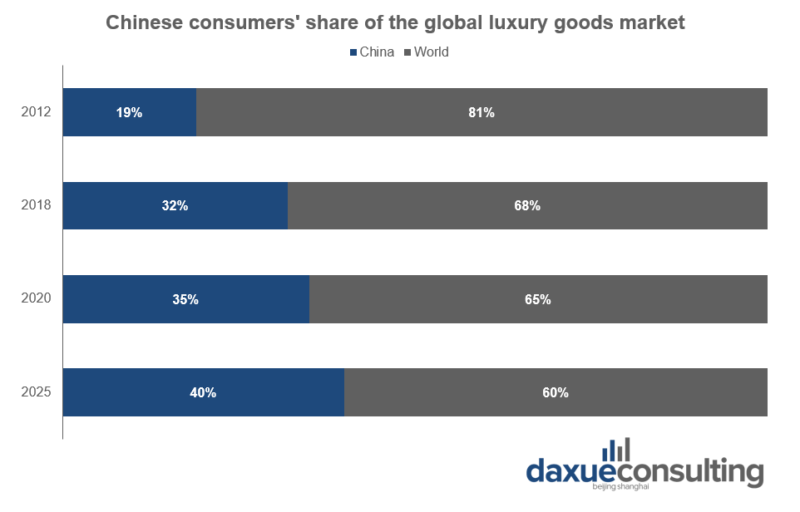

According to a report jointly released by Bain & Co. and the TMall Luxury Division, mainland China accounted for 20% of the world’s luxury industry last year and it is going to become the largest luxury market by 2025.

Unlike the in the past, nowadays Chinese consumers’ reluctance to purchase pre-owned luxury clothing is gradually vanishing: according to the 2021 China Second-hand Luxury Industry Overview, China’s second-hand luxury market jumped from roughly 5.9 billion RMB to 17.3 billion RMB between 2016 and 2020. However, although the amount of luxury goods accumulated on the Chinese market in the last decade is now worth about 4 trillion RMB, sales of pre-owned luxury products account just for 5% of the overall luxury market, compared to over 20% in the US, Japan and the UK.

Gen-Z consumers living in high tier cities are the main driving force of China’s second-hand luxury market, as a result of their growing attention to environmental issues and their hunger for exclusive clothing at accessible prices. Beyond second-hand luxury marketplaces, such as Secoo, Plum and Dewu, the rising demand for accessible luxury goods led to the emergence of online clothing rental services in China during the mid-2010s.

The sharing economy in China

Born in the West, the sharing economy has found a conducive environment in China. Indeed, nowadays sharing services are ubiquitous in Chinese people’s everyday life, from ride-hailing to bikes, passing through umbrellas and power banks. The most recent trend of the sharing economy in China is beauty booths. According to the National Bureau of Statistics of China, in 2019 the domestic sharing economy generated over 3 trillion RMB in revenues and it is expected to further grow by 30% in the following 3 years. In addition, it is estimated that there are about 200 million gig workers across the country, accounting for almost one fourth of China’s entire labor force.

The rise of online clothing rental services in China

The high demand for more affordable and sustainable ways to get a hold on luxury clothing led to the rise of a constellation of online apparel rental apps. Among the main factors behind the hype for fashion rental platforms in China it is worth mentioning:

- Young Chinese’s appetite for a varied wardrobe

Chinese fashion consumers like constantly updating their look and expanding their wardrobes to keep up with the latest trends. Therefore, they do not subscribe to rental services just to find outfits for special events;

- Hurdles in purchasing clothes in China

When shopping for luxury apparel, Chinese consumers have to deal with exorbitant prices, counterfeit goods, and low-quality clothing. Problems related to sizing can occur as well, especially when it comes to buying online, since it is not possible checking how something fits until the order gets home. For their part, online clothing rental services in China grant users the chance to familiarize themselves with collections and brands they would otherwise not dare to purchase online, figuring out the right sizing and measurements;

- Getting hold of luxury clothing at bargain prices

Consumers who cannot afford full-time ownership of luxury goods can now rent, with the possibility to then purchase, luxury goods through Chinese wardrobe rental platforms.

MsParis, the pioneer of high-end fashion rental platforms in China

Founded in 2014 focusing on special-occasion garments, MsParis was a pioneer of online clothing rental services in China. MsParis offers two different categories of service: “light luxury” and “basic luxury.” The basic service targets women aged between 18 and 24, while the light luxury plan is designed for more mature women looking for stylish office wear. The online fashion rental platform boasts a selection of more than 1 million items of over 500 international fashion brands, such as Moschino, Ralph Lauren and Calvin Klein. At the beginning, the platform granted users to subscribe for about 400RMB and rent an unlimited number of items per month. Nevertheless, the current membership plan allows subscribers to rent up to 30 pieces per month and 6 pieces per shipment for 488 RMB, in an attempt to keep afloat during the big market crunch which forced many of its competitors to shut down.

Change or perish: online clothing rental services in China at a crossroads

The golden age of China’s online wardrobe rental platforms was between 2014 and 2017, when they managed to get over 130 million dollars from e-commerce giants and venture capital funds, such as Alibaba Group, Softbank China Capital, China Growth Capital, and many others. After such frenzy for online clothing rental services in China, the covid-19 pandemic made chicken come home to roost and most major players in this field went bankrupt.

YCloset was a pioneer of fashion rental platforms in China, in 2017 it had six rounds of financing from prestigious investors like Alibaba, SoftBank, IDG Capital, and Sequoia Capital and became the industry’s unicorn. By paying a monthly subscription plan of ¥499, users could rent an unlimited amount of apparel and accessories, delivery and cleaning fees included. Furthermore, users could even purchase their favorite outfits at reasonable prices instead of continuing to rent them. When the platform changed its renting rules in an endeavor to make its business more sustainable, it sparked outrage among users, thus worsening its situation. In July 2021, the company announced its imminent shut down.

Same fate for the San Francisco-based online wardrobe rental company Le Tote. In 2018, the US startup decided to expand its business in China, opening its headquarters in Shenzhen and satellite offices in Beijing and Hong Kong. After purchasing the department store chain Lord & Taylor and the outbreak of the global pandemic, Le Tote got into financial troubles and decided to file for bankruptcy.

The pitfalls of the online clothing rental services in China

The covid-19 pandemic and the consequent market crunch revealed the weaknesses of the online fashion rental programs. First, this business model is capital-intensive, and it poses challenges by itself, since it involves a wide range of costly operations such as supply, storage, logistics, after-sales, cleaning, inventory renewal, etc. Second, an underestimation of related costs, along with price competition among main players, led to set unprofitable membership fees. Third, in order to persuade consumers to rent clothes, subscription plans should have been perceived as cost-effective. Instead, most of such platforms lacked top items which could have convinced customers that the service was worth the price. Fourth, platforms had better diversify their business to make it more sustainable. When they began to do it, it was too late.

At the same time, online wardrobe rental companies suffered the competition from counterfeit goods, affordable luxury, and second-hand luxury platforms. The latter currently represent a rising trend in the pre-owned luxury market.

Lessons from the rise and fall of online clothing rental services in China

- Chinese Gen-Z consumers are keener to purchase pre-owned luxury goods than older generations were, yet second-hand luxury items account for a small percentage of overall sales, indicating that the market is still not mature enough.

- In the late 2010s, young consumers’ growing demand for accessible apparel, along with their environmental concerns and appetite for showing off a varied wardrobe, led to the emergence of online clothing rental services in China.

- Founded in 2014, MsPris was one of the first and longest-running platforms providing such kind of service. Recently, the online apparel rental app adjusted its offer in an attempt to make its business more sustainable displeasing many of its users.

- The covid-19 pandemic induced most of fashion rental platforms in China to shut down. YCloset and Le Tote were possibly the best-known victims caused by the bursting of the bubble.

- Both features inherent to this kind of business and wrong strategies embraced by online wardrobe rental platforms were at the basis of the fall of online clothing rental services in China. Nowadays, Chinese consumers’ preferences seem to be shifting towards second-hand luxury apps, such as Secoo, Plum and Dewu. The future will tell us whether it is a temporary hype or a sustainable success.