Created as a way to prevent decomposition and facilitate the transportation of food, the cured meat market in China preserves an age-old tradition. In 2023, it reached a revenue of more than RMB 61 billion (USD 8.4 billion) and is expected to have a year-on-year increase of 8% by 2024. Cured meats are more than just products, they represent a way to express Chinese people’s cultural heritage. Across the country, many areas have their way of producing and consuming cured meat, which can depend on the way of preservation or on the animal itself. More specifically, Chinese people address two different names to the preserved meat: “腊肉” (larou) if it’s pork, and “腊味” (lawei) if it’s every other kind of animal.

Download our China F&B Industry White Paper now

WH Group and beyond: domestic players lead the cured meat market

Domestic companies dominate the cured meat market in China. Indeed, the country hosts many of the world’s biggest cured meat producers. For example, WH Group Limited (萬洲國際) is one of the biggest food processing companies in China, particularly famous for producing hams, bacon and sausages. As of 2023, the company boasted more than 90 production plants spread all over Europe, Asia, and America, and had a revenue of around RMB 190 billion (USD 26.2 billion). Another example is the “Shandong Jinluo Enterprise” (临沂新程金锣肉制品集团有限公司) which, however, is not at the same level of WH group; in 2023, the company reached a revenue of RMB 33.2 billion (USD 4.5 billion).

Non-domestic companies are finding other ways to succeed in the cured meat market

Many foreign companies have tried to reach the same success as the Chinese cured meat giants but with negative outcomes. For instance, the US meat manufacturer “Tyson Food” (泰森食品) is one of the few companies in the cured meat market in China that is not a homegrown player. As of August 2023, the company reached around RMB 7.9 billion (USD 1.1 billion) in annual net sales. However, the company’s popularity is slowly fading because it could not keep up with the fierce competitors. As of August 2023, the company divested a total of RMB 60.7 billion (USD 8.4 billion), and plans to sell the entirety of its poultry business, which was the strongest sector of the American group in China.

Importations of Spanish ham are getting stronger in the Chinese market

Despite the cured meat market in China mainly relies on self-production, imported products have gradually carved out their niche. Many foreign products, such as imported European meats, are considered luxury items that not everyone can afford. The main example is the Spanish ham or “jamón ibérico”, which is becoming increasingly more popular among Chinese consumers. In the first half of 2022, its importations increased by 239% compared to the previous year. Furthermore, in January 2024, the International Association of Iberian Ham (ASICI), organized the project “伊比利亚火腿,欧洲世界大使项目” (Iberian Ham, European world ambassadors) for the 3rd year in a row. The initiative consisted of promoting the Iberian ham across China and consolidating its label as one of the finest cured meats in the world. The Spanish ham is also popular on Chinese social media. As of April 2024, the hashtag “#西班牙火腿#” (#Spanish ham#) has more than 8 million views on the platform Weibo. Apart from Iberian ham, European cured meats’ relevance is also rising in China. In July 2022, the European Union organized an event to promote the quality of pork meat in China and enhance its importation, called “欧洲猪肉,从农场到餐桌的卓越品质” (European pork, excellent quality from farm to table). The event became very popular among social media platforms like Weibo, and some videos garnered more than 210,000 views as of April 2024.

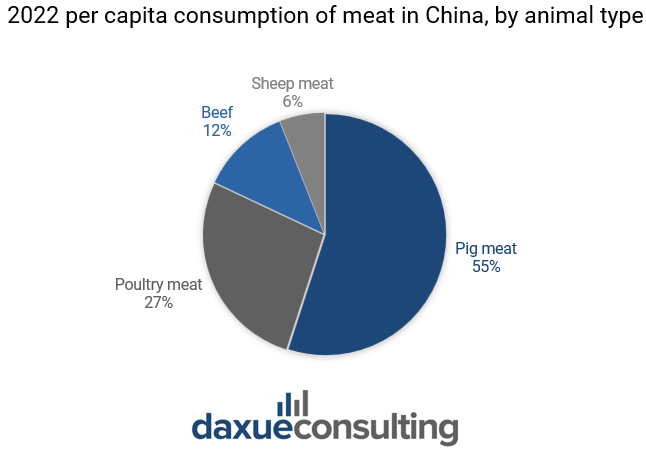

The consumption of pork meat is unmatched in China

Pork represents more than 60% of the total meat consumption as of 2023, making it a very popular product in every Chinese people’s diet, and the trend is increasing year on year. One of the main reasons why pork is more popular than any other kind of meat relies on its price. Indeed, as of March 2024, a kilo of pork meat is priced at a range from RMB 20-30 (USD 3-4), whereas a kilo of beef can cost up to RMB 50 (USD 7). Therefore, there are more specialties based on pig meat, for example, pork sausage, ham, and bacon.

Cured pork meat is the essence of Chinese traditional cuisine

Chinese consumers’ enduring love for pork has nurtured a rich tradition of preserving and smoking this meat. Pork sausages (腊肠), a beloved delicacy, hold a special place in the diets of many, particularly in southern China. Production and seasoning techniques vary across regions, adding to the diversity of flavors and textures enjoyed nationwide. In 2022, the domestic sausage market reached a revenue of more than RMB 1.8 billion (USD 248.7 million), with a production volume of around 200 million tons. The art of creating smoked sausages is so popular in southern China that, since October 2022, the cured meat of Huangpu, Guangdong province, was entitled “intangible cultural heritage”.

Chinese ham is so popular that struggles to keep up with the demand

Jinhua ham (金华火腿) is another Chinese delicacy mainly produced in the city of Jinghua, situated in the Zhejiang province. It has a millenarian tradition in the Chinese culture, produced since the Tang dynasty in 907 C.E. In 2023, more than 30,000 hams were produced in Jinhua. The scarcity of yearly ham production is primarily due to the exclusive breed of pigs known as “两头乌” (“Jinhua pigs” or “two-headed pigs”), which necessitate high costs for rearing and a lengthy period before they are suitable for butchering. Despite being very popular among Chinese consumers, this cured meat is banned in some countries such as the US because it doesn’t follow the strict health and safety guidelines of the U.S. government concerning production and transportation.

More than just cured meat: bacon became the expression of a cultural heritage

With a market revenue of around RMB 19.4 billion (USD 2.6 billion) in 2022, bacon is one of the most appreciated cured meats in China, especially in the southern regions such as Sichuan, Guangdong, and Hunan. In particular, the cured meats of Chengkou, in the Sichuan region, have become very popular inside and outside China. In 2007, the process of preparing this product was nominated intangible cultural heritage of Chongqing due to its unique processes of farming, butchering, and marinating pork meat. As of 2023, this business reached RMB 800 million (USD 110 million) in revenue.

Larou is particularly popular in festivity periods such as the Chinese New Year. In this time in 2023, the demand for this cured meat grew by 60%, posing challenges for cured meat manufacturers in matching demand, due to its long smoking time and the low number of certified producers. As an example, the entirety of Chengkou cured meat manufacturers produced only 500 tons of Larou in 2023. Therefore, Larou is such an exclusive product that the Sichuan restaurant chain “Meizhou Dongpo” (眉州东坡), which has more than 120 restaurants worldwide as of 2024, pays tribute to the heritage of this cured meat by putting it on the menu only once a year, during the Spring Festival.

Not every cured meat: the quality for consumers is very important

Despite the cured meat market in China mainly depends on self-production, consumers are also becoming more aware of the quality of imported bacon, especially as far as artificial ingredients, such as additives, are concerned. Moreover, the Chinese government enforced many rules concerning the import/export of these products and the sustainable production of cured meat. As an example, in May 2023, the Chinese government stipulated an agreement with the French Ministry of Agriculture about the importation of cured meats in the country. The pact enforced stricter rules concerning the production and the safety of these products, introduced quarantine for French pork meat, limited the use of nitrites for the conservation of the meat, and allowed the exportation of this food only for the companies that are registered in China. Moreover, in December 2021, the Chinese government released the “14th 5-year cold chain logistics development plan”, in which the authorities implemented many regulations concerning cured meat production, transport, and sale to preserve the quality of the meat even if it’s shipped across China.

The cured meat market shows deep roots in Chinese culture

- With a revenue of more than RMB 63 billion as of 2023, the cured meat market in China represents the backbone of the country’s meat industry.

- The market is mainly dominated by domestic cured meat industries, which also had a wide expansion worldwide. Foreign players aren’t very popular, and some are also exiting the sector due to the fierce competition.

- In recent years, the import of many European luxury cured meats such as the Spanish ham are increasing due to their uniqueness and refinement.

- Sausage and ham are two of the most popular cured meats in China, and every region of China has its preparation and consumption methods. Their culture is stronger in the southern parts of the country.

- Bacon is a symbol of the Chinese traditional heritage. In 2007, Larou became the immaterial cultural heritage of Chongqing, and more and more restaurants have started to serve exclusive dishes with this cured meat as the main character, especially during festivities like the Chinese New Year.

- Chinese consumers are increasingly more health conscious and prioritize quality, inducing manufacturers and the government to improve their standards.