Over the last decade, veganism became increasingly popular in the West, which has led to the rapid development of meat alternatives. However, imitation meat, which is sometimes seen as a healthier substitute for animal meat, is not a new concept, especially in China. With the rising health-conscious among Chinese consumers, the plant-based meat market has shown great potential for growth.

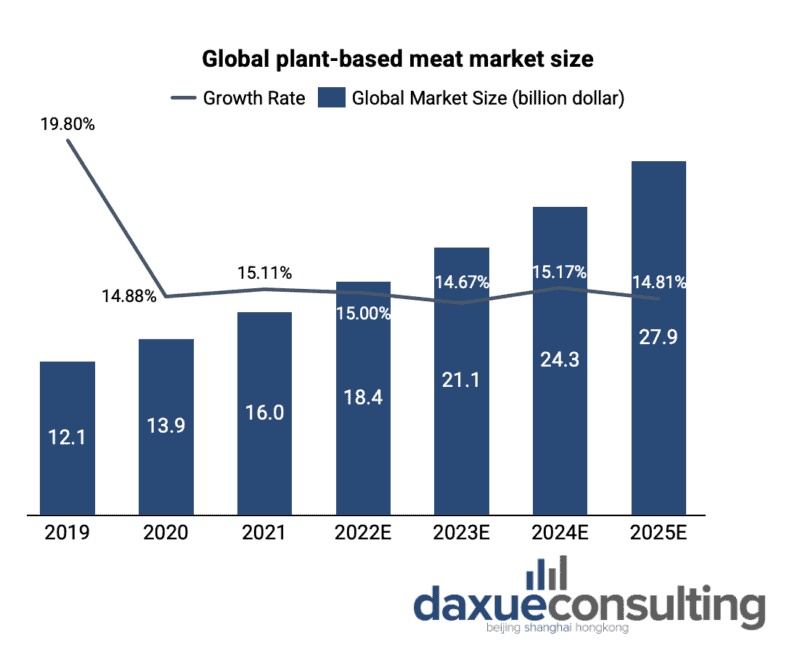

The global plant-based meat industry was valued at 16 billion USD in 2021, with a projected CAGR of 15% by 2025. Despite some European countries and the US showing faster growth, China currently represents 53% of the global meat substitutes industry, in comparison to the US at only 5.5%. China’s plant-based meat market has a forecasted market size of 1.44 billion USD (9.69 billion yuan) and a predicted CAGR of 16.6% by 2025.

Despite the small population of vegans and vegetarians in China, at around 5%, the country is, in fact, a major plant protein exporter and processor. Combined this with its unsaturated market has allowed Chinese plant-based meat start-ups to benefit from a cost advantage. However, the Chinese substitute meat industry still faces some hurdles – as most producers and distributors are Western-based, logistics issues have arisen, the extra regulatory approvals regarding import food ingredients, along with the legal framework for vegan meat in China are still in its’ infancy.

So what are the determinants of the growth of the Chinese plant-based meat industry and how can it avoid supply issues?

Health concerns push for lower meat intake in China

Although there are more and more people eating vegan in China, only a small percentage of the Chinese population are identified as vegan or vegetarian, which is also relatively low in Asia, especially compared to nations like Vietnam or India.

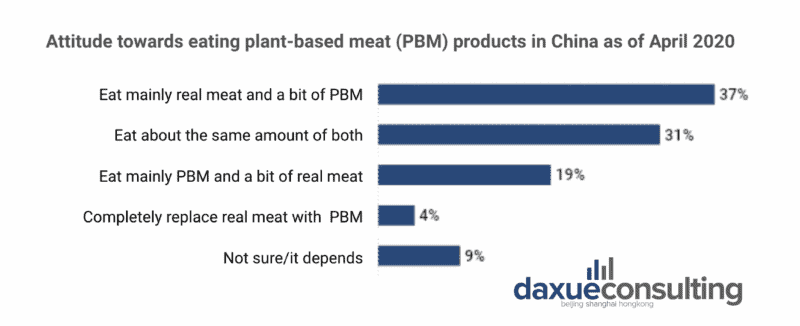

Nevertheless, consumption of substitute meat in China is on the rise as even non-vegan or vegetarian Chinese people are open to trying plant-based meat. According to Good Food Institute, 86.7% of surveyed people consume plant-based meat products despite over 90% of them not identifying as vegan. This high penetration rate among non-vegan consumers being interested in meat alternatives is both cultural, as the Chinese “meatless” meat culture existed since the 6th century, and more importantly, Chinese people believe sustainable food is healthy, aligning with the ever-growing health-conscious in China. Likewise, “flexitarian” is a preferred concept to describe Chinese people’s diets, which are not fully committed to neither veganism nor vegetarianism but are willing to reduce their meat consumption due to cultural factors and health concerns.

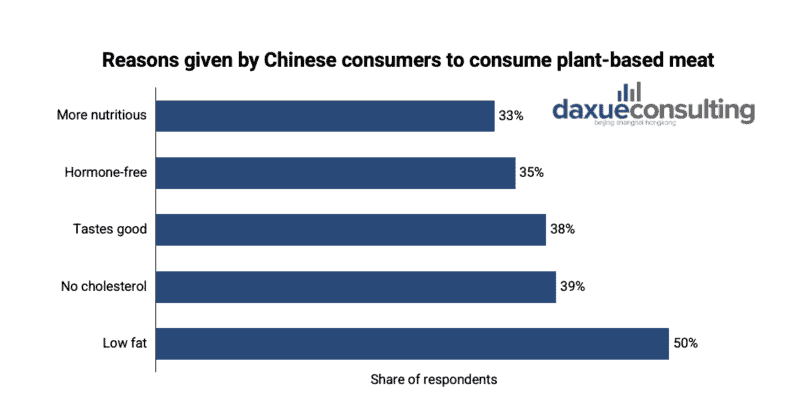

In times when China had less food security, meat was treated as ‘the more the merrier’. However, as times are changing, younger Chinese reduce their meat intake majorly for health and weight concerns, such as consuming low-fat, no cholesterol, higher nutrient level, and hormone-free products. On the other hand, some of the consumption of plant-based meat in China comes from wealthier consumers who want to eat what they consider to be healthier, safer, and more environmentally friendly products.

The largest suppliers of vegan meat are located outside of Asia

Today, the biggest producers and suppliers of alternative meat are situated in Europe and North America. While these companies have factories across the world and Asia is certainly no exception, logistical issues may and have resulted in bottlenecks leading to product shortages.

Impossible Foods, one of the market leaders in the substitute meat industry, bases its products on soy protein, of which, half of the worldwide production is made in China. Nevertheless, Impossible Foods requires APAC suppliers to avoid shortages. Furthermore, the plant-based meat company needs extra regulatory approvals from China as its products contain heme (a molecule that impairs meat flavour) and soy protein. This regulation process was announced by Impossible Foods CEO Pat Brown in November 2021, but no further updates have been published so far. Therefore, the barrier to entering the Chinese plant-based meat market remains.

On the other hand, Beyond Meat, another market leader, is better poised to take on the Chinese market. One of its main suppliers is the pea protein Chinese giant, Shuangta (双塔), with whom they signed an 85% pea protein sales contract. Beyond Meat went even further by opening its first Chinese production plant near Shanghai. By opening this new facility, the company aims to improve the efficiency of distribution and the cost structure of operation.

Beyond Meat also collaborated with other F&B restaurants in China, such as KFC, to offer customers more sustainable and diverse protein choices. For instance, the Beef Wrap, one of the most demanded items in KFC China, is now available with plant-based meat filling. The partnership was quite favourited by Chinese customers as 2.5 million vegan KFC products were sold in 2021. Similarly, Beyond Meat also partnered with Starbuck in April 2020, offering a new product line named the “Plant-diet series” (植物膳食系列). These partnerships with well-known brands in China have provided Beyond Meat with a steppingstone to grow in the vegan meat market in the nation.

The growing domestic brands in China’s alternative meat market

While US-based Beyond Meat and Impossible Foods have been very successful in creating plant-based ground beef for burger patties, China-based providers have focused on pork innovations, which is actually a better fit for Chinese cuisine as pork is a more favoured and demanded meat of choice in China. 23.7% of meat consumption in China is pork and only 4.1% is beef, whereas 26.1% of meat consumption is beef in the US. The differences in demand are also related to economical reasons, as pork is relatively cost-efficient to produce and purchase, as well as due to Chinese culture where pork was historically associated with health and wealth. Thus, domestic brands have been developing plant-based pork products instead of beef. Over the past years, numerous plant-based raw ingredients providers have sprung up in China, thanks to technology that engineers tastes and textures resembling meat.

Z-Rou, a domestic plant-based pork producer, sources all of its ingredients locally, with a goal to be recognised as a local plant-based meat brand. Z-Rou sources its soy from China’s northeast region and coconut oil from Hainan.

Qishan Food (齐善食品), a 26-year-old brand, has been the most popular among other Chinese plant-based meat brands. The brand has developed over 300 plant-based products with a focus on Chinese cuisines, such as plant-meat rice balls and plant-oyster sauce. The brand runs over 200 direct storefronts and 34 distributors across China. Its mature distribution channel and Chinese cuisine products have allowed Qishan Food to stand out from the rest.

Another growing player, Baicaowei (百草味), has launched its new product line – New ‘Meat’ Time (新‘肉’时代) in March 2020, specializing in plant-based meat snacks which include spicy sausage and beef. The brand specifically targets younger consumers between the age of 18 to 35, who sees snacking as a social activity but are afraid to gain weight. Meat snack is a popular snack category in China, as a result, alternatives such as plant-based meat are considered healthier. These plant-based meat snacks also differentiate from its original players which are usually frozen, instant, and semi-prepared foods.

Plant Professor (植物教授), a start-up brand in 2020 that sells plant-based dumplings. Plant Professor targets young Chinese females aged 18 to 30 who are conscious of their calorie intake. Its dumpling product has only 300 calories, which is half the calories of a standard meal of 600 calories.

La Mian Shuo (拉面说) – a popular instant noodle brand, collaborated with Vesta Food’s brand, HUICUI, to introduce a plant-based pork option. This was one of the top-selling products on Douyin (Chinese TikTok), achieving 60k in sales from a single Livestream on April 16, 2020.

The Chinese legal framework around alternative meat is still in its infancy

As of 25th December 2020, the Chinese Society of Food Science and Technology released the Group Standard for Plant-based Meat Products (植物基肉制品), stating a clear definition of plant-based meat, as well as packaging and labeling specifications. This legal framework provides opportunities for the plant-based meat industry in China as they have officially been accepted by the government and policy. However, this could pose threats and challenges to the animal-meat industry as plant-based meat squeezes into the market and overtakes market share.

Since 2019, the development of substitute meat in China is supported by legislation, aiming at developing the Chinese soybean industry as well as the 14th Five-Year Plan which highlights carbon neutrality measures. Despite the growing plant-based meat market in China that could aid the Chinese government to achieve its emission goals, it is worth noting that the environmental impact of reducing meat consumption is relatively smaller. In comparison, the energy industry has a significant negative impact that contributes to over 78% of global gas emissions. On the other hand, the meat transformation to plant-based has a bigger influence on reaching the goal of reducing meat intake.

The future of China’s vegan meat market

The plant-based meat market will continue to grow as it is not a temperate trend.

Thanks to the wearable technology in healthcare (such as the Apple Watch & Fitbits), China’s Health Plan, and online fitness trends, the ever-growing health awareness of Chinese consumers is likely an ongoing trend that will continue to boost the consumption of plant-based meat. Furthermore, the flexitarian diet, as not being fully committed to vegan but being open to meat alternatives for the purpose of reducing meat intake, is also likely to drive market growth. These trends, along with the demand for “healthy”, “low-calorie”, and “low-fat” products, which are forecasted to increase by 200% in 5 years from 2021, together further create growth in China’s plant-based meat industry.

Chinese netizens debating the topic of ‘whether plant-based meats are healthier’

On the other hand, the tagline of #whether plant-based meat is really healthy?# has received over 120 million views on Weibo, where Chinese netizens discuss the concerns around the safety and higher prices of plant-based meat. Many Chinese people remain skeptical, some even felt disgusted by plant-based meat. In fact, these discussions and concerns mainly involved demographics aging 35 or above, who tend to be more price-sensitive and are described as a “late adaption group”.

To gain better access to the Chinese plant-based market, the supply chain plays a key role in cost reduction, and thus attracts price-sensitive groups. The self-built factories, for instance, have more flexible control over production to quickly respond to market demand and meet the emerging trends of Chinese consumers. This also helps build a stable and reliable supply chain to modify the cost structure and achieve stronger price competitiveness in the market.

The limited volume of domestic soybean production is forecasted to disrupt the supply chain of the plant-based meat market.

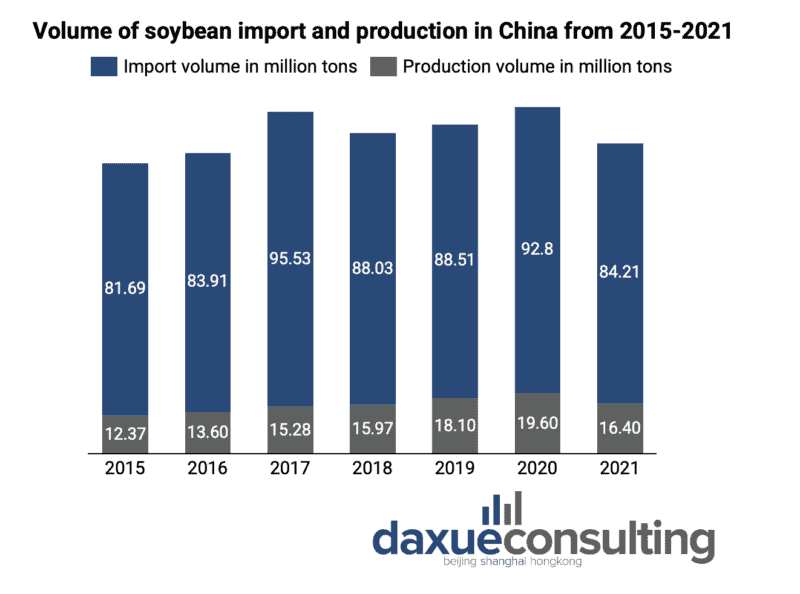

Although the market of plant-based meat will continue to grow, more concerns have been raised from the supply side. Soybeans, one of the most commonly used ingredients for plant-based meat, are facing limited production in China. In 2021, the number of imported soybeans in China reached 84.21 billion tons, which is five times more than its domestic production. One major reason is due to the costs of soybeans, with domestic production costing at 846.9 USD (5,700 yuan) per ton, compared to imported soybean which costs 475.5 USD (3,200 yuan) per ton.

China’s heavy dependence on imports of soybean leads to higher potential risks for current market players since the trade war between US and China continues to limit the imports of soybean and is likely to create shortages. On the other hand, the stringent zero-Covid policy will continue to affect import activities as extra screening and disinfection are required, especially for regions with larger outbreaks of Covid cases.

Under these circumstances, companies are likely to produce and use domestic soybeans, which are more costly compared to imported ones. As a result, the disruption of the supply chain will lead to a higher price of plant-based meat that is adverse in terms of penetration rate and market access. To restrict the long-term influences, companies with better abilities to improve the supply chain are more likely to stand out from the rest, as one solution can be collaborating with domestic farmers, who offer bargained prices and high-quality soybeans.

Key takeaways of the vegan meat market in China

- China’s plant-based meat market is one of the largest markets and represents over half of the global market size.

- The industry benefits from a relatively high penetration rate as most Chinese consumers are willing to try plant-based meat even if they are not vegan or vegetarian or are engaged in a “flexitarian diet”.

- Among a growing demand for healthy products, vegan meat in China positions itself as a “healthy” meat substitute.

- While most producers and suppliers of plant-based meat are foreign, domestic brands are also booming – as one of China’s main focuses of vegan meat is on pork innovation, which is a staple element of Chinese cuisine.

- Legislation in China around plant-based products is still very new.

- However, as the country pushes goals toward sustainability, the industry is expected to benefit from future government incentives.

- There are risks in supply chains due to the disruption of imported soybeans and the limit of domestic production.