Chinese major international hubs like Shanghai, Beijing, and Hong Kong have traditionally acted as China’s luxury hot spots. As of 2023, this trend continues to dominate with Shanghai boasting a luxury consumption volume of RMB 53.5 billion, placing it in the lead. Beijing closely follows with RMB 52.3 billion. However, according to the latest China Luxury report published in 2023 by Bain & Company, the growth potential of these main luxury hot spots has been steadily decreasing due to external factors such as increased saturation of supply and rising competition among luxury retailers. As a result, luxury brands are looking beyond these traditional hubs and considering smaller cities for sales growth and market expansion.

Download now our China luxury market report

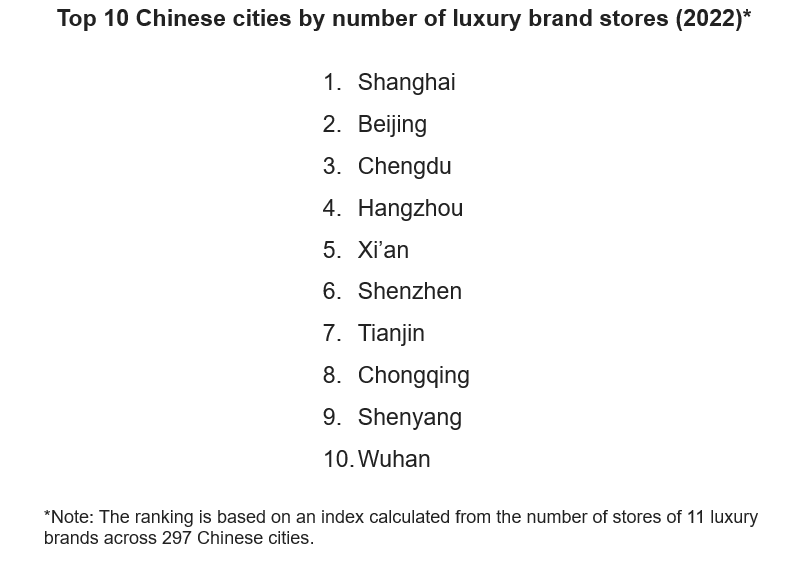

Retail evolution: The expansion of luxury storefronts in secondary cities

Tier-2 cities in China are rapidly climbing the ranks in luxury consumption, challenging the dominance of traditional hubs through notable annual growth rates. Cities like Hangzhou and Nanjing are firmly standing out with their exceptional year-on-year growth in luxury spending, emerging as key contenders to become leading centers in the luxury market. Similarly, smaller cities such as Suzhou and Xiamen are establishing themselves as considerable players, distinguished by the impressive growth trajectories of their luxury hubs. These emerging luxury hot spots share commonalities that boost their appeal, such as a high-quality living environment and well-regulated business conditions, essential attributes for attracting core consumers of luxury goods from beyond their borders.

To understand where the next luxury hot spots in China will emerge, it is crucial to look beyond the conventional markets and delve into the potential of these secondary, high-growth urban centers. Our analysis aims to determine which emerging locations are set to become China’s top luxury destinations. We will assess the potential of these hubs by examining key factors like demographic growth and increases in household disposable income. In addition, we will couple these factors alongside the strategic expansion of the luxury retail landscapes of these hubs, notably by assessing the number and variety of flagship stores from elite brands such as Hermès, Louis Vuitton, Loro Piana, and Bulgari.

Zhejiang: Pioneering the next wave of luxury market expansion

Even though Shanghai might be the biggest single consumption hub, Zhejiang is the leading Chinese province in terms of luxury consumption, with 7 of its cities being ranked among the top 50 cities for luxury spending as of 2023. Hangzhou, the capital of Zhejiang, lies in the heart of this quickly rising luxury consumer hub in China.

Hangzhou: the emergence of a premier luxury destination

Hangzhou represents a compelling choice for luxury brands looking to capitalize on China’s luxury market boom. The economic and retail environment in Hangzhou is highly favorable for luxury brands. The city’s status as a tech hub contributes to its wealth, making it an ideal market for luxury goods with a consumer base that possesses significant spending power. This consumer spending is very visible if we look at the over RMB 321 million revenue flow generated by luxury sales within the city in 2023 alone.

The city’s population has grown significantly, from 5.76 million in 2010 to approximately 7.64 Million in 2020, an increase that underscores its attractiveness as a place to live and work. This population boost, combined with a vibrant economic environment, has led to a rise in household disposable incomes, from RMB 45,000 in 2015 to RMB 77,000 in 2022, reflecting an average annual growth rate of 4.8%. Renowned for its historic landmarks and natural beauty, including the UNESCO-listed West Lake, the city is already a huge tourist hot spot drawing a large number of tourists, further increasing its already large and wealthy consumer base.

Hangzhou’s luxury market is supported by the presence of high-end retail outlets including two Hermès and Louis Vuitton stores, and Flagship stores of Brunello Cucinelli, Loro Piana, and Bulgari, all located in strategic shopping hubs such as the Hangzhou Tower and Hangzhou MixC. These locations don’t act just as shopping destinations but also as social gathering spots for the affluent, enhancing the city’s profile as a luxury hot spot.

Ningbo: harnessing port supremacy to fuel luxury growth

Ningbo is another major new luxury hot spot in Zhejiang. Located strategically close to Shanghai, the city has evolved into a significant global port and industrial hub. Nowadays the city represents a promising marketplace for luxury brands looking to expand in China. In 2023, the overall amount of revenue generated by the sales of luxury goods within the city reached a new peak of RMB 191 million, consisting of a cumulated rise of 17% in the two years spanning from 2021.

According to China’s national census, Ningbo’s population has steadily grown from 7.6 million in 2010 to approximately 9.4 million in 2020, marking an annual growth rate of about 1.19%. This growth is supported by Ningbo’s status as a significant manufacturing and logistical hub, which attracts a diverse workforce enhancing its demographic dynamics. Economically, Ningbo has also witnessed substantial growth in household disposable income, with the average annual disposable income rising from RMB 36,876 in 2015 to RMB 76,690 in 2022, representing an average annual growth rate of 8.5% over the last 7 years.

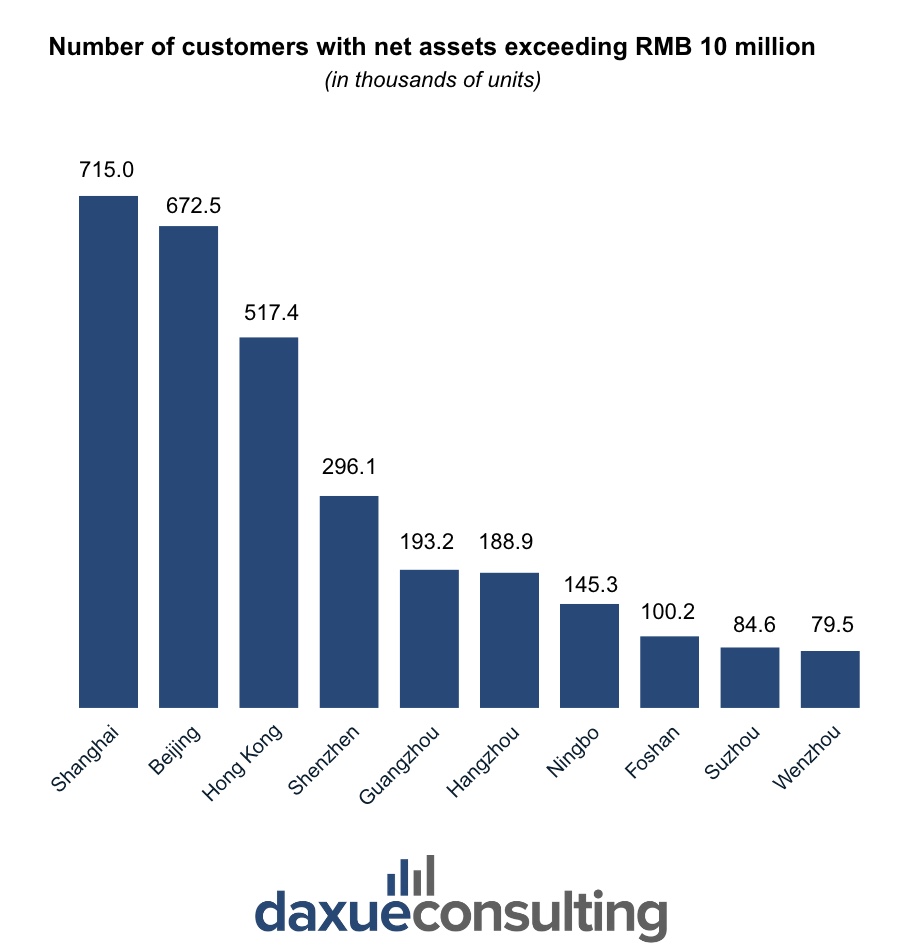

In the luxury market, Ningbo is steadily making its mark with several upscale shopping areas catering to the relatively underserved population of affluent consumers. The city, despite its middle-size status, is estimated to act as the residence of over 145 thousand high-net-worth individuals (defined as holding assets of more than 10 million RMB). Notable luxury retailers include Hermès, Louis Vuitton, and Bulgari are all located at Tianyi Square, the beating heart of Ningbo’s retail landscape.

Strategically, Ningbo’s strategic proximity to Shanghai complemented with its disposal of vast transport and logistics capabilities, are an integral asset for the city’s rising appeal as a new luxury hot spot in China. The port facilitates a high volume of commercial activity, making it a critical entry point for luxury items. Additionally, it enhances logistics for luxury brands and provides access to a broader market.

Jiangsu: A fierce competitor in the luxury showdown

Nanjing: When cultural magnificence meets luxury retail

Nanjing, the capital of Jiangsu province, is being increasingly recognized as a major luxury hot spot in China thanks to its unique blend of historical and cultural background combined with a robust industrial base and significant educational resources. Nanjing offers significant opportunities for luxury brands looking to expand in China thanks to its ability to attract a constant flow of young professionals and students. This influx of a high-revenue workforce supports a population that has grown to approximately 9.94 million in 2024, a cumulated 12% increase from 2020. The city’s status is further bolstered by the presence of prestigious universities and research institutes, enhancing its profile as a national education center and enriching the consumer market with a vibrant and youthful demographic.

With an advanced economic structure, Nanjing’s average annual disposable income is notably high, reaching around RMB 76,646 in 2022, growing at an average rate of about 8.5% annually. This economic prosperity is supported by high-paying industries including software, automotive, and pharmaceuticals, which contribute to its residents’ substantial spending power.

The city’s rich cultural heritage and ongoing urban developments make it an attractive destination for both domestic and international tourists, which ultimately benefits luxury retailers. Its luxury retail landscape is vast and diverse, being composed of several high-end shopping malls that attract premium international brands. For example, Deji Plaza, a prime shopping destination, houses very unique and tailored stores from brands such as Hermès, Louis Vuitton, and Bulgari.

Suzhou: evolving from industrial vigor to luxury prominence

While still rather behind in consumer luxury spending, accounting for RMB 128 million in revenue, Jiangsu’s second biggest city Suzhou, is rapidly developing as a significant luxury destination within China. For instance, between 2022 and 2023, average revenue from luxury sales increased by 23%.

Suzhou’s compelling status as a future hot spot for luxury retail investments is mainly driven by its strong economic growth and strategic location near Shanghai. As of 2024, Suzhou’s population is approximately 8.35 million, with a healthy cumulated growth rate of about 17.1% since 2020.

The average annual disposable income in Suzhou has also been increasing fast averaging at a rate of approximately 10.2% per year. In 2022, it was placed at around RMB 79,537. This substantial income growth reflects the city’s economic dynamism and its residents’ increasing purchasing power, factors that are crucial for the sustenance of luxury markets. In addition, the city’s ancient cultural heritage coupled with a modern industrial vitality, makes it an attractive hub for business and tourism, which are key external drivers of luxury retails.

With its ongoing economic growth and urban development, Suzhou is poised to enhance its desirability as a destination for luxury retailers looking to diversify its presence in the Chinese market. Suzhou’s appeal to luxury shoppers is exemplified by the presence of high-end retailers such as Hermès, Louis Vuitton, and Bulgari, all located in the Suzhou Center Mall.

Haikou’s ascendancy in Hainan’s luxury arena

Hainan has experienced a significant increase in luxury goods consumption overall, thanks to the advantages provided by duty-free exemptions implemented by the Chinese government to stimulate the island’s growth. Until recently, Sanya, which has now become the fifth-largest city in China in terms of luxury consumption, was the leading luxury hot spot in the province. However, the situation has changed as Haikou, the province’s capital city, is rapidly emerging as an alternative epicenter for luxury consumption in the region, challenging its sister city’s current dominance.

As of 2024, Haikou’s population stands at approximately 2.06 million, with a cumulated growth rate of more than 8% since 2020. This population increase is bolstered by the central government’s initiatives aiming to develop the entire island into a major free trade port by 2030, which attracts both domestic migrants and international expatriates. The average annual disposable income in Haikou, as of 2021, is estimated at RMB 43,605, modest for a luxury hot spot but increasing rapidly with an average growth of 8.5% per year.

Overall, Haikou has started to witness substantial growth in the luxury retail sector, making it the Chinese city with the fastest growth rate in luxury consumption, an astonishing 89% year-on-year increase in 2023, reaching a total luxury consumption of RMB8.9 billion. The city’s luxury landscape is bolstered by the presence of high-end brands such as Hermès, Louis Vuitton, and Bulgari, all located in the recently inaugurated Haikou International Duty-free City.

The next consumer trends to expect in the Chinese luxury market

- China’s luxury hot spots are shifting away from traditional hubs like Shanghai and Beijing towards emerging cities. This trend is propelled by new economic policies, unique strategic locations, and evolving consumer demographics.

- Hangzhou boasts advanced technology and educational resources, attracting wealthy consumers and enhancing its luxury retail infrastructure.

- Ningbo uses its status as a major global port to improve distribution efficiencies and accessibility for luxury goods.

- Nanjing offers a vibrant market through its rich cultural history and strong educational framework, appealing to luxury consumers.

- Suzhou combines cultural heritage with industrial growth, providing a unique luxury shopping experience in picturesque settings.

- Haikou gains from duty-free policies that reduce luxury goods prices, rapidly establishing it as a key luxury consumption center.