As technology becomes increasingly sophisticated, more industries are integrating these innovations to boost their productivity. Financial software is arguably one of the most used systems in businesses. Understanding the financial software market in China is particularly beneficial given the country’s booming economy and status.

The global financial software market

Broadly speaking, financial software, often known as financial system software, is a sector that deals with accounting and monetary transactions. This sector includes applications that monitor all financial activity within a commercial organization.

The global fiscal management software market was estimated to increase at a CAGR of 9% from US$16.3 billion in 2021 to US$24.4 billion in 2026. In 2019, the world’s personal software market was estimated to reach US$940 million and was expected to increase by 79.8%, reaching US$1.69 billion in 2030.

Exploring the global consumer demographic

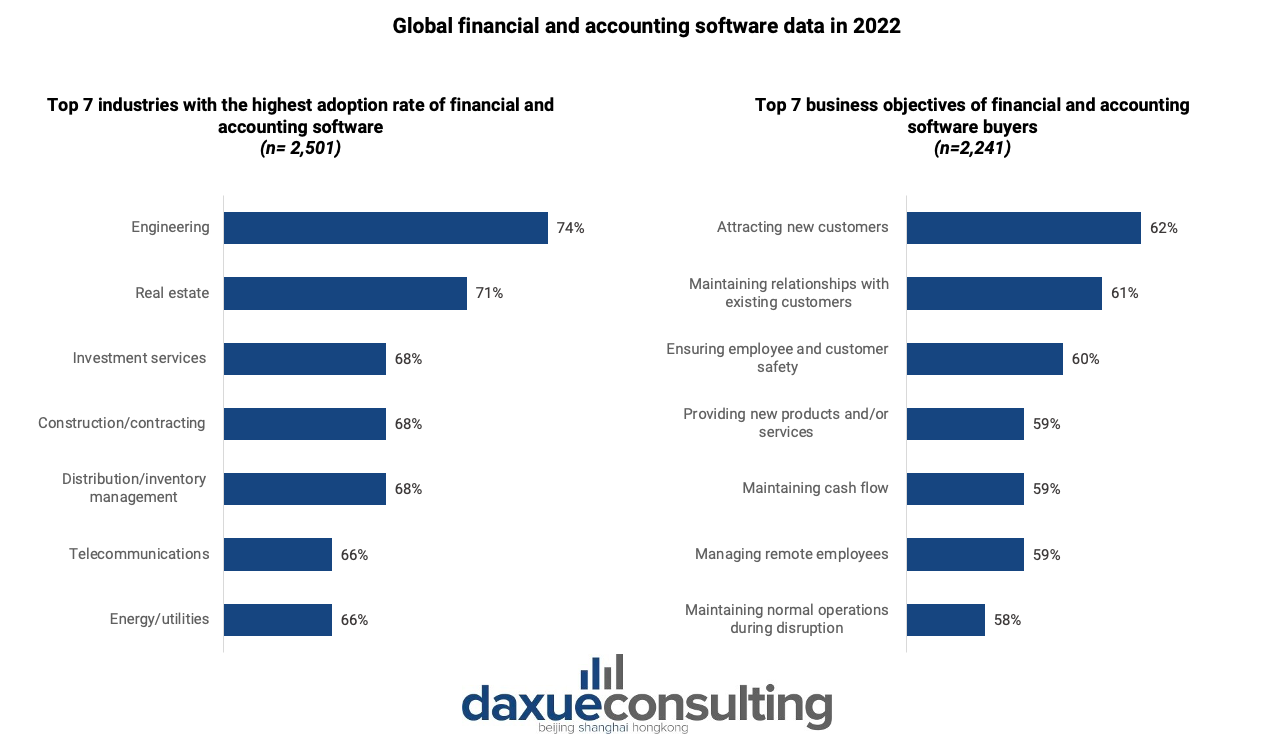

On a global level, the engineering and real estate industries are the segments that have the highest adoption rate of accounting and finance software with improving productivity as the top reason for investing in such software. For the majority of purchasers, customer acquisition and retention are the primary business goals in 2022.

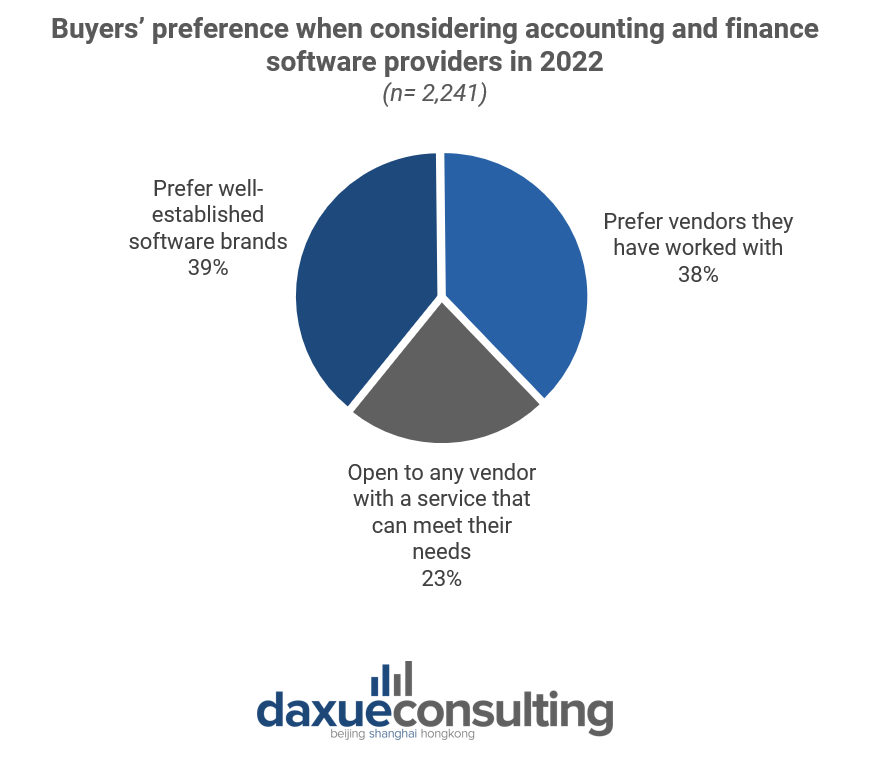

When it comes to deciding which software to purchase, 39% of buyers surveyed choose brands with reputable names. Therefore, building a well-established brand is important to compete in this industry. However, there are opportunities for new entrants as a substantial portion of consumers surveyed, 23%, are also open to any vendors that could suit their needs.

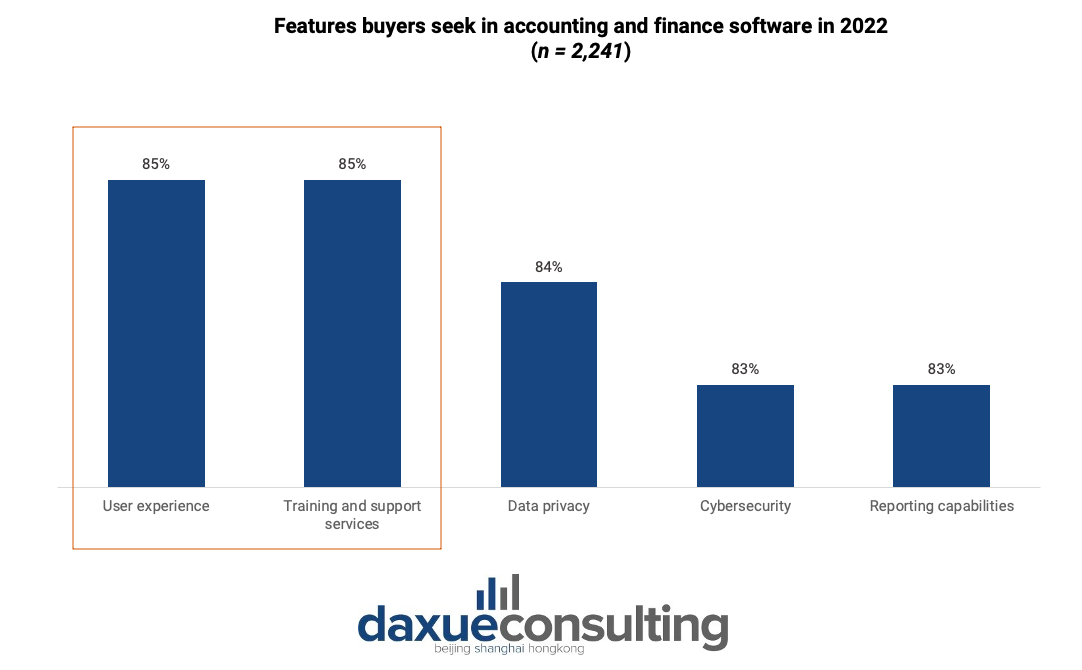

User experience and training and support services are two features that most buyers are looking for in accounting and financial software. It is then closely followed by data privacy, cybersecurity, and reporting capabilities.

Cloud-based financial software and invoice automation software are becoming popular

Consumers are increasingly investing in cloud-based financial software. Cloud-based accounting and financial platform users benefit from quick upgrades, high scalability, quick and affordable installations, and simple application integration.

Invoice automation software is also becoming increasingly popular among companies of all sizes. Accounts payable invoice automation and supplier e-invoicing software are forecasted to grow at a CAGR of 17% from US$850 million in 2020 to US$1.9 billion in 2025.

Reporting automation is also becoming widespread as compared to robotic process automation, it provides clients with more value while requiring less effort from them. It produces reports on schedule without requiring users to conduct their own research, which lowers errors and gives users more time to analyze data.

The software market in China is growing by 12.1% each year

China’s software industry is increasing at a rapid pace. The country’s enterprise application software market was estimated to reach US$6.5 billion in 2020 and to boast a year-on-year increase of 12.1%.

The rapid advancement of cloud computing and the need for business digital transformation are the major factors promoting growth. The adoption of enterprise-level application software as a service (SaaS) by businesses, particularly medium and large enterprises, has also considerably expanded with the swift development of cloud computing.

According to IDC, China’s software industry can be grouped into three different categories: Customer Relationship Management (CRM) SaaS market, Enterprise Resource Management (ERM) SaaS market, and Supply Chain Management (SCM) SaaS market. Within the ERM category, financial SaaS is among the most mature market. The primary focus of the SaaS financial software market in China is on expense management components like travel reimbursement.

China’s financial IT industry is developing rapidly

In the past five years, the development of financial IT is growing faster than the development of the financial industry.

The sustainable development of China’s financial IT industry is jointly promoted by internal and external factors. Technological progress is the internal driving force for the development of the industry and the domestic financial industry is moving toward the era of intelligent finance.

One of the external factors that stimulate the growth of China’s financial IT industry is the relaxed financial regulatory environment. After 2018, the domestic financial regulatory environment tends to be relaxed and financial innovation is encouraged. Industry support policies are also frequently issued.

There is a vast opportunity in the banking sector for the financial software market

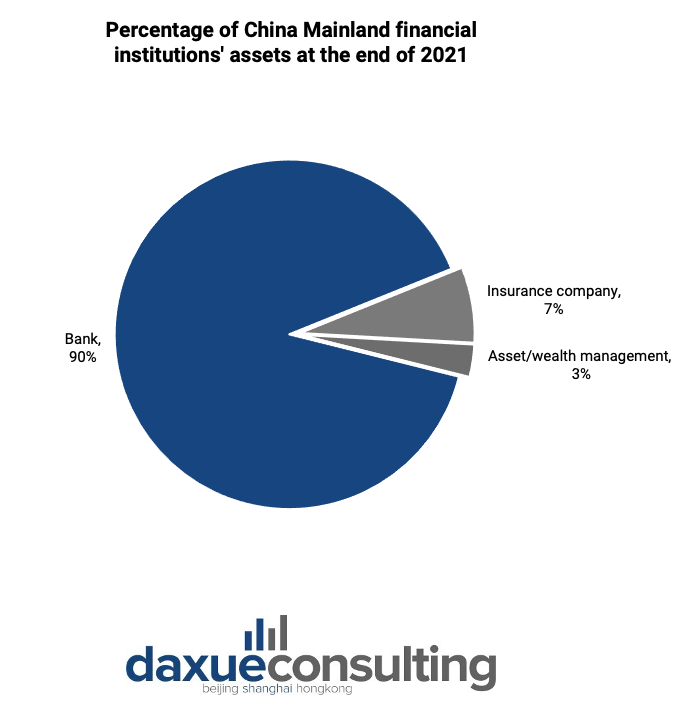

In China, banks are occupying the vast majority of the overall financial industry market share. The banking segment is highly concentrated by the top 10 local players which are state-owned and national-level commercial banks.

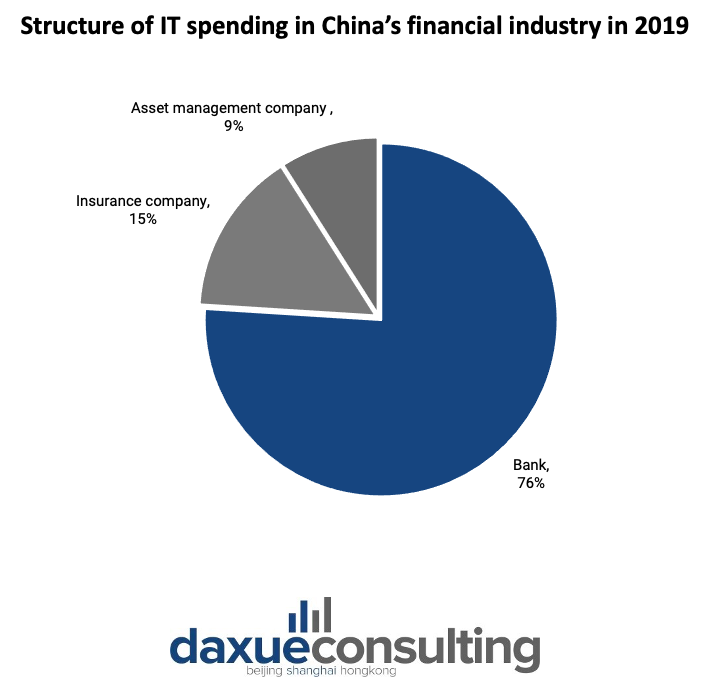

Compared to other financial institutions the banking sector clearly vaunted the most asset by the end of 2021. As the sector with the largest asset, it is not surprising that banks are also the largest IT structure spender in China’s financial industry. Formerly, the digital transformation of banks was more of an information and online upgrade of traditional business than a fundamental change in the scope or business model of the banking industry.

Now, along with the application of financial technologies such as artificial intelligence, big data, cloud computing, and blockchain, the transformation of commercial banks has ushered in new opportunities and possibilities for the financial software market.

The banks’ input structure is also gradually changing as they steadily increase and diversify their procurement of cutting-edge technologies. Big data, cloud computing, and AI are currently the most important sectors, and it is anticipated that blockchain, RPA/IPA digital middle platform, and other technologies will contribute even more in the future.

What to know about the financial software market in China:

- Technology advancement, especially cloud computing technology, is playing a significant role in promoting the development of the financial IT industry in China. The application of the financial cloud laid the foundation for the use of other emerging technologies.

- A gradually relaxed financial environment also promotes China’s financial IT industry growth.

- Among the financial institutions, the banking sector offers the largest opportunity for financial software in China. It is the segment with the largest IT spending.

Author: Regina Sukwanto