In 2023, the sun protection market in China is projected to exceed 1 billion US dollars, positioning it as the world’s second-largest market in this industry. The leading market, valued at approximately 2 billion US dollars, is currently held by the United States. The sun protection market covers a range of products, including but not limited to sunscreen products, sun protection wears, and electronics.

The growing trend of outdoor leisure activities is driving a continuous increase in the demand for outdoor footwear, apparel, and sun protection products. In 2022, outdoor sports experienced a boom in popularity as barriers to inter-provincial travel led Chinese consumers to focus on urban activities, fueling the vibrant growth of various outdoor sports like camping, frisbee, and land surfing. Sun protection is the biggest demand in outdoor sports, with 89% of outdoor goers buying sun protection products as of January 2023.

China’s sun protection products are on the rise with safety concerns in mind

The Chinese sunscreen market has displayed consistent growth since 2008 with an estimated compound annual growth rate (CAGR) of about 15% from 2023 to 2025. The demand for sunscreen products is on the rise, fueled by increasing awareness of sun protection and a surge in travel activities. In addition, China’s domestic market is poised for a significant YoY growth of 15.9%, driven by a booming passenger transport volume and rising per capita disposable income. This growth presents opportunities for established cosmetic brands and suppliers of active cosmetic ingredients to expand their market share.

As consumer education about sun protection becomes more widespread, consumers are placing greater emphasis on the safety of sunscreen products. According to the “2022 Sunscreen Trend White Paper” by Cinda Securities, 39%of consumers prioritize the “safety/reassurance” factor when purchasing sunscreen products. Consequently, in recent years, the market competition for traditional sunscreens, which offer single-band protection and have lower technological barriers, has been fierce and the growth rate slow. On the other hand, there is a relatively tight supply-demand pattern for new sunscreens with excellent functional characteristics that are still under patent protection or have just passed the protection period.

Based on the big data platform Bevol, during the period of 2018-2021, sunscreen products containing high-risk ingredients such as 4-methylbenzylidene camphor (4-MBC) gradually fell out of favor among leading products due to safety concerns. Instead, sunscreens containing ingredients like Diethylhexyl Butamido Triazone (DHBT), Tert-Butylmethoxydibenzoylmethane (TDSA), Ethylhexyl Triazone (EHT), Diethylamino Hydroxybenzoyl Hexyl Benzoate (PA/DHHB), and Phenylbenzimidazole Sulfonic Acid (P-S/BEMT) have been increasingly used in sunscreen products.

Exploring the most popular sunscreen products in China’s sun protection market

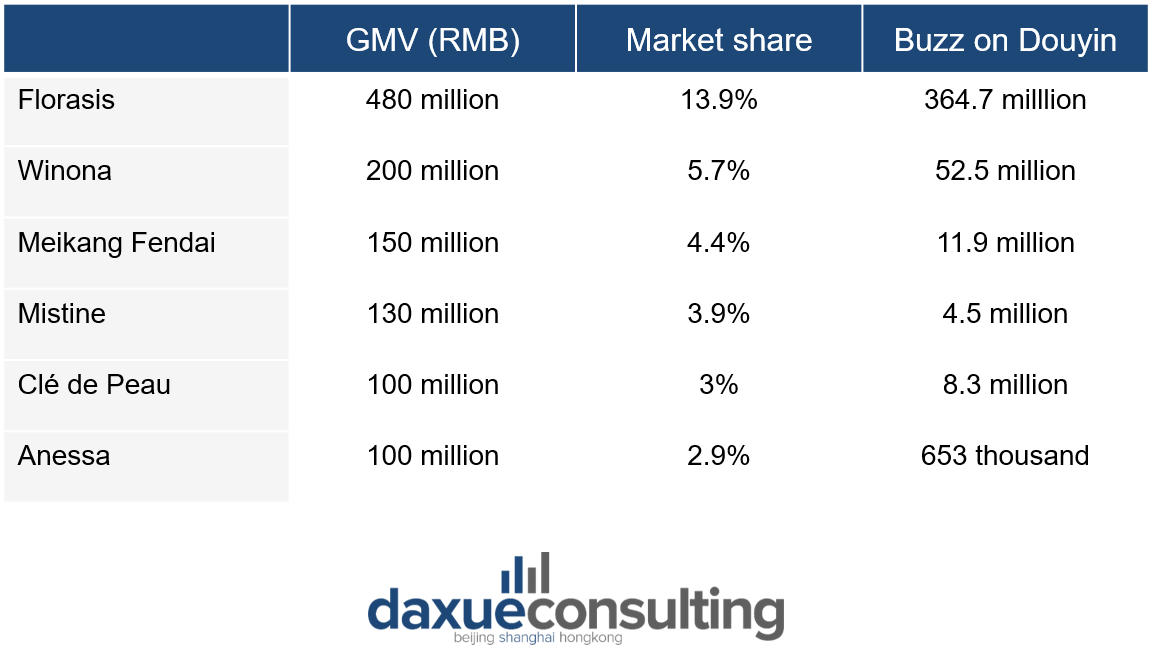

The sunscreen market in China presents a vast and varied landscape of brands, ranging from cheap to luxurious items. The three most popular domestic ones include the makeup Chinese giant Florasis (花西子), Winona (薇诺娜), and Meikang Fendai (美康粉黛), while among the international brands are the Thai Mistine (蜜丝婷) and two brands owned by the Japanese Shiseido Group, Anessa (安热沙) and Clé de Peau (肌肤之钥). French and Italian brands are among the most expensive options, as their average price surpasses 200 RMB (27.7 US dollars).

Adjust to the heatwaves by embracing creative sun protection fashion

The trend of outdoor activities has seen significant growth since the onset of COVID-19. In line with this, the government’s release of the ‘Development Plan for the Outdoor Sports Industry’ and the gradual relaxation of restrictive policies have contributed to the ongoing enhancement of supporting industries. As a result, various related sectors, including footwear, sun protection, and sports equipment, are poised for further development.

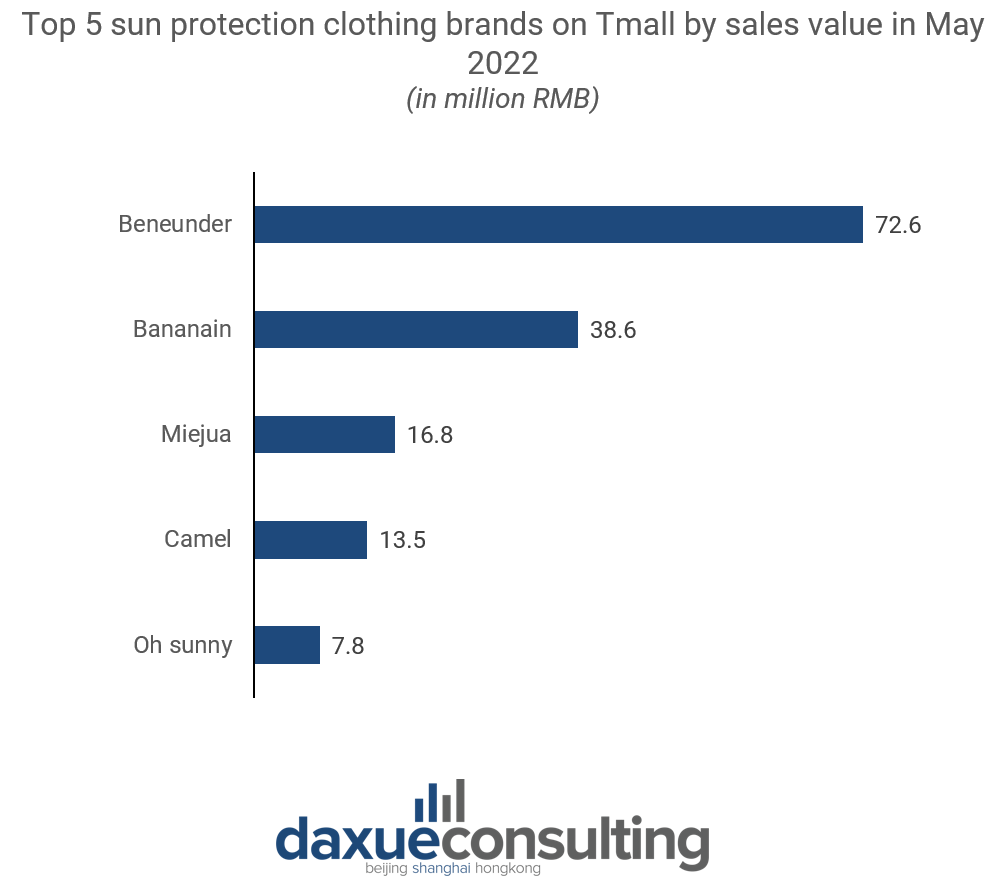

For sun protection, there are traditional sun protection parasols, hats, and hand sleeves. In terms of local brands that focus on sunproof apparel, there are Bananain, Beneunder and OhSunny. Other larger brands, such as Anta, Uniqlo, Lululemon, and Decathalon have also added clothing such as UV tinted hats and jackets to their local product assortment.

In addition, sunkinis (swimwear clothing covering more than normal bikinis) are pretty beloved due to their exceptional sun protection, featuring UPF (Ultraviolet Protection Factor) ratings that outperform standard swimwear. This fabric is breathable and dries quickly, catering to outdoor activities like beach outings, water sports, and leisurely sunbathing.

From unique fabrics to creative weaving techniques and innovative coatings, the style and functionality of sun protection clothing are central aspects of their promotion on social media. Addressing the common concern of avoiding tanning while at the beach, influencers, and Key Opinion Leaders (KOLs) leverage this sentiment as a smart approach to showcasing swimwear products on various platforms. What’s more, some of these products go beyond sun protection and offer extra features like mosquito repellent capabilities to cater to a wider range of consumer preferences.

Chinese consumers are seeking for lightweight outdoor solutions for sun protection

Chinese consumers are seeking lightweight outdoor solutions that offer effective sun protection while aligning with their expectations of versatility, ease of use, and adaptability across different situations. However, the current sun protection market in China tends to prioritize functionality over aesthetics, resulting in limited choices in terms of styles and colors for everyday wear. Traditional bulkier outdoor gear doesn’t integrate well into daily life.

As a response, Chinese consumers are favoring lightweight outdoor solutions that balance functionality, portability, and convenience, catering to activities such as sports, commuting, and social gatherings. For instance, innovative cooling sun-protective apparel provides reliable sun protection for the head, neck, and hands throughout the day, suitable for both daily wear and sports activities without compromising comfort. Similarly, compact, and foldable eyewear, weighing less than 19g, offers comfort and pocket-sized portability, merging style with protection for various leisure and sports activities. This ensures refreshment and safeguarding through cooling and sun-protective technology.

China’s sun protection trends, safety focus, and outdoor gear demand

- The sun protection market in China is rapidly expanding and is set to reach 1 billion US dollars in 2023, which is second only to the nearly 2 billion US dollars market in the US.

- As awareness about sun protection grows, consumers are prioritizing the safety and reliability of sunscreen products. Traditional sunscreens face fierce competition, while newer products with advanced functional characteristics are gaining traction, appealing to safety-conscious consumers.

- The rising trend of outdoor leisure activities is propelling the demand for outdoor gear and sun protection products. There are creative designs for different outdoor activities.

- Chinese consumers favor lightweight, fashionable, and functional sun protection gears over the traditional ones.

Author: Howard Lai

Read our report on sustainable fashion in China