In 2023, the global economy continues to grapple with the aftermath of COVID-19 and the war in Ukraine. Despite initial efforts at recovery, the labor market is shrinking, nations are trying to navigate the complexities of inflation, and economists are pessimistic about the future trajectories and anticipating the economic recession.

Download our China luxury market report

Despite various challenges, including cautious consumer spending and a tepid economic recovery, China continues to exhibit steady growth. The latest announcement in 2023 by China’s National Bureau of Statistics revealed positive growth in various sectors, with the GDP growing by 4.9% during 2023 Q3.

The number of billionaires in China continues to surpass that of the US. The recently released Hurun Global Rich List 2023 captures this trend, revealing that China maintains its lead with 1,241 individuals with more than RMB 5 billion, despite a slight decrease of 5% from 2022. As a result, China emerged as a prominent global force propelling the luxury market forward.

The change in the luxury segment from loudness and shine to quietness and values

As China’s luxury market bounces back, a subtle but significant transformation is in play. Despite the sector’s rapid recovery, contemporary consumers exhibit a heightened caution, leading to a forecast of an exclusive rise in high spenders. Meanwhile, rather than flashy displays, there’s a rising preference for “quiet luxury” – a shift to understated, minimalist styles that radiate elegance without the need for loud statements.

On the one side, this change is closely tied to the behavior of China’s ultra-high-net-worth individuals (UHNWIs), who prioritize top-notch craftsmanship and superior quality, and tend to be less attracted to flashy logos. On the other hand, the rise of stealth luxury in China is due to broader factors like the Common Prosperity campaign and an economic slowdown, pushing for more discreet displays of affluence.

According to the Hurun Research Institute, Hermès, Louis Vuitton, Gucci (for men), and Chanel (for women) were the most beloved labels among Chinese wealthy consumers as of March 2023.

Sustainability now is an integral part of the winning strategy for brands, including ultra-luxury

In the last decade, sustainability has emerged as one of the influential factors in shaping consumer choices. Young consumers in China compared to previous generations pursue higher education and a worldrounded outlook, leading to a deeper understanding and awareness of environmental sustainability.

Based on our 2022 Green Guilt report, 89% of Gen Z and 90% of Millennials have altered their shopping decisions due to environmental sustainability concerns at least once. This tendency spreads among all product segments, particularly in the ultra-luxury, as high-income consumers are more willing to pay a premium for purchasing greener products.

Italian ultra-luxury outperforms in China

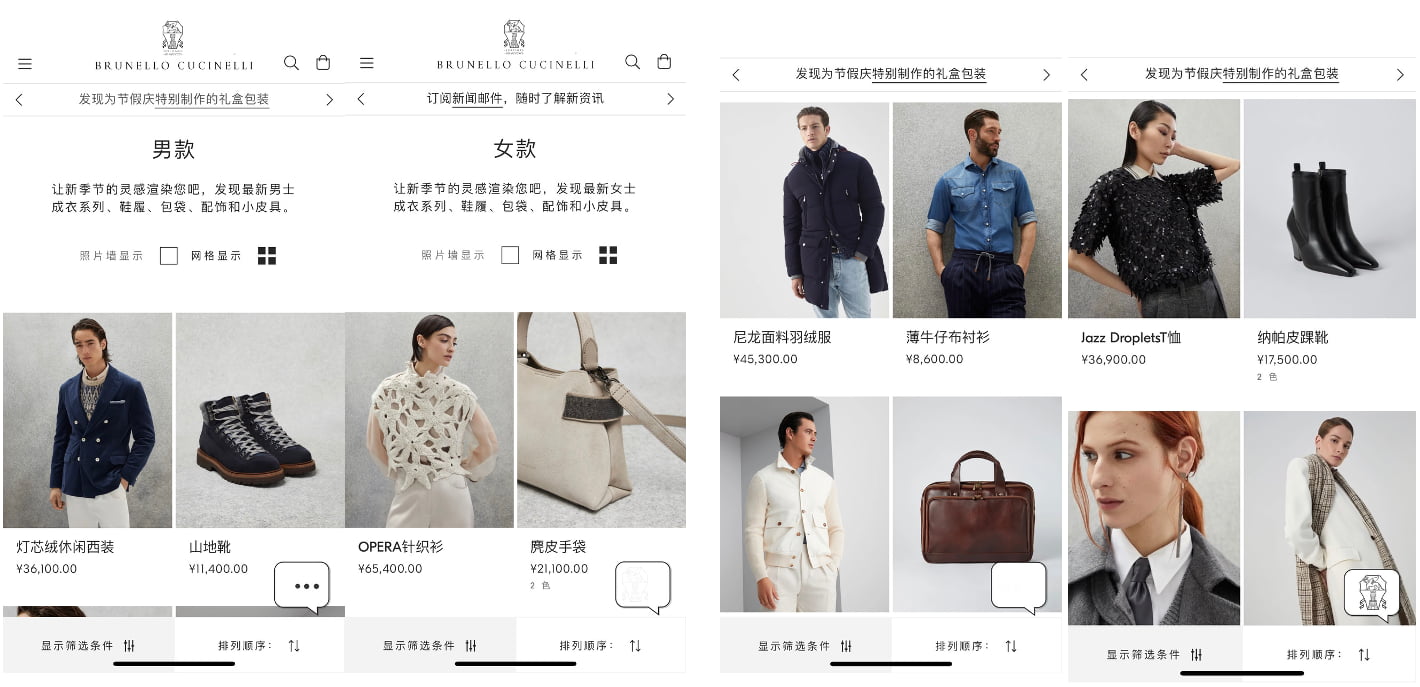

1. Brunello Cucinelli : Exclusive Italy craftsmanship through e-commerce

Brunello Cucinelli is an Italian luxury brand with a rich history, gaining strong positioning as a ultra-luxury brand by using a large variation of strategies. The brand offers superior quality with more than 52% of its products made by hand. The average price of the Italian brand is higher than accessible luxury and aspirational luxury brands reflecting its positioning in the ultra-luxury segment. Brunello Cucinelli himself justifies this positioning by stating that they want to give their customers more than clothes, but heritage they can pass on to their children, with a glimpse of Italian culture.

The distinct feature of the brand is the production, taking place exclusively in Italy. Its unique attentiveness not only makes it stand out but also underscores the brand’s dedication to customer care and personalized attention for each item. Additionally, the commitment to Italian craftsmanship in production aligns with the brand’s sustainability values, in direct opposition to fast fashion’s disposability, a significant contributor to carbon emissions.

The half-year official financial report 2023 demonstrated the brand’s stable increase in revenues all over the world. This tendency was remarkable in Asia, in China especially.

The Italian brand’s position in China – keeping values, while rising consumers awareness

The brand firstly entered China’s ultra-luxury market in 2013. As sales continuously grew, the brand started a project called “Celestial Empire” in 2018. Shortly after, in 2021, the Italian maison opened a multifunctional space in Shanghai called “Casa Cuccinelli.”

Through a blend of digital and physical stores, Brunello Cucinelli embraced an omnichannel strategy, expanding beyond physical boutiques to leverage China’s e-commerce shift. Present on platforms like Weibo, WeChat, and Xiaohongshu, the brand established a virtual boutique on Tmall Luxury Pavilion.

Safeguarding exclusivity through cautious branding in China

Regarding their communication strategy, the subdued ultra-luxury brand in China required promotion in a gentle and refined manner, aligning with the nuanced approach to the brand’s essence. This is a challenging task, given that in the Chinese market, brands often heavily rely on blatant campaigns and traffic stars to break through and gain recognition.

Implementing a highly cautious communication strategy played a pivotal role in safeguarding the exclusivity of the brand while simultaneously enhancing its allure and desirability. An exemplary instance of a successful marketing strategy was the collaboration with Wendy Yu, a prominent businesswoman and founder of Yu Holdings and the Yu Prize. She not only featured in a campaign but also recorded a podcast episode for the brand, showcasing the effectiveness of this approach.

2. Loro Piana: from cashmere to virtual reality

Loro Piana is one of the oldest textile brands, founded in Quarona, Italy, in 1924. Originating with wool and cashmere textiles, the brand later diversified into ready-to-wear clothing in the 1980s, and ventured into home interiors in 2006. Today, Loro Piana comprises three distinct divisions: textiles, luxury fashion, and home interiors, all united by a shared focus on premium fabrics and impeccable craftsmanship. In 2007, the company opened its first store in Mainland China, located in Shanghai. By December 2023, the luxury cashmere brand has 28 stores across the country.

Despite obvious similarities with its Italian competitor, Loro Piana turned to a different market strategy. Loro Piana has been actively diversifying its portfolio in China, with recent initiatives aimed at expanding into new product categories. Upon integration into the LVMH Group, Loro Piana set the intention to shift the revenue distribution, targeting a reduction in the men’s clothing business to two-thirds of total revenue. Furthermore, the new strategy emphasizes a heightened focus on leather goods and accessories, aiming to augment the share of other business categories. Notably, the brand launched its inaugural handbag series and collaborated with the fashion icon Hiroshi Fujiwara. The latest interesting addition was a line of scented candles, signaling a strategic leap into the lifestyle sector.

Loro Piana’s bold ventures into virtual realms and technology

Aligning with modern China’s digital landscape, the brand strategically engages its audience through social media, notably on platforms like Xiaohongshu and Weibo.

Beyond more conventional and expectable expansions, the brand introduced the virtual realm. By utilizing the Aura Blockchain Consortium‘s hub, the first global blockchain solutions provider dedicated to the luxury industry, the Italian luxury brand enables customers to trace every step of its vertically-integrated production process. Its adoption of blockchain technology ensures proof of ownership and authenticity, aligning with the industry’s trend for transparency. This move reflects a commitment to a future-proof and socially responsible luxury approach, promoting garment longevity and showcasing the brand’s dedication to innovative technologies for a multigenerational community.

A deep dive into China’s ultra-luxury market evolution

- The concept of luxury in China is undergoing a shift from ostentatious displays to “quiet luxury,” emphasizing understated, minimalist styles reflecting a rise in high spenders.

- Sustainability has become a crucial aspect of luxury brands’ winning strategy, with Chinese consumers, particularly high-income ones, showing a willingness to pay a premium for greener products.

- Italian ultra-luxury brands, Brunello Cucinelli and Loro Piana, exemplify success in the Chinese market through a blend of traditional craftsmanship, sustainability values, and strategic market adaptation.

- Brunello Cucinelli embraced an omnichannel strategy in China through a virtual boutique on Tmall Luxury Pavilion, Weibo, WeChat, and Xiaohongshu.

- Loro Piana is diversifying its business, reducing emphasis on men’s clothing, introducing new categories like handbags and scented candles.