Despite Harvest Pressures and Global Trade Tensions – The Demand for Soybean in China Remains on a Steep Uptrend

In recent years, the Chinese government has initiated measures in reforming its agricultural sector by implementing new grain policies. As a result of this endeavor, the soybean market along with alternative grains and oils such as corn, sunflower, palm oil, and canola will see a steady rate of expansion and growth in the coming years. The reasons for China’s continued reliance and proliferated demand for soy is in part due to the large scale use of soybean meal in its animal feed industry. Over the long term, the likely commercialization of genetically modified crops and adoption of technology into China’s agribusiness should boost the domestic grain yields. Despite these efforts, local production will continue to be dwarfed by the animal feed industry and domestic consumption, thus leaving China overwhelmingly reliant on imports for soy. On top of this, trade diversions between the United States and China are posing important uncertainties regarding demand and trade patterns in the oilseed complex.

A Three Player Trade Market

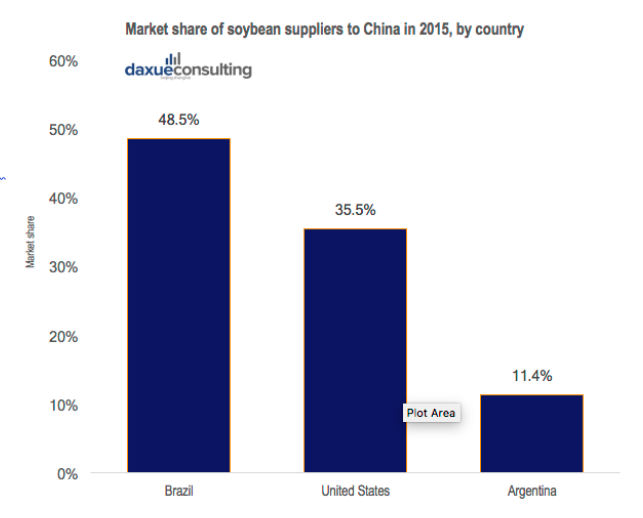

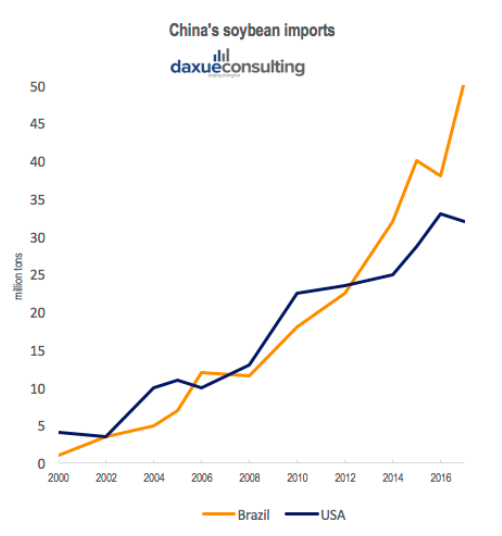

Despite a 36 yearlong partnership in soy product trade between the United States and China, this July the Chinese Ministry of Commerce imposed a 25 percent tariff on all U.S. soybean imports. With over a billion consumers of soy, China stands as the largest importer of U.S. soybeans. Since 1995, the volume of soybeans imported to China has been increasing drastically. Data from the National Bureau of Statistics of China and China Customs show that in 2016 almost 84 million metric tons of soybean were imported to China, approximately 8 times as much as the import volume in 2000, at 10.42 MMT. China currently purchases approximately one in every three rows of the soybean grown in the United States, a market value estimated at around $12 to $14 billion dollars annually. Since 2010, the United States market share of China’s soybean imports has been between 35 and 40 percent, second only to Brazil.

Recently, as a result of the sudden trade conflict and tariff hikes on imported soy, great concern has arisen among China’s farmers and consumers over their heavy reliance on U.S. soy. However, the imposition of tariffs will not have a damaging impact on China in the short term. In the coming months it can count on a bumper Brazil crop and rely on its surplus of previously imported soy. As a result, this will serve as a buffer to avoid meat price increases and food price inflation. However, the country may face soybean shortages towards the end of 2018 and in 2019 if it limits imports from the U.S. Due to these concerns, China is aiming at reducing its consumption of soy in feed and could resort to importing alternative oilseeds (vegetable oils and meals), or grains (corn) in the future. Although this may be a feasible solution over the long term, the situation is untenable for China and that the country will eventually have to resume imports from the U.S., which will be positive for soybean prices.

On the other hand, should the tariffs remain in place for a longer period of time, the demand for soy will need to find a new source of supply as China’s livestock production and animal feed industries boom. Additionally, the soybean crushing sector in particular will experience increasing input costs that will force China to re-accelerate U.S. imports given the lack of large alternative suppliers. In domino effect, this will have negative implications for profitability in the meat sector. Adding to the trade tensions uncertainties is the recent outbreak of African swine flu in China’s pork sector. If authorities are unable to contain the disease, it will have severe ramifications on domestic pork production, meat consumption, and meat imports.

Changing Tastes

Stemming from the tariff dilemma, there will undoubtedly be changes in Chinese soy consumption, with minimal downside risk. On the upside, trade trends within the seed, oil crops sector, and palm oil consumption will provide ample opportunities for market diversification and growth. Likewise, China may also import a larger share of processed soy meal and oil than usual in the coming quarters. In turn, this may lead to higher soy production as authorities look to incentivize domestic soy plantings, despite significant constraints in land acreage and choice of crop, corn to soy. In any case, if China cashes in on its upmost potential in soy crop production, it will still be minimal and insufficient compared with the needs of demand. This poses significant risks for the production and supply chains all the way down to the consumer. But also presents an opportunity for companies to diversify and penetrate this non-traditional market in a global trade slowdown.

As Global Supply Concerns Mount – What Other Countries Can Possibly Supply China’s Soybean Demand?

As harvests are seasonal, China purchases most of its soybeans from the U.S. in the late summer and fall (primarily October–December), and then switches to South American beans during the spring months (February–May). Brazil remains the largest seller of soybeans to China, but its exports tend to be exhausted come autumn. Accordingly, it is reported that the Brazilian supply of soybeans that have been almost exclusively providing feed for China’s livestock industry for the past months are now beginning to run dry. Subsequently, this reality has already started to put pressure on Chinese soybean stocks with crush rates now exceeding beans imported, as well as increasing Brazilian soy prices. Without United States soy, China finds itself in a situation where it needs to find an alternative supply and a way to cover a 10-20 million ton soy deficit. However, Brazil and Argentina have both been increasing their soy imports from the United States, and then shipping it to China.

As an alternative, China could secure partnerships with Russia, Ukraine and Kazakhstan (which only contributed to 1 percent of China’s previous soy imports) to increase supply, target efficiencies in yield with new technologies, and expand planted acreage. Specifically, farmers in the North Kazakhstan region will start exporting soybeans to China this fall with a plan to export 150,000 tons of soy to China. Nonetheless, this number is minimal in comparison to the 32.9 million tons of soy China bought from the United States in 2017. Even more so, China and India have taken additional steps to lift a 2012 ban on Indian oil meal exports to China, as the world’s most populous nation seeks other sources of protein following its ongoing trade dispute with the U.S.

Lastly, there is Argentina, the third largest soy exporter to China. However, as a result of recent Argentinian policy, farmers are now swapping corn production for soybeans after an export tax hike on soy, meals, and oils was raised to 28 percent. Due to these reasons, there are many external and internal forces pressuring China’s soybean outlook near term. China must take a national strategy of relying on its current surplus of soybean stockpiles, reducing future imports, expanding domestic production of alternative grain, and increasing its agribusiness partnerships with other countries.

Feeding China’s Appetite for Soy: Consumer Trends and Dietary Preferences

As China rapidly urbanizes with approximately 55 percent of its population living in cities and towns, increases to their incomes over time and improvements to their diets will heighten their demand for soy products and vegetable oil. Subsequent with this shift there has been an increase in animal protein consumption, with Chinese meat consumption currently at 59 kilograms annually per household, shortly behind U.S. meat consumption at 85 kilograms.

China buys around two-thirds of the world’s soybean exports, and uses most of it for soy protein in animal feed that feeds roughly 435 million pigs in the country. China’s dominance as an importer reflects its policies that favors soybean imports over feed grains, as well as dietary shifts toward more animal proteins. As a result, a strong demand for soybean meal usage for livestock feed rations has arisen. In addition, as a primary cash crop within the Chinese diet, soy is a central ingredient in many oils used for cooking and for various sauces used in dipping. In addition, soy is a key provider of nutritional protein value in its meat and milk. To the right is an illustration of a few of China’s food preferences that are soy based, including tofu, soy milk, dried bean curd, and bean sprout.

Thus, as demand grows in China’s food industry for high nutritional value and more protein, demand for livestock has increased proportionally. However, vital in this equation is the quality of soybean seed used. Growing seed varieties with higher protein content increases the demand and value of the soybean, which ultimately impacts the price per bushel. When the protein levels are raised in the soybeans, the meat quality and health of the animal in the feed will be better as well; such as the fish, chicken, and pigs with higher protein levels. So when customers in the value chain are demanding and paying more for higher protein, it improves the farmer’s basis and the price they receive. Therefore, in order to compliment China’s demand in the near term and find alternative solutions to the soybean shortage, there is a large market opportunity for industry actors to seize and capture.

A Harvest Gone Unsold?

Soy is not going away any time soon in China, and will remain a staple crop to be used in the Chinese diet for time to come. However, China cannot produce a sufficient supply domestically, thus presenting many opportunities in the grain, seed, and oil crop industries for foreign exporters and innovators in agricultural biotechnologies to capitalize on. Drastic change in the form of beneficiary replacements and supplements to soy in food nationwide is highly unlikely to take form in the near future. Sudden change to the nutritional makeup of a nation’s food supply for both consumers and livestock is an unthinkable endeavor. Hence, the key factors guiding the future trajectory of this market and its capitalization will ultimately come down to a return to favorable trade policies. Thus, creating a globally integrated “agribusiness” supply chain that efficiently connects the farmer, distributer, and the consumer.

Author: Jeffrey Craig

Daxue consulting can help you understand China’s agricultural markets

Daxue consulting can provide you support in entering the growing agricultural market in China. We conduct all the market research and consulting services you may need, such as store-checks, retail analysis, implementation feasibility, market survey etc. To know more about agriculture in China, do not hesitate to contact our dedicated project managers at dx@daxueconsulting.com.