribers on its Taobao flagship store alone. According to the evaluation initiated by the China consumers’ association in 2021, Usmile ranked 1st in terms of cleaning effectiveness, noise level, and battery capacity.

BOP (波普), established in 2018 and received over 10 million RMB founding a year after, provides plant-based oral products, targeting consumers aging from 25 to 35 that are looking for vegan and cleaner options.

Key takeaway of the dental market in China

- The oral care market in China is far from saturated and is showing rapid growth with the support of relevant policies and the increasing awareness of the importance of oral hygiene among Chinese consumers.

- Chinese consumers are inviting advanced oral products in their daily routine, which brings more opportunities to the industry.

- The shifting interest in consumer behavior invites newcomers to the oral care market in China and challenges existing players to innovate to meet the diverse demands of Chinese consumers.