Despite the perception that the COVID-19 outbreak is a distant memory, it continues to significantly impact the daily habits and preferences of individuals even today. According to the Online leisure in 2022 report, which focuses on snacking trends in the post-pandemic era, there has been a consistent and substantial rise in online snack sales in China, totaling a 29% increase over three years. Additionally, due to the increased amount of time spent at home compared to pre-pandemic times, 40% of consumers have reported an increase in their snack purchasing frequency. Currently, people are prioritizing their leisure activities at home, with snacking being an integral part of this new lifestyle. Following the statistical data from 2021 with an exclusion of some categories consumers’ demand for snack food reached RMB 488.4 billion, with a specific emphasis on healthy snacks.

Download our report on the She Economy in China

Chinese cultural glance through the snacking patterns

Consumers’ needs and attitudes towards snacks have shifted, as evident from the increased significance of snacking for various purposes such as indulgence, convenience, and energy.

Snacking Made Right Report from 2022 by Mondelez International, 71% of consumers worldwide indulge in snacks at least twice a day. The report also revealed that consumers are increasingly replacing traditional meals with snacks, such as 60% of respondents opting for a snack instead of dinner, a significant increase from 46% in 2020.

With a population exceeding 1.4 billion, the snack market in China is a flourishing industry that offers a wide array of choices to its consumers. As such, small convenient meals have become an integral part of daily life in China.

Based on the latest findings from the collaborative report “How the World Snacks” by Mandelez International, The Food Institute, and Ipsos, China falls into the category of the “mini-meal snacker”, meaning putting more emphasis on the intrinsic meal/food value, and perceive snacks as a proper meal-replacement. China has a rich food culture intertwined with its traditions, including snacking habits. A prime example is the tradition of enjoying bite-sized appetizers like “dim-sums.”

Regional differences in snack specialties in China

The distribution of leisure food specialties in China is influenced by the unique characteristics and tastes of agricultural products in different regions. This gave rise to distinct regional differences in snack food offerings. For instance, Sichuan, Inner Mongolia, Zhejiang, and Hubei are known for their dried meat products. Hunan, known for its spicy cuisine, showcases a seafood ready-to-eat snack food called Hunan dried fish. In addition, Fujian, Anhui, Yunnan, and Shandong have developed snack foods centered around biscuits and pastries.

Typical peoples’ snack patterns: mid-day hunt for social interaction

As stated in the analytical report by the Chinese Daily Global, Chinese consumers have the highest preference for snacking during the periods of 2 pm to 4 pm and 6 pm to 8 pm, accounting for 39.3% and 24.9% of respondents, respectively. When it comes to the activities consumers engage in while snacking, the white paper reveals that 80.7% of surveyed individuals choose to watch TV or play video games. Others opt to snack during work, study, or gatherings with friends.

In addition, consumers tend to share snacks with others. In such a relationship-based country, eating snacks becomes a convenient way to strengthen relationship by sharing food together.

The office snacking culture is deeply ingrained in China, with many companies offering complimentary snacks to their employees. Snacks not only boost work efficiency but also serve as a bonding tool among colleagues. It fosters a sense of community, with people often arranging communal spaces with snacks for informal gatherings and chats during breaks, mirroring the dynamics of a family gathering.

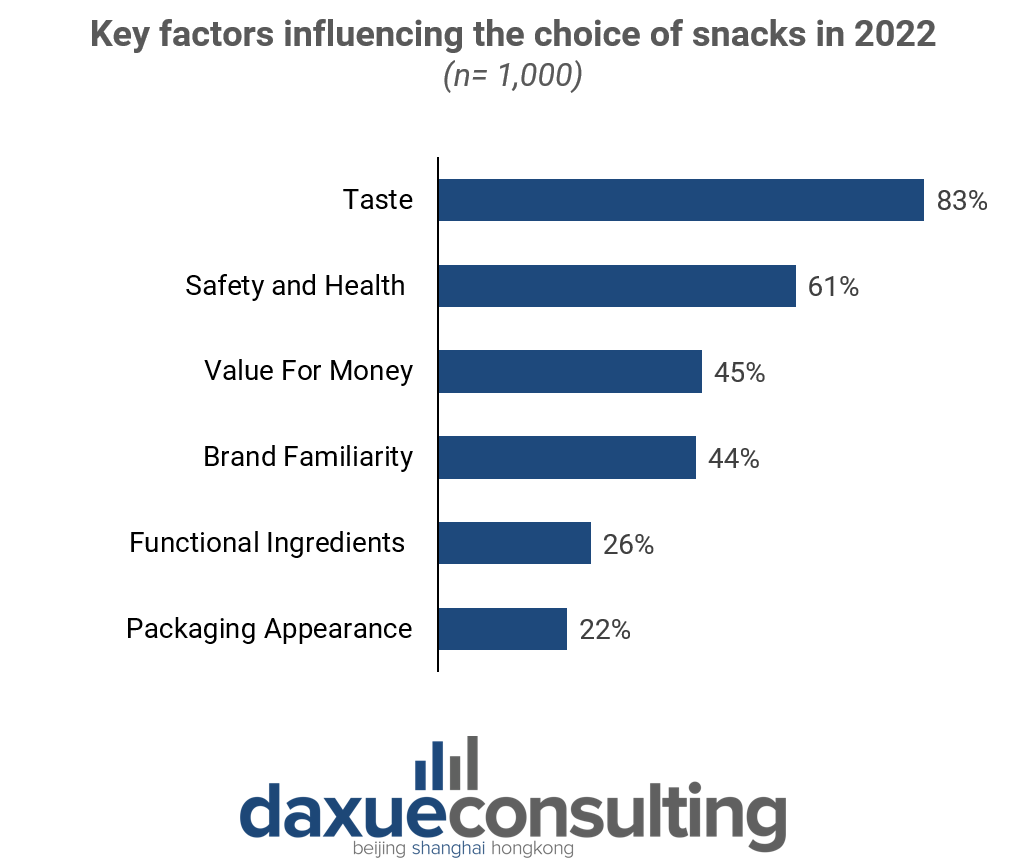

According to the Healthy and Leisure Snacks Report, taste emerged as the most significant factor influencing snack choices in 2022, with 83% of 1,000 participants valuing it. Additionally, 61% pay attention to the health and safety of ingredients, while 45% prioritize high value for money. Brand familiarity holds importance for 44% of respondents. Furthermore, functional ingredients and packaging appearance are considered significant by 26% and 22% of participants, respectively.

Female customers as the driving force in China’s snack market

The typical consumers of snacks in China are estimated to be members of the Generation Z (aged 16 to 24 years), along with slightly older millennials (25- to 34-year-olds), with a particular focus on women within these demographics. Notably, females among Gen Z are the most frequent snackers, consuming an average of 3.8 snacks per day compared to 3.5 for males in the same generation. It is interesting to observe that 75% of the young cohort replaces at least one meal each day with a snack, which is 6% higher than millennials, the next closest cohort. As consumers age, snacking generally declines, with individuals aged 55+ averaging just 2.8 snacks per day.

For instance, the Meat & Braised Meat Research Report newly posted in August 2023 states that among customers of beef jerky, pork, and dried or braised meat snacks, the distribution of the majority of the products leans towards females. The significant percentage difference can be up to 20%, 30%, and sometimes even more than 50%.

Competitive landscape of China’s leisure food industry

China’s leisure food industry faces fierce competition, with several strong brands under the spotlight: Qiaqia Food, Liangpin Shop, and Three Squirrels emerge as strong players, followed closely by Yanjin Shop and Laiyifen.

The 2022 third-quarter financial reports of the five listed companies in the leisure snacks industry reveal varying results. Liangpin Shop, Three Squirrels, Qiaqia Food, Laiyifen, and Yanjin Shop reported revenues of RMB 7.03 billion yuan, RMB 5.33 billion, RMB 4.38 billion, RMB 3.25 billion, and RMB 1.97 billion, respectively, for the first three quarters.

In terms of net profit, both Liangpin Shop and Three Squirrels experienced declines of 8.8% and 78.9%, respectively. However, Qiaqia Food, Laiyifen, and Yanjin Shop exhibited improved performance. Laiyifen and Yanjin Shop, in particular, witnessed significant year-on-year growth of 453% and 182.85%, respectively.

Healthy snacks exponential growth and shifts in customers’ perception

China’s snack market can be divided into 2 subcategories: Westernized snacks (chocolates, pastries, candies, etc.) and more traditional Chinese snacks (dried fruits, nuts, meat and fish roasted snacks).

In response to the increasing focus on healthy and nutrition, the snack market in China has experienced significant changes. Both the Chinese government and snack companies have responded to rising levels of obesity and non-communicable diseases, as well as increasing demand for healthier options. These changes involve reducing sugar, salt, and fat levels in snack products.

From the customers’ standpoint, over 60% of the 1,000 people who participated in the CBNData research report expressed a preference for healthier, nutritionally dense snacks with lower fat content or rich in high-quality fats. The top three healthier snack categories based on customers’ perception are roasted nuts, seeds, and fruits getting 72%, then braised meat with 55%, and pastries following with 43%.

In response to these trends, snack companies are actively creating sustainable and guilt-free options. For example, OREO air cake with mindful portion labeling was launched in 2022, and over 60% of the snack portfolio in China now contains either individually wrapped mindful portions (<200 calories) or has mindful portion labeling on the packaging.

Beyond nutritional benefits, some consumers seek snacks that offer additional functions like protein replenishment and skincare, aiming to enhance their psychological well-being.

Top 3 most popular healthy snack categories: roasted nuts, seeds, and dried fruits; meat snacks and pastries

Dominance of roasted nuts, seeds, and dried fruits

As the concept of healthy snacking gains popularity, there has been a gradual increase in the consumption of nuts. Nuts and seed products have experienced steady growth in online sales, surpassing RMB 20 billion. The rich dietary fiber and nutritional value of nuts are important reasons for choosing them as daily snacks. The Qiaqia sunflower seeds especially outperformed other competitors, accounting for the continual increase in sales and domination in terms of market share by 54%.

Another significantly popular snack is dried mango. Consumers favor it since the snack is loaded with vitamins, moist in texture, and has a remarkable mixed (sweet and sour) flavor.

Nutritional benefits as one of the key selling points of the meat snacks

Compared to other types of snacks, meat snacks provide more energy and nutrients, making them a more satisfying meal replacement than carbohydrate snacks. The prevalence of meat snacks in China steadily continues and might increase in the most recent years, as it already rose from 14% to 21% of the country’s snack consumption in 2020 alone.

How Chinese bakeries are crafting winning strategies

Bakery companies have two primary strategic approaches to win customers. First, they can integrate Chinese culture by blending national fashion elements with familiar ‘traditional’ tastes. Second, they can focus on adopting Westernized recipe styles. However, given the robust sales of traditional Chinese pastries like egg yolk cakes, peach cakes, and walnut crisps, it’s evident that there is a significant interest and appeal for Chinese baking products, which may also align with broader national trends and preferences.

Localization as another means to win consumer acceptance

Localization plays a crucial role in driving consumer acceptance of innovative and healthy snack products in China.

Understanding consumer preferences and aligning product offerings with local features is a fundamental strategy to enhance sales and achieve growth in this market. To capture global attention, multinational corporations engage in various modernizations and flavor experiments, exploring new textures and seasonings. These ‘food experiments’ often generate significant buzz on social media, amplifying the brand’s promotional efforts.

What brands should know about the growing snack market in China

- The Covid-19 pandemic has significantly impacted consumer behavior, requiring companies to adapt to the new reality in order to meet the changing demands of customers.

- The snack industry is heavily influenced by health considerations, with a particular emphasis on sugar-free, low-fat, and low-calorie products.

- Roasted nuts, seeds, and dried fruits are gaining a lot of attention among customers.

- Female customers play a crucial role in driving market growth.

- Combining Chinese localization with Western modern trends has emerged as a successful strategy.