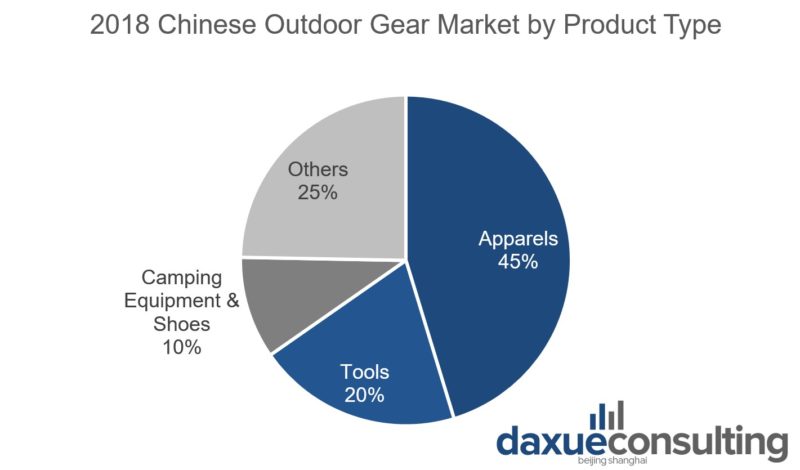

Recreational camping is not a new concept to Chinese consumers, but about a decade ago it was more of a niche sport reserved for the hardcore outdoor enthusiasts, aka the “donkey friends” or “luyou” (驴友) in Chinese. But nowadays, the Chinese outdoor and camping market is both large and growing as it penetrates a wider consumer base. In terms of market size, the Chinese outdoor gear (including tents and apparels) market reached $60 Billion in 2018 and it is expected to reach $100 Billion by 2025. About 3% of China’s population, or about 30 million people go camping every year. To put that in perspective, 40 million Americans or about 10% of the American population go camping every year, indicating the potential of the Chinese camping market.

What does this mean for foreign outdoor and camping companies?

While the camping market in China appears to be an appealing opportunity for foreign players, the market structure is competitive. Of the 935 outdoor gear brands globally, 52% were Chinese brands which accounted for 55% of the market share, pretty unexpected considering that the Chinese outdoor equipment industry really only started during the early 90s.

Moreover, it would be wrong to assume that Chinese campers camp in the same way as other countries do. This regional difference is due to the geographical and cultural characteristics.

Therefore to effectively capture a share in the Chinese camping market, any foreign entrant must understand the drivers behind such movement, the behaviours of Chinese campers, and the Chinese camping culture.

Camping enabled by policy and infrastructure support

Camping became easier with the government’s initiative in developing camping infrastructures. The Chinese government passed new legislations in 2017 addressing the sustainable development of land and the reinvention of tourism. Among the keywords present in this plan were ecotourism, self-driving tours, RV campsites, and service stations. We saw the number of campsites grew from 958 in 2016 to 1,778 in 2019. At the same time, we saw the standardization of the licensing process for outdoor equipment such as RVs.

Who are the Chinese campers? What is their motivation to camp?

Demographically, half of the campers in China were Gen X and Gen Y, with Gen Z’s growth being the fastest. These are the most globalized generations of China who are very knowledgeable of the Western ways of traveling. Their parents’ generations already pioneered the shift from group tours to self-driving tours, which also included the mass adoption of cars. The millennials are also more environmentally conscious when it comes to consumption and camping is the natural next step forward.

Culturally, these millennials are active on social media such as Xiaohongshu where there is an increasing number of camping Vloggers. The attractiveness of camping is that it is slightly outside urban dwellers’ comfort zone, but not too much, at least Vloggers could overcome the challenges. At a slight discomfort compared to hotels, campers gain cost savings and non-standardized experiences.

Which cities are popular for camping

Geographically, the cities that searched for camping the most are Beijing, Chengdu, Shanghai, Chongqing, and Guangzhou with 80% of the searchers between the ages of 19-33. To provide some context, Beijing, Shanghai, and Guanzhou are the tier 1 cities in China while Chongqing and Chengdu are large cities in the south west mountainous regions.

Here is a clear picture of the typical buyer of camping equipment in China: Gen X or Gen Y who have established themselves in the big cities and are trying to escape the urban jungle. They want to run away from the stress and pollution, but cannot run away too far due to their jobs. They want to experience nature, but also do not want the experience to be too demanding that it wears them out. For young families, another motivation would be to educate the children on survival skills and this is also a good way for parents to bond with their kids. The recent COVID pandemic also gave camping another push as the awareness of air quality and contactless way of traveling increased.

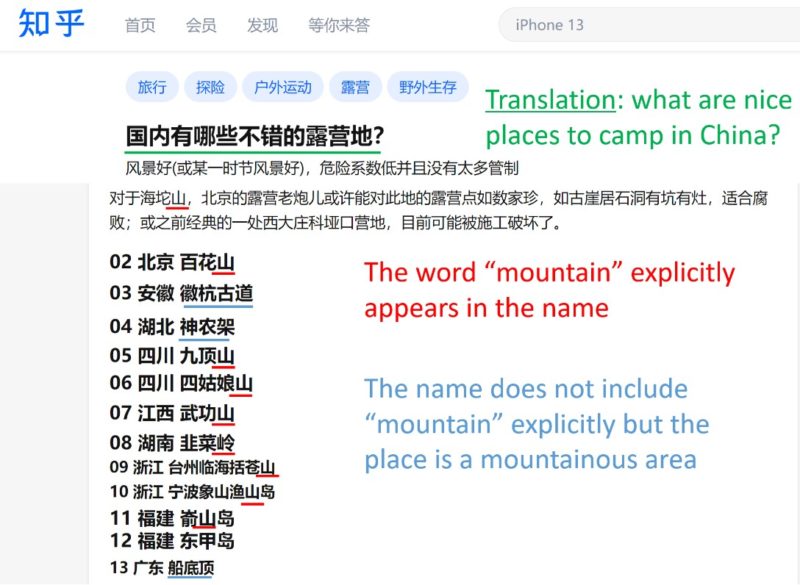

Where do people like to camp in China?

China is a geographically diverse country, but the most common recommendation is mountains. This is slightly different from Canada and the US where lakes are popular. Other popular choices in China are prairies and beaches.

Typically people do not drive more than 3 hours for camping and thus are unlikely to camp in extreme weather.

How Chinese campers camp and what gear they use

The distinction between hardcore “donkey friend” campers and softcore beginner campers is important.

Hardcore campers would set up tents in places without campsites and amenities. They could tolerate discomfort and tend to use more professional and practical gears. Lightweight and sturdiness are valuable product attributes.

On the other hand, softcore and beginner campers want an easy and comfortable experience, so much that there is a new term called “Glamping” or Glamourous Camping. This idea is popularized by KOLs on platforms such as Xiaohongshu and Douyin. Unlike traditional hardcore camping, glamping is not physically demanding, thus there is less requirement on the equipment being lightweight. The idea is to bring the comfort of a house to a tent in all aspects from eating to sleeping. For example, tents can be very large and tall, enough to have a living room.

Tents can be glam

Moreover, since over 90% of Chinese campers only spend 1 night in the tent, the tent and related equipment need to be more Instagram-worthy than sturdy. Although there is no precise standard of what exactly constitutes glamping, some estimate that 20% of camping in China can be categorized as glamping. With the idea of “Glamping”, a tent could be more expensive than a hotel room.

For beginner campers in China, they do not have to invest in tents and related equipment (which altogether would cost at least thousands of RMB) right off the start. Campsites with tents set up and available to rent offer a convenient starting point and it is also suitable for families who do not have enough storage space for equipment that they will only use one or two times per year. This is a key way in which the Chinese way of camping differs from the western way of camping. Renting an RV can be seen as another form of glamping as campers can enjoy additional amenities such as the comfort of air conditioning. RV sales have been growing at double-digit rates since 2016. As people get more experienced they would buy their own tents along with tarps, power supply, etc.

What do Chinese people eat while camping?

Chinese campers are creative when it comes to camping food. Like Americans, Chinese campers also like to barbeque, except Chinese campers grill almost anything from lamb to chicken to fish. Other choices include hot pot, stew, dumplings, and instant food. What stood out to us is this one variety of instant food called self-heating instant hot pot. From the outside it looks like a bowl of instant noodles except it has 2 layers: an inside layer to put food in, and an outside layer for heating. To heat the food, you put the packet of quicklime in the outside layer and pour water on it. The reaction between lime and water will generate enough heat to warm up the food on the inside.

One outdoor and camping brand Decathlon has been localizing their products based on the preference of Chinese campers. To understand the Chinese outdoor and camping market in depth and figure out how your brand can succeed in this market, please contact our project team by emailing dx@daxueconsulting.com

Author: Cedric Zhang