With the increasing purchasing power of Chinese consumers, Chinese men are willing to spend more on clothes. Revenue in the men’s clothing segment reached RMB 754.4 billion in 2023, and the market is expected to have an annual growth of 4.44% (CAGR 2023-2027). In particular, China’s formal menswear market has grown quickly. The demand for formal menswear has been driven by the increasing number of graduates across China, who are entering the job market, but not only. Nowadays, suits are also worn outside of work and formal occasions, to give off a “cultured” and “educated” image.

Download our report on sustainable fashion in China

China’s formal menswear market is rapidly growing

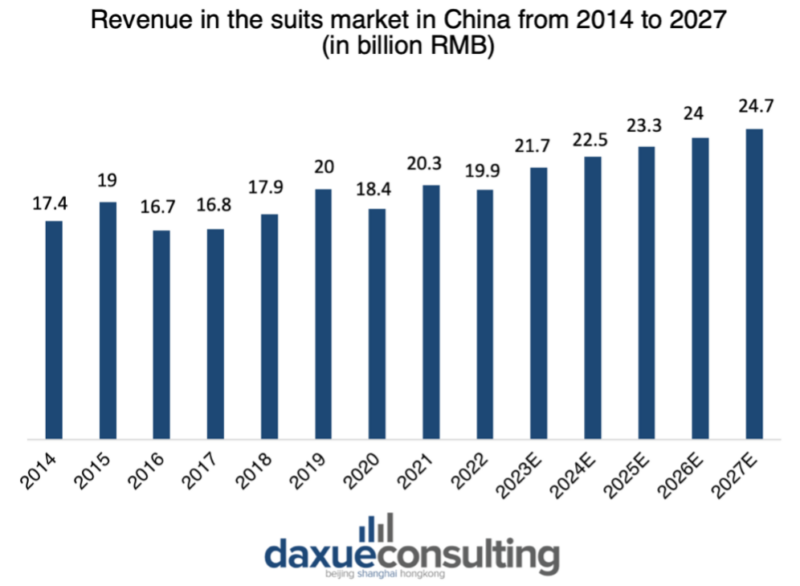

The formal menswear market in China is experiencing a rapid surge in demand, signaling a promising avenue for growth. Since 2015, the demand for Western-style suits has shown an overall upward trajectory, propelling the overall market to new heights. In 2022, the revenue of Western-style suits reached an impressive RMB 19.9 billion, which is slightly less than the year before. However, China’s suit market grew by 9% from 2022 to 2023, and it will eventually reach an estimated RMB 24.7 billion in revenue in 2027. Currently, China’s formal menswear market ranks first in terms revenue, ahead of the US, Italy, and Japan.

China’s formal menswear market is highly competitive

A market characterized by a lowmarket concentration

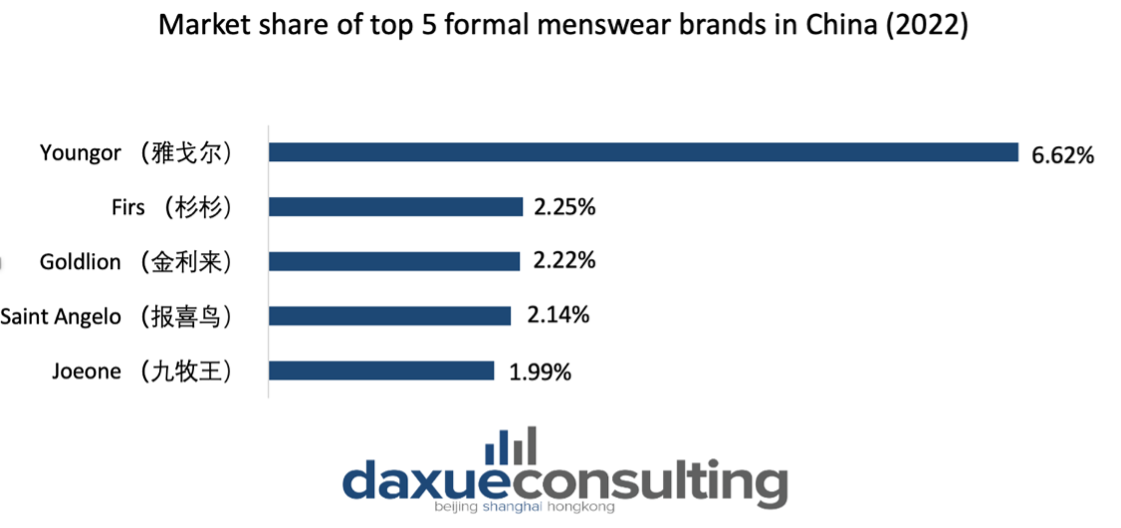

China’s formal menswear market is characterized by low market concentration, setting the stage for intense competition between both international and domestic brands. Around 70% of the market share is controlled by numerous small formal menswear companies, leaving the remaining 30% in the hands of larger brands.

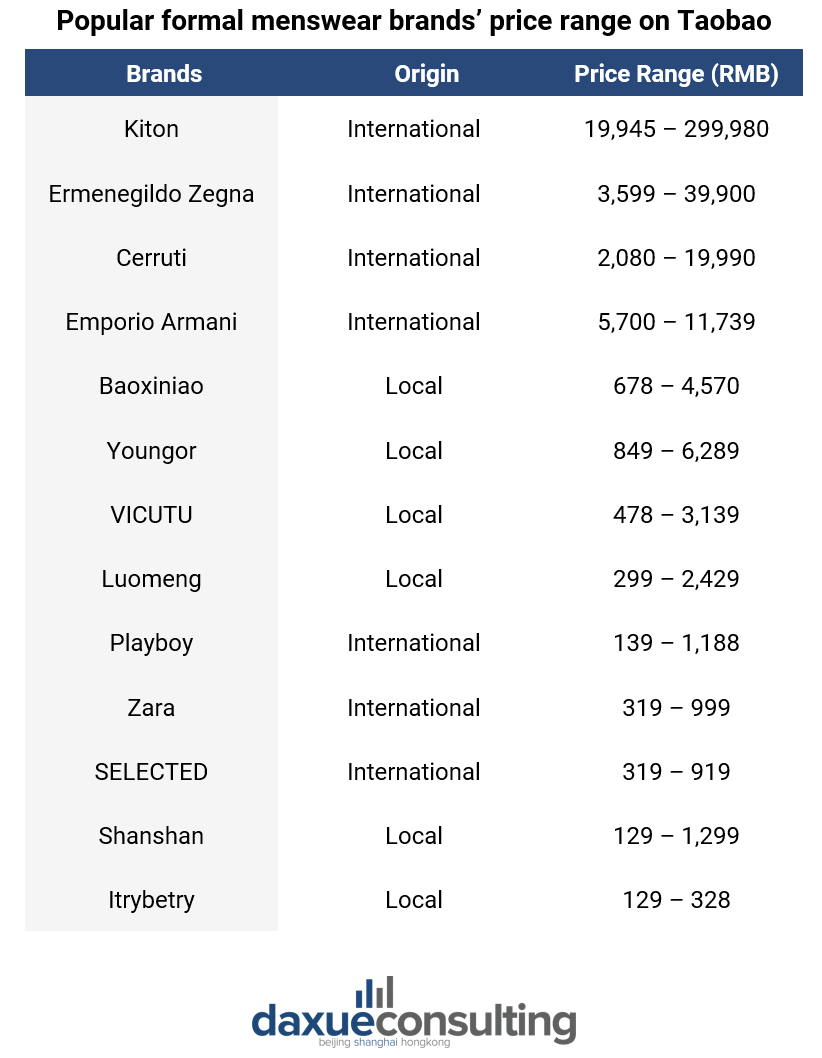

Foreign luxury brands have a firm grip on the high-end formal menswear market in China. Brands like Kiton, Ermenegildo Zegna, Cerruti, and Emporio Armani sell suits that can reach up to RMB 299,980 on Tmall. Meanwhile, domestic brands are more present in the low- to mid-end formal menswear market. This dynamic competition between foreign and domestic brands underscores the diverse preferences of Chinese consumers.

Tailor-made and bespoke suits are on the rise

Tailor-made or bespoke suits are getting more popular in China, especially in cities located along the coast, more subject to international influence. Customization caters to individuals looking for exclusivity, craftsmanship, and a perfect fit. Made-to-measure and bespoke suit brands use quality materials and personalized customer service, which young Chinese consumers appreciate.

In August 2023, the Chinese suit brand Denim Couture (丹宁定制) completed a multi-million yuan first round of financing, which will be mainly used for store expansion and digital system construction. This brand is committed to providing customers with customized suits, coats, and shirts. According to the founder, suits are tricky to make, as they require precise measurements of the sleeves and shoulders. Hence, in order to accommodate each customer’s unique body shape, he conceived the concept of “one version for each individual” (一人一版), ensuring a tailor-made fit. Denim Couture’s clientele includes well-known domestic anchormen, celebrity entertainers, business elites and fashionable grooms.

Currently, many traditional textile and apparel companies are venturing into clothing customization through smart manufacturing and other means after having amassed research and production capabilities. In the future, suit customization is expected to drive the growth of formal menswear in China.

Chinese suits are in demand overseas

Currently, numerous Chinese clothing brands are actively pursuing global expansion, and they are experiencing strong demand in international markets. China is the biggest exporter of clothing, with exports reaching RMB 98.5 billion in March 2023, a year-on-year increase of 31.9%. Within the category of exported garments, Chinese haute couture suits are consistently gaining traction and popularity worldwide, effectively showcasing the allure and appeal of products bearing the label “Made in China.”

With the rapid development of digital technology, many Chinese clothing companies, including Da Yang Group, have undergone a transformation towards digitalized and intelligent manufacturing. Their custom-made suits have been particularly popular overseas in 2022, with 1.9 million sets produced. The overseas demand has grown by 70% compared to 2021, with sales reaching nearly RMB 2.2 billion.

Currently, customers from all around the world can use a virtual fitting room software developed by Da Yang to accurately select styles, fabrics, and colors, providing a clear picture of how the clothing will look when worn. This technological innovation allows customers to define fashion for themselves, and it has received widespread recognition within the customer base.

Youngor: an aggressive online expansion

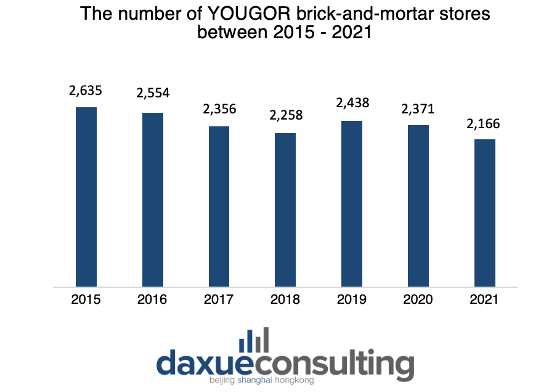

Youngor is a Chinese company from Ningbo specializing in formal menswear. In 2022, Youngor had RMB 171.5 billion in sales revenue. In recent years, the brand has taken a strategic approach to adapt to the evolving retail landscape. In China’s formal menswear market, there has been a clear reduction of offline stores in favor of online stores. While offline revenue accounted for 77% of total revenue in 2017, they accounted for 53.9% in 2022. Youngor has made significant efforts to optimize its sales and marketing channels by closing inefficient brick-and-mortar stores, a move aimed at streamlining operations and focusing on more productive outlets. This process has resulted in a noticeable reduction in the total number of physical stores, declining from 2,635 in 2015 to 2,166 in 2021.

Furthermore, the brand has been acutely attentive to the changing dynamics of consumer foot traffic. They have strategically expanded into shopping centers with higher traffic, growing their presence from a mere 4% in 2016 to a more substantial 19% in 2021.

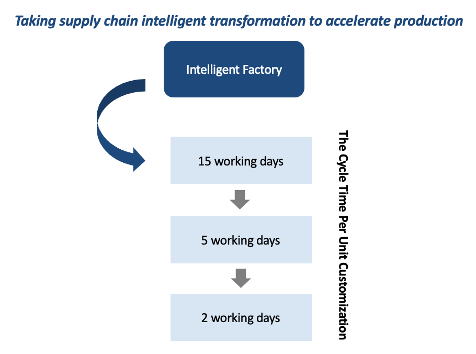

Additionally, the company has invested in supply chain intelligent transformation to enhance production efficiency. Their intelligent factory initiatives, implemented since 2017, have yielded impressive results, with production efficiency rates showing remarkable improvements of 20% to 30%. This commitment to technological advancement underscores the brand’s dedication to remaining competitive and adaptable in a rapidly changing market.

What we can learn about China’s formal menswear market

- China’s formal menswear market is on the rise, with revenues in the men’s clothing segment reaching RMB 754.4 billion in 2023.

- The market is highly competitive, featuring a low market concentration with numerous small companies holding 70% of the market share.

- International luxury brands dominate the high-end segment, while domestic brands cater to the mid-range and lower-end markets.

- Customization is becoming popular, especially in coastal cities, offering bespoke suits tailored to individual preferences and measurements. Some companies are even exploring customization through smart manufacturing.

- Chinese formal menswear brands are expanding globally, with strong demand for Chinese haute couture suits in international markets. Digital technology, such as virtual fitting rooms, is reshaping the industry and receiving widespread recognition.

- Companies like Youngor are adapting to the changing retail landscape by optimizing online sales channels and investing in supply chain intelligence transformation to enhance production efficiency.