According to Mintel and Sinolink Securities, the Chinese breakfast market is currently worth around 2 trillion RMB. The market witnessed a negative impact and slow development during the Covid-19 pandemic in 2020 but soon recovered from the crisis and realized constant growth with a compound growth rate of 7.7% from 2020 to 2025. China’s breakfast market is expected to reach 2.6 trillion RMB by 2025.

Even though most Chinese people have breakfast at home, getting take-outs from the nearest breakfast stores or ordering delivery are the most frequent choices for urban consumers who have limited time in the morning. Mintel’s research shows that more than 60% of Chinese consumers purchase breakfast outside at least once a week.

However, the current Chinese breakfast market is facing a mismatch between low supply from restaurants and high demand for quickness and convenience from consumers. Along with the income growth and Chinese consumers’ willingness to pay more for breakfast than in the past, many traditional street-food style breakfast stores are upgrading to standardized chains and high-end stores. Western food chains such as KFC, as well as convenience stores like Lawson and 7-11, also began to promote their breakfast offer with more localized tastes.

Analyzing Chinese breakfast habits

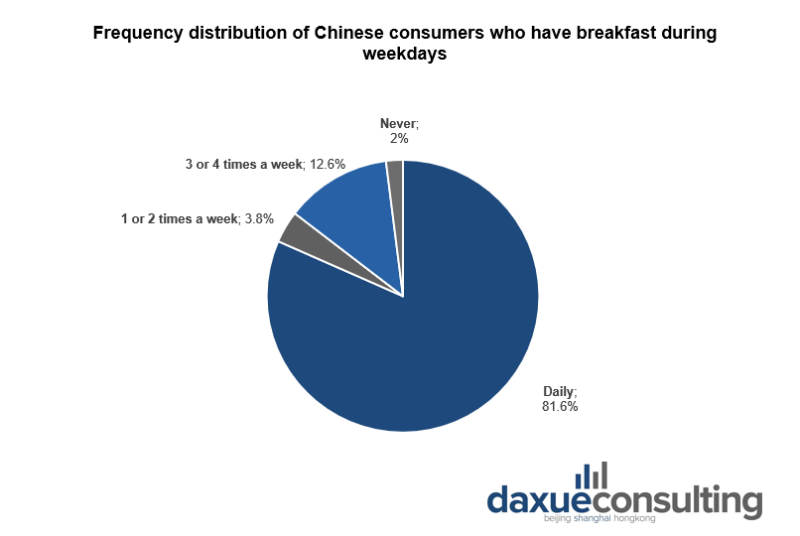

According to the Chinese Breakfast Behavior Report 2022, 81.6% of surveyed Chinese consumers have breakfast on a daily basis, whereas 2% always skip breakfast. Married consumers who live in first-tier cities with high education and income levels are more likely to have breakfast daily. Moreover, Chinese people have breakfast more frequently on working days than on weekends.

89.4% of surveyed Chinese consumers have breakfast containing rice, wheat, or other grains. The percentage of people eating meat (including eggs) and consuming dairy products and nuts are 53.9% and 49.3%, respectively, most of whom are first-tier city consumers. In comparison, only 42.2% of Chinese people have vegetables and fruits for breakfast.

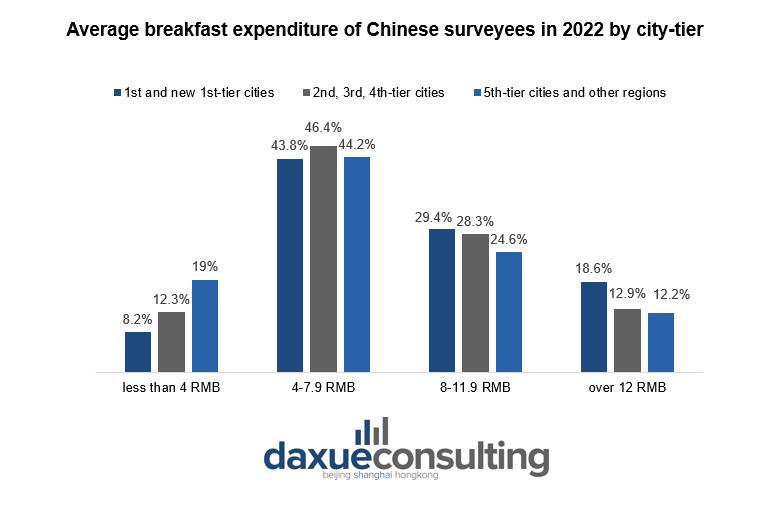

Regarding expenses, 45.2% of average Chinese consumers spend between 4 RMB and 7.9 RMB. First and new first-tier-city consumers have the highest breakfast expenditure, allocating more than 12 RMB on breakfast.

What do Chinese eat for breakfast?

Traditional dim sum like steamed buns and dumplings, as well as soy milk, porridge, and youtiao (Chinese deep-fried dough stick), boast the highest penetration rate for consumers who love having a traditional Chinese breakfast, whereas coffee and sandwiches are the most popular choices among those who opt for a Western-style breakfast.

Chinese consumers show a preference for traditional breakfast

Chinese consumers have different breakfast habits depending on their local traditions and food culture. For example, people consume hot dry noodles and sour and spicy soup the most in central China, while people from southern regions like to eat porridge, rice noodle rolls, and steamed dumplings for breakfast.

Alibaba’s research shows that in Shanghai in 2021, the top 5 breakfast choices were soy milk with youtiao, coffee, steamed and fried dumplings, and porridge. While in Hangzhou, not far from Shanghai, most people prefer eating sandwiches, Chinese leek pancakes, fruits, and rice vermicelli for breakfast.

Unlike Western people having the habit of drinking coffee and juice in the morning, Chinese people drink soy milk and jiuniang in their traditional breakfast. Soy milk is usually consumed with youtiao as a typical Chinese breakfast combination, while jiuniang consist of fermented steamed glutinous rice and has thousands of years of history in China.

Western breakfast in China is gaining ground

Chinese-style breakfast plays a dominant role in the Chinese breakfast market. According to Alibaba, 87% of breakfast deliveries in 2021 was Chinese-style breakfast food, indicating the leading position in China’s breakfast market. However, as urban consumers get more open to western culture, Western-style breakfast shows vast potential with rapid growth. For example, compared to 2020, the order ratio index of Western-style breakfast in 2021 increased by one-third, while Chinese-style breakfast orders experienced a slight drop.

The most popular Western breakfast choices in China are usually coffee, sandwiches, bread, and slices of cakes. Like what happens for traditional breakfast, consumers from different areas also have different preferences for western food. Among Western-style breakfast options, in Jinan and Qingdao, sandwiches and French fries have the highest sales, while in Shanghai people consume coffee the most.

The booming breakfast industry in China

Limited choice, poor hygiene, and low sufficiency of traditional breakfast stores induced China’s breakfast industry to innovate. In recent years, along with the standardization in chain stores, many breakfast shops have digitalized through accepting QR-code orders, installing self-service counters, and setting up unmanned breakfast vans.

In 2020, the Shanghai government launched the “Shanghai Breakfast Project”, aimed at promoting digitalization and further development in the breakfast industry, particularly by setting up breakfast networks in business and industrial areas, as well as educational and medical points in the city. It is expected to establish 773 more breakfast stores in such locations by the end of 2022.

How restaurant chains are adapting their offer to changing breakfast habits in China

Trendy buns stores

Traditional Chinese steamed buns have been the most popular breakfast choice for a long time in the country. In the past, buns were served in local street food vans with limited flavors and a simple look. However, nowadays in China, traditional street buns are getting trendier with different regional filling specialties and strong visual impact. For instance, founded in 2020, Chengdu’s Li and Bai buns store was the first to put Sichuan meat sauce in the fillings of the buns, as well as to introduce colorful buns’ skins to differentiate the distinct flavors, such as green fresh-fried veggie Xiaolongbao, black pork buns, and red “Good Luck” buns.

Another buns chain store from Chengdu, Baozhuanye, is also on hype. Unlike Li and Bai, the brand offers new combinations other than the traditional breakfast with soy milk, such as buns with coffee and sparkling drinks. Baozhuanye not only operates in the morning but also sells breakfast varieties the whole day till midnight to strengthen its market position of “breakfast buns that can also be served at night as snacks after drinking.”

Breakfast delivery and pick-up boxes

As more and more Chinese consumers rely on online shopping and food delivery, breakfast in China is also gradually becoming available online. In September 2020, the vegetable delivery app Dingdong started offering 600 different breakfast options for Chinese families, including pastries, dairy products, eggs, and soy-based breakfast. Consumers can receive the products comfortably at home at half past six in the morning if they place the order one day in advance.

Along with the success of breakfast delivery and convenience stores’ breakfast corners, a new style of breakfast stores, Hexiaoma, has emerged in China’s breakfast market. It is a breakfast chain that serves breakfast and afternoon tea snacks like sandwiches and coffee from 7 am to 8 pm. Customers can pick up freshly made food they ordered at the store or online from the pick-up boxes. The brand had seven stores when it debuted in 2020 and planned to open 1,000 stores in Shanghai in the following three years.

Western chains are adapting and localizing their breakfast selection

Western fast-food chains are putting efforts into their breakfast menus to fight against the fierce competition in the breakfast industry in China as well. KFC is a good example of successfully localized breakfast. The US chain offers porridge, soy milk, rice balls, youtiao, and Asian fusion food like cheese, egg burgers, and pastries. In 2021, KFC launched a campaign called “Good morning city taste” with breakfast specialties in different regions of China.

Instead, other western food chains opted for different strategies. For instance, McDonald’s offers authentic Western-style breakfasts to differentiate their products from competitors, while Starbucks started serving 15-RMB and 19-RMB breakfast sets of pastries and milk in Jiangsu, Zhejiang, Shanghai, and Shenzhen in 2021.

What can we learn from China’s fast-growing breakfast market?

- China’s 2 trillion RMB breakfast market is expected to grow with a forecast compound growth rate of 7.7% by 2025. Even though most Chinese people have breakfast at home, more and more urbanites prefer getting take-outs or ordering deliveries.

- Due to the mismatch between the scarcity of breakfast suppliers and the increasing consumers’ demand, many traditional street-food style breakfast stores upgraded to standardized or high-end chains, and western food restaurants started to promote more localized options.

- 81.6% of surveyed Chinese consumers have breakfast every day, and most prefer breakfast containing rice, wheat, or other grains. The most frequent price range for breakfast in China is between 4 RMB and 7.9 RMB, with first and new first-city-tier consumers more likely to spend over 12 RMB.

- Chinese consumers prefer Chinese-style breakfast the most and have different habits depending on their local traditions and food culture. Steamed dim sum, soy milk, porridge, and youtiao have the highest penetration rate for traditional Chinese breakfast.

- Western-style breakfast, on the other hand, shows vast potential with rapid growth. Depending on the region, people consume coffee, sandwiches, bread, and slices of cakes.

- Traditional street buns are getting trendier nowadays in China with different regional fillings and strong visual impact. Customers can get breakfast delivered or pick it up at the store by just using their phones. Many western fast-food chains also have different breakfast offers like McDonald’s and Starbucks. Instead, KFC is popular in China for its localized tastes and Asian-fusion breakfast menu.

Author: Ariel Wu