On July 16, the Vice-Minister for Ecology and Environment Zhao Yingmin officially ushered in the China’s long-planned carbon emission trading market, the world’s largest CO2 market. The carbon exchange system, which made its debut with 4.1 million tons of carbon dioxide quotas worth 210 million RMB traded in a single day, was actually launched in 2017, and it was supposed to come into action in 2021. Nevertheless, although the legal framework regulating China’s carbon emission trading market had already come into force in February 2021, the carbon exchange program was still not available due to operational issues. The trading system is going to play a major role in helping the country to achieve its ambitious goal to reach a carbon emission peak in 2030 and become a net zero emitter by 2060.

China’s carbon emission trading market will initially involve companies in the power sector, which are responsible for about 40% of the national CO2 total emissions, but then it will expand in the following years covering other highly pollutant industries, including cement, steel and aluminum. China’s carbon emission trading market will provide participating companies with emission quotas and they will be able to use it for their own purposes or sell on the market. The exchange price of such quotas is around 40 and 50 RMB.

With its huge population of about 1.4 billion, spreading awareness among citizens and prompting them to reduce their carbon footprint is fundamental. Thereby, on December 2019, Guangzhou launched its own Carbon Exchange Platform: local residents get carbon coins (convertible in RMB or in merchandise) when they opt for low-carbon transportation or manage to save water and electricity. Such system will become nationwide.

Untangling China’s energy sector

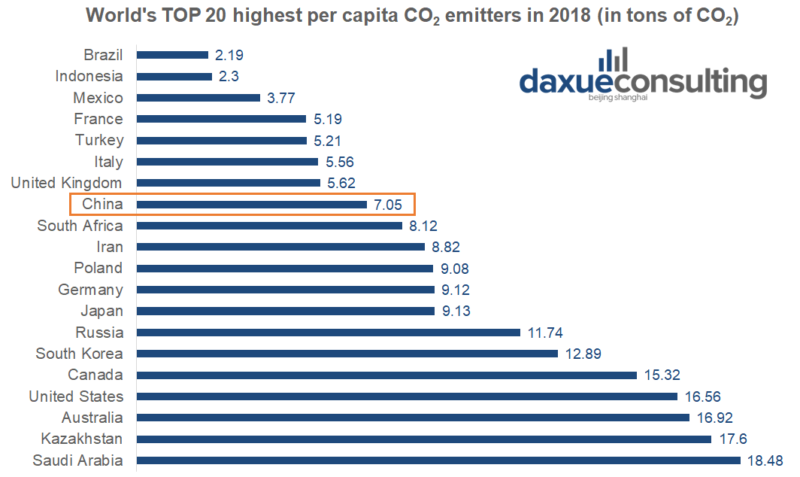

According to the International Energy Agency, in 2018 China emitted around 9,528 gigatons of CO2, recording a 356% increase compared to 1990. Although the country ranks first in absolute terms, accounting for 28% of the global carbon emissions, China is the 13th largest per capita emitter, following the Saudi Arabia, Kazakhstan, Australia, the US and Canada, among others. Coal is China’s main source of energy. In fact, despite the tremendous progress in renewables, coal keeps on accounting for roughly 62% of the national energy mix. Other fossil fuels, such as oil and natural gas still play a major role in the country’s energy supply. Nevertheless, as the share of oil in China’s energy mix declines, those of natural gas, nuclear and renewables are gradually on the rise.

Even though fossil fuels are key sources for the national energy supply, China is a world leader in green technologies: about one third of the world’s wind turbines, more than two thirds of global solar panels and almost 75% of the world’s lithium-ion battery cells are Made in China. Such success is partly due to state dirigisme, since Chinese government is heavily supporting and investing in clean energy in order to achieve its emissions target. For instance, in 2021, China plans providing its renewable energy sector with about 5.95 billion RMB in subsidies, 5.69 billion of which are expected to go to the solar and wind industries. However, China still has a long road ahead before being able to replace fossil fuels with green energy sources.

A glimmer of light for foreign investors

Big State-Owned Enterprises dominate China’s traditional energy sector, while government subsidies and procurement practices strongly favor domestic companies in the renewables. Market concentration, state aid and lack of transparency discourage foreign players from entering China’s green energy market. Nevertheless, the country’s ambitious carbon reduction agenda, along with efforts to reduce debt and improve industry efficiency, is creating new opportunities for foreign companies and investors.

In December 2020, the Chinese State Council Information Office released a new White Paper announcing plans to lift restrictions on foreign investments in the energy sector during the 14th five-year plan period between 2021 and 2025. Such investment liberalization will involve coal, oil, gas power generation and new energy businesses, thus boosting the development of China’s green energy sources. Instead, measures restricting foreign involvement in nuclear power will remain in force. Moreover, in February 2021, in an attempt to foster competition and improve production quality, the National Energy Administration released a circular suggesting a new regulatory framework aimed at phasing out government subsidies in the solar and wind industries. A green bond market will replace state subsidies as a main financing channel.

Hydrogen fuel cell technology and China’s New Energy Vehicles

In April 2020, China drafted a new Energy Law mentioning hydrogen as a core resource in the national energy mix. In 2020, the Ministry of Finance, along with 4 more ministries and commissions, released the so-called “Notice of Five Ministries regarding the Development of Fuel Cell Vehicle Demonstration,” aimed at fostering the expansion of hydrogen fuel cell batteries in ships, drones and commercial vehicles. Nowadays, China is the largest New Energy Vehicle (NEV) market in the world. However, among the three main categories of NEVs, fuel cell cars are still lagging behind: just 2.73 units manufactured in 2019, compared to 972,000 battery electric vehicles and 232,000 plug-in hybrid electric vehicles.

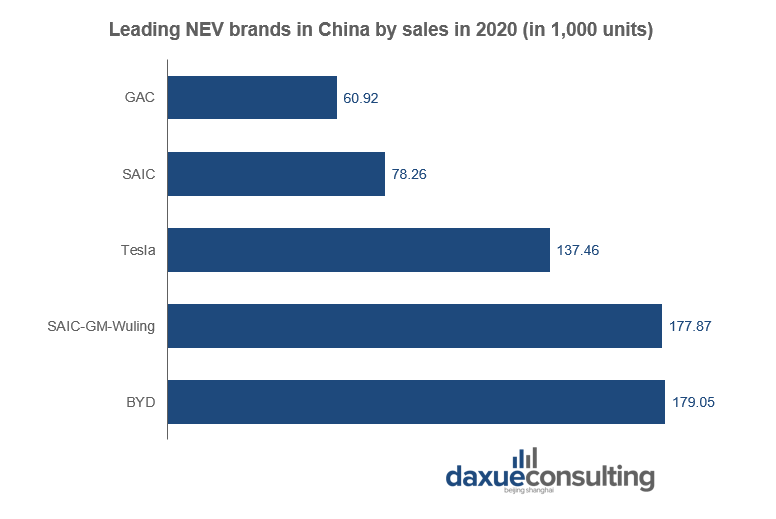

BYD, SAIC-GM-Wuling and Testla have been the most popular alternative energy commercial vehicle brands in China in 2020. As the country focuses more and more efforts on cutting greenhouse gas emissions, NEVs will turn into a market plenty of opportunities for foreign companies, especially after the ongoing lifting of foreign ownership limits on automakers, which will enter into force into 2022.

Takeaways: the impact of China’s carbon emission trading market on companies

- China’s long-planned carbon emission trading market came into action on July 16th 2021 in order to support the country in its pursuit of the net-zero emissions target by 2060. The CO2 exchange program will initially just involve companies in the energy sector, but it will then expand to cover other highly pollutant industries, including cement, steel and aluminum.

- Despite the tremendous progress in renewables, coal remains China’s main source of energy. However, the country is the world’s largest manufacturer of green technologies.

- Market concentration, government subsidies and lack of transparency discourage foreign players from entering China’s green energy market. Nevertheless, the country’s ambitious carbon reduction agenda, along with efforts to reduce debt and improve industry efficiency, is paving the way to liberalization reforms in the energy sector, creating new opportunities for foreign companies and investors.

- NEVs, and in particular hydrogen fuel cell vehicles will become an appealing and profitable market for foreign companies, especially once that restrictions on foreign ownership in the automotive industry will be completely lifted in 2022.