The Korean snack market has recently taken off. In 2021, the size of the market was an estimated 3.7 trillion won (2.8 billion USD), up 4.5% from the previous year and it is expected to grow annually by 4.28% until 2027 This can be explained by the increasing number of people who enjoy snacking at home due to the pandemic, but also by new trends that have taken over the snack market. As this is a pivotal time in the Korean snack industry, it is essential to understand the changes that are going on.

Chips and biscuits are currently leading the market, but more healthy snacks are expected to gain market share

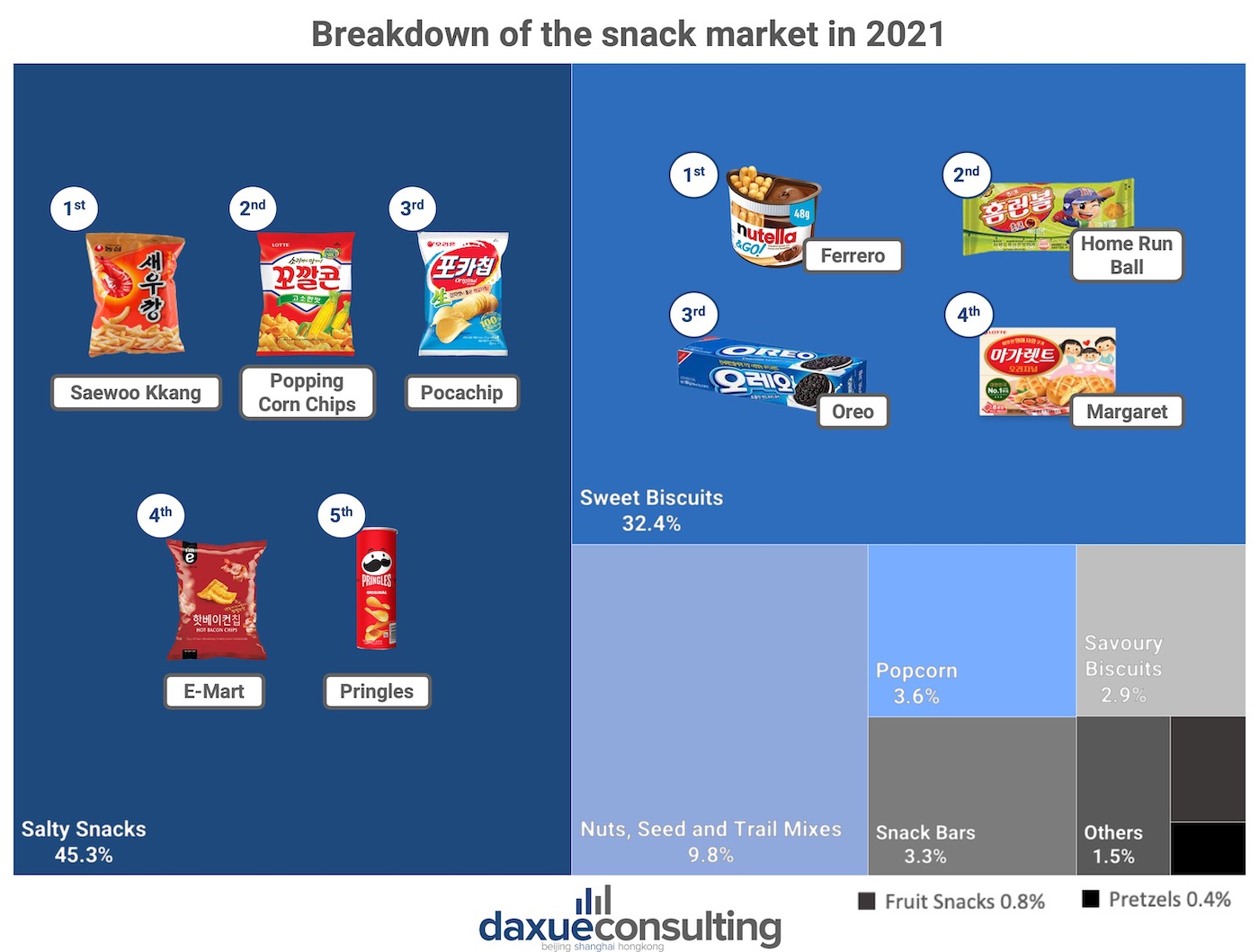

The Korean snack market is dominated by salty snacks and sweet biscuits. Salty snacks’ best-sellers are long-established products such as Saewoo Kkang, Popping Corn Chips, and Pocachip, all released more than 30 years ago. As for sweet snacks, the most popular brands are Ferrero, Home Run Ball, Oreo, and Margaret. But according to Euromonitor, their position would be challenged in the future by more healthy categories such as mixed nuts, snack bars, fruit snacks, and pretzels.

Iconic Korean snacks have unique flavors and textures

Korean snacks are different from western countries’ by usually having a wider range of taste and flavors. Iconic Korean snacks include:

- LOTTE Popping Corn Chips (롯데 꼬깔콘): These crunchy corn chips are ranked first in sales. A popular way to eat them is to put a chip on each finger of a hand and eat them one by one. It is an all-time favorite thanks to its unique flavor, texture and shape.

- LOTTE Pepero (롯데 빼빼로): Pepero is the Korean version of Pocky and it is available in 12 varieties. The date of 11/11 has been proclaimed Pepero Day. On this day, people offer Pepero to their lover, friends, family and colleagues.

- Nongshim Saewoo Kkang Shrimp crackers (농심 새우깡): It is one of the oldest snacks in Korea and has always been a steady-seller. In 2020, when the singer Rain’s song, “Kkang” became a viral meme, the connection was quickly made with the crackers’ name. The brand then decided to hire the singer as their spokesperson, leading to an increase in sales by 30%.

- Orion Peanut and Squid balls (오리온 오징어 땅콩): Seafood-flavored products are very appreciated in Korea and this peanut and squid snack is a perfect example. It is very popular among older people.

- Haitai Calbee Honey Butter Chips (해태 허니버터칩): This honey and butter flavored chips, widely promoted by celebrities and featured in K-drama, were so popular that it resulted in a shortage in 2015.

The pandemic revived the Korean snack market

The snack market had been stagnant due to the decline of children in South Korea, which represents a large part of snacks consumers, and rising health concerns. But after Covid-19, the market bounced back and it has been growing for the past two years.

Indeed, many Koreans have become Jipkokjok (집콕족) or “stay-at-home people” and did activities at home instead of going outside, which led to a significant increase of snack consumption. For instance, streaming has become the main source of entertainment in South Korea.

Another factor of snack consumption increase is the switch in Korean’s drinking habits. Indeed, after the pandemic, they tend to have more “honsul” (혼술), which means drinking at home. Koreans usually pair alcohol with snacks/side dishes called anju (안주), thus, a lot of snack brands took this opportunity to market their products as home-drinking snacks. These actions paid-off as sales of prepackaged snacks have been increasing due to the growing number of people consuming them as an accompaniment for alcohol. Consequently, today, snacks are no longer just for children, but also adults

Imported snacks have also been growing as it has become more difficult to travel and many consumers are reminiscing about their past trips through foreign snack consumption (+20% year-on-year in 2020).

Snacks are convenient meal replacement

After Covid-19, working from home and distance learning freed up some time, and having a healthy lifestyle has become a priority. Thus, many Koreans became more willing to have breakfast, which was not necessarily the case for busy workers and students. In this context, small packed, convenient, and nutritious snacks represent the perfect morning meal to squeeze into Korean’s fast-paced life.

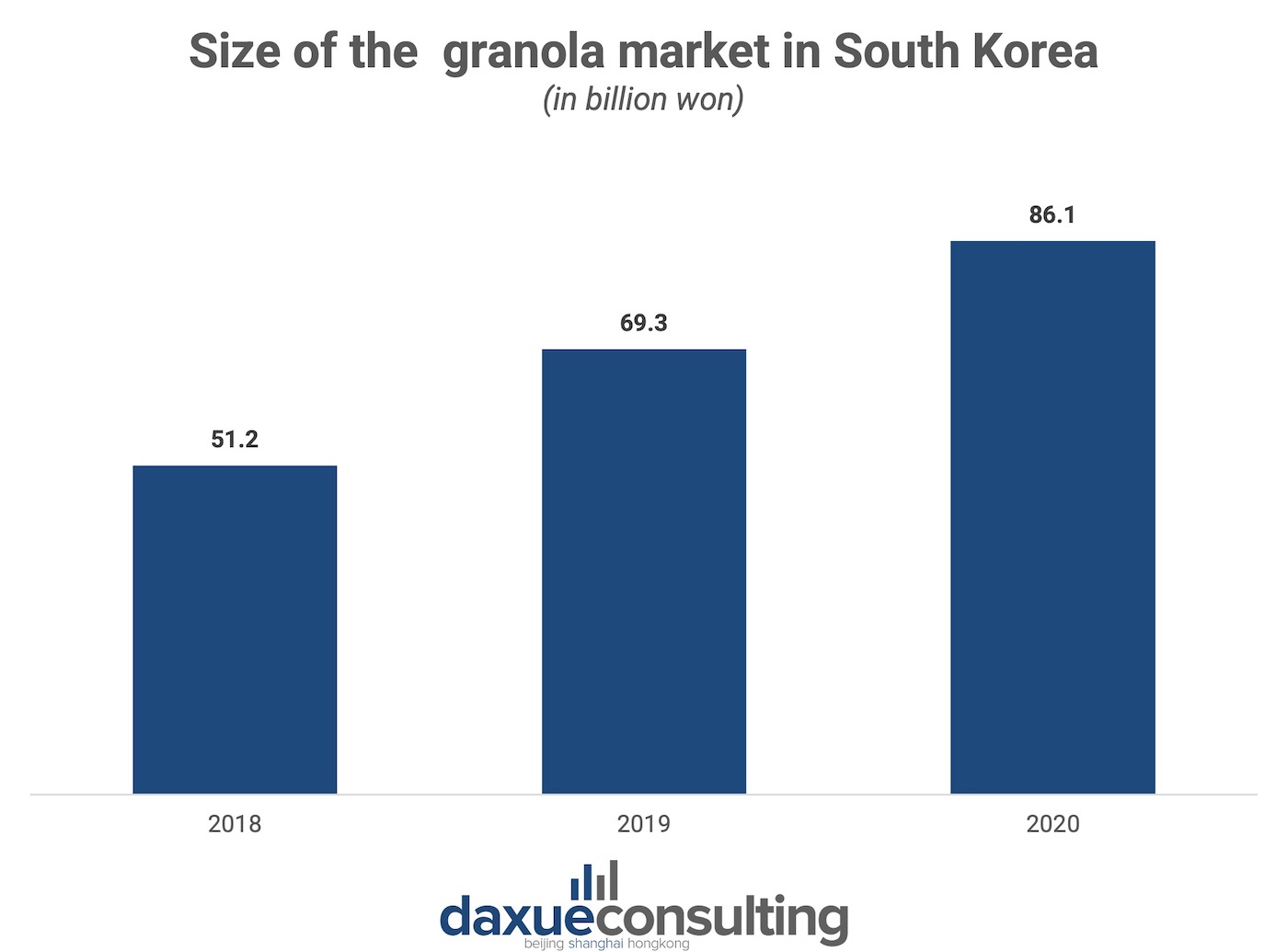

For example, granolas and nuts have become particularly popular. According to Euromonitor, the size of the domestic granola market has been increasing every year from 51.2 billion won in 2018 to 69.3 billion won in 2019 and 86.1 billion won in 2020. One of the popular products is the Orion granola line launched in 2018, which saw a 34% increase of sales in 2020 to reach 15 billion won (10.8 million USD).

With sales of 11 billion won (7.9 million USD) and a 180% growth from the previous year, the American brand Quaker, which success lies in its adaptation to the Korean taste and active online presence, has also been very popular. Its star product is “Drinking Oatmeal” which consists of oatmeal powder mixed in a plastic bottle that can be drunk as a shaker when diluted with water or milk. Specially developed for busy people it is getting good reviews for its taste as well as for its convenience.

Greek yogurt is also a rising healthy breakfast option, as it is low in calories and high in protein and calcium. Pulmuone’s Greek yogurt, which has ranked first in domestic Greek yogurt sales for six consecutive years, increased its sales by 54% in 2021.

Since snacks are more and more used as meal replacement, quality has become determinant. Thus, products that emphasize “health” and “premium” rather than taste and texture are growing.

Main trends by generation: Older Koreans have a sweet tooth, while young snackers chase trends

Current trends in the Korean snack market vary according to generation. For teenagers, it is Japanese snacks and everything that would make them feel “Insa”. “Insa” (인싸) is a popular expression to describe people that are “inside” of a group: they have a lot of friends and keep up with trends. In order to fit in, teenagers show a lot of interest in products that are a hot topic on social media such as retro products. One pertinent example is the recent craze about Samlip’s Pokemon bread. Sold in limited edition in convenience stores, they have attracted a crowd of people desperately trying to get one of the collector breads.

For those in their 20s, diet snacks and chips are the most attractive, such as people in their 30s and 40s guilty pleasure is sweet potato snacks. Indeed, this vegetable is considered naturally sweet, healthy, and packed with antioxidants. As for the older generation, they like to stick to the basics and enjoy flavors that mix sweet and salty.

Convenient stores have become the main distribution point of snacks

Concerning snack distribution, large supermarkets share has declined while convenience stores and online shares have increased, making convenient stores the main snack distribution channel.

Convenient stores present several advantages. They are easily accessible due to the high number of stores, are always open and often have great loyalty programs through mobile apps, offering coupons and a reward system. Although they are a bit more expensive than supermarkets, the promotional offers and convenience make them just as attractive. “Convenience stores are usually more expensive than supermarkets. However, “buy one get one free” or “buy two get one free” promotions at convenience stores makes it no different.” – stated user jjjiyada on a Naver.

Thanks to the Hallyu Wave, Korean snacks are taking over the world

While snacks have experienced a revival of popularity in Korea these years, the same applies for other countries. With the Hallyu Wave, Korean snacks have never been trendier in 2021, Korean snack exports reached 466 million USD (673 trillion won) (+13%), which is an all-time high, with the top export countries being US, Japan and China.

Key takeaways about South Korea’s snack market:

- The pandemic has boosted the Korean snack industry due to more Koreans choosing to stay at home.

- As Koreans are used to drink alcohol with sides and that they drink more often at home now, snacks that pair well with alcohol have been really appreciated.

- Foreign snack consumption has increased since people cannot travel as much as before and try to remember their past trips through snacks.

- Healthy, nutritious, and easy to carry snacks are convenient meal replacements for busy Koreans

- Current popular snack trends include sweet potato flavor, diet snacks, sweet and sour mix, and retro products.

- Convenient stores are the main distribution point for snacks.

- Thanks to the Hallyu Wave, Korean snacks have been very trendy around the world.