Over the past two decades, China’s automotive industry has undergone a transformative evolution and emerged as the world’s largest and most dynamic market. With around 150 automotive companies, one-third of which are joint ventures and the rest domestic brands, the industry is highly competitive and rapidly evolving. Rapid urbanization, sustained economic growth, and aggressive government policies have propelled China to dominate global automotive production and sales, accounting for 41% of worldwide automotive sales in 2024, particularly in the new energy vehicle (NEV) segment.

China’s automotive dominance and the rise of domestic OEMs

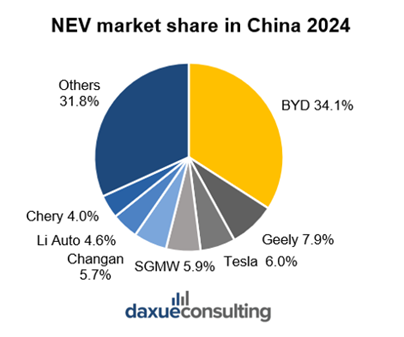

China solidified its position as the world’s largest automotive market in 2010, with production and sales reaching record highs in 2024, producing 31.28 million vehicles and selling 31.44 million, marking year-on-year increases of 3.7% and 4.5%, respectively. This growth in passenger vehicles and a rebound in commercial vehicle sales underscore the market’s resilience and dominance. However, the most striking shift has been the ascent of domestic Chinese automotive OEMs. Once reliant on foreign joint ventures (JVs) for technology and branding, Chinese automakers like BYD, Geely, and SAIC now command over 68% of the domestic market as of 2025. This rise has been fueled by vertical integration, government support, and breakthroughs in NEV technology. BYD, for instance, leads globally in electric vehicle sales, capturing 34.1% of China’s NEV market in 2024, while Geely and SAIC have expanded into premium smart vehicles and affordable NEVs.

The government’s strategic policies have been instrumental in this transformation. For decades, China mandated that foreign automakers form JVs with local partners, capping foreign ownership at 50%. This policy facilitated technology transfer and nurtured domestic capabilities. By 2022, ownership restrictions in the automotive industry were removed from the list of industries subject to the foreign investment access negative list, allowing foreign companies full control over passenger vehicle operations. However, the legacy of these policies persists: Chinese automotive OEMs now leverage mature supply chains, cost advantages (up to 47% lower than global peers, by achieving economies of scale through vertical integration, controlling the entire production chain to reduce reliance on external suppliers and lower production costs), and cutting-edge innovations in batteries and autonomous driving to outpace international competitors.

Chinese NEV revolution and export surge

Source: CNEV, redesigned by Daxue Consulting, Chinese NEV market share

China’s NEV sector is the crown jewel of its automotive strategy. In 2024, NEV production hit 11.2 million units, with the NEV market growing by 38.2%. Chinese automotive OEMs have capitalized on subsidies, tax incentives, and infrastructure investments to build a globally competitive ecosystem. BYD’s “mega factory” in Zhengzhou, an extensive complex larger than San Francisco, exemplifies this ambition. With a planned annual capacity of over one million NEVs, the facility integrates production, worker housing, and R&D, enabling unprecedented scale and efficiency.

Export growth further underscores China’s automotive ascendancy. From January to August 2024, vehicle exports surged by 27% year-over-year to 4.09 million units, with NEVs dominating shipments to Europe, Southeast Asia, and Latin America. Brands like Chery and Great Wall Motor are expanding overseas manufacturing in markets such as Malaysia and Brazil to bypass rising trade barriers. However, geopolitical tensions pose risks: the U.S. imposed 247.5% tariffs specifically on all NEVs imported from China in 2025. Even a non-Chinese NEV, such as Tesla Model 3, made in Shanghai and shipped to the U.S., would incur this cost. This forces foreign brands to reconsider their export strategy. While the EU introduced duties up to 45.3%, forcing OEMs to pivot toward plug-in hybrids (PHEVs) and localized production.

Challenges regarding the current automotive industry

Foreign entrants face a triad of challenges in China’s automotive market. First, geopolitical friction has disrupted supply chains and market access. U.S. and EU tariffs have reshaped export strategies, compelling Chinese automotive OEMs to establish overseas plants (e.g., BYD in Hungary, Chery in Brazil). Second, regulatory complexity persists despite liberalization. While China now permits wholly foreign-owned enterprises in most automotive segments, navigating subsidies, local content rules, and data security laws requires localized expertise. For example, NEV subsidies are increasingly tied to domestic battery sourcing, incentivizing partnerships with Chinese suppliers like CATL.

Third, competition from Chinese automotive OEMs is intensifying. Chinese brands are estimated to launch 330 new car models from 2024 to 2026, blending affordability with advanced features like autonomous driving and AI-powered cockpits. Foreign JVs, once dominant, are losing ground. SAIC-Volkswagen and FAW-Toyota, which historically primarily focused on internal combustion engines, saw sales drop by 7.8% and 14.1% in early 2025. To adapt, global automakers like Volkswagen have shifted R&D and decision-making to China, launching localized NEV lineups such as the ID.7 sedan and co-developing models with tech partners like Xpeng, similar to the success of next-gen JVs (NEV/AI-focused, like BMW-DeepSeek).

Strategic opportunities for foreign companies to enter the Chinese market

Despite these hurdles, China’s automotive OEM market offers compelling opportunities for foreign players willing to adopt agile, localized strategies.

1. Leverage joint ventures and local expertise

Even as China relaxes ownership restrictions, joint ventures (JVs) remain a strategic tool for foreign automakers to navigate the market’s complexities. BMW’s decades-long partnership with Brilliance Auto exemplifies this approach. While wholly-owned subsidiaries offer autonomy, JVs provide unparalleled access to domestic supply chains, regulatory expertise, and consumer insights. This collaboration has evolved beyond manufacturing; BMW now integrates Chinese AI startup DeepSeek into its smart NEV development, blending German automotive engineering with China’s software innovation.

By co-developing AI-powered features like personalized voice assistants, BMW tailors its NEVs to local preferences for ultra-connected, tech-driven cabins. Such partnerships also aid in compliance with China’s stringent data security laws while speeding up the time to market. For foreign brands, JVs act as bridges to China’s innovation ecosystem, enabling them to harness local agility. As Chinese tech firms lead in AI, these collaborations ensure foreign brands remain competitive in a market where software is so critical.

2. Target niche segments and commercial vehicles

With passenger vehicle markets nearing saturation, commercial vehicles, particularly electric buses, trucks, and forklifts, offer untapped potential. While Chinese manufacturers like BYD dominate segments such as urban electric buses, showcased by their success in California, foreign brands can capitalize on specialized gaps. For instance, cold-climate regions in northern China face range limitations with existing NEVs. The most recent data (2022) shows NEV market penetration was 15.4% in Northwest China and 9.7% in Northeast China, significantly lower than the 28.5% in East China and 32% in South China.

This highlights the opportunity for advanced battery systems resilient to sub-zero temperatures. Similarly, heavy-duty electric trucks for mining and construction demand durability and high torque, areas where foreign engineering expertise could compete with local offerings. Autonomous driving technology for logistics fleets, aligned with China’s smart-city ambitions, also remains an underpenetrated niche. By focusing on these high-value segments, foreign brands can avoid direct competition with cost-optimized domestic giants while addressing unmet needs. Potential partnerships with local logistics firms such as SF Express further enable integration into China’s electrification ecosystem, transforming niche innovation into scalable market entry.

3. Integrate into China’s NEV ecosystem

Foreign companies can strategically embed themselves in China’s commercial NEV market by tapping into the country’s world-leading battery supply chains and rapidly maturing autonomous driving ecosystems. Tesla’s Gigafactory Shanghai exemplifies this approach: by sourcing 95% of components locally, including batteries from CATL and electronics from domestic suppliers, it achieves cost efficiency, regulatory compliance, and agility in adapting to China’s strict technical and safety standards. Similarly, foreign commercial NEV makers can leverage partnerships with Chinese tech giants like Huawei, whose expertise in smart driving algorithms and vehicle-to-everything (V2X) connectivity offers a shortcut to integrating advanced autonomous features tailored to China’s complex urban environments. Collaborating with battery leaders such as CATL or BYD not only secures access to cutting-edge battery technologies but also ensures compliance with evolving domestic rules, which prioritize locally sourced components for subsidies and procurement eligibility.

4. Leverage China as a global export hub

China’s dominance in cost-efficient manufacturing and vertically integrated OEM supply chains offers foreign automakers a dual advantage: accessing the world’s largest auto market while establishing a globally competitive export hub. Companies like Tesla and BMW exemplify this strategy. Tesla’s Shanghai Gigafactory, which leverages China’s immense supplier network, not only meets surging domestic demand but also exports Model Y vehicles to Europe and the Asia Pacific regions, capitalizing on China’s lower production costs to undercut rivals abroad. Similarly, BMW’s Shenyang plant produces the electric iX3 for global markets, blending China’s manufacturing agility with the brand’s premium engineering. This localization mitigates tariff risks, critical amid rising trade barriers, while aligning with China’s technical standards and consumer preferences.

5. Learnings from Chinese OEMs’ global expansion

Meanwhile, Chinese automakers like BYD adopt a reverse approach, leveraging their domestic supply chain strength to build overseas factories that bypass trade policies while offering localized products. For example, their Europe-specific luxury line, Denza, aims to compete with established brands like Ferrari and Mercedes, with plans to open factories in Hungary and Turkey in 2025. A strategy foreign firms should imitate, embedding R&D, localization, and production in China’s ecosystem enables innovation tailored to local trends while creating a pipeline for export-ready vehicles. As geopolitical tensions reshape global trade, China’s role as both a market and a manufacturing springboard becomes inseparable, a reality foreign brands can harness by deepening integration with local partners.

Unlocking opportunities through Chinese automotive OEMs

- China has transitioned from relying on foreign partnerships to dominating its automotive sector through domestic OEMs, driven by aggressive government policies, cost-efficient manufacturing, and breakthroughs in new energy vehicles (NEVs).

- Joint ventures (JVs) and collaborations with Chinese automotive OEM players (e.g., automakers, tech firms) remain vital for accessing supply chains, regulatory insights, and consumer trust, even as ownership restrictions ease.

- Foreign brands can leverage China’s world-leading battery supply chains (e.g., CATL, BYD) and autonomous driving ecosystems (e.g., Huawei’s tech) for cost efficiency, compliance, and innovation speed.

- Tap into China’s cost-efficient manufacturing to produce vehicles for both domestic and international markets, mitigating geopolitical risks like tariffs.

- Partnering with Chinese tech firms to co-develop AI-driven features is critical for competing in a market where software defines differentiation.