As Chinese consumers become more aware of the importance of skin health, the use of sunscreen is no longer limited to sunny summer days. Nowadays, people in China regularly apply sunscreen even during colder seasons when the sun’s rays are not as intense. This shift in behavior is only one of the many reasons behind the growth of the sunscreen market in China in recent years.

The ongoing growth of the sunscreen market in China

According to Statista Market Insights, the sun protection market in China generated nearly USD 1 billion in 2022 and is projected to experience a CAGR of over 7% from 2023 to 2028. Specifically, the Research and Development Center Cida Securities further elaborates that the Chinese sunscreen market has been incessantly expanding since 2008 and is expected to maintain a CAGR of around 15% from 2023-2025. However, during the strict lockdowns of China’s zero-Covid policy, the market experienced a temporary setback, similarly to many other segments in the beauty sector.

A closer look at the factors fueling the market’s expansion

The market’s growth is primarily driven by new health concerns among the population. As people become increasingly aware of the harmful effects of prolonged sun exposure, they are more inclined to find new ways to protect themselves. For this same reason, products offering more layers of protection are in high demand, while single-band protections and low-barrier creams register slow growth.

The 2015 edition of the “Safety and Technical Specifications for Cosmetics” allows only 27 sunscreen filters into China, with 25 being chemical nature and 2 being physical. Foreign brands aiming to enter the market need to review and modify to ensure compliance with the regulations.

Other factors influencing the market’s growth are certainly the population’s higher disposable income and the renovated interest in outdoor sports. As a result, Chinese consumers are seeking products that meet various requirements, including easy application and re-application, long-lasting and waterproof properties, as well as additional functions like moisturizing and protection against air pollution.

Unveiling the consumer profile of China’s sunscreen market

When choosing what sunscreen to buy, consumers mainly take into consideration the smell, efficacy, application ease, as well as other side functions such as its moisturizing effect or air pollution protection. Such products are distributed within three price bands: economic products generally cost less than RMB 55 (USD 7.6), mid-to-high units in between RMB 55-229 (up to USD 31.7), while high-end sunscreens are more expensive than RMB 229. According to the data analytics company Feigua Data (果集飞瓜), the market segment with a cost comprised between RMB 36.9 to 55 (USD 5.1 to 7.6) has experienced a growth of 282% from 2021 to 2022, showing that the most promising growth opportunities are situated in the mid-price section.

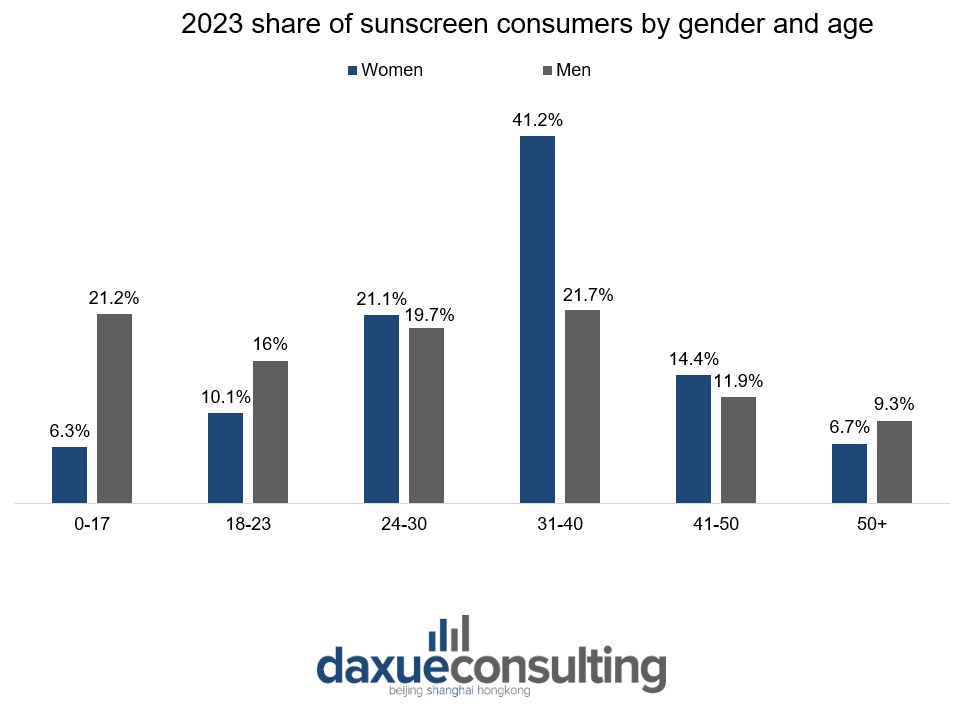

Consumers are mostly women

Most of the consumers in the Chinese sunscreen market are women, although in recent years there has been a growing demand for sun protection products also among men, especially from the ones born after the year 2000 (37.3% of the overall sunscreen consumers). However, sunscreen consumption is more frequent among women between 24 and 40 years old.

2 trends influencing consumers’ sunscreen preferences

1. White skin effect

In China, and in many other countries of East and Southeast Asia, having white, pale skin has always been part of the local beauty standards. It is not unusual to see Chinese women walking down the street with an umbrella on a perfectly sunny day: that is because they do not want to get tanned.

It is not difficult to imagine, then, that whitening products are also a big trend in China’s beauty sector and the sunscreen market is also experiencing the growing demands for creams and lotions which make the skin appear white and smooth, without feeling greasy.

2. Safety and product quality

As mentioned above, consumers are paying more attention to the ingredients and the overall feeling of the products. They want effective protection from UV rays and additional functionalities that hydrate and repair the skin. The growing importance of skin health has led consumers to use sunscreen in various contexts, whether indoors, outdoors, and even while commuting, across all four seasons. Moreover, the sun protection market is evolving to include more varied options, such as lips sunscreen and hair sunscreen, opening new opportunities for brands to diverge from traditional skin protection.

Exploring the most popular brands and products in the Chinese sunscreen market

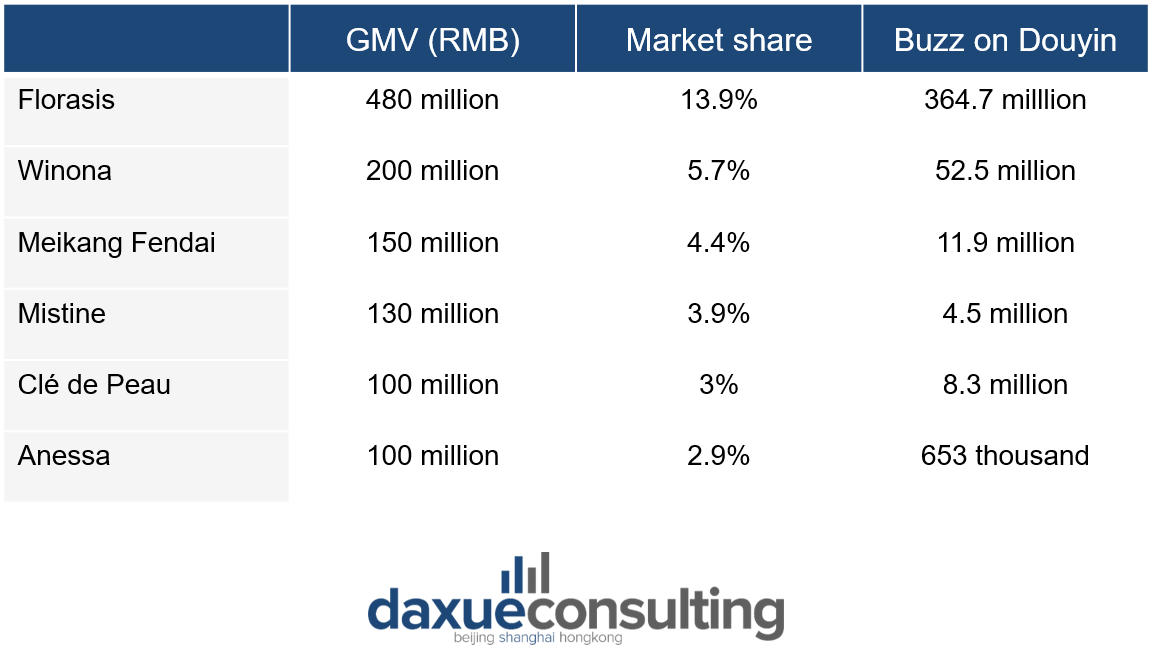

The sunscreen market in China presents a vast and varied landscape of brands, ranging from cheap to luxurious items. According to Feigua Data, the three most popular domestic ones include the makeup Chinese giant Florasis (花西子), Winona (薇诺娜) and Meikang Fendai (美康粉黛), while among the international brands are the Thai Mistine (蜜丝婷) and two brands owned by the Japanese Shiseido Group, Anessa (安热沙) and Clé de Peau (肌肤之钥). French and Italian brands are among the most expensive options, as their average price surpasses RMB 200 (USD 27.65).

Meikang

Meikang is a Chinese brand of cheap and affordable cosmetics as well as sun protection products founded in 2009. According to the digital marketing platform PinData (品数), the brand doubled its monthly revenue in between January and February 2023, and again between February and March, going from RMB 414 million (USD 57.2 million) to RMB 1.9 billion (USD 262.6 million) by the end of the first quarter. Its sunscreen creams are renowned for their high protection level, SPF50+ PA+++, along with their skin whitening effect and non-greasy formula.

Meikang boasts two official pages and one flagship store on Douyin, which as of April 2023 achieved a transaction value of approximately RMB 4.36 million (USD 602.7 thousand).

Mistine

Founded in Thailand in 1988, Mistine entered the Chinese market in 2016 via e-commerce platforms and has expanded to the sunscreen market with waterproof and sweatproof products. As a brand catering to the younger generations, Mistine has collaborated with famous Key Opinion Leaders (KOLs), like Wu Lei and Ju Jingyi, as well as other important brands, like Pop Mart. Additionally, it launched different online interactive events on Douyin and Weibo, successfully leveraging their KOLs popularity to attract more people from the Gen Z. Mistine’s popularity is due to a clear positioning in the market and subsequent effective content marketing strategies targeting the younger generations.

Diving into the sunscreen market in China

- The growth in the sunscreen market in China is driven by various factors, including increased awareness of skin health, a higher disposable income and interest in outdoor activities.

- Health concerns and the desire for comprehensive UV protection drive the market, with high demand for products offering multiple layers of protection. Other features influencing consumers’ choices are ease of application, long-lasting properties, and additional functions like moisturization and protection against air pollution.

- China’s sunscreen market has expanded consistently since 2008, but temporary setbacks occurred during strict lockdowns of China’s zero policy.

- While women constitute the majority of sunscreen consumers, there is a growing demand for sun protection products among men, particularly those born after 2000.

- Popular brands in the Chinese sunscreen market include domestic brands like Florasis, Winona, and Meikang Fendai, as well as international brands like Mistine, Anessa, and Clé de Peau.

Author: Chiara M. Barbera

Download our white paper on China’s beauty industry